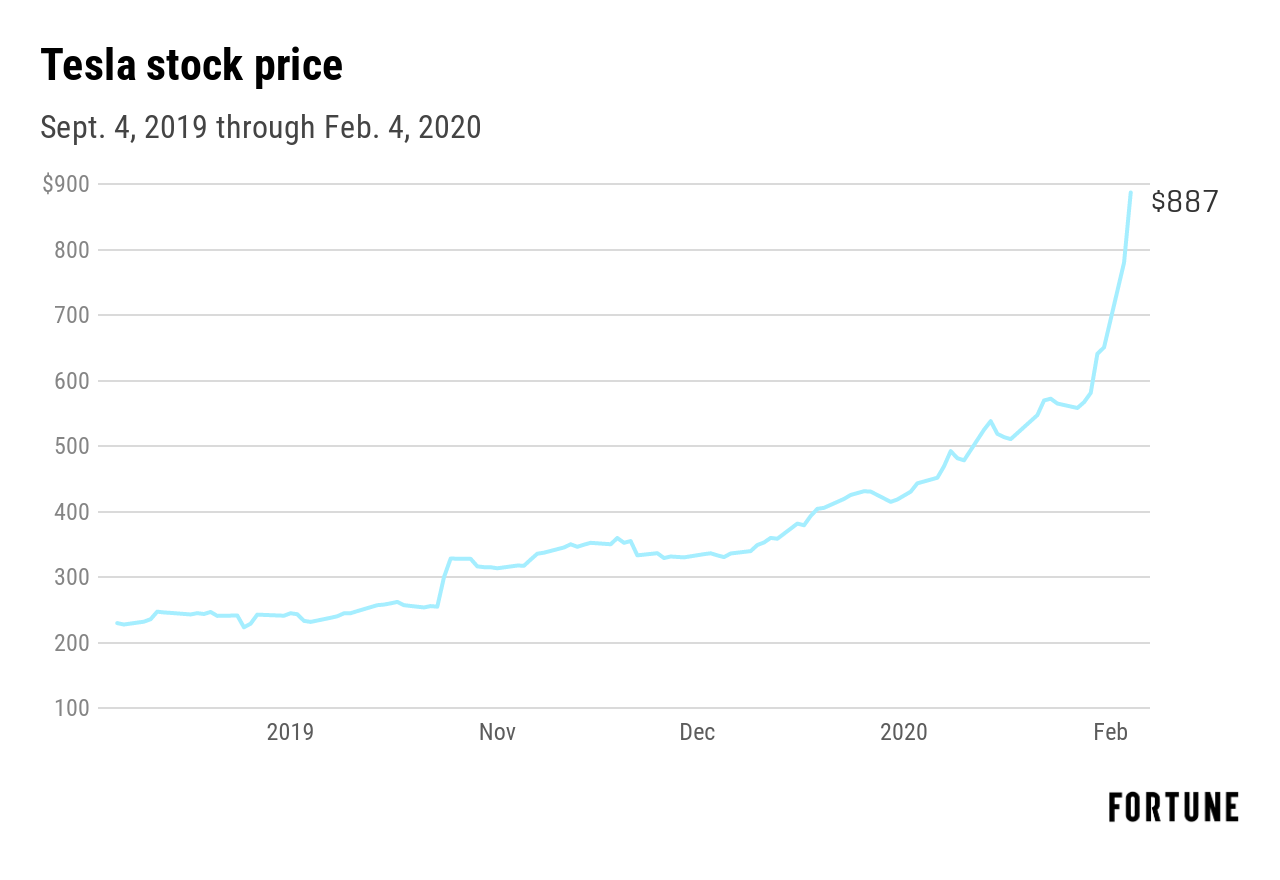

Investors who like that sensation of their stomach dropping away don’t need to board a roller coaster. They can just buy Tesla shares.

In December, the electric car maker closed at $414.70. By the end of yesterday, the stock was trading at $968.99, or up 114% for the year. Then today, shares plunged more than 17% to $734.70, their worst one-day drop since January 13, 2012, when the share price fell by 19.3%.

