As traditional financial institutions look for ways to integrate cryptocurrencies into their offerings, interest is growing in tokenization, the process of creating digital representations stored on a blockchain of real-world assets.

Plume is among the startups aiming to become the standard in this sector with a blockchain that would let users more easily invest in real-word assets ranging from Pokémon cards to oil reserves to Medicaid-backed invoices. And the company just closed a $20 million investment round led by Brevan Howard Digital, Haun Ventures, Lightspeed Faction, and Galaxy Ventures, bringing its total funding to $30 million.

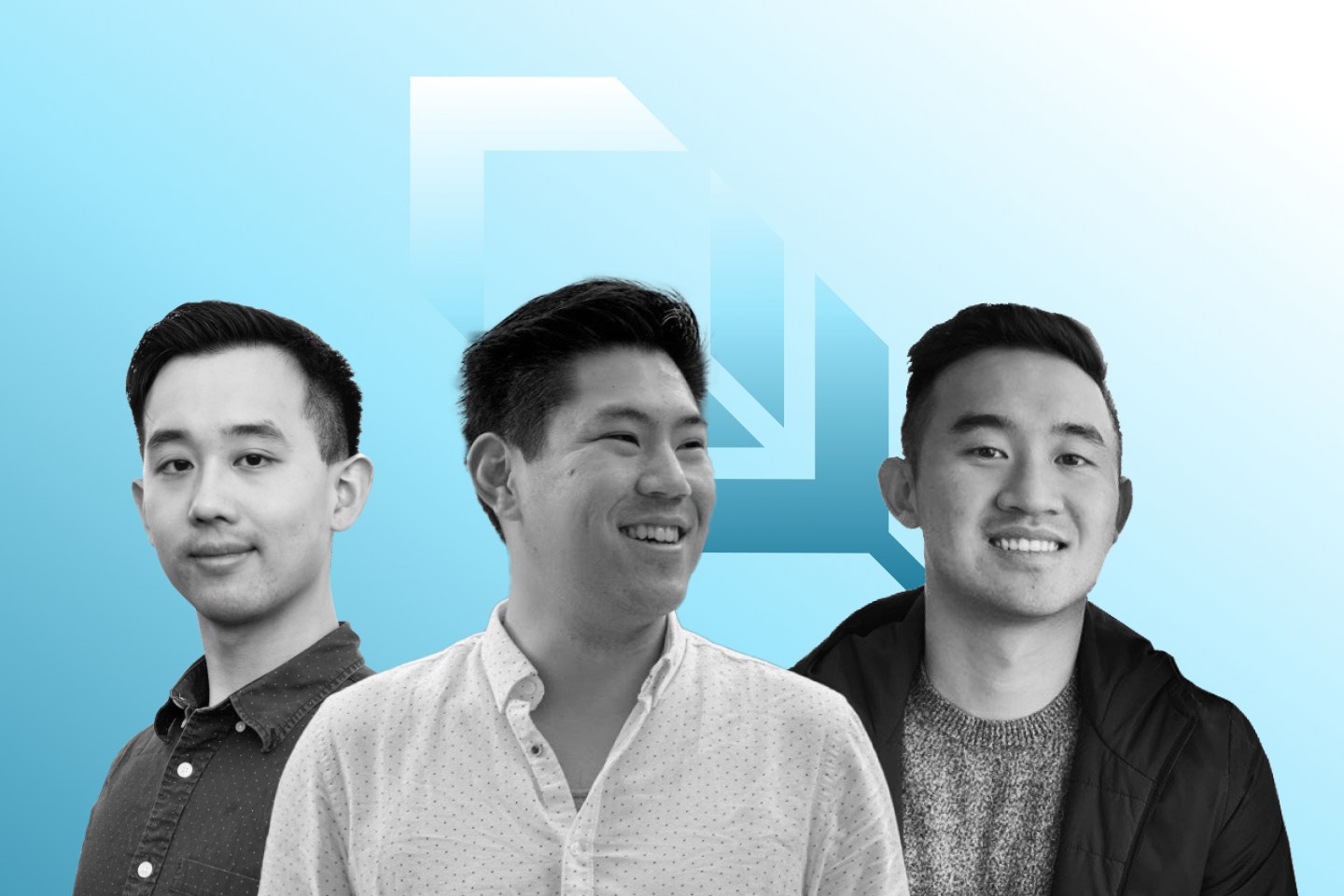

The Plume blockchain, which is not yet available publicly, is part of the company’s effort to build the first real-world asset finance ecosystem, or “RWAfi,” according to co-founder and CEO Chris Yin.

“For us, it’s about expanding the surface area in which you can interact with the real world,” Yin told Fortune.

Yin says his company will provide infrastructure that developers can use to offer RWA financing. While it is possible to issue tokenized assets on an existing blockchain like Ethereum—such as Superstate does—Yin says his new blockchain is focused specifically on real-world asset tokenization which he hopes will help attract an ecosystem of crypto-native users before the company expands into the traditional finance world.

“Each chain has its own flavor, its own community, its own style,” he said. “… To bootstrap the ecosystem, you need to have it come into one place.”

Users will be able to interact with the Plume blockchain in three different ways, Yin said. It will let users earn returns on tokenized assets like T-bills. It will help users trade real-world collectibles, like watches or sneakers, by verifying authenticity. And it will also allow users to bet on the outcome of an event or the future price of an asset by feeding the blockchain real-world data.

One hundred and eighty projects have already begun building on the network’s infrastructure, according to Plume, including a decentralized private credit platform called Credbull. In October, Credbull began rolling out on the Plume blockchain a fixed yield credit facility—a type of loan agreement that lets the borrower take out money over an extended period of time with a fixed interest rate.

While developers can already build on Plume’s blockchain, users will have to wait until early next year for access, the company said.

Yin says Plume will use the money raised in its latest funding round to expand from crypto-native users to traditional financial firms and asset managers. It will also make it easier for developers to customize the blockchain.

“You can increase your customer reach, by going through these blockchain networks…We have an ecosystem where you can plug in, take loans out, rehypothecate, loop, lend, borrow, whatever,” Yin said. “And you can reach people all over the world that you couldn’t normally reach.”