This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. It’s a busy day for investors with a full lineup of corporate results, plus a Fed rate decision and Big Tech testifying on Capitol Hill. Ahead of the big fireworks, Europe and Asia are mostly in the green this morning; U.S. futures are bouncing off their lows, edging into positive territory.

Let’s check in on the action.

Markets update

Asia

- The major Asia indexes are mixed in afternoon trade. The Shanghai Composite leads the way again, up 2%.

- Some promising news for Apple ahead of tomorrow’s earnings call: Q2 iPhone sales in China jumped 225%, far ahead of rivals, new research shows.

- The HSBC-Huawei affair has gone from worrisome to downright weird. Fortune‘s Grady McGregor reports that the bank’s statement on the matter, posted to WeChat, was deleted by Internet censors, “replacing it with a notice that it had violated China’s Internet regulations.”

Europe

- An hour into the trading session, the European bourses were off their lows with the benchmark Europe Stoxx 600 up nearly 0.3%.

- Deutsche Bank shares were up 2.9% at the open following the bank’s disclosure this morning of better than expected quarterly results and a slightly more optimistic full-year guidance.

- Is Europe’s auto sector ripe for a comeback? Daimler and PSA Group have reported better than expected figures in recent days, leading PSA’s CEO Carlos Tavares to crow, “our order book is stellar.” Not all analysts are convinced the sector is on the road to recovery.

U.S.

