A number of high-profile celebrities, including comedian Larry David and tennis star Naomi Osaka, are suffering a hit to their reputations after endorsing the bankrupt crypto exchange FTX. Now, their pocketbooks also could take a hit.

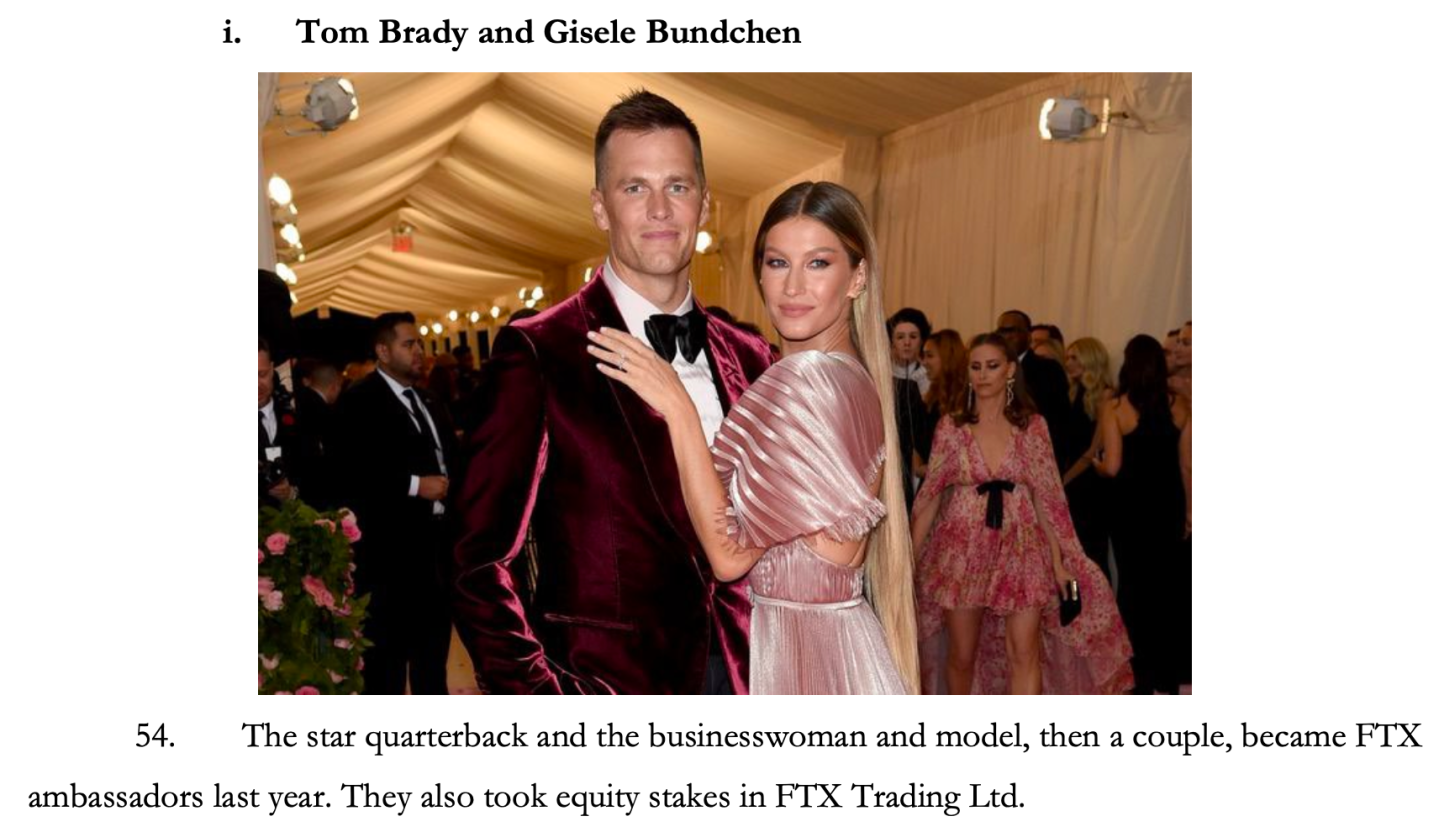

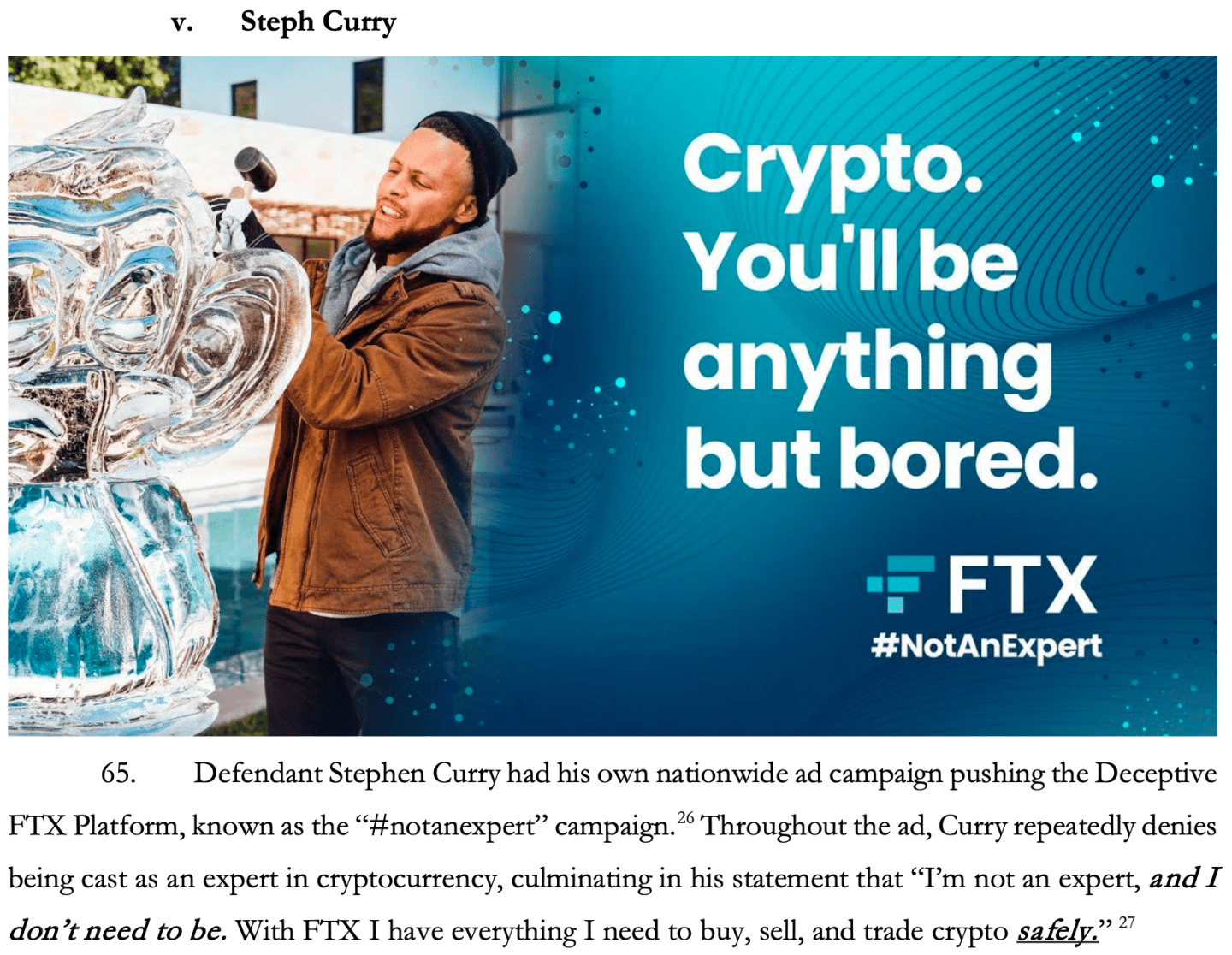

On Wednesday, Oklahoma man Edwin Garrison filed a class action lawsuit on behalf of FTX users, describing the company as a “Ponzi scheme” and saying the celebrities had endorsed unlicensed securities. In addition to FTX, other defendants in the suit include NFL star Tom Brady and his supermodel ex-wife Gisele Bundchen, NBA legends Steph Curry and Shaquille O’Neil, MLB’s David Ortiz and Shohei Ohtani, and the Golden State Warriors.

The complaint, filed in Miami, says damages clear the $5 million minimum to bring the case in federal court, and says Garrison is seeking to represent “thousands” or “millions” of other customers who bought securities in the form of interest-bearing accounts.

The lawsuit is just the latest fallout from the implosion of FTX, which until 10 days ago was regarded as a blue-chip crypto company valued at $30 billion, but has since been revealed to have been engaged in shady accounting and raiding customer accounts to make risky investments.

While it is common for class-action lawyers to file complaints—sometimes frivolous ones—in the wake of any business scandal, this one could prove to be trouble for the celebrities, as the attorneys bringing the case include David Boies, a super-lawyer who’s pled numerous cases before the Supreme Court.

The complaint portrays FTX as a scam to defraud unsophisticated investors, and says the attorneys have been recovering numerous text messages and emails that FTX has sought to destroy. It also includes images that depict Brady, Bundchen, Curry and others hyping FTX. Here is a sample, including accompanying text from the complaint:

The legal case

Garrison is accusing FTX and the celebrities of violating Florida securities and consumer protection laws and of engaging in an illegal civil conspiracy. These claims, however, are based on an important factual point: That FTX’s U.S. subsidiary steered customers to its overseas exchange where they could purchase “yield-bearing accounts” and obtain rates of up to 8% for lending cryptocurrencies like Ethereum.

