Here we go again.

What chain stores have long called the “Super Bowl” of retail is upon us once more: the annual shopping bonanza known as Black Friday.

Starting Thursday afternoon, tens of millions of Americans will head into stores or go online for deals on televisions, coffeemakers, and bed sheets. While a good Black Friday weekend for retailers doesn’t necessarily guarantee a bountiful holiday season, it is an important early gauge of shopper mood and an indication of which promotions are working and, perhaps more importantly, which ones aren’t.

The stakes are high this holiday season: despite low gas prices and low unemployment—both factors that on paper should bolster consumer spending—retailers from Macy’s (M) and Nordstrom (JWN) to Kohl’s (KSS) and Best Buy (BBY) have not reported robust business. So, stores have been aggressive early this year.

Target waived its free shipping order minimum, and Walmart is starting its Cyber Monday sales on Sunday. Meanwhile, their tormentor, Amazon, has been adding deals every five minutes for eight days.

Still, for all the talk of Black Friday being a diluted relic, it remains the biggest-headline grabbing event of the retail calendar.

So, here are a few key facts for you retail nerds out there.

How many people will head out shopping this Thanksgiving/Black Friday weekend?

Some 135.8 million Americans are expected to either hit stores or shop online between Thanksgiving Day and Sunday, according to the National Retail Federation. That is a bit less than last year, largely because Black Friday deals have come earlier this year, watering down the weekend’s impact. (Amazon.com, Walmart, and Target, among others, have been offering deals all month.) But on the whole, the NRF expects retail sales will be up 3.7% for the season.

Is “Black Friday creep” over?

It seems that way, for the most part. After years of stores opening earlier and earlier, retailers seem to have discovered there is a limit to how much you can eat into the holiday. Big names such as Target (TGT), Macy’s (M), and Kohl’s (KSS) are sticking to 6 p.m. starts. Walmart (WMT), which has been open on Thanksgiving for decades because it sells groceries, will start its Black Friday deals at 6 p.m on Thanksgiving. Best Buy (BBY) will open at 5 p.m. once again.

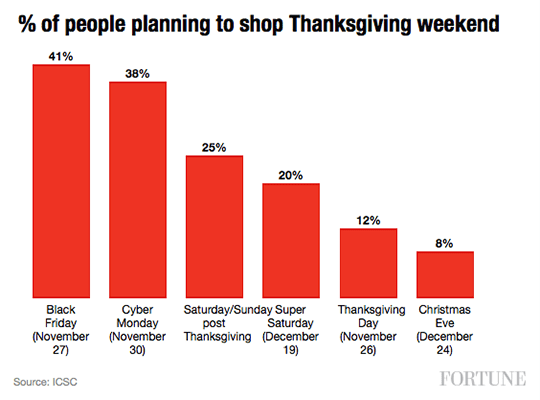

Before we shower these retailers with praise, let us remember that people still have a Thanksgiving meal to attend. And besides, only a small minority of people even want to shop on Thanksgiving, according to a recent survey by the International Council of Shopping Centers.

One exception is J.C. Penney (JCP). In an attempt to crawl back from a disastrous 30% annual decline in sales a few years ago, will open stores at 3 p.m. on Thanksgiving, hoping to get an edge over the competition with three extra business hours. It’s unclear if people will hit the mall at that time, which is when many people will be expected at the table, when no other store is open.

While companies like Staples (SPLS) got credit for closing on Thanksgiving, it’s worth asking whether people really shop for office supplies that day. With sales in decline, it’s a pretty safe bet Staples would be open if it were worth it.

How are discounts shaping up?

For apparel, the deals should be outstanding. Clothing stores have complained about the warm autumn that has prompted shoppers to delay buying cold weather gear. That has led to inventory build-up, which retailers will try to clear this weekend. And big swathes of the country will be warm this weekend, including the Northeast, meaning deals will be plentiful. According to a Jefferies analysis of Black Friday circulars, Kohl’s average discount is up 15%, Macy’s is up by 9.5% and Penney’s is up 19.9%.

Across all shopping categories, the deals are roughly on par with last year. Reuters reported that Penney offered an average 58% off in Black Friday ads this year, slightly less generous than 59% last year, citing Market Track data. Kohl’s is offering 54% off, up from 51%.

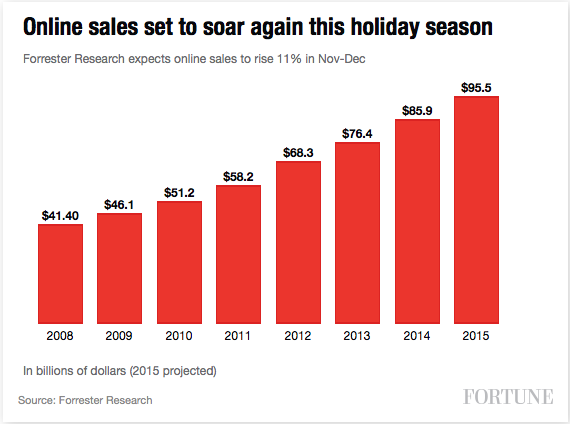

Cyber Monday is starting to bleed into Sunday

Just as Black Friday deals start earlier every year, Cyber Monday is following suit. Walmart is getting a jump this year on Sunday, and Amazon is also ramping up its deals. It’s easy to see why Cyber Monday is increasingly important: Forrester Research projects online sales will rise 11% this year compared to last year, three times the growth rate of retail overall. And with nearly $3 billion at stake, it’s no wonder Cyber Monday is on its way to becoming as big of a deal as Black Friday.