Good morning. CFOs are increasingly responsible for aligning AI investments with business goals, measuring ROI, and ensuring ethical adoption. But is responsible AI an overlooked value creator?

Scott Zoldi, chief analytics officer at FICO and author of more than 35 patents in responsible AI methods, found that many customers he’s spoken to lacked a clear standard of responsible AI—aligning AI ethically with an organizational purpose—prompting an in-depth look at how tech leaders are managing it.

According to a new FICO report released this morning, responsible AI standards are considered essential innovation enablers by senior technology and AI leaders at financial services firms. More than half (56%) named responsible AI a leading contributor to ROI, compared to 40% who credited generative AI for bottom-line improvements.

The report, based on a global survey of 254 financial services technology leaders, explores the dynamic between chief AI/analytics officers—who focus on AI strategy, governance, and ethics—and CTOs/CIOs, who manage core technology operations and alignment with company objectives.

Zoldi explained that, while generative AI is valuable, tech leaders see the most critical problems and ROI gains arising from responsible AI and true synchronization of AI investments with business strategy—a gap that still exists in most firms. Only 5% of respondents reported strong alignment between AI initiatives and business goals, leaving 95% lagging in this area, according to the findings.

In addition, 72% of chief AI officers and chief analytics officers cite insufficient collaboration between business and IT as a major barrier to company alignment. Departments often work from different metrics, assumptions, and roadmaps.

This difficulty is compounded by a widespread lack of AI literacy. More than 65% said weak AI literacy inhibits scaling. Meanwhile, CIOs and CTOs report that only 12% of organizations have fully integrated AI operational standards.

In the FICO report, State Street’s Barbara Widholm notes, “Tech-led solutions lack strategic nuance, while AI-led initiatives can miss infrastructure constraints. Cross-functional alignment is critical.”

Chief AI officers are challenged to keep up with the rapid evolution of AI. Mastercard’s chief AI and data officer, Greg Ulrich, recently told Fortune that last year was “early innings,” focused on education and experimentation, but that the role is shifting from architect to operator: “We’ve moved from exploration to execution.”

Across the board, FICO found that about 75% of tech leaders surveyed believe stronger collaboration between business and IT leaders, together with a shared AI platform, could drive ROI gains of 50% or more. Zoldi highlighted the problem of fragmentation: “A bank in Australia I visited had 23 different AI platforms.”

When asked about innovation enablers, 83% of respondents rated cross-departmental collaboration as “very important” or “critical”—signaling that alignment is now foundational.

The report also stresses the importance of human-AI interaction: “Mature organizations will find the right marriage between the AI and the human,” Zoldi said. And that involves human understanding for where to ”best place AI in that loop,” he said.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Faisal Qadir was promoted to EVP and CFO of Spectrum Brands Holdings, Inc. (NYSE: SPB), a home essentials company with brands such as Black+Decker, effective immediately. Qadir succeeds Jeremy W. Smeltser, who will remain a full-time employee through Dec. 31. Smeltser’s departure is part of Spectrum Brands’ previously stated objective to reduce spending and is not the result of any disagreement with the company, its board, or management, according to an SEC filing. Smeltser will receive his base salary for fiscal 2025, be eligible for a performance-based bonus, and receive pro rata vesting of select long-term incentives. Upon departure, he is entitled to 18 months’ base salary and his target annual bonus as severance. Qadir, who has served as VP of strategic finance and enterprise reporting at Spectrum Brands since 2012, entered the CFO role under a new employment agreement.

Brian Robins was appointed CFO of Snowflake (NYSE: SNOW), an AI Data Cloud company, effective Sept. 22. Snowflake also announced that Mike Scarpelli is retiring as CFO. Scarpelli will stay a Snowflake employee for a transition period. Robins has served as CFO of GitLab Inc., a technology company, since October 2020. Before that, he was CFO of Sisense, Cylance, AlienVault, and Verisign.