This is important because FTX has long held that Americans were not allowed on the overseas exchange, and that it prevented potential users from using it. Garrison, however, claims that even though he signed up through the subsidiary, an app known as FTX US, and clearly identified himself as a U.S. resident, the app showed him ads that took him to the more freewheeling overseas version.

“Despite the fact I identified myself by name and address, the FTX Trading App now shows that I am earning yield on the ETH. The yield is valued at 8 percent APR,” states Garrison. “I was able to access the yield-earning product after following a link to the FTX Trading App from FTX US’s website.”

This detail about yield-bearing accounts appears to be critical to Garrison’s argument that FTX was an illegal Ponzi scheme—specifically because it dangled high yields to entice later investors to hand over money used to pay back earlier investors.

The complaint also draws a conclusion that the accounts were securities, though the question of when a crypto is a security is not settled under U.S. law.

If a federal judge accepts these claims about FTX US steering clients to the overseas exchange where they traded securities, it could spell considerable trouble for the celebrities named in the suit. FTX has already filed for bankruptcy, a process that will see its remaining assets picked clean by investors and other creditors, meaning it will likely have no money to pay for any class-action liability—but that’s not the case with Brady and others, who presumably have deep pockets the attorneys will target if they win in court.

The class action does not appear to be an open-and-shut case, and it’s possible it will settle before landing in a court room, but at the least the lawsuit underscores the perils of celebrities endorsing crypto.

Our new weekly Impact Report newsletter will examine how ESG expectations and issues are impacting the roles and responsibilities of today's executives—and how they can best navigate those challenges. Subscribe here.