A growing procession of tech industry leaders including Elon Musk and Tim Cook are warning about a global crisis in the making: A shortage of memory chips is beginning to hammer profits, derail corporate plans and inflate price tags on everything from laptops and smartphones to automobiles and data centers — and the crunch is only going to get worse.

Since the start of 2026, Tesla Inc., Apple Inc. and a dozen other major corporations have signaled that the shortage of DRAM, or dynamic random access memory — the fundamental building block of almost all technology — will constrain production. Cook warned it will compress iPhone margins. Micron Technology Inc. called the bottleneck “unprecedented.” Musk got to the intractable natureo f the problem when he declared Tesla is going to have to build its own memory fabrication plant.

“We’ve got two choices: hit the chip wall or make a fab,” he said in late January.

The fundamental reason for the squeeze is the buildout of AI data centers. Companies like Alphabet Inc. and OpenAI are gobbling up an increasing share of memory chip production — by buying millions of Nvidia Corp. AI accelerators that come with huge allotments of memory — to run their chatbots and other applications. That’s left consumer electronics producers fighting over a dwindling supply of chips from the likes of Samsung Electronics Co. and Micron.

The resulting price spikes are starting to look a bit like the Weimar Republic’s hyperinflation. The cost of one type of DRAM soared 75% from December to January, accelerating price hikes throughout the holiday quarter. A growing number of retailers and middlemen are changing their prices every day. “RAMmageddon” is the term some use to describe what’s coming.

“We stand at the cusp of something that is bigger than anything we’ve faced before,” Tim Archer, chief executive officer of chip equipment supplier Lam Research Corp., said at a conference in South Korea this month. “What is ahead of us between now and the end of this decade, in terms of demand, is bigger than anything we’ve seen in the past, and, in fact, will overwhelm all other sources of demand.”

What’s worrying about the trend is that prices are soaring and supplies are running dry even before the AI giants really get going with their data center construction plans. Alphabet and Amazon.com Inc. just announced plans for a construction blitz this year that could reach $185 billion and $200 billion, respectively, more money than any company in history has poured into capital expenditures in a single year.

Mark Li, a Bernstein analyst who tracks the semiconductor industry, warns that memory chip prices are going “parabolic.” While that will bring lavish profits to Samsung, Micron and SK Hynix Inc., the rest of the electronics sector will pay a painful price in the months ahead.

“This structural imbalance between supply and demand is not simply a short-term fluctuation,” said Yang Yuanqing, the CEO of Lenovo Group Ltd., in an interview after earnings Thursday as he explained the crunch will last at least through the rest of the year.

The disruption is threatening the profitability of entire product lines and upending long-term plans.

Sony Group Corp. is now considering pushing back the debut of its next PlayStation console to 2028 or even 2029, according to people familiar with the company’s thinking. That would be a major upset to a carefully orchestrated strategy to sustain user engagement between hardware generations. Close rival Nintendo Co., which contributed to the surplus demand in 2025 after its new Switch 2 console drove storage card purchases, is also contemplating raising the price of that device in 2026, people familiar with its plans said. Sony and Nintendo representatives didn’t respond to requests for comment.

A manager at a laptop maker said Samsung Electronics has recently begun reviewing its memory supply contracts every quarter or so, versus generally on an annual basis. Chinese smartphone makers including Xiaomi Corp., Oppo and Shenzhen Transsion Holdings Co. are trimming shipment targets for 2026, with Oppo cutting its forecast by as much as 20%, Chinese media outlet Jiemian reported. The companies did not respond to requests for comment.

“Right now, we’re kind of in the middle of a storm that we are dealing with hour by hour and day by day,” Steinar Sonsteby, CEO of the Norwegian IT firm Atea ASA, told analysts in February.

Cisco Systems Inc. cited the memory squeeze when it gave a weak profit outlook last week that led to its worst share loss in nearly four years. Qualcomm Inc. and Arm Holdings Plc both warned of more fallout ahead.

At Sunin Plaza, the do-it-yourself PC mecca in Seoul, the usual weekday buzz has evaporated. The labyrinth of stalls, once a high-energy hub for gaming graphic cards and motherboards, is now engulfed in an eerie quiet.

“It’s actually wiser to hold off doing business today, as prices are almost certain to be higher tomorrow,” said Suh Young-hwan, who runs three DIY PC shops in Seoul and frequently does business with stalls at Sunin Plaza. “Unless Steve Jobs rises from the dead to declare that AI is nothing but a bubble, this trend is likely to persist for some time.”