Big Deal

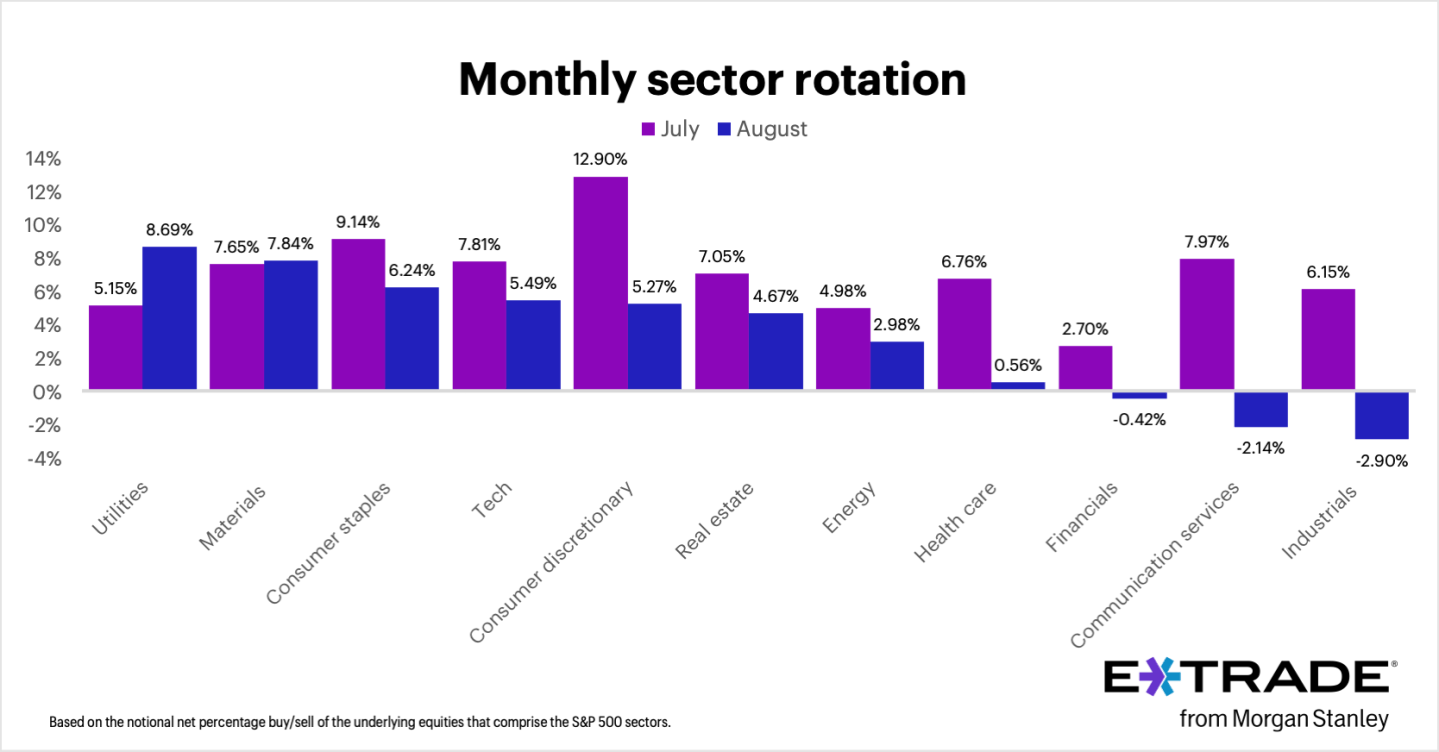

August marked the S&P 500’s fourth consecutive month of gains, with E*TRADE clients net buyers in eight out of 11 sectors, Chris Larkin, managing director of trading and investing, said in a statement. "But some of that buying was contrarian and possibly defensive," Larkin noted. "Clients rotated most into utilities, a defensive sector that was actually the S&P 500’s weakest performer last month. Another traditionally defensive sector, consumer staples, received the third-most net buying." By contrast, clients were net sellers in three sectors—industrials, communication services, and financials—which have been among the S&P 500’s stronger performers so far this year.

"Given September’s history as the weakest month of the year for stocks, it’s possible that some investors booked profits from recent winners while increasing positions in defensive areas of their portfolios," Larkin added.

Going deeper

"Warren Buffett’s $57 billion face-plant: Kraft Heinz breaks up a decade after his megamerger soured" is a Fortune report by Eva Roytburg.

From the report: "Kraft Heinz, the packaged-food giant created in 2015 by Warren Buffett and Brazilian private equity firm 3G Capital, is officially breaking up. The Tuesday announcement ends one of Buffett’s highest-profile bets—and one of his most painful—as the merger that once promised efficiency and dominance instead wiped out roughly $57 billion, or 60%, in market value. Shares slid 7% after the announcement, and Berkshire Hathaway still owns a 27.5% stake." You can read the complete report here.

Overheard

"Leading an AI revolution requires more than issuing directives from the corner office. It takes personal engagement and a willingness to break with tradition."

—Paul Hudson, CEO of global healthcare company Sanofi since September 2019, writes in a Fortune opinion piece. Previously, Hudson was CEO of Novartis Pharmaceuticals from 2016 to 2019.