This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning, Bull Sheeters.

Today, we could be glimpsing the future. Before the markets open, we get quarterly results from the old guard of Wall Street and Big Finance: JPMorgan Chase and Goldman Sachs. Shortly after that, we get the stock market debut of the biggest cryptocurrency exchange out there, Coinbase.

Something tells me all the attention will be on the latter.

On cue, bitcoin is booming to new records.

Meanwhile, U.S. futures are moving nowhere this morning. That’s hardly a surprise with trading volumes so weak. Again yesterday, the number of S&P shares changing hands was well below the average trading volume—and yet the benchmark still hit an all-time high on Tuesday. That’s the classic definition of a melt-up.

Let’s see what’s moving markets today.

Markets update

Asia

- The major Asia indexes are mostly higher in afternoon trading with the Hang Seng up 1.4%.

- Toshiba shares in Tokyo are up 5.3% as a potential bidding war for the industrial conglomerate heats up.

- Southeast Asia’s most valuable startup, Grab, will list in the U.S. through—what else?—a SPAC merger, valuing the ride-hailing app at nearly $40 billion.

Europe

- The European bourses were up a touch, with the Stoxx Europe 600 gaining 0.1% at the open.

- Shares in Credit Suisse were down 1.5% in mid-morning trade. The Swiss lender is making slow progress in clawing back assets from the Greensill implosion, and it’s sold off a $2 billion tranche of stocks held by its stricken client, Archegos Capital Management.

U.S.

- U.S. futures are again trading sideways this morning after the S&P 500 closed at another all-time high yesterday, helped by tech stocks.

- All eyes are on bank earnings—JP Morgan Chase, Wells Fargo and Goldman Sachs report Q1 results…

- … and crypto. Coinbase shares are set to begin trading today. The big question: can it achieve a mind-boggling $100 billion valuation? It’s a longshot.

Elsewhere

- Gold is flat, trading below $1,750/ounce.

- The dollar is down.

- Crude is up with Brent trading around $65/barrel.

- Bitcoin hit yet another record, topping $64,000.

***

Take it to the bank

Move over, tech bulls.

Throughout 2020, the most crowded trade was long-tech. As you no doubt recall, that began to change after Election Day, and after the vaccine rollout kicked off in a big way.

