If the AI boom had a physical form, it was alive and kicking at Web Summit this week as 71,000 startup founders, venture capital investors, tech CEOs, and the media who follow them gathered under literal storm clouds in Lisbon, Portugal, to discuss the future of the industry.

Tech stocks sold off dramatically as the conference wore on, after ‘Big Short’ investor Michael Burry pointed out that some AI hyperscaler tech companies—including Meta and Oracle—were elongating the depreciation schedules of their AI capital expenditure (capex) to make their short-term profitability look more favourable. The Nasdaq Composite lost 2.3% yesterday. In addition, Oracle shares declined by 30% over the last month as investors rejected the company’s plan to increase its debt in large part to spend more on AI chips.

But few people inside the giant dome of the MEO arena at Web Summit seemed concerned. Fortune asked a dozen executives at the conference for their opinions. What follows is a selection of their perspectives.

Broadly, people fell into three categories of opinion on whether AI spending is sustainable:

- Yes, it’s a bubble. The amount of venture capital investment and capex from large companies far exceeds the amount of revenue being generated by the AI companies that receive the funding—a classic bubble scenario.

- Yes, it’s a bubble, but it’s a good bubble. Great companies will emerge after there is an inevitable attrition of poor-quality competitors, this cohort argues.

- No, it’s not a bubble because demand for AI far exceeds supply. Companies that supply semiconductor chips, data center infrastructure, and other AI services to corporate clients just cannot keep up with the demand.

The folks in the “yes, it’s a bubble” category were the minority

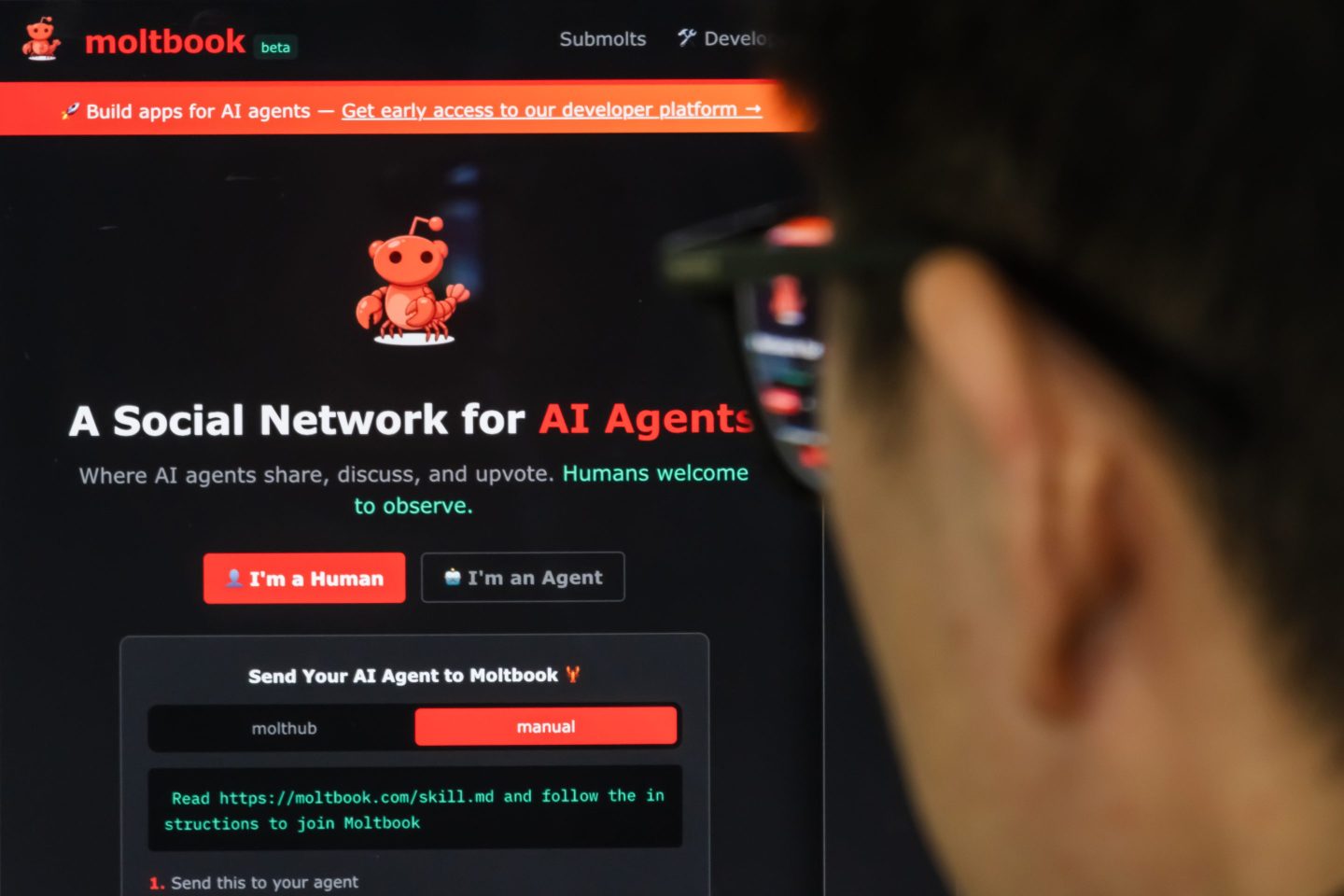

Laura Chambers, CEO of Mozilla—maker of the Firefox browser—sees the situation as a classic, straightforward bubble. Funding is abundant, it is easier than ever to make low-grade products, and most AI companies are running at a loss, she says. “Yes. It’s really easy to build a whole bunch of stuff, and so people are building a whole bunch of stuff, but not all of that will have traction. So the amount of stuff coming out versus the amount of stuff that’s going to [be sustainable] is probably higher than it’s ever been. I mean, I can build an app in four hours now. That would have taken me six months to do before. So there’s a lot of junk being built very, very quickly, and only a part of that will come through. So that’s one piece of the bubble,” she said.

