This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Bull Sheeters. The markets are awash in red this morning. It’s looking like a classic risk-off day. Here’s why.

Market movers

They’re calling it the deadliest day yet. Coronavirus infections soared overnight, up 45%, to more than 60,000 cases worldwide. The repercussions can be felt far from Wuhan. Yesterday, organizers of the annual telecoms trade show Mobile World Congress, an event that brings tens of thousands to sparkling Barcelona each February, pulled the plug after a string of big-name cancelations.

This morning, the Asian and European markets across the board are down, as are the U.S. futures. What’s up? Typical safe havens: the dollar, gold and bonds. If there’s any silver lining it’s that the equities sell-off is fairly orderly. So far.

It’s not all virus news that’s upsetting investors. Corporate results are weighing on stocks. The two are intrinsically linked as more companies with exposure to China drop bad news on the markets. This morning it was Nestle’s turn. The Swiss foods giant wound back a big sales target, citing China uncertainty. In the past week, a parade of luxury goods brands have made similarly skittish statements.

Afterwards, stocks sink. And the cycle continues.

“Prepare now”

Over the past week, the markets had been remarkably sanguine. And that’s despite the coronavirus death toll and infections rates climbing.

But as the news takes another grim turn, it’s worth re-examining what’s at stake.

China accounts for 16% of global economic output. As Bain & Co. points out, its economy is seven times larger than it was in 2002-03 during the SARS outbreak. “The cost of novel coronavirus pneumonia will surpass all previous outbreaks,” Bain projects, before adding: “Prepare now.”

Why’s that?

Because an increasing number of global companies are highly reliant upon the Chinese consumer or its workers, or both. Multinationals are banking on China as a sales-growth engine (think autos, beer and luxury goods brands). Or, they’re highly reliant on its factories and supply chains (think tech manufacturers) to make products they ship around the world.

And so when China catches a cold, the global economy suffers.

