Here’s a riddle: Two startups are competing to win a hot new sector. How can it be that Startup A, which appears to have the early lead in the market, is valued at $5 billion, while Startup B—which is not even available in the U.S. right now—is worth nearly twice that? The answer probably has something to do with crypto.

The scenario above describes the race between Kalshi and Polymarket to dominate prediction markets, a field that has been around for years but only took off in 2024 thanks to a more permissive regulatory environment. Right now, Kalshi is racking up new U.S. users, who are betting on everything from sports to political events, while Polymarket is still getting its paperwork in order to operate legally in this country. Both firms announced new funding rounds last week, but Polymarket made the bigger splash with a valuation of $9 billion.

The offerings from the two startups are as similar as those from Uber and Lyft. The only significant difference, aside from Kalshi’s head start in the regulatory process, is that Polymarket is built on blockchain rails. Kalshi is scrambling to add crypto capacity, but it will be hard-pressed to catch its rival, which has been clearing transactions on the Polygon layer 2 network since it began, and has a founder who participated in the Ethereum crowdsale while still in high school. Critics can find plenty to fault with Polymarket but no one can doubt its crypto bona fides.

A harder question is why Polymarket’s crypto pedigree makes it worth so much more than its rival. That’s especially the case at a time when Kalshi is scooping up big chunks of the U.S. sports gambling market, and is trouncing Polymarket in terms of app downloads and active users. The answer here can likely be summed up in two words: token drop.

Polymarket CEO Shayne Coplan shared a post last week that ranked cryptocurrencies, including a fictitious-as-of-yet token called POLY in fifth place, right behind Solana and Ethereum. The company hinted elsewhere that the token is likely to drop next year and, if that happens, look for Coplan and Polymarket’s investors to be in position for a windfall.

The Kalshi founders, meanwhile, will probably have to get rich the old-fashioned way: Building the most popular service, and working to expand and defend its big early mover advantage in the U.S. The task isn’t going to be any easier given that fast-moving giants like Robinhood and Coinbase are also taking a keen interest in the emerging prediction market industry.

The final wildcard in all this is that both Polymarket and Kalshi are run by flawed CEOs. As I reported in a recent magazine feature, there are red flags about whether Coplan has the maturity to take a fast-moving startup all the way. Kalshi CEO Tarek Mansour, meanwhile, has a penchant for underhanded tactics that have hurt his company’s reputation.

Finally, there is the matter of which startup can execute better in a controversial and highly regulated new industry. Right now, Kalshi has an edge here thanks to its buttoned-up legal approach towards issues like dispute resolution and ethical controls. Polymarket, on the other hand, has a murky process for disputes that is controlled by owners of an obscure cryptocurrency. The company also has a hands-off attitude to approving contracts, which has led to controversy over the listing of “arson market” bets like those on President Donald Trump’s demise, and a history of wash trading on its platform. These are challenges that a token drop alone will not solve.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Biggest-ever stablecoin deal: Coinbase and Mastercard have jockeyed to buy BVNK, a London-based provider of stablecoin services. The crypto giant has the inside track to close the deal, which has echoes of Stripe’s recent $1.1 billion acquisition of Bridge. But, with bids around $2 billion, BVNK could fetch twice the price. (Fortune)

“Largest liquidation event in crypto history” is how one analytics firm described the market carnage on Friday that saw Bitcoin fall around 20% and major altcoins tumble 40% before prices made a modest recovery. The frantic day of trading saw centralized exchanges like Binance experience problems, though major DEXes handled the volume without incident. (Decrypt)

Banks get together on stablecoins (again): Goldman Sachs, Santander, BoA and others are creating a consortium to explore using stablecoins for payments. The plan, which will reportedly focus on G7 currencies, follows previous efforts by banks to work together on crypto—including R3—that largely foundered. (Bloomberg)

SoftBank bets on Binance: The payments wing of Japanese investment giant Softbank acquired a 40% stake in Binance Japan. The deal comes at a time of crypto deregulation in the country, and as SoftBank offers rewards to overcome a cash-first mentality on the part of many Japanese investors. (Reuters)

Block’s new Bitcoin groove: Jack Dorsey’s Block, which has wandered the fintech wilderness for years, is thriving again. Its share price hit an all-time high last week, coinciding with a new feature on the company’s flagship Square payment system that will let merchants accept Bitcoin without fees. (The Block)

MAIN CHARACTER OF THE WEEK

“Bitcoin Jesus,” or Roger Ver, a colorful figure from crypto’s early days who earned his nickname by giving out Bitcoin to random people, is back in the news. Ver, who renounced his U.S. citizenship in 2014, was arrested in Spain for criminal tax fraud in the U.S. last year—but has now reached a settlement with the Justice Department that will see him pay $48 million for the charges to be dropped.

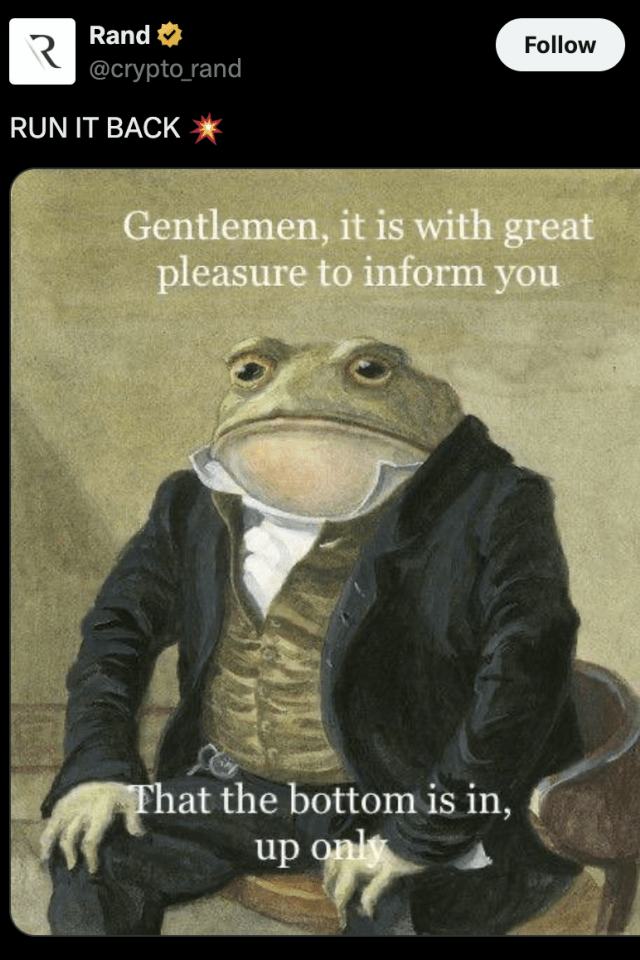

MEME O' THE MOMENT

The modest gains that followed Friday’s massive market wipe-out gave rise to a series of memes, like the one above by crypto bulls reassuring each other the worst is over. But at a time when the broader market feels overheated, the actual trajectory is anyone’s guess.