Proof of State is the Wednesday edition of Fortune Crypto where Leo Schwartz delivers insider insights on policy and regulation.

Sam Bankman-Fried isn’t going away. Physically, he’s likely going to prison, but his specter will haunt the crypto industry for years to come.

Every financial reporter within 5,000 miles of Lower Manhattan has fixated on the trial, much to the dismay of PR departments that have seen their pitches go ignored. The discontent runs deeper than unreported funding announcements and product launches, however. Blockchain acolytes want to pretend like Bankman-Fried doesn’t matter.

I have seen the sentiment repeated like a Hail Mary recited over rosary beads—a kind of counter-programming to the media’s blanket coverage. Wall Street Journal antagonizer Nic Carter recently tweeted that the trial was just “clout chasing” reporters trying to “squeeze the last drops of juice out of the saga.”

“At this point, most of us have moved on already,” he said.

I don’t think we’ve been following the same trial. Whether seemingly every outlet in the English-speaking world needs to be reporting on incremental court filings is a valid debate, but it has been abundantly clear that Bankman-Fried’s rise and fall is an indictment of the crypto industry.

I started covering this beat full-time in August 2022, just over two months before FTX’s collapse. I remember the hushed tones that were used to discuss Bankman-Fried, a larger-than-life figure who, as Michael Lewis so artfully said, will leave an equivalently shaped hole in the world.

That was most true in D.C. When I attended a talk he gave at the Bipartisan Policy Center in October, it was still an open question whether he would attend in person—he had beamed into an event the previous day at D.C. Fintech Week. Bankman-Fried did end up strolling in, surrounded by an entourage led by his short-lived lobbyist Eliora Katz, who later testified at his trial. Despite Bankman-Fried’s awkward answers replete with his famous word salad, the crowd gave him a rock star’s welcome, perhaps hoping for maxed-out donations.

Crypto folks often blame journalists for his rise. Kraken cofounder Jesse Powell recently tweeted that mainstream media outlets “created” Sam Bankman-Fried. It’s true his image was bolstered by magazine covers and profiles focusing on his strange philanthropic philosophy rather than the clear conflict of interest undergirding FTX. Even so, that would absolve what really laid the foundation for his empire—billions of dollars of capital.

During the trial, prosecutors have hammered home how Bankman-Fried was handed essentially unlimited funds for several years. That was not only from customers, but from venture capitalists who failed at due diligence—Paradigm, Sequoia, and even firms like Coinbase Ventures and Circle—as well as lenders like Genesis, BlockFi, and Celsius that went down with the ship. That’s not to mention the billions that FTX and Alameda then doled out as investments, welding themselves to the plumbing of the ecosystem.

While there may have been private whispers decrying Bankman-Fried’s false allegiance to the crypto ideology in the name of arbitrage opportunities, the vast majority of the industry was happy to hitch itself to his wagon while the money was flowing. Those who passed up investments did not do so with grave warnings. The only group that seemed to voice any opposition during his peak was hardcore Bitcoiners, and of course, the “dumb motherfuckers” of DeFi, right before FTX fell.

Like all stories, journalists will move on, and news about Bankman-Fried will slow to a trickle. If crypto is prone to cycles, the ease with which he captured crypto in a few short years should not be forgotten. This is an industry of fast money and grifters. There will be more SBFs.

