This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. The S&P 500 closed a mere 12 points from a new all-time high on Monday, led by resurgent tech stocks. This morning, U.S. futures are beginning to rebound, following the lead of European and Asian stocks. There’s a growing sense of inevitability that the benchmark S&P will hit record territory in a matter of days, on its way to a string of new all-time highs.

Here’s what’s moving markets.

Markets update

Asia

- The major Asia indexes are mixed in afternoon trade, but the Shanghai Composite continues its impressive run. It’s up 0.3%.

- The Trump Administration’s war on Huawei continues with the Commerce Department on Monday adding 38 Huawei affiliates in 21 countries to an economic blacklist, a huge hit to the company’s 5G aspirations.

- There could be a rival bidder for TikTok’s U.S. business. According to Bloomberg, Oracle is weighing whether to vie against Microsoft for the video streaming app.

Europe

- The European bourses are solidly in the green, with the Europe Stoxx 600 up 0.1% after a negative start.

- Germany‘s spike in coronavirus cases is concerning, but manageable, Chancellor Angela Merkel says. That’s after the country recorded its most cases since April, and as neighboring European countries begin tightening restrictions amid a rise in cases in recent weeks.

- Alexander Lukashenko, the longtime leader of Belarus and often called Europe’s last dictator, appears to be losing some of his grip on power. Workers across the country went on strike as mass protests against Lukashenko’s disputed Aug. 9 election victory gather steam.

U.S.

- The U.S. futures are flat on Tuesday, though well off their lows. That’s after the Nasdaq and S&P 500 eked out gains yesterday with tech stocks—Amazon, Spotify and Microsoft—leading the way higher.

- Tesla shares closed up 11% on Monday to a new all-time high following Wedbush analyst Daniel Ives raising his price target to $1,900. Tesla’s market cap has now surpassed consumer products giant Procter & Gamble.

- Beleaguered plane-maker Boeing is looking to extend buyout offers to employees as it now aims to reduce headcount by more than 10%.

- Lawmakers are still miles apart in their negotiations over a new coronavirus stimulus package. Senate Republicans now plan to introduce a long-shot slimmed-down proposal, but don’t expect any agreement being reached before September.

Elsewhere

- Gold continues its impressive run, up above $2,000/ounce, helped by Warren Buffett joining the gold rush.

- The dollar is down. Again.

- Crude has rebounded, with Brent up 0.3%.

***

Risk on… and on

We’ve been on watch for a new S&P 500 record for the past week. And, of course, the Nasdaq has been Mr. Reliable, hitting new all-time highs seemingly every trading session. It closed at 11,144.53 yesterday, another record.

This run for the ages, in which the S&P is up more than 50% over the past 102 trading days, is dividing the markets pros. There’s the camp that believes equities are over-priced by just about every historical measure out there. And then there’s the group that feels central bankers and policymakers have set us up for even further gains.

Brian Levitt, Global Market Strategist and Talley Léger, Senior Investment Strategist at Invesco, are among those who believes the “risk-on environment may be here for the long term.”

They lay out a series of reasons why this bull run still has legs. For starters, they believe stimulus measures and loose monetary policy will pump further liquidity into the markets. And, they’re not too concerned about COVID spikes, and the threat of coronavirus lockdowns like the kind we saw in the spring. Most controversially, they see stocks, despite their lofty valuations, as the best game in town.

“Global equity valuations, although not necessarily cheap on an absolute basis, remain attractive to many alternatives,” they write, adding that “investors will likely be willing to pay higher multiples of earnings over time.”

Looking forward, they see us moving into a period of higher and higher equities gains—depending on where you put your money, of course.

“Ultimately,” they write, “we expect this new emerging market and business cycle to be among the longest on record, perhaps even surpassing that of the post-2008 period. A prolonged period of slow growth, low inflation, low interest rates and massive policy accommodations will likely be a period that is conducive to sound performance from credit and equities.”

