The regulatory process is normally a dry affair: Corporate executives ask their lawyers to file paperwork and then sit around until an agency makes a decision. But in the case of pending applications for a Bitcoin ETF, crypto nerds are sharing any detail—real or imagined—with an obsession reminiscent of Swifties tracking the progress of the Taylor-Travis courtship.

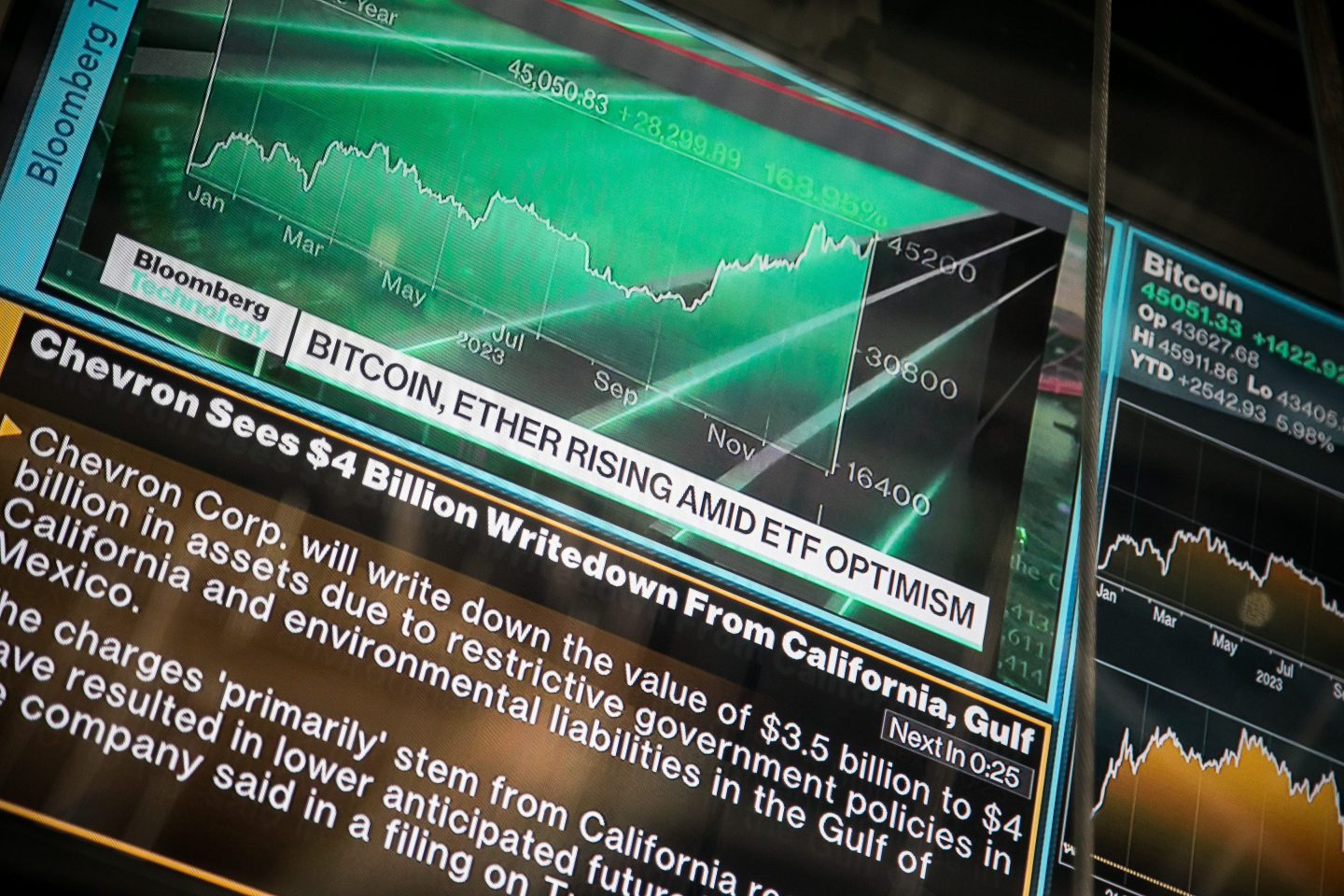

This fixation has only increased in the new year even though very little has happened in the past week when it comes to the Bitcoin ETF applications. But that hasn’t stopped crypto bulls from gushing that an SEC approval will cause prices to go gangbusters, or others to opine that any price boost from an approval is already baked in. No one really knows for sure, but the crypto world has been happy to fill the information void with speculation, rumors, and conspiracies.

The latest example came on Wednesday morning when Bitcoin fell with a thud after a research report predicted that the SEC’s approval—widely expected to come next week—wasn’t going to happen after all. By midday, however, the nervous Nellies on Crypto Twitter appeared to have convinced themselves that the report author was wrong, and prices made a modest recovery. Their confidence was boosted by a tweet from an unreliable journalist that the SEC will begin notifying would-be issuers on Friday that their applications have been approved, and that trading in Bitcoin ETF shares will begin next week.

This might be true. Or it might not. But what is certain is that this climate of chatter and uncertainty has provided opportunity for some A-plus trolling of the ETF obsessives. Most notably, Bloomberg’s Joe Weisenthal posted a BlackRock filing to support the position that an “ETF might boost the price, but theoretically it could benefit Bitcoin in other ways as well. One entity controlling so much of the economic weight of the network might be in a position to push through block size increases, and code changes that enable smart contracts.”

This is exactly the sort of thing that triggers paranoid Bitcoiners’ fear of centralization, and while some correctly warned, “That’s bait!” others eagerly piled onto Weisenthal—prompting him to troll them some more. It’s not my style, but I admire the game. At the very least, Weisenthal’s jibe underscored just how squirrelly the very-online world of crypto devotees can get.

The irony in all this is that those clamoring for early information on the ETF decision are unlikely to get it. The SEC, after all, is tasked with policing insider trading so it would be insane for anyone involved in the process to leak the agency’s decision in advance. The upshot is that, when it comes to predicting the outcome of the Bitcoin ETF process, there’s really only one thing to do: wait.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Goldman Sachs is rumored to be seeking out a role to create and redeem shares for Grayscale’s and BlackRock’s proposed Bitcoin ETFs. (CoinDesk)

Australian scammers created a fake CEO for their crypto hustle, obtaining endorsements from Chuck Norris and others en route to fleecing investors of over $50 million. (The Guardian)

Prominent VC Fred Wilson predicts 2024 will see Web3, especially decentralized applications, hit the mainstream. (AVC)

A new wave of crypto scams is relying on deepfakes to produce bogus YouTube videos, including a recent one of Solana’s founder. (The Verge)

FTX has now filed around a dozen lawsuits in a bid to claw back $16 billion worth of assets, 90% of which it says it will distribute to customers. (WSJ)

MEME O’ THE MOMENT

This is the web version of Fortune Crypto, a daily newsletter on the coins, companies, and people shaping the world of crypto. Sign up for free.