“Private companies are overvalued OR public companies are undervalued.”

One of these statements must be true, particularly given the massive discrepancy between the two distinct valuation environments. It’s not uncommon in the private markets to see businesses valued at 10x, 20x, or even 100x revenue depending on the stage. These valuation levels may even be palpable in an early-stage investment round. For example, a company that will do $2 million of revenue this year and $20 million next year might deserve a rich valuation, let’s say $200 million. Investors in this case are willing to pay forward for future growth. On $2 million of revenue the valuation multiple is 100x, but on $20 million the valuation multiple is 10x. If the business were to slow its growth but still grow 5x from $20 million of revenue to $100 million of revenue, then in retrospect investors might feel like their original investment was a bargain at 2x [very] forward revenue.

The above scenario plays out frequently in the private markets and proves why it’s so difficult to value hyper growth start-ups. The valuation multiple can be off by an order of magnitude or more depending on which forecast revenue number you end up using (and revenue might be the only relevant metric available). In time, however, all businesses slow down and reach more normalized growth levels. At maturity, a business is worth the net present value of its future cash flows with other key business fundamentals taken into account. Of course, these days private investors are taking on unprecedented levels of risk and betting that a wide array of companies will “grow into it”.

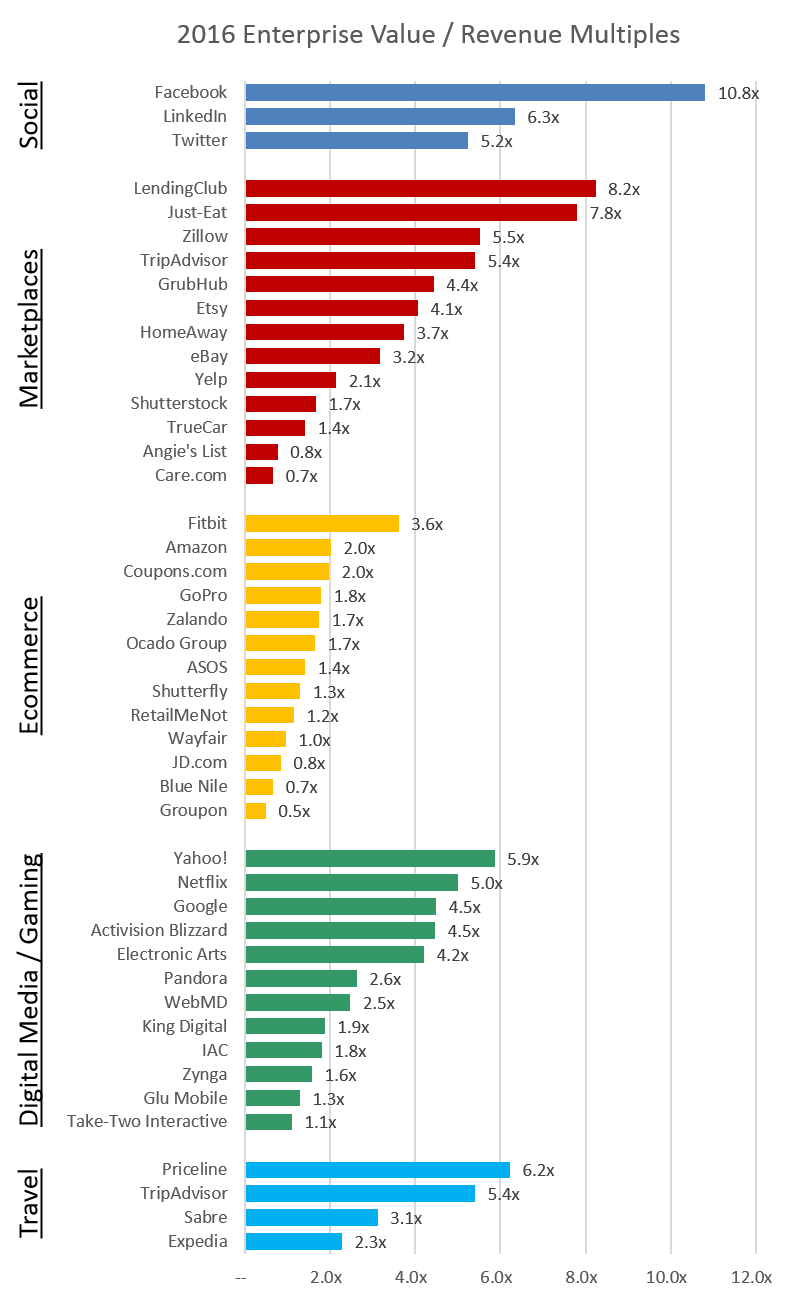

The public data is fun to look at so I went ahead and compiled my own index of consumer Internet companies across the following categories: Social, Marketplaces, Ecommerce, Digital Media / Gaming, and Travel. For each, I plotted the 2016 enterprise value / revenue multiple.

Note: Most of these companies are not valued solely based on a multiple of forward revenue. This is simply the closest metric used for most private valuation rounds. Other important metrics take into account growth rates, operating margins and free cash flow characteristics. I also focused on US companies for the most part.

As you can see, almost no companies achieve higher than a 10x forward revenue multiple save for Facebook (FB). Even LinkedIn (LNKD) and Twitter (TWTR) only get 5-6x.