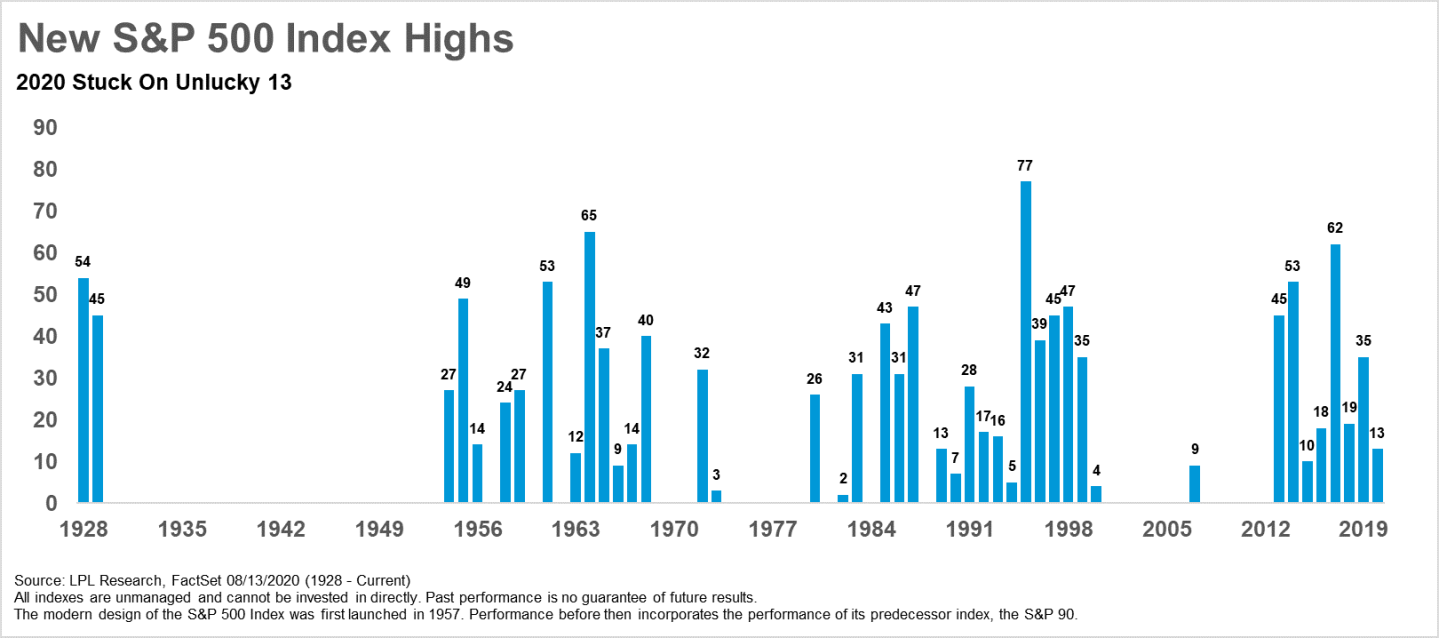

And since they mention the post-2008 period, here’s a chart (courtesy of LPL Research) at just how impressive a stretch that period was. Between 2012-2019 period, the S&P hit hundreds of all-time highs:

Most investors, no doubt, wouldn’t mind returning to market conditions like the one we saw over the past “risk-on” decade.

***

Have a nice day, everyone. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

The next breakout asset? Price-wary investors are continuing to eye commodities—and not just gold—as the next asset class ready to pop. They see equities as overpriced, and bemoan bonds for delivering dismal returns. It's part of a larger trend towards hunting for alternative assets as the equities market keeps hitting fresh records.

IPO dreams. Robinhood pulled off a $200 million funding round, valuing the popular stock-trading app at $11.2 billion. It was a series G round, which increases the speculation the next stop is a Robinhood IPO.

"Clicks versus bricks." The tech component of the S&P 500 has been powering the benchmark index during this entire bull run. Here's why the tech rally still has legs.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quote of the day

"Should history repeat, and there’s no guarantee it will, the S&P 500 should set a new all-time high by the end of August."

That's CFRA's Sam Stovall in an investor note yesterday on what to expect from the benchmark index as it nears record territory.