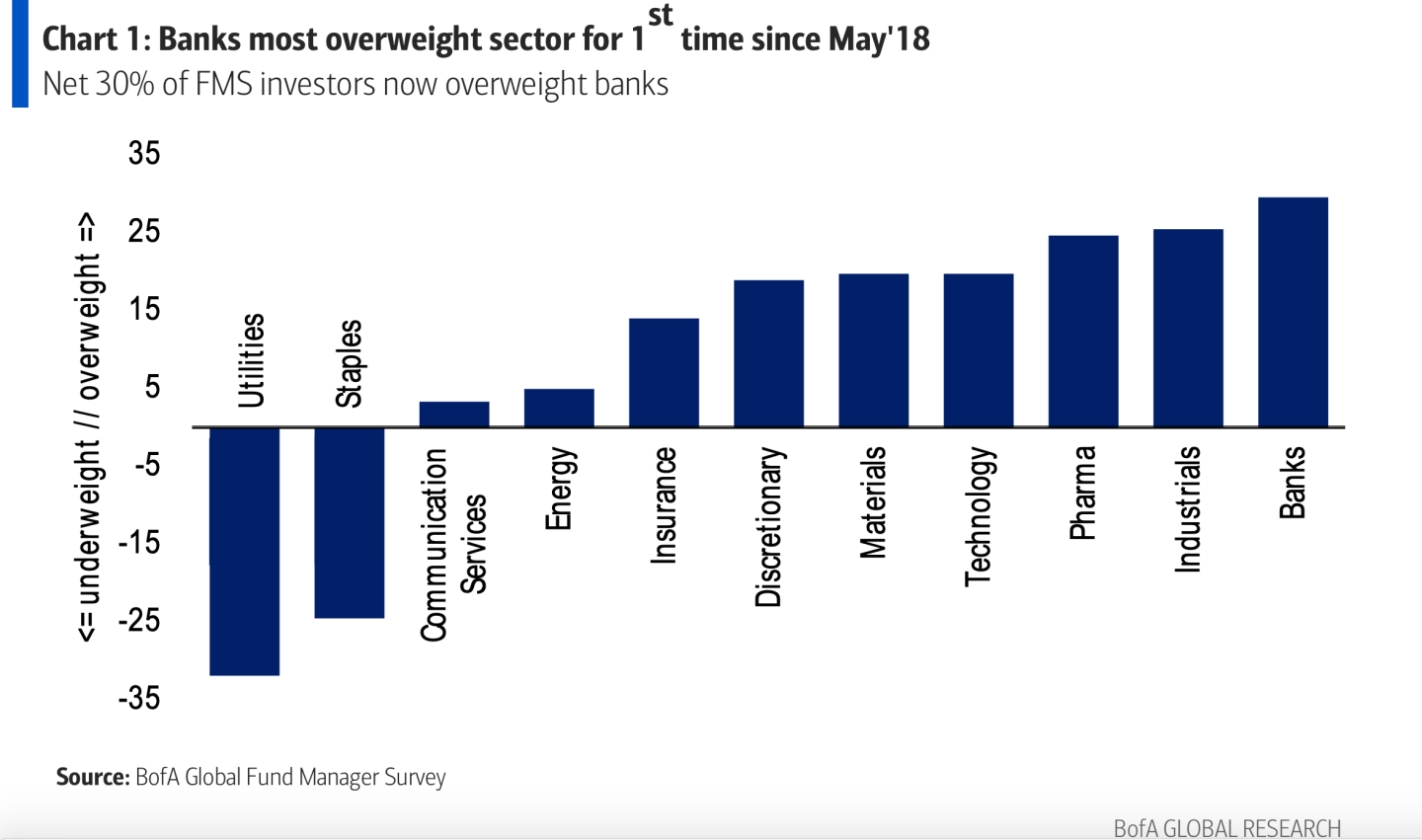

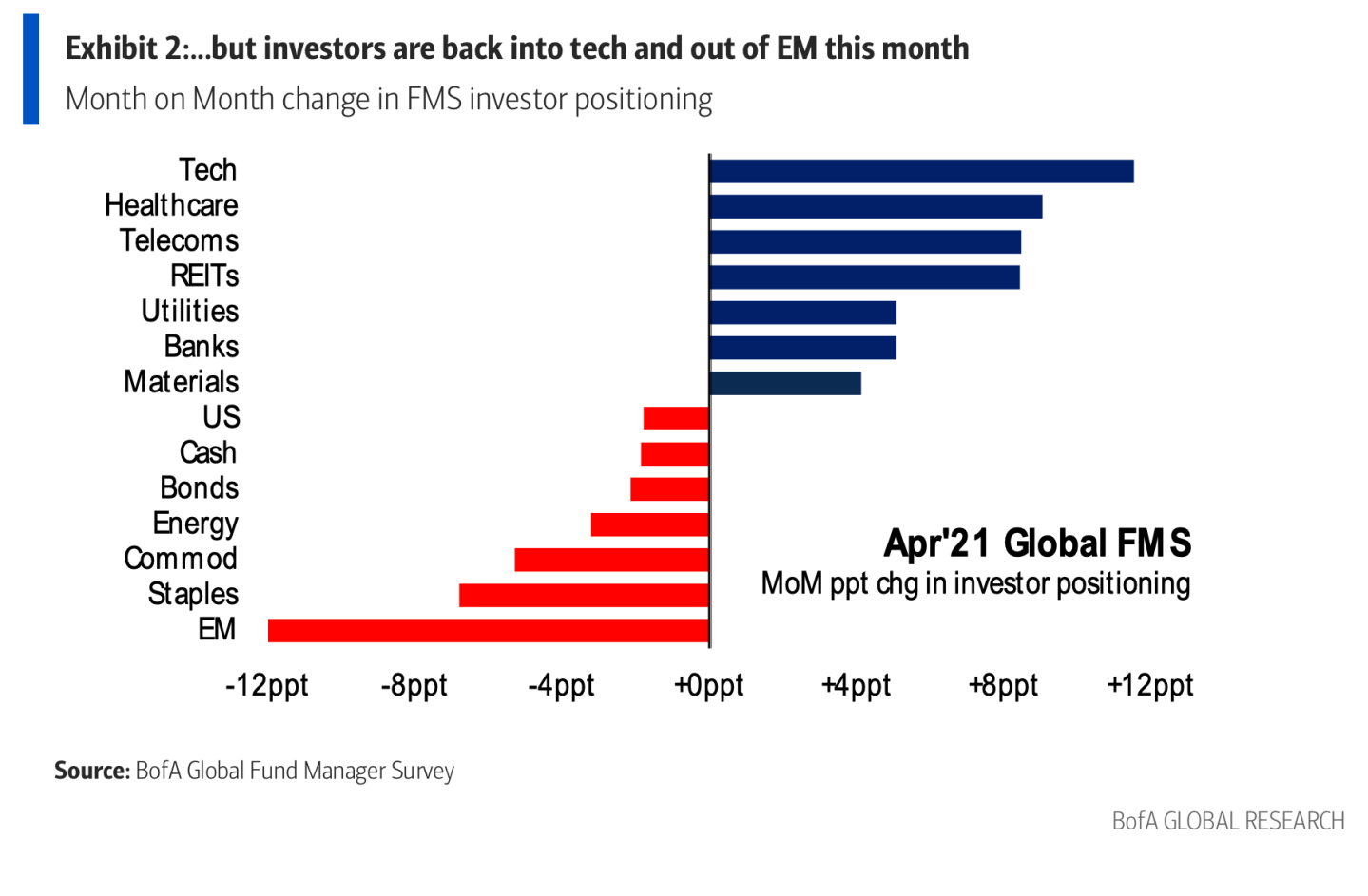

Now, the investment pros are bullish on banks once again. According to the latest Bank of America fund manager survey, banks are now the most overweight sector, pushing ahead of tech, pharma and industrials.

But don’t fret, tech bulls. The retreat from tech shares earlier in the year is reversing course, as investors continue to buy on the dip. That phenomenon shows up in the latest BofA survey as well, with fund managers crowding back into tech so far this month.

With bank earnings on tap this week (and tech earnings to follow later in the month), this trend will be one to watch. The banks stand to do well in an environment of rising real rates, and certain areas of tech could surge should the Biden infrastructure bill pass with big spending provisions for 5G, broadband and semiconductor R&D incentives. We’ll keep an eye on this development.