The premium and DIY PC segment was hit hard when US chipmaker Micron decided last year to end its popular Crucial brand of consumer memory sticks, after three decades in operation. Kelt Reeves, CEO and founder of custom PC maker Falcon Northwest, said Crucial’s demise started a “stampede” to secure as much inventory as they could, driving memory prices to new highs in January. Across 2025, Falcon Northwest’s average selling price rose by $1,500 to roughly $8,000 for each custom-made computer.

All of this has echoes of one of the biggest supply chain disruptions in recent memory: the Covid-era shortages of cheap, basic auto and power chips that paralyzed automakers from Ford Motor Co. to Volkswagen AG, forced smartphone makers to stockpile at exorbitant prices and galvanized a global movement, including in the US, to attract and build local chip manufacturing.

Back then it was because of an unexpected surge in demand for products from people working from home and trying to minimize contact.

This time round, the shortages stem from the memory industry’s pivot toward AI. Meta Platforms Inc., Microsoft Corp., Amazon and Alphabet are throwing astronomical sums at data centers that can train and host artificial intelligence algorithms, hiking spending from $217 billion in 2024 to about $360 billion last year — to an estimated $650 billion in 2026.

That splurge — rivaling the costliest human endeavors in history — is borne out of ambitions to outdo their giant rivals in a field that could determine their futures. The big four tech firms are paying top dollar for the components, resources and human talent that will make all that AI infrastructure possible.

