This is the web version of The Ledger, Fortune’s weekly newsletter covering financial technology and cryptocurrency. Sign up here to get it free in your inbox.

Yesterday, there was a surprise announcement from Wall Street’s blockchain contingent: J.P. Morgan sold Quorum, the enterprise blockchain the bank spent years developing, to ConsenSys, the Brooklyn-based blockchain software firm run by Ethereum co-founder Joe Lubin.

It was an interesting move by the big bank, which has lately been heading more towards the world of cryptocurrency than away from it. Last year, J.P. Morgan announced its own blockchain-based payment system, JPM Coin, and is now also banking crypto exchanges Coinbase and Gemini.

So why would J.P. Morgan decide to jettison its blockchain tech now? My hunch is that it reflects a shift in priorities on Wall Street, where financial firms have lately put greater emphasis on trading businesses than software businesses—and building blockchains is, at its core, a software business.

The trend is a major reason why Catherine Coley, CEO of major crypto exchange Binance’s U.S. arm, this week declared 2020 to “be the year cryptocurrency goes mainstream,” noting reports that finance heavyweights from PayPal to Goldman Sachs are more seriously exploring digital assets and crypto.

The friendly attitude towards digital currency is a far cry from the “Bitcoin Bad, Blockchain Good” tune that bank leaders (including J.P. Morgan CEO Jamie Dimon) were singing just three years ago. It’s not exactly surprising: Cryptocurrency, along with tech stocks—risk assets, as you might call them—are basically the best story to come out of 2020: they’re the only things that keep going up (well, besides COVID-19 cases).

As Coley points out, Bitcoin outperformed other winners including Apple, Amazon and Microsoft stocks, as well as real estate, over the past decade: “When the best performing asset doesn’t even exist in traditional banking models, banks get interested,” she writes in Fortune.

Goldman, for its part, has also been quietly reorganizing its digital assets and cryptocurrency team. The bank teased a Bitcoin trading operation in mid-2018, during then-CEO Lloyd Blankfein’s final days at the helm, but those plans languished after current CEO David Solomon took over later that year (and cryptocurrency prices collapsed). Then this February, Goldman lost Rana Yared, who was helping to lead its blockchain and crypto efforts. But earlier this month, Goldman revealed it had hired a new global head of digital assets, Mathew McDermott, while also poaching a former leader of J.P. Morgan’s Quorum project, Oli Harris. “It definitely feels like there is a resurgence of interest in cryptocurrencies,” McDermott told CNBC.

Meanwhile, with a flurry of deal activity among financial firms, there may be more blockchain shakeouts. Charles Schwab, for one, is in the process of acquiring TD Ameritrade, which has its own “scalable blockchain” in the works, and was also early to offer Bitcoin futures trading—though Schwab has not expressed interest in getting into the crypto business.

For now, J.P. Morgan is keeping at least one foot in blockchain tech, taking a “strategic investment” in ConsenSys as part of the Quorum spinoff: “We look forward to continuing our multifaceted partnership with J.P. Morgan for many years and ushering in an era of enterprise and mainnet compatibility,” Lubin said in a statement. But so it may also end the era of banks trying to build their own blockchains—which, some would argue, were never truly blockchains at all.

Jen Wieczner

DECENTRALIZED NEWS

Credits

Jack Ma's Ant Group aims for a record IPO ... Bitcoin's run above $10,000 is now second-longest ever ... Why isn't relief spending causing huge inflation? ... Crypto exchange FTX acquires Blockfolio for $150m ... WorldRemit to acquire Africa-focused Sendwave ... JPMorgan spins off a major blockchain unit to Consensys ... Coinbase dodged the Ethereum Classic hack ... Blockchain fund Ribbit Capital files for $350 million SPAC.

Debits

Ethereum tokens vulnerable to 'fake deposit' attack ... Citi made a $900 million clerical error ... In a downturn, credit card points become a lifeline ... Many 'blockchain experiments' don't need a blockchain at all ... Korean police seize major crypto exchange ... Crypto mining firm Layer1 may have misled investors ... Even Sir Isaac Newton made terrible investing decisions. Stay humble.

FOMO NO MO'

"If you want to participate in DeFi and yield farming, you need to know what you’re doing. It's mostly technical folks who have been in this for a while," says Johnson of Jump Capital.

This may not be a bad thing. The technical barriers could prevent millions of amateur investors from losing their shirts, which is what happened when the 2017 bubble popped.

From an in-depth exploration of so-called 'decentralized finance' and the yield farming phenomenon from Fortune's Jeff John Roberts. Building on the automated 'smart contract' capabilities built into blockchain systems like Ethereum, DeFi allows anyone with the know-how to lend or borrow cryptocurrency, often at interest rates far better than what's available at conventional banks. That, plus special bonus tokens Roberts compares to airline miles, have led to a boom, with more than $400 billion now in DeFi systems. There are major risks, though: because smart contracts are software, bugs can be devastating, as they were for the experimental YAMS token that surged and crashed in early August.

BUBBLE-O-METER

35 cents

The cost of sending a postcard through the U.S. Postal Service. Recently-appointed Postmaster General Louis DeJoy this week revealed before Congress he didn't know that price. DeJoy, who has made major service cuts in the name of righting USPS finances, further admitted "I know very little" about postage, arguably the USPS' primary product.

THE LEDGER'S LATEST

Chase's Sapphire card created a cult - can it last through COVID? - Jeff John Roberts

Wells Fargo cuts jobs as the pandemic, and past scandals, take their toll - Rey Mashayekhi

Why Apple gave Wordpress leeway on payments, but fought Epic Games - Robert Hackett

Why 2020 might be the year cryptocurrency goes mainstream - Catherine Coley, Binance U.S.

A peek into Palantir's financials - Lucinda Shen

Cyberattacks interrupt New Zealand stock market twice in one day - Eamon Barrett

Scott Galloway invests in Robinhood alternative Public - Lucinda Shen

MEMES AND MUMBLES

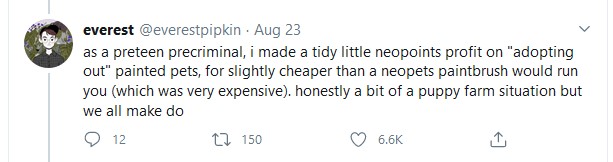

The unassuming opening to a mind-blowingly epic thread about what amounts to a crime syndicate of nine-year-olds circumventing commodity trading controls in the late-2000s online game Neopets.

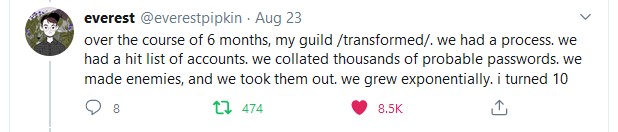

As with so much corporate and financial crime, what starts as a clever angle quickly devolves into outright Neopetian thuggery, with a ring of snot-nosed brats hacking their enemies' accounts to turn them into zombie farms for 'painted' pets.

And finally, when U.S. dollars get involved, we truly enter the heart of darkness.

This edition of The Ledger was curated by David Z. Morris. Contact him at david.morris@fortune.com