As of today’s close, Tesla ranks as the world’s Number 2 automaker by market cap. (Six months ago, it would have been fifth.) And out of a group of automakers, including VW, GM, Ford, Fiat Chrysler, Honda, Daimler, and BMW, Tesla had the lowest annual revenue for the more recently reported full year.

Most analysts are also cautious about the company. Out of 38 analyst ratings obtained from Bloomberg, 16 were negative, 16 neutral, and only 7 were classified as positive.

The company’s evangelists have had a very good 2020 thus far to be sure. But a developing competitive landscape—well-funded startups like Rivian and virtually every big car maker, including GM, Ford, and Volkswagen, are working on EV models—have naysayers believing there is little to no chance the company will earn enough to justify its sky-high share price, which on Tuesday was more than six times bigger than Toyota’s, the largest car maker in the world.

Tesla: present and future

While Tesla is considered an EV pioneer, it’s also an equities heavyweight. The company currently represents 1.1% of the entire value of the Nasdaq Composite Index, with only 11 companies—including Apple, Microsoft, Amazon, Facebook, and Intel—having a bigger influence. Its market cap is certainly outsized when compared to other automakers on such metrics as revenue and net income, as the chart below shows.

The bulls, however, believe it’s all about what’s to come. “We believe EV demand is inflecting globally and Tesla is leading the charge,” Dan Ives, managing director of equity research at Wedbush Securities, told Fortune in an email exchange. “The stock is reflecting the good news and much more in the future. Now it’s about continued execution for Musk and company.”

Still, the climb of share prices over the last six months, at least before today, has been fearsome.

“Doubts about Tesla have been put to rest,” David Russell, vice president of market intelligence at TradeStation, wrote in a note to Fortune. “People who worried Elon Musk couldn’t deliver have been proven wrong and now they’re frantically playing catch-up. People should never forget that the stock market is forward looking. Investors price in years of growth before it actually takes place. Tesla moved like this back in 2013 and 2014, followed by half a decade of consolidation. Now it may be doing something similar.”

Forecasting the road ahead

Part of the market’s reaction can also be explained by the tension between the true believers—who think that Tesla is the company that will dominate all auto sales for the foreseeable future—and those who have shorted the stock, thinking that only hype has kept it afloat. Even the shorts can find themselves unintentionally pushing up the price in a rally because they have to buy additional shares to cover their positions.

Bill Selesky, senior research analyst at Argus Research, thinks that the run up has been a combination of all these factors. “It’s hard to tell which part has the most influence,” he told Fortune in an email exchange, “but I think more and more that the market is telling itself that EVs are a real part of the future and there’s no turning back.”

Brad Cornell, emeritus professor of finance at UCLA and managing director at global consulting firm BRG, had shorted 1,000 Tesla shares for a fund he runs, and lost some money in the process. He closed out most of his position, but still had 200 shares shorted.

“When this craziness started, we met and said we don’t understand this,” Cornell said. “We think it’s overvalued but we’re not going to risk out investors’ money.”

Cornell agrees that Tesla is currently the leader in the EV market, “but the competition is finally waking up,” he said. “My suspicion is they’re going to lose money in the quarter ended March and that’s going to cause a lot of problems.”

Cornell pointed to a valuation of Tesla done by a colleague of his: Aswath Damodaran, a professor of finance at NYU’s Stern School of Business. Damodaran initially estimated in June 2019 that within 10 years, the company would have $100 billion in annual revenue (that’s more than four times its 2019 sales) with a 10% pre-tax operating margin (last year, -2.7%), making a current value of a share worth $190. He bought at $180.

With shares closing just over $734 today, it was a great trade. But as with all things Tesla, you just never know what’s going to happen tomorrow.

More must-read stories from Fortune:

—All of your questions on filing taxes in 2020, answered

—The health of the economy in nine charts

—Why investors are cooling on “direct-to-consumer” brands

—The coronavirus is already disrupting the global supply chain

—WATCH: Biggest investing opportunities and risks for 2020

Subscribe to Fortune’s Bull Sheet for no-nonsense finance news and analysis daily.