Quality marketplaces also tend to get premium multiples with Lending Club (LC) and Just-Eat leading the pack around 8x forward revenue. Most other marketplaces center around the 3-6x range with some stragglers like Angie’s List (ANGI) and Care.com (CARE). E-commerce companies, on the other hand, trade completely differently. Given the lower margins and other challenging business characteristics, e-commerce businesses are worth 0.5x-2.0x forward revenue. FitBit (FIT) is doing it’s own thing right now similar to how GoPro (GPRO) behaved post-IPO, although the latter has since come down to more reasonable levels.

The Digital Media / Gaming bucket has a nice variety of various business models and valuations tend to be across the board in the 1.0-6.0x range. Dominant industry players with monopolistic tendencies seem to get much higher multiples (Google, Activision, EA) and the same is true for travel (Priceline, TripAdvisor).

Looking at revenue multiples is a fun way to gut check valuations. That’s not to say that private valuations should match up to public valuations. Hyper-growth companies in new and exciting markets deserve a premium – the question is just how much? Many of the above public companies used to trade at well north of 10x forward revenue in the public markets. That is because companies used to go public much earlier and their growth rates were much higher than they are now. Valuation multiples naturally decrease over time as a company effectively grows into the high expectations placed on them.

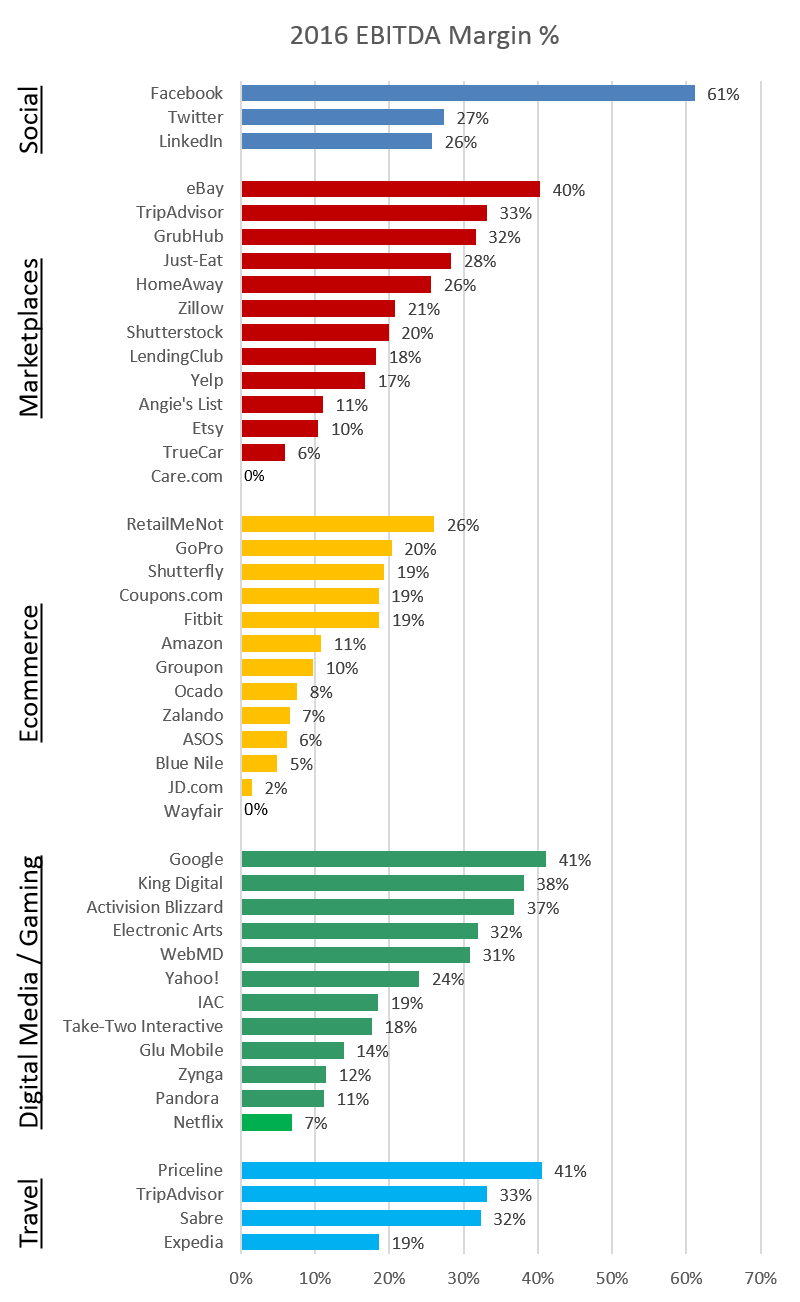

In future posts, I’ll take a deeper look at each of these categories and go beyond the revenue multiple to see what really makes these businesses tick. As a teaser, I’ll leave you another important metric, EBITDA margin.

The below chart shows 2016 EBITDA margin for all of the companies depicted above. EBITDA margin is just one indicator of profitability and even a superficial glance sheds some light as to why certain companies command higher valuations than others. Just look at Facebook, Google (GOOG) and Priceline (PCLN) – not exactly the high cash burn businesses you see in start-up land!

Mahesh Vellanki is a senior associate with Redpoint Ventures, where he has been involved with the firm’s investments in DraftKings and Nextdoor. This post originally appeared on his blog.