The crypto industry is more volatile than most, so it’s not surprising many people tend to view it through all-or-nothing narratives. Depending on your point of view, crypto is either about to take over the world—or else be exposed as a scam-ridden fad and get washed away for good. Right now, the latter view is in fashion amid an ongoing price slump and aggressive anti-crypto measures by regulators.

Needless to say, the doom-and-gloom view is as overstated as the bull case—something I was reminded of after recent conversations with two longtime crypto investors. Stéphane Ouellette, the founder of Toronto-based investment firm FRNT Financial, told me that the current regulatory climate may be hostile but that it’s still infinitely better than the early days, when crypto firms couldn’t even get a bank account.

Ouellette says he wasn’t surprised by the implosion of big names like Celsius and FTX, saying his firm had always viewed their business models as suspect or illegal, and avoided them in favor of longer-term strategies. Those include brokering institutional trades and offering trading tools that are familiar to big, traditional investors. He adds that he sees no point in venting at regulators or the slow pace at which they operate.

“I worked for two years to get a derivatives license. That’s how long it takes—it’s finance,” said Ouellette, adding that his firm doesn’t touch DeFi because its returns are based on pumping tokens and that he doesn’t see why exchanges can’t be satisfied offering 15 credible tokens rather than hundreds of sketchy ones.

Ouellette added that the current environment for crypto in the U.S. is bad, but cautioned against taking a narrow view. He notes that lawmakers in many states, particularly those run by Republicans, have a more positive view of crypto, and it’s a mistake to view its future in response to the agenda of the current chair of the Securities and Exchange Commission. “There’s no need to blow up eight years of building because one U.S. regulator is going after the space.”

I heard a similar sentiment from David Pakman, a veteran of Apple and the venture capital industry, who is now the managing partner of the crypto-focused fund Coin Fund. He told me he’s deeply discouraged by the U.S. regulatory climate but that he sees nothing to be gained in engaging in public standoffs with federal agencies. Pakman added that we would be worried for the crypto sector as a whole but for the fact that, even as U.S. regulators try to smother it, the industry is thriving in places like Europe, Dubai, Singapore, and Hong Kong—the rest of the world, in other words.

The bottom line here is that, when it comes to assessing the state of crypto, it’s crucial to beware of narratives that are often transient and can obscure the bigger picture.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

The CEO of fund manager VanEck says there will be no Bitcoin ETF for at least 18 months, citing the SEC's ability to "drag their feet." (Bloomberg)

Bit Digital, one of the largest Bitcoin mining outfits in the U.S., says it will locate a sizable portion of its operations in Iceland in response to the domestic regulatory climate. (WSJ)

Eye-popping returns have returned to DeFi thanks to a novel trading technique called looping that can earn 60% yields—but with enormous risk. (Bloomberg)

Coinbase launched a subscription service in 35 countries, Coinbase One, that includes no-fee trades and free tax help. (TechCrunch)

An auction for Celsius is going down to the wire as two large investing groups bid to acquire the bankrupt firm's mining and other assets. (WSJ)

MEME O’ THE MOMENT

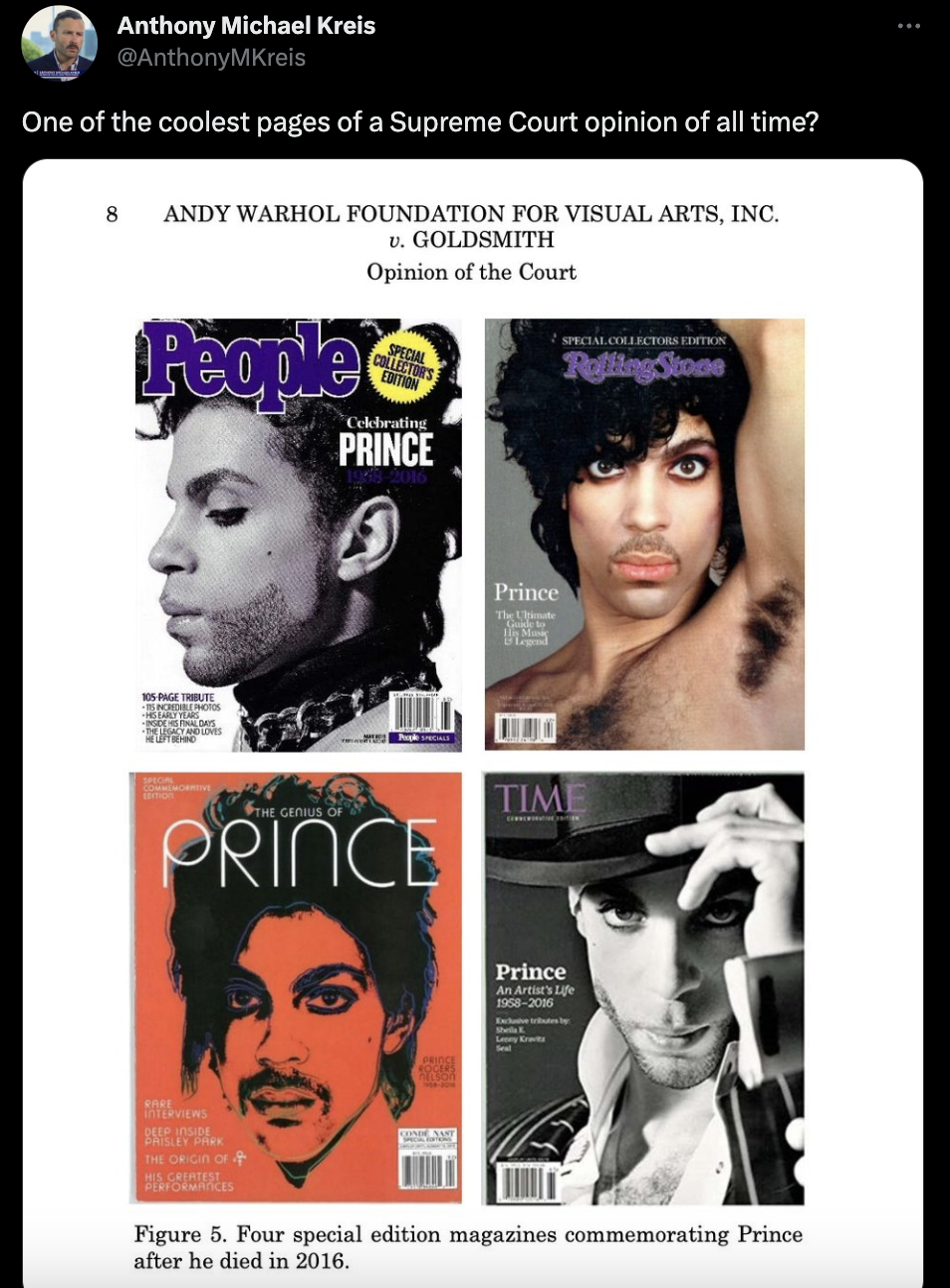

Not crypto but the coolest SCOTUS page ever in Thursday's Warhol/Prince decision:

This is the web version of Fortune Crypto, a daily newsletter. Sign up here to get it delivered free to your inbox.