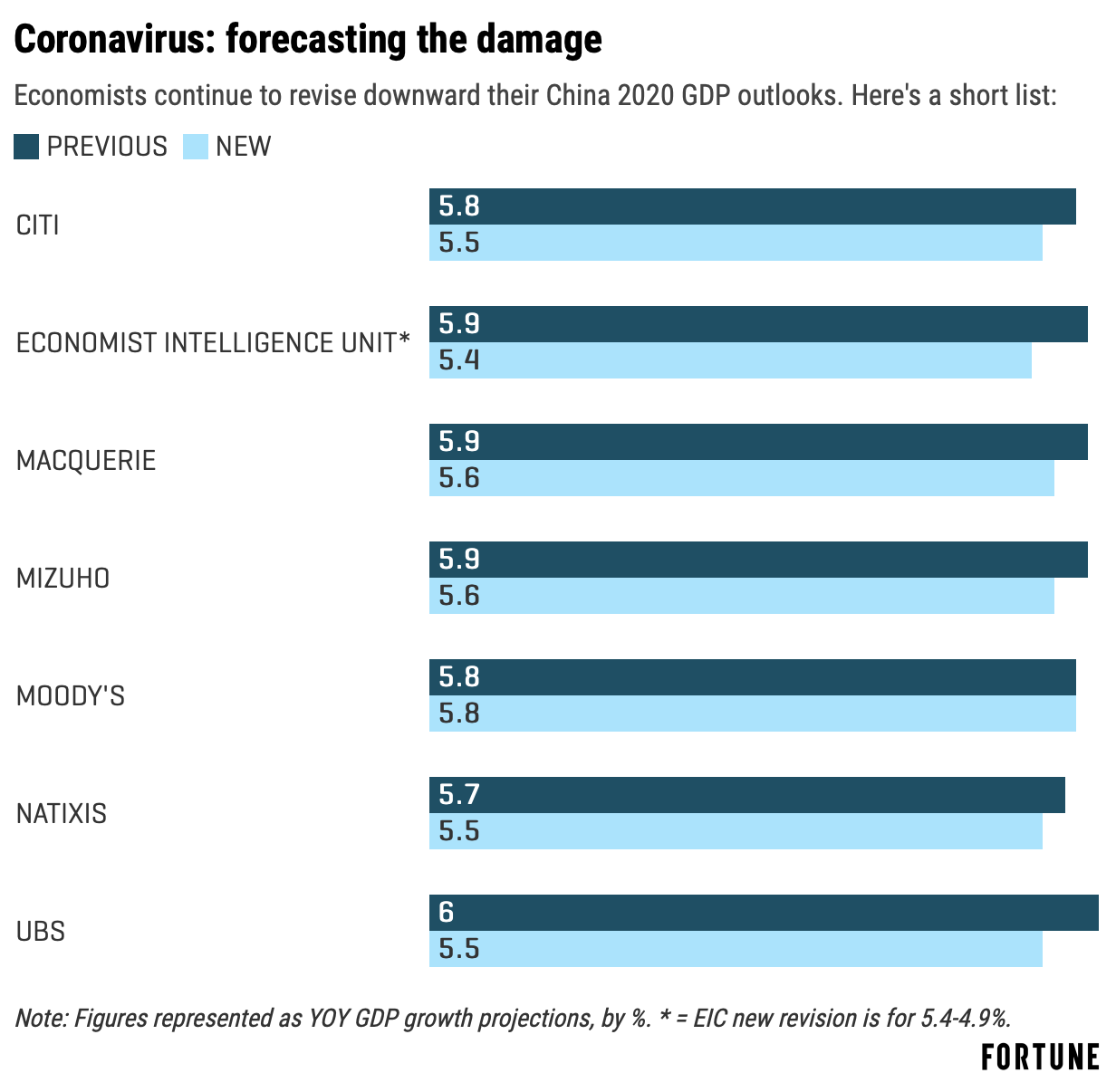

We’re not quite a month into this crisis, and economists are beginning to run the numbers on what it will mean for the Chinese economy, as the chart below shows.

***

This is merely the short list. The economists and analysts above are calculating anywhere from a 0.2 percentage-point drop to as much as 1%. These forecasts could change again as the situation remains fluid and fraught.

We still don’t know, for example, when the epidemic will peak, when the rest of the country will return to work, and when it will get back up to full production. We also don’t know how long it will take to jumpstart the supply chains, and, as we’re hearing from multinationals, what impact it’s having on sales this quarter, and what to expect going forward.

The longer the coronavirus contagion drags on, the greater likeliness China’s problem becomes a global one. Stay tuned for more risk-off days.

***

Have a good day everyone. I’ll see you tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Today's reads

Hell in a handbag. Back in 2003, during the SARS epidemic, Asia’s well-heeled consumers barely missed a beat. They went back to stocking up on $2,500 Gucci handbags and $300 Hermes scarves once the outbreak threat passed, and the sector bounced back quickly. That's unlikely with the current coronavirus, Adrian Croft reports in Fortune. Chinese buyers now account for 35% of the $300 billion global luxury goods market, and much of its growth. The coronavirus is also eating into the $110 billion personal fortune of luxury goods magnate Bernard Arnault.

Thiam’s swansong. Credit Suisse this morning reported its highest annual profits in almost a decade, buoyed by fourth-quarter earnings that outgoing chief executive Tidjane Thiam said were a vindication of his strategy, the Financial Times reports. It wasn't all rosy, though. The investment bank business swung to a larger than expected loss and shares sank as much as 3%. Thiam, 57, was forced to step down last week following a boardroom battle with chairman Urs Rohner as a spying scandal overshadowed his turnaround plan.

Sanders backlash. Former Goldman Sachs CEO Lloyd Blankfein took to Twitter to criticize Bernie Sanders after his New Hampshire primary success, saying the Democratic frontrunner will "ruin our economy and doesn’t care about our military. If I’m Russian, I go with Sanders this time around.” It's no secret Wall Street and Sanders don't see eye to eye. Investors though seem to be betting Sanders, despite his early success, is unlikely to advance to the White House.

Market candy

$165 million. That's the amount Jeff Bezos paid for a Beverly Hills mansion on nine acres, setting a record for a Los Angeles-area home. The property, designed for Hollywood film titan Jack Warner in the 1930s, was described by Architectural Digest in 1992 as the “archetypal studio mogul’s estate,” built in Georgian style with expansive terraces and its own nine-hole golf course. The Amazon founder is on a shopping spree befitting the world’s richest man. Bezos, who recently cashed out $4.1 billion of Amazon shares, has also reportedly entered the art market, setting a record for artist Ed Ruscha at a Christie’s auction with a $52.5 million purchase of “Hurting the Word Radio #2”.