Leo Schwartz

leo.schwartz@fortune.com

@leomschwartz

DECENTRALIZED NEWS

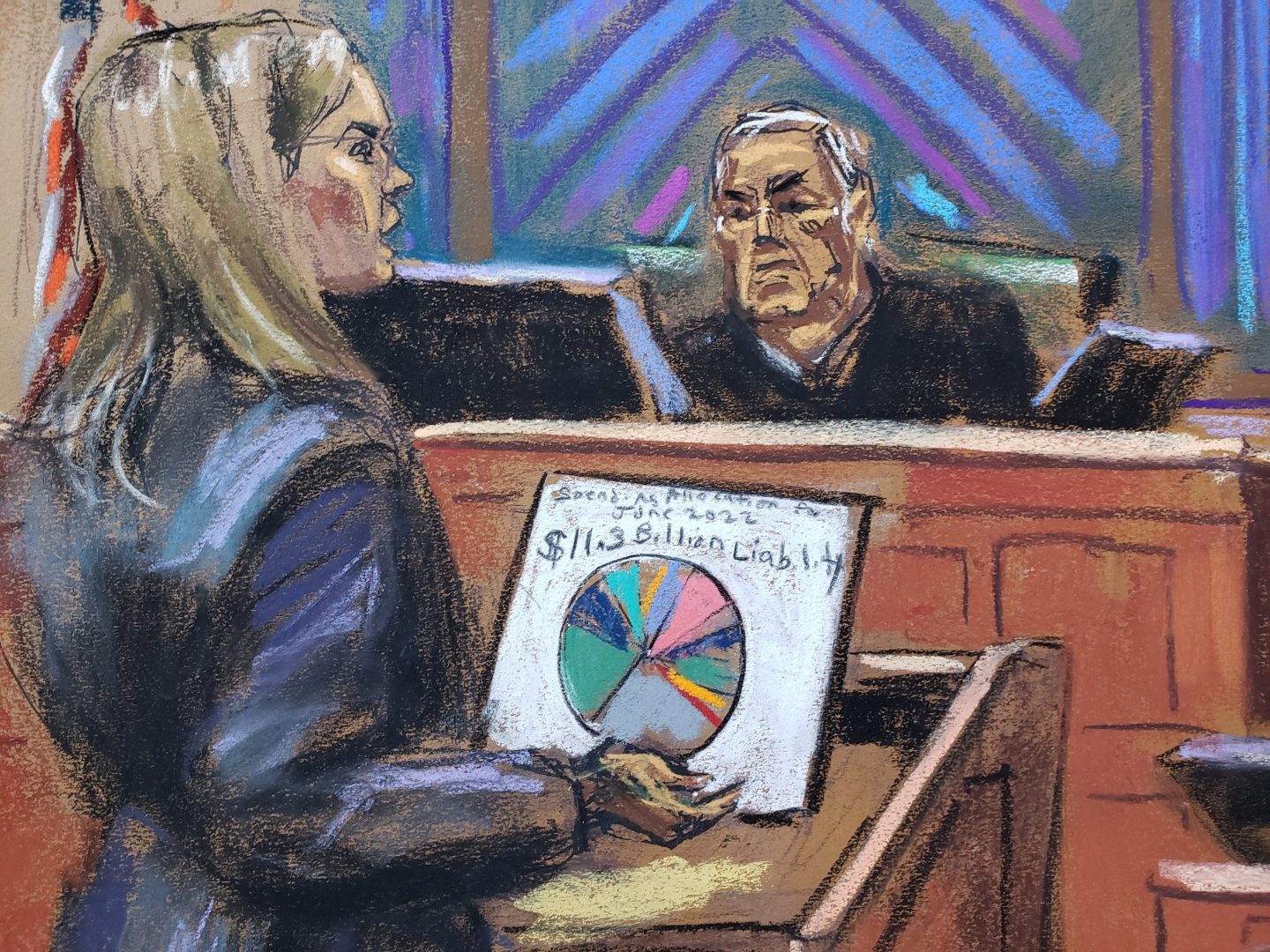

Sam Bankman-Fried withstood his final day of cross-examination as both legal sides prepare for closing statements. (Fortune)

Circle is no longer supporting USDC minting for consumer accounts, which the stablecoin firm described as phasing out a legacy feature. (The Block)

A federal government accountability arm said that the SEC was in the wrong with a controversial rule affecting the crypto industry. (CoinDesk)

Financial planners are warming up to Bitcoin—in moderation—as the possibility of an ETF increases. (Bloomberg)

Department of Justice prosecutors are spent hundreds of hours preparing witnesses like Caroline Ellison for the financial trial of the century. (Wall Street Journal)

MEME O’ THE MOMENT

This is the web version of Fortune Crypto, a daily newsletter on the coins, companies, and people shaping the world of crypto. Sign up for free.