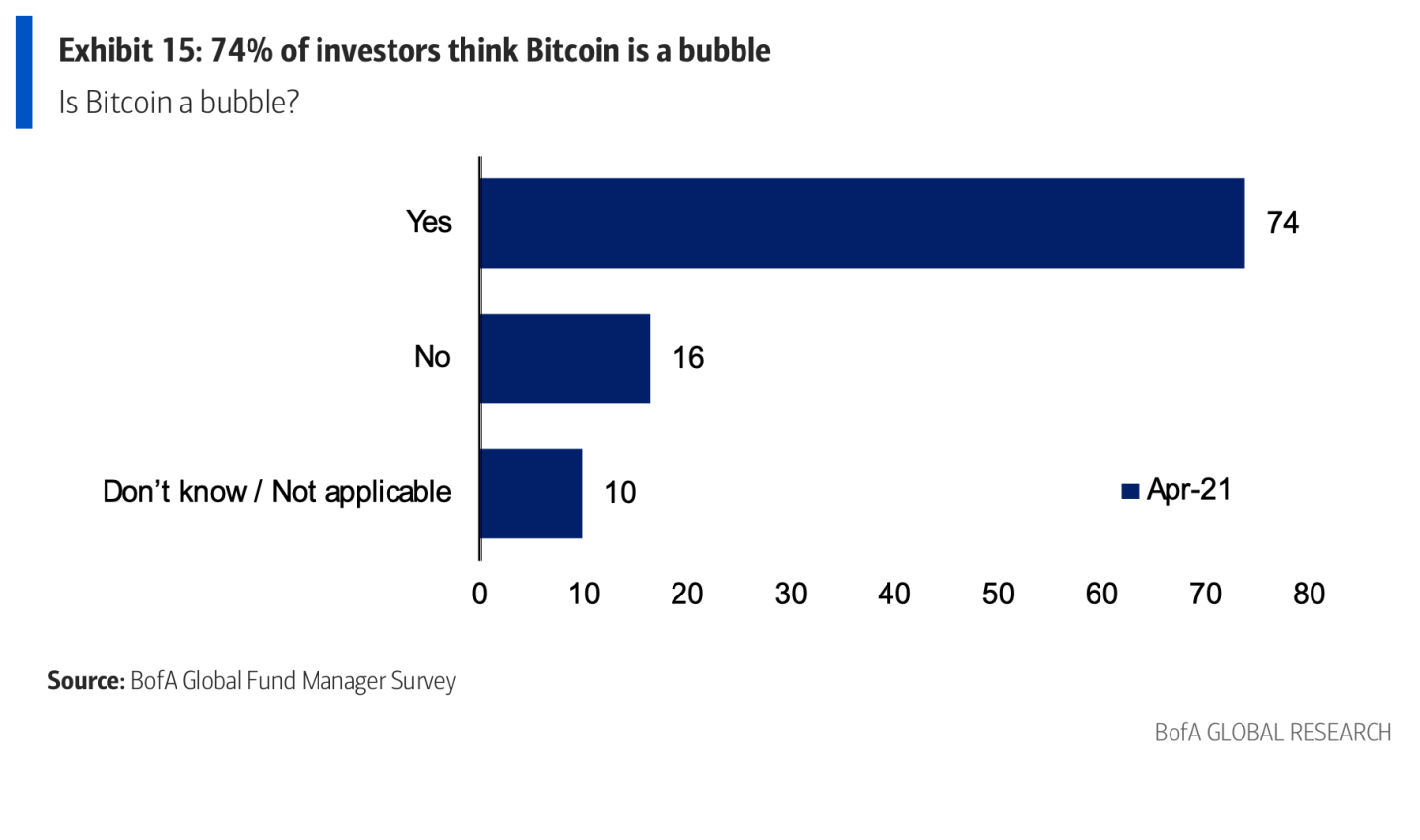

Finally… no survey investors would be complete without a crypto question. Crypto bulls, you may want to look away right about now.

BofA asked investors where they stood on Bitcoin: is it a bubble, or not?

The verdict? Without a doubt, Bitcoin is one big bubble, respondents say.

No doubt, Coinbase devotees could care less what these investment pros think. As I glance at the big board, bitcoin is up more than 10% in the past week, hitting a series of new records in that time.

***

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Epic funding round. Fortnite video game maker, Epic Games, yesterday wrapped up a $1 billion funding round. That values the firm at a staggering $28.7 billion. That's one giant unicorn!

Interest checking. The KBW Nasdaq Bank Index is outperforming the benchmark S&P 500 by a wide margin this year, up 25.8% YTD. That makes sense. Banks are seen as proxies for the wider economy. If the economy grows, bank shares should take off with it. That's the thinking going into earnings season, which kicks off in earnest with a bevy of bank results later today.

What to know about the Coinbase IPO. We're mere hours away from the stock market debut of the cryptocurrency exchange. It will be anything but conventional. For starters, Coinbase management has chosen a direct-listing. How does that work? Fortune's Anne Sraders explains.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

The butterfly effect

The most bullish 2021 growth predictions largely hinge on one thing: a successful COVID-19 vaccine rollout. What happens when these public health campaigns bog down? You see a hit to the global economy, and to the global markets. I've been examining this issue for some time, and wrote this analysis, which looks at the global implications for stocks, interest rates, growth projections and more, when the best-laid plans to vaccinate the masses run into snags.