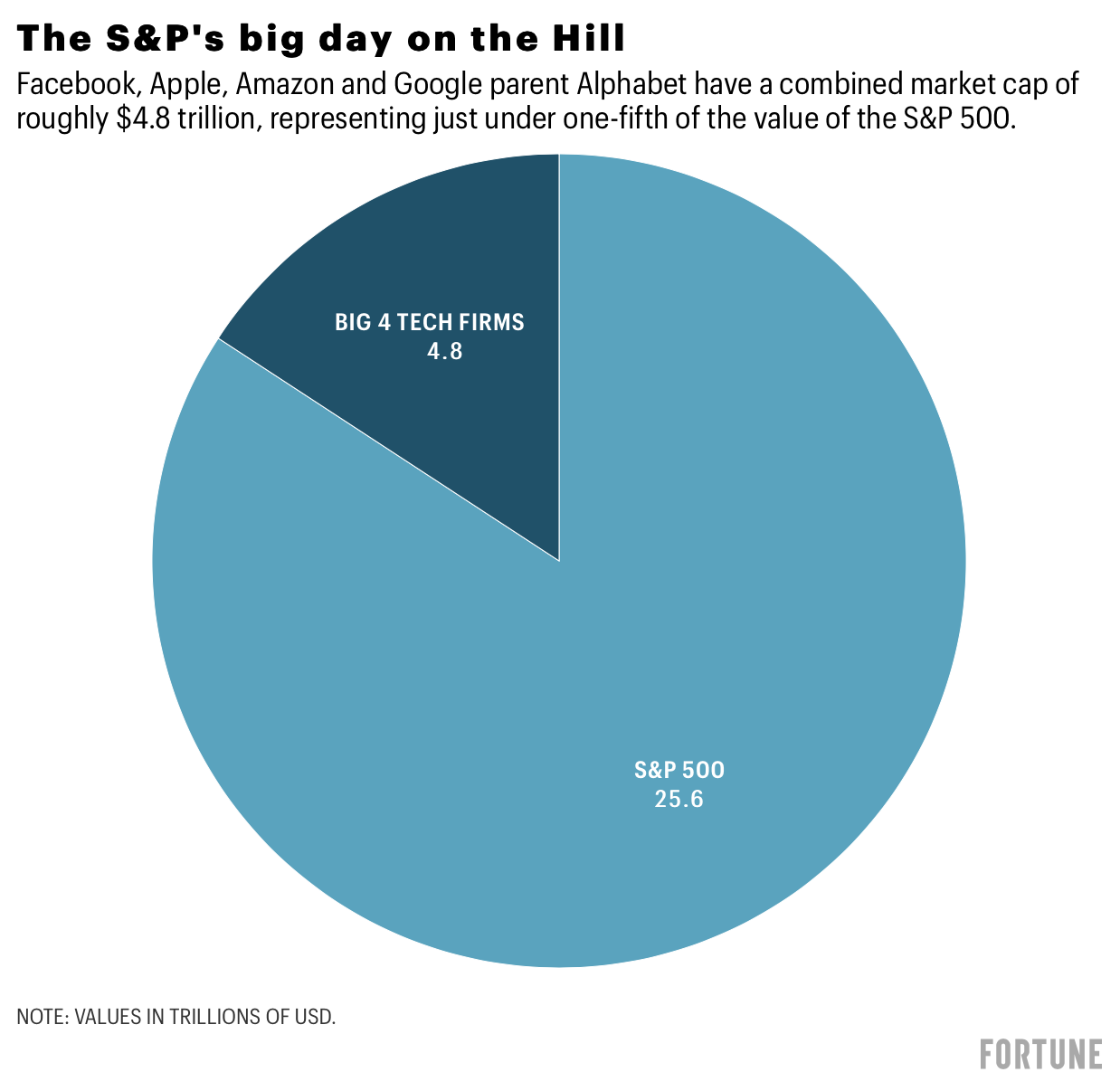

- U.S. futures are trading mostly sideways ahead of a big day for Big Tech on Capitol Hill. The CEOs of Google, Amazon, Apple, and Facebook—combined, they account for nearly one-fifth of the S&P, by value— will likely face a heated line of questions from the House Judiciary Antitrust Subcommittee.

- The other big news out of Washington today will come from the Fed, which is scheduled to deliver a rate decision. Yesterday, it extended to year-end seven of its nine emergency lending programs.

- In a note to Bull Sheet, C.J. MacDonald, client portfolio manager of GuideStone Capital Management, points out the Fed “has only utilized a small part of its available monetary arsenal. In March, the Fed initiated $2.9 trillion in monetary aid measures, but to date has only used $138 billion of it. And ironically, the market knows that this huge cache of ammo is standing by, which may mitigate the need to use it at all if the economy declines again later this year.”

Elsewhere

- Gold futures are climbing again, settling above $1,950 an ounce. One analyst made the bullish call of $3,500 within two years.

- Nobody’s bullish on the dollar. It’s down again.

- Crude too is in the green.

***

In the hot seat

When the titans of tech testify today on Capitol Hill, a good chunk of your portfolio, no doubt, will be in for a grilling.

Facebook’s Mark Zuckerberg, Amazon’s Jeff Bezos, Apple’s Tim Cook, and Sundar Pichai of Alphabet, which owns Google, have been called upon to defend and discuss the dominance they have across so many business sectors. Their market power has become more pronounced during the pandemic as huge parts of the economy have no choice but to carry out business virtually.

How big have the Big Four become? I thought I’d put it into a simple pie chart.

Google parent Alphabet, Amazon, Apple, and Facebook have a combined market cap of $4.8 trillion, a significant (and growing) piece of the S&P. (Add Microsoft, which is not testifying today, and that pie wedge swells to $6.3 trillion, or nearly one-quarter of the benchmark index.)

The massive divide between the haves and have-nots of the S&P is at historic levels, leading a number of market observers to crack that the S&P 500 should really be renamed the S&P Five.

Not surprisingly, the personal wealth of Bezos and Zuckerberg has grown by a cool $72 billion since the start of the year, according to Bloomberg. As if we need a reminder: Big Tech is having a very good pandemic.

Back to today’s testimony, Fortune‘s Danielle Abril reports the four tech CEOs will likely face a tough line of inquisition as both Republicans and Democrats have their issues with the companies’ dominance.

“Democrats will argue that Big Tech has become too big and powerful and thus needs to be reined in. Republicans will also speak to the harms of Big Tech but with a slight nuance in favor of creating new regulation specifically for the tech companies rather than changing overarching antitrust laws,” she writes.

It will be incumbent upon the CEOs to push the message that they’re a force for good—that they’re a major employer, that they’re investing heavily in innovation to make America more competitive, and that they add value to the American economy.

Shareholders can certainly vouch for the value-added argument.

***

Have a nice day, everyone. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

On condoms and Lysol. Consumer goods giant Reckitt Benckiser reported on Tuesday knockout first-half sales for its disinfectants and cleaning supplies business. It's condom business, however, was a different story. Love in the age of COVID is a brutal affair.

When will this pandemic be over, already? You may want to look away now... The COVID threat won't fade before 2022, says former U.S. surgeon general Vivek Murthy.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

When $1 trillion ain't enough

The Republicans and Democrats are still far apart on stimulus plan 2.0. How far apart? The $1 trillion plan the GOP lawmakers proposed on Monday just doesn't cut it, a number of Left-leaning economists and advocates say. What would they like to see? For starters, "recurring cash payments" to America's families until the worst of the pandemic passes—whenever that may be.