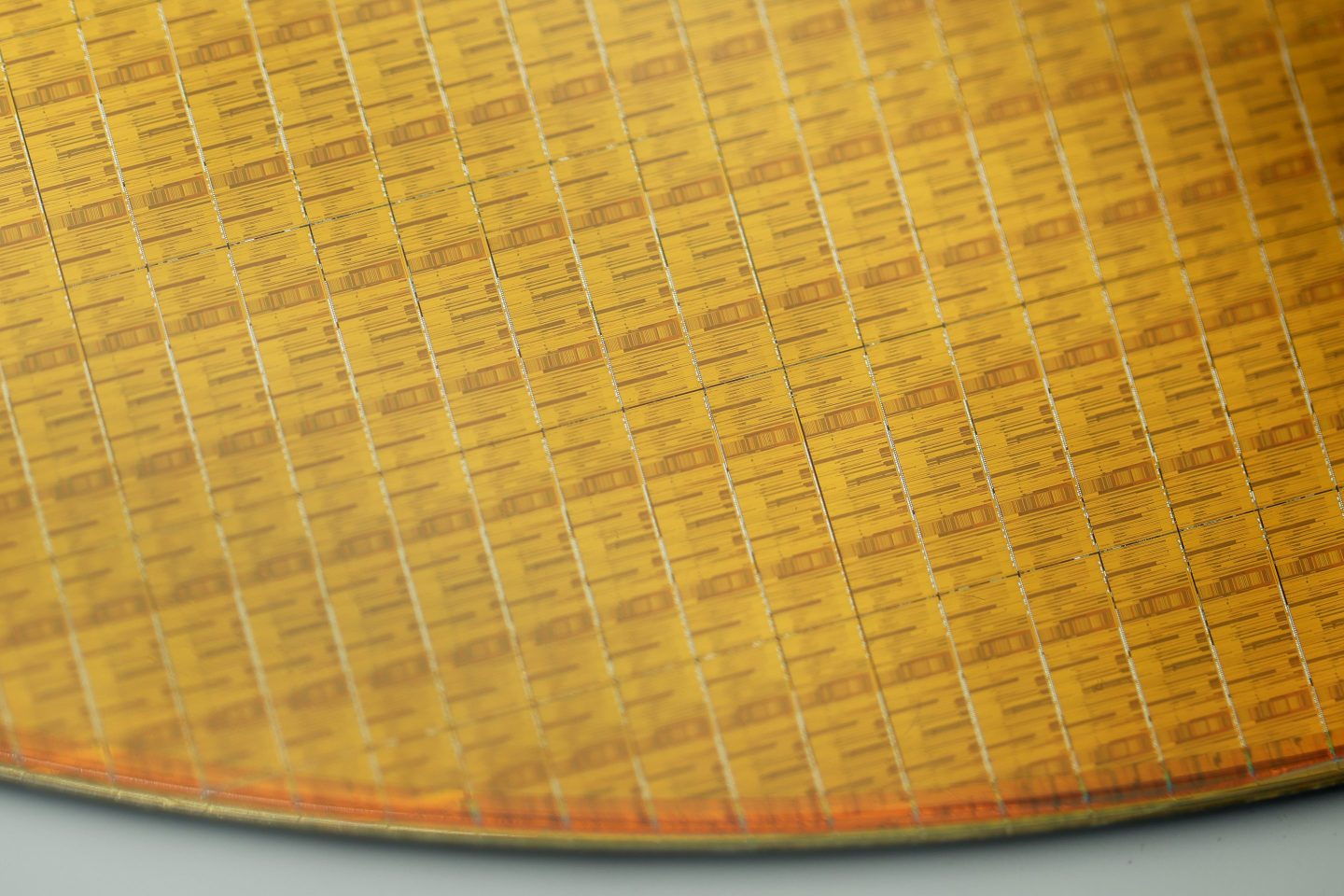

Few sectors have been transformed by that headlong rush more than global memory. In the three years since ChatGPT, Samsung, SK Hynix and Micron have diverted the bulk of their manufacturing, research and investments toward the HBM used in AI accelerators from Nvidia and Advanced Micro Devices Inc. That means less plant capacity to make plain-vanilla DRAM for basic electronics like phones.

The three companies are prioritizing HBM over DRAM because of simple math.

For every Nvidia AI accelerator that the hyperscalers buy, these companies also need high-bandwidth memory, or HBM, to power their efforts. Such chips are made up of intricately packed DRAM, often stacked in layers of eight or 12. Nvidia’s latest Blackwell comes with 192 gigabytes of RAM, or six times the amount that a powerful modern PC would need. An integrated AI server system dubbed the NVL72 boasts 72 Blackwell chips and 13.4 terabytes of RAM. Each NVL72 rack-scale system sold uses enough memory for a thousand high-end smartphones or a few hundred beefy PCs.

The demand for HBMs will increase 70% year-over-year in 2026 alone, Taipei-based consultancy TrendForce estimates. Meanwhile, HBM will take up 23% of total DRAM wafer output in 2026, up from 19% last year, according to the consultancy.

They also — during normal times — yield better margins simply because Samsung and all can charge more given the imbalance in supply and demand. Micron’s revenue is expected to more than double in the fiscal year ending in August. SK Hynix’s sales more than doubled in 2024 and are likely to double again this year.

But that wave of HBM business spells trouble for memory consumers. It’s leaving the rest of the world bereft of the memory that people need to store cellphone photos, steer cars, download movies and run computer programs. GF Securities estimates that there is a 4% gap between the supplies and demands for DRAM and 3% for NAND, but those figures do not yet factor in low inventories in some industries so the actual imbalance is likely bigger.

“DRAM shortages are set to persist across the electronics, telecom, and automotive industries throughout the year,” Counterpoint analyst MS Hwang said. “We are already seeing signs of panic buying within the auto sector, while smartphone manufacturers are pivoting toward more cost-effective chip alternatives to mitigate the impact.”

And it’s unlikely that the supply of basic memory will rebound anytime soon.

Samsung, SK Hynix and Micron have together endured multiple boom-bust cycles in memory chip demand. While they are racing to increase supply, it will take years to build and outfit the new chip facilities needed to make more memory chips.

“This is the most significant disconnect between demand and supply in terms of magnitude as well as time horizon that we’ve experienced in my 25 years in the industry,” Micron Executive Vice President of Operations Manish Bhatia told Bloomberg News in December.

Bhatia may be referring to a growing view that the industry is experiencing a so-called “super-cycle” of AI demand. That refers to a wave of technology adoption so vast and broad that it’s skewing or even eradicating the memory sector’s decades-long cycle of boom and bust, where chipmakers build capacity to chase rising prices, only to overdo things and precipitate a downturn. This time, the upswing is clear and few — least of all the hyperscalers — are gambling on an end.

Electronics companies from Xiaomi to Samsung and Dell Technologies Inc. have all warned consumers to brace for higher price tags this year, ahead of key midterm elections in the US, when inflation could become a focal point.

Skyrocketing memory costs mean DRAM could soon account for as much as 30% of low-end smartphones’ bill of materials — tripling from 10% in early 2025. The biggest impact would be on cheaper handsets that lack pricing power, Counterpoint Research said.

“Memory is now the new gold for the AI and automotive sector, but clearly it’s not going to be easy,” AMD partner Arista Networks Inc. Chief Executive Officer Jayshree V. Ullal told analysts in February. “It’s going to favor those who planned and those who can spend the money for it.”