Think back to a simpler time.

For instance, January and February. Though it seems distant now, the S&P 500 hit its all-time high of 3394 on Feb. 19. “The stock markets previously had priced in a Goldilocks scenario and entered the year with an elevated price-to-earnings multiple, providing little cushion,” says Jared Franz, an economist at investment giant Capital Group. Then came the coronavirus.

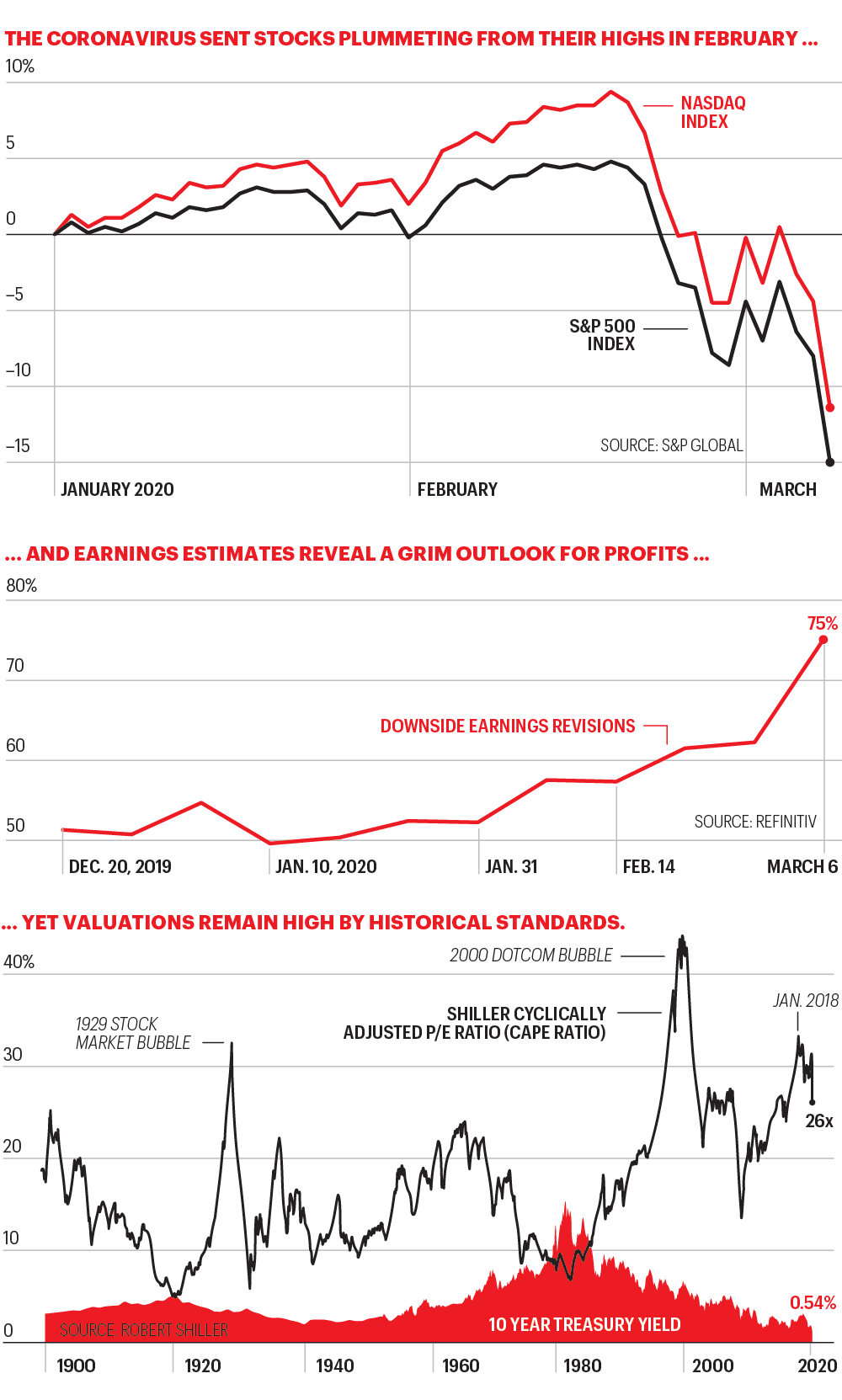

As the effects of the coronavirus continued to spread throughout late February and March, the stock market sustained a series of blows. Investors were not only plagued by uncertainty, they also began to reassess the rich premiums they had been paying for all sorts of assets. And once they started asking “How much is this market really worth?” the answer was bleak indeed. “In the past cycle, the elixir was that when the Fed eases, the price of risk assets goes up,” says Liz Ann Sonders, chief investment strategist at Charles Schwab. “That narrative is now undergoing an epic shift. Credit is tightening even though rates are falling, and that’s hitting valuations.”