“I think the most interesting piece is monetization, though. All the AI companies, all these AI browsers, are running at a massive loss. At some point that isn’t sustainable, and so they’re going to have to figure out how to monetize.”

Babak Hodjat, chief AI officer at Cognizant, said he believed diminishing returns were setting in to large language models. The DeepSeek launch from earlier this year—in which a Chinese company released an LLM comparable to ChatGPT for a fraction of the cost—was a good example of this. Building AI was once a huge, expensive, and difficult undertaking. But today, many AI use-cases (such as custom-built, task-specific AI agents) don’t need huge models underpinning them, he said.

“The bulk of the money that you see—and people talk about a bubble—is going into commercial companies that are actually building large language models. I think that technology is starting to be commoditized. You don’t really need to use that big of a large language model, but those guys are taking money because they need a lot of compute capacity. They need a lot of data. And their valuation is based on, you know, bigger is better. Which is not necessarily the case,” he told Fortune.

About half of the remainder were in the “good bubble” category

Dan Gardner, CEO of digital creative agency Code & Theory compared the current moment to the dot-com boom of 2000: “It is a bubble, and it’s not a bubble. It’s a bubble in the sense that there will be tremendous amount of wasted capital [like what happened in the 2000 crash.] That was a bubble, and a tremendous amount of people lost their money. And we had some of the biggest companies in the world [like Amazon and Google], trillion-dollar companies, that came out of that.”

Lyft CEO David Risher said that AI may be a financial bubble right now, but the companies within it are nonetheless building tools and learning skills that will be transformational in the long term.

Talking to CNBC, he said: “Let’s be clear, we are absolutely in a financial bubble. There is no question, right? Because this is incredible, transformational technology. No one wants to be left behind.”

But he argued that the financial bubble was a short-term problem. “The data centers and all the model creation, all of that is going to have a long, long life, because it’s transformational. It makes people’s lives easier. It makes people’s lives better … On the other hand, you know, the financial side, it’s a little risky right now.”

The rest see a boom, not a bubble

Several AI supply companies can’t keep up with demand—and are pretty happy about it. They aren’t blind to the potential for a contraction, but know the business they are doing is real and backed by demand from clients with deep pockets.

Brad Smith, president of Microsoft, told Fortune: “From a long-term perspective, I think the answer is no. I think that we’ve got years, if not decades, ahead of us for growth. From a short-term perspective, I’ll only speak for Microsoft; I can’t speak for every company in the industry. We have more demand than supply. That’s the reality from customers, and we have an ongoing pipeline of demand and needs, and we see steady growth, and we’re encouraged by where things are going. And we’ll always be disciplined as we’re investing.”

Emily Fontaine, global head of venture capital at IBM, operates a $500 million AI-focused venture capital fund. She has already made 23 investments into companies building AI products that often fit into an ecosystem run by IBM products or by clients of IBM. “I strongly believe, if you have conviction, and you’re investing in the right companies, you’re gonna make the right decisions for your criteria,” she said.

She admits the industry is living through a heady boom: “We can’t deny a ridiculous amount of money is going into AI startups, right? $160 billion, year-to-date. That’s just the U.S. Look at that compared to 2024, which was $104 billion. It’s a huge amount. We can’t deny there’s a ridiculous amount of investment going on.” But she says client demand is robust: “I strongly believe that investing is going to pay off. Over the last few months we’ve gone from AI adoption in say, 26% now to 43% in enterprise companies.”

Ami Badani, head of strategy/CMO at chipmaker ARM, has a front row seat. ARM has a partnership with Nvidia in which the former provides the latter with multiple services, licenses, and products. They just can’t make chips fast enough, she told Fortune.

“I feel like there’s enough demand. Even today, you look at demand and that exceeds supply, and there’s an insatiable amount of demand and appetite for where we need to get to, so I don’t really worry about ‘could folks pull back?’ If you look at GDP growth and where we believe that we need to get to in terms of AI, and these use cases, that’s all limited by power and compute,” she said. “So I don’t worry about it [a bubble] too much. It doesn’t wake me up at night, if that’s what you’re asking.”

Nicolas Sauvage, president at TDK Ventures, supervises the VC firm’s $500 million investment fund. Like Badani, he sees an environment where demand is stronger than supply. “Are we going to have a moment where the demand is going to be less than the supply, especially when every company is racing to build that infrastructure, are getting as much chipset as they can today? The demand is matching. Actually, the demand is higher than the supply, so we’re not seeing that over-supply,” he said.

He is, obviously, aware that the major AI companies are not yet showing the revenues they will need to demonstrate that they are sustainable businesses. But that is because they don’t yet need to—in fact they can turn on the revenue switch any time, he said: “My feeling is that any of these companies could decide to turn the revenue tap on if they want it. They are not at the point where they are being challenged to do that, so the question is, when do they decide to do it?”