The Fortune 500 rankings are based on revenue, not stock returns. That’s why, every year, several companies make the list that have punished their shareholders far more than rewarded them.

This year’s list partly reflects performance in 2015, during which time falling oil and gas prices savaged Peabody Energy (BTU) and Chesapeake Energy (CHK), which lost 93% and 77%, respectively; while falling ad sales and mounting losses crushed iHeartMedia (IHRT).

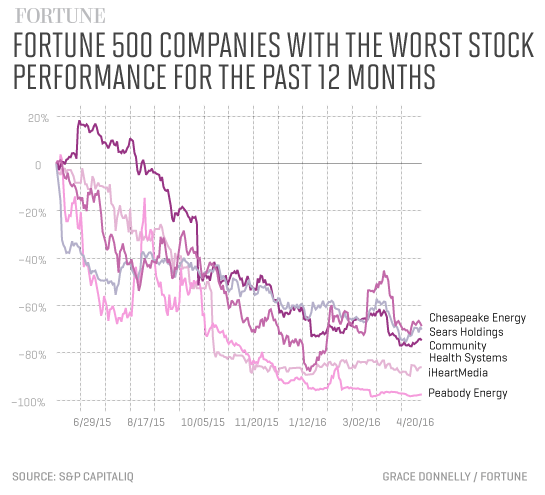

With oil on the rebound recently, the lineup of worst-performing stocks has shifted somewhat in the first half of 2016. For this article, we assessed the Fortune 500 companies based on their stock performance from the time last year’s list came out up to the release of the newest list—June 4, 2015 through June 3, 2016.

You can find a list of the biggest stock losers in that time frame, below the chart. And you can visit our new Fortune 500 list for more news and information about America’s biggest companies.

1. Peabody Energy Corporation

Fortune 500 rank: 458

One-year performance: -97.5%

Year-to-date 2016 performance: -84.6%

By now, coal-mining company Peabody Energy (BTU) belongs in the Fortune 500 hall of infamy: It was also the worst-performing stock on our list last year, as well as the worst performer in calendar 2015. Coal was already in decline as the world turned to more environmentally-friendly energy sources; when oil and natural gas prices collapsed in the last couple of years, they became even more attractive compared to coal, which is now so cheap that it’s hard to make any money by mining it. That has been the undoing of Peabody, which filed for bankruptcy in April after years of onerous losses. It lost $2 billion last year, placing it on our list of the Fortune 500’s billion-dollar losers. The company was delisted from the New York Stock Exchange after its Chapter 11 filing, further dooming its shareholders, who can now only trade the stock over-the-counter.

2. iHeartMedia

Fortune 500 rank: 414

One-year performance: -86.1%

Year-to-date 2016 performance: 14.4%

iHeartMedia (IHRT) is an especially volatile stock, due to its unusual structure. It's one of the only publicly traded Fortune 500 stocks that isn't listed on a major stock exchange (along with Fannie Mae (FNMA), Freddie Mac (FMCC), and now Peabody Energy), after it was largely taken private in a leveraged buyout in 2008. Today, only about 30% of the company trades on the public market, which has lately pummeled its shares. The radio station operator and advertising company, formerly known as Clear Channel, was also the second-worst stock of 2015, falling 88%, and even a recent rally hasn't helped much: The shares are still down more than 86% since last year's Fortune 500 list.

Saddled with nearly $21 billion in debt stemming from its buyout, iHeartMedia reported bigger-than-expected losses of nearly $755 million last year due in part to weak advertising sales, including in its billboard subsidiary Clear Channel Outdoor Holdings (CCO). That sent its stock off a cliff, and its share price has since hit lows of less than $1 after iHeartMedia's creditors threatened to declare it in default—a move that could force the company into bankruptcy, and which it is currently disputing in court.

3. Community Health Systems

Fortune 500 rank: 125

One-year performance: -74.6%

Year-to-date 2016 performance -48.2%

Two years after completing its acquisition of Health Management Associates to create the largest for-profit hospital system in the U.S., Community Health Systems (CYH) has largely failed to integrate the companies and reap the "synergies" it had hoped for in the nearly $4 billion deal. The company has reported three straight quarters of disappointing earnings that fell short of Wall Street's expectations. It admitted fewer patients to its hospitals in 2015 (thanks in part to a milder flu season at the end of the year), and also warned that it was having a harder time collecting payment from the patients it did treat, increasing its estimate for "doubtful accounts" by $169 million. Community Health Systems is now trying to divest more of its assets to pay down its $16.7 billion debt burden, after already spinning off 38 smaller hospitals in April.

4. Sears Holdings

Fortune 500 rank: 111

One-year performance: -70.1%

Year-to-date 2016 performance: -36.7%

Investors have been on bankruptcy watch for Sears Holdings (SHLD) for years, and recent dismal results for department stores in general have enforced the impression that the company is teetering on the edge of going out of business. Indeed, Sears' same-store sales have fallen every year for a decade. Sears, which operates its eponymous stores as well as the Kmart chain, also landed on our list of the Fortune 500's billion-dollar losers, with losses of $1.1. billion in 2015. That boosted its total losses in the last five years to $8 billion. The company's biggest problem is that many shoppers have lost interest in buying what it sells: One survey earlier this year found that women prefer shopping at Goodwill secondhand stores than at Sears. Many investors won't touch the stock, fearing that Sears may soon move on from selling its smaller assets to fully liquidating its business.

5. Chesapeake Energy

Fortune 500 rank: 223

One-year performance: -68.6%

Year-to-date 2016 performance: -9.1%

After going full-bore into the U.S. fracking boom a few years ago, Chesapeake Energy (CHK) has, like its industry peers, recently been crushed by the collapse in the prices of oil and natural gas, its bread and butter. It reported net losses of almost $15 billion last year. On top of that, the stock has languished under the cloud of a four-year investigation into an alleged bid-rigging conspiracy at the company: Chesapeake was the third-worst performing stock in the Fortune 500 in calendar 2015, down 77%. While it settled criminal charges from part of the antitrust investigation for $25 million last year, investors were watching and waiting for the other shoe to drop amid an ongoing probe in Oklahoma. But Chesapeake shareholders cheered earlier this year when the investigation only led to charges against ex-CEO Aubrey McClendon, without implicating the company in any wrongdoing. (The company's stock soared higher still after McClendon died in a fiery car crash the very next day.) Despite being free from the overhang of a federal investigation, Chesapeake's stock price is still closely tied to energy prices, which have retreated again recently, hurting the shares.