The bedrock metrics show one thing for sure: Even after the repeated drops, stocks have simply gone from outrageously overpriced to overpriced. The coronavirus was the catalyst that kicked off the current cycle of doubt, but there’s another factor at play too: For most of 2019, stock prices roared ahead while earnings stalled, creating a mismatch between inflated valuations dependent on rising profits and profits that hit a wall. And, says Franz, that wall has only grown higher: “Earnings expectations for the S&P 500 were already muted and have come down further given potential supply disruptions” caused by the coronavirus outbreak.

At the S&P 500’s mid-February summit, the price-to-earnings ratio stood at 24.2, based on S&P projected 12-month trailing earnings, through Q1 2020, of $140. That’s 21% above its 20-year average of roughly 20, and almost 40% over the 70-year norm of 17.5. The steep drop of 19% through March 9 lowered the multiple to 19.6—near the average of the past two decades, an era in which they have been richly priced.

As always, equities deliver returns in two packages: dividends and capital gains. Let’s start with dividends. At the recent peak, rising prices had driven the yield to just 1.87%. The selloff has lifted yields to almost 2.2%, better but still below the average of over 3% since 1951. This year, companies spent an amount equal to 42% of their earnings on those dividends. So, on the dividend front, investors are being poorly rewarded for their risk.

On the capital gains side, there are three driving factors: share buybacks, growth in profits, and “multiple expansion,” or a rising price-to-earnings ratio. Today, S&P 500 companies are spending the equivalent of all earnings that don’t go to dividends on buybacks. (They are able to fund internal investment through added borrowing.) If the S&P continues to steer the cash equivalent of more than half its profits to repurchases, share counts will fall by 3.0%. That would lift earnings per share by a like amount, so if the P/E—the figure by which you multiply those earnings to get the share price—stays at 19.6, the S&P index will advance by the same 3%. Hence, if the current P/E of 19.6 holds, you’ll get a combined 5.2% return from dividends and buybacks alone.

But these improvements when it comes to dividends and capital gains are minor when compared with the abyss below.

Quarterly earnings went flat starting in Q2 of 2018 and have barely budged since then. With the coronavirus likely to hammer earnings a lot harder than analysts are positing, even no growth now sounds rosy.

And profits are still 40% above where they were three years ago. So today’s 19-plus P/E is putting a high valuation on what looks like an earnings bubble. For confirmation that values are out of whack, look at the CAPE, or cyclically adjusted price/earnings ratio, a measure developed by Robert Shiller, a Yale professor and Nobel laureate. Shiller adjusts the multiple by using a 10-year average of inflation-adjusted profits, a methodology that smooths the lurching swings that make equities look cheap when profits spike and pricey when earnings drop.

Even after the big drop, the Shiller P/E registers 26. It has never stayed at a level that high for long, and the only times it’s been higher were the run-up to the market crash in 1929 and the tech bubble of 2000. If valuations, measured by the Shiller benchmark, return to normal by 2021, the S&P would fall an additional 22%, to 2150.

One thing we can be sure of? Reversion to the mean is a powerful force in the markets—and it usually prevails.

A version of this article appears in the April 2020 issue of Fortune with the headline “Riding a roller-coaster stock market.”

More must-read stories from Fortune:

—Is this your first stock market crash? Some advice for young investors

—Here are two of the biggest losers from the Saudi Arabia oil price war

—Why investors suddenly turned on pot stocks

—Here are some of the most extreme ways companies are combating coronavirus

—Why it’s so hard to find the next Warby Parker

Subscribe to Fortune’s Bull Sheet for no-nonsense finance news and analysis daily.