Good morning. The U.S. economy closed out 2025 with a puzzling mix: sluggish job growth alongside accelerating productivity.

The U.S. Bureau of Labor Statistics (BLS) reported on Friday that nonfarm payrolls rose by a seasonally adjusted 50,000 in December 2025, missing the 73,000 Dow Jones estimate and slowing from November’s revised gain of 56,000. November payrolls were revised down by 8,000 jobs, while October’s loss deepened to 173,000 from 105,000. For 2025 as a whole, payrolls grew by an average of 49,000 jobs per month, down sharply from 168,000 in 2024.

Bank of America Global Research analysts wrote in a report on Friday that although payroll growth has slowed since June, the unemployment rate has risen by only about 11 basis points. The report noted, “We have been highlighting that tighter immigration restrictions are likely to play a bigger role in the slowdown in job growth this year.”

The unemployment rate is a key statistic for the Federal Reserve, and markets responded to Friday’s miss by pricing out a January rate cut, according to the analysts. Futures now imply less than half a cut priced in through April.

The productivity factor

Despite weak job growth, forecasts still point to solid overall economic expansion. I asked Gregory Daco, EY chief economist, how the U.S. economy can continue to grow strongly while hiring softens.

“We’re seeing a clear decoupling between growth and hiring,” Daco said. Output is still expanding, but companies are generating that growth with fewer incremental workers and fewer hours.

“Productivity has rebounded meaningfully as businesses continue to streamline operations, automate processes, and extract more output from existing teams in a high-cost, high-interest-rate environment,” Daco explained. “This isn’t AI-led in a narrow sense yet—it’s the payoff from multi-year efficiency drives, tighter cost discipline, and delayed hiring.”

According to the BLS, nonfarm business sector labor productivity increased 4.9% in the third quarter of 2025, as output rose 5.4% while hours worked increased just 0.5%.

Areas of job growth

Where job growth has occurred, employment in food services and drinking places continued to trend higher in December, adding 27,000 jobs. The sector added an average of 12,000 jobs per month in 2025, roughly in line with the 11,000 average monthly gain in 2024.

Health care employment also continued its upward trend in December, rising by 21,000 jobs, including a gain of 16,000 in hospitals. Health care added an average of 34,000 jobs per month in 2025, down from an average monthly increase of 56,000 in 2024.

Monster’s newly released 2026 Job Market Outlook also reflects these pockets of strength. Based on full-year 2025 job postings and job seeker data, the report shows employer demand remaining firm in health care, essential services, infrastructure-related roles, and skill-based jobs, even as other parts of the labor market slow.

‘Hiring hasn’t stopped’

As private payroll growth weakened throughout 2025 and hiring appetites diminished, I asked Daco whether he expects that trend to continue amid ongoing geopolitical uncertainty and tariff-related risks.

“Yes—barring a material improvement in policy clarity, I expect hiring restraint to persist,” he said. Private payroll growth has already slowed sharply as firms shift into cost-control mode, with geopolitical risks, tariff uncertainty, and elevated financing costs reinforcing that bias, he explained.

“Hiring hasn’t stopped, but it has become more selective and more conditional on clear demand visibility,” Daco added. “In this environment, CFOs are likely to continue favoring efficiency, automation, and capex discipline over broad-based workforce expansion.”

Sheryl Estrada

sheryl.estrada@fortune.com

*Quick note: “The Data Imperative: Reinventing Finance with AI,” is the next Emerging CFO webinar which will take place Tuesday, Jan. 27 at 11 a.m. ET. Join Fortune, in partnership with Workday, for a timely discussion featuring Adobe’s CFO Dan Durn, and additional speakers to be announced, that will offer firsthand insights and practical strategies from leaders shaping AI-driven finance transformation. You can register for the event here. Email us at CFOCollaborative@Fortune.com with any questions.

Leaderboard

Young Kim was appointed CFO and chief operating officer at Bitmine Immersion Technologies, Inc. (NYSE: BMNR) effective immediately. Kim has more than 20 years of experience. From 2021 to 2025, he served as partner and senior portfolio manager at Axiom Investors, following a decade as senior portfolio manager at Columbia Threadneedle Investments from 2011 to 2021. Earlier in his career, Kim held roles across investment research, venture capital, business development, and software engineering.

Jimmi Sue Smith is retiring from her position as CFO of Koppers Holdings Inc. (NYSE: KOP) effective Jan. 5. Smith will continue to serve as treasurer, as well as in an advisory role, to assist with a transition through Feb. 28. Bradley Pearce, chief accounting officer, will serve as interim CFO and still perform his current role while an external search is conducted to identify a permanent successor.

Big Deal

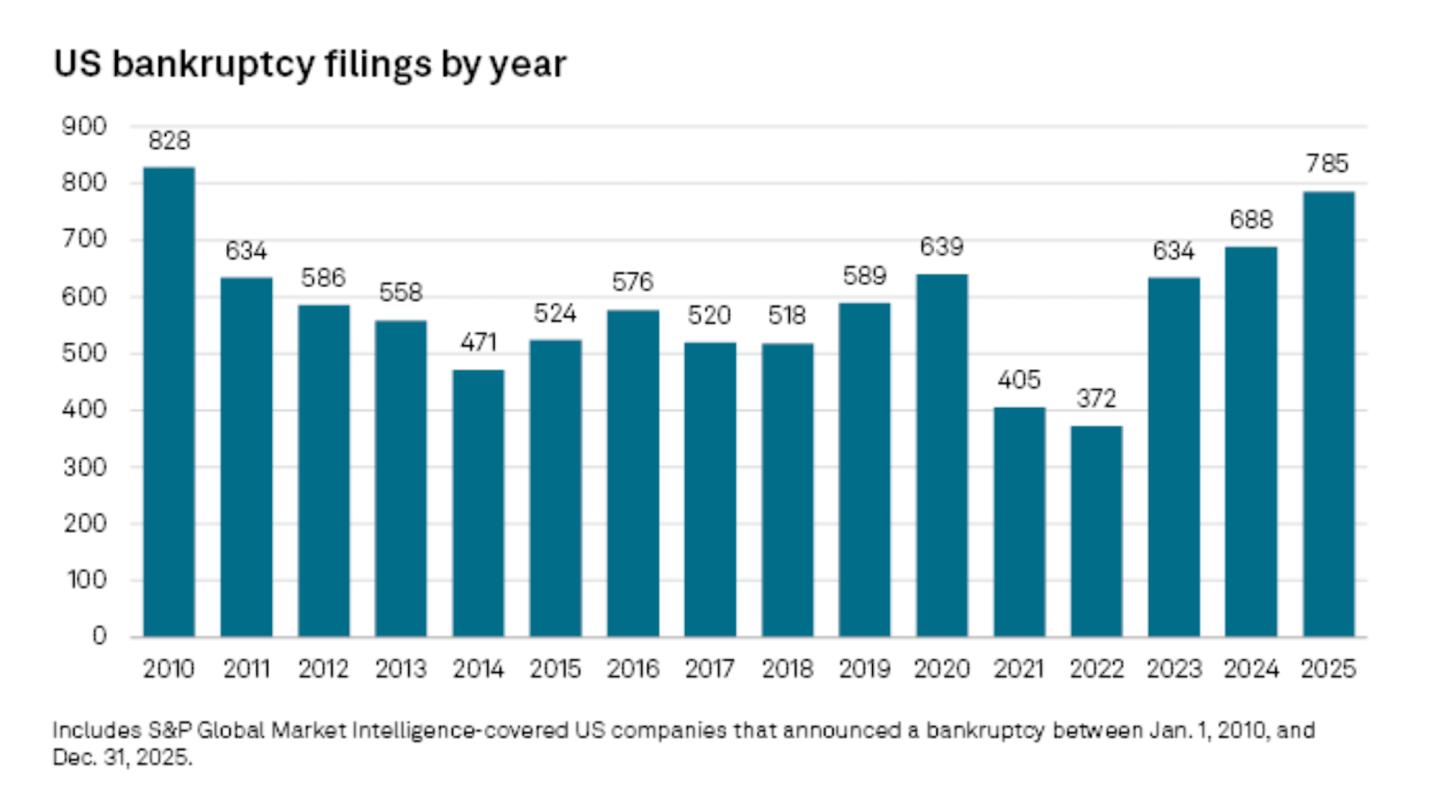

The latest S&P Global Market Intelligence data shows that large U.S. corporate bankruptcies rose to one of the highest monthly totals in five years in December 2025, with filings increasing to 72 from 63 in November. This uptick extended the 15-year high for annual filings first set in November, bringing the total to 785 for the year—the highest since 2010. Rising interest rates have been a significant factor, as many companies struggled to refinance their debt, according to the report.

The data covers companies with public debt and at least $2 million in assets or liabilities, as well as private companies with at least $10 million in assets or liabilities at the time of filing.

Going deeper

"Powell blasts DOJ criminal probe as attack on Fed independence. ‘Public service sometimes requires standing firm in the face of threats’" is a Fortune article by Jason Ma.

He writes: "Federal Reserve Chairman Jerome Powell said in a statement on Sunday that the Justice Department served the Fed with grand jury subpoenas, threatening a criminal indictment over his testimony before the Senate last June related to renovations on the headquarters, which has seen cost overruns. Powell, who is typically cautious in his public remarks, was clear that the probe was political in nature and had nothing to do with the Fed renovations or his testimony, dismissing them as 'pretexts.'" Read the complete article here.

Overheard

"After more than two decades of declining well-being for most middle- and low-income households, it is clear that structural reforms are needed to bring costs back in line with wages."

—Gene Ludwig, former U.S. Comptroller of the Currency, and chairman of the Ludwig Institute for Shared Economic Prosperity, and Shannon Meyer, a research analyst at the Ludwig Institute, write in a Fortune opinion piece titled, "Millions of Americans are grappling with years of declining economic wellbeing and affordability needs a rethink."