President Trump’s Big Beautiful Bill was a Bad Body Blow to wind and solar power. Trump framed the bill, which will quickly phase out many green-energy tax breaks, as a move to cement U.S. “energy dominance”—as represented by its oil and gas industry—and as a victory over sinister Chinese solar-cell makers. But the law will also exacerbate another conflict with potentially planet-altering consequences: the looming clash between the energy needs of American AI “hyperscalers” and those of just about everyone else.

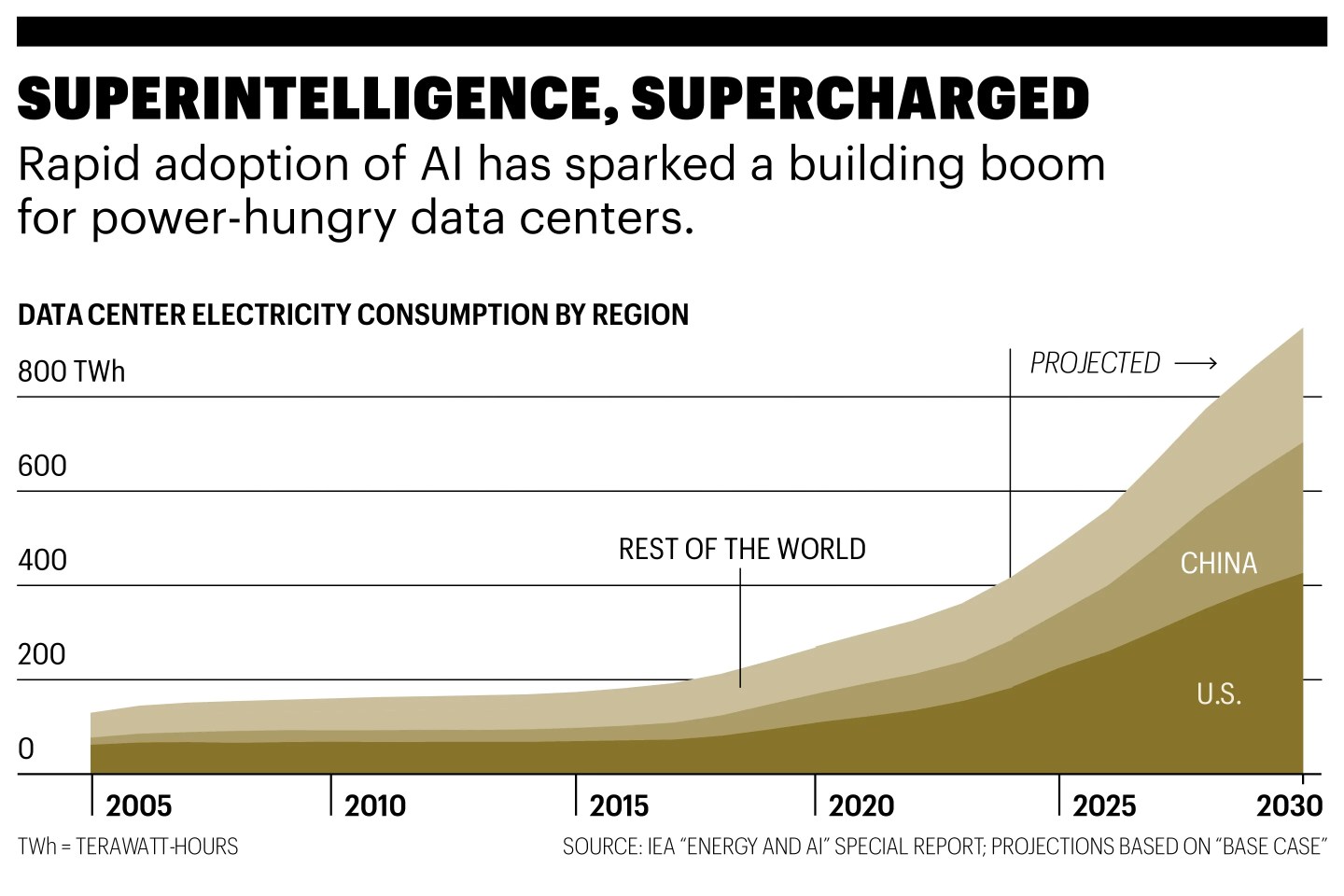

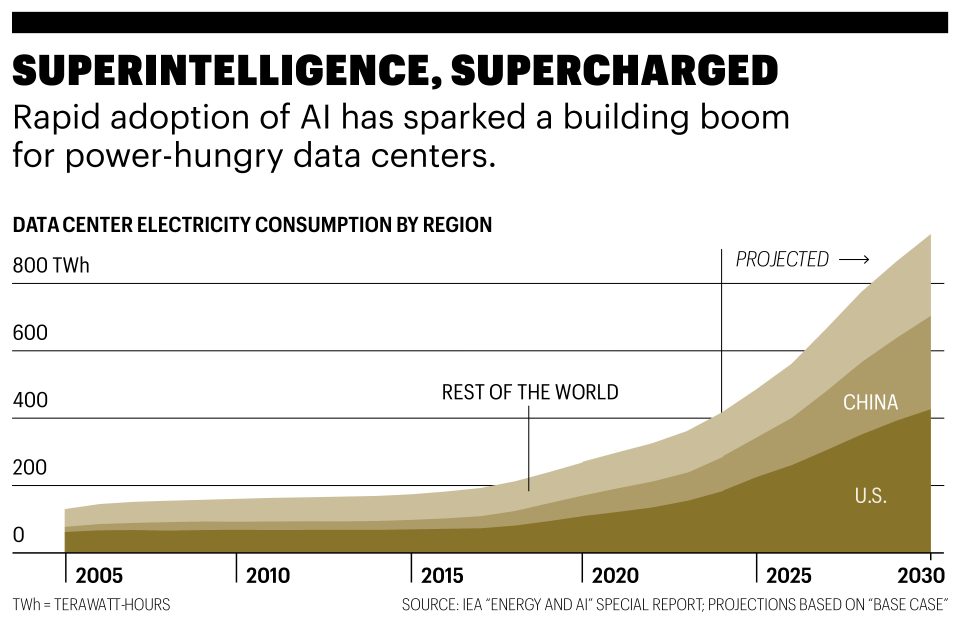

No matter where the energy comes from, analysts project an enormous increase in U.S. electricity consumption between now and 2050. The biggest factor behind the surge: the massive data centers that Google, Meta, and their rivals are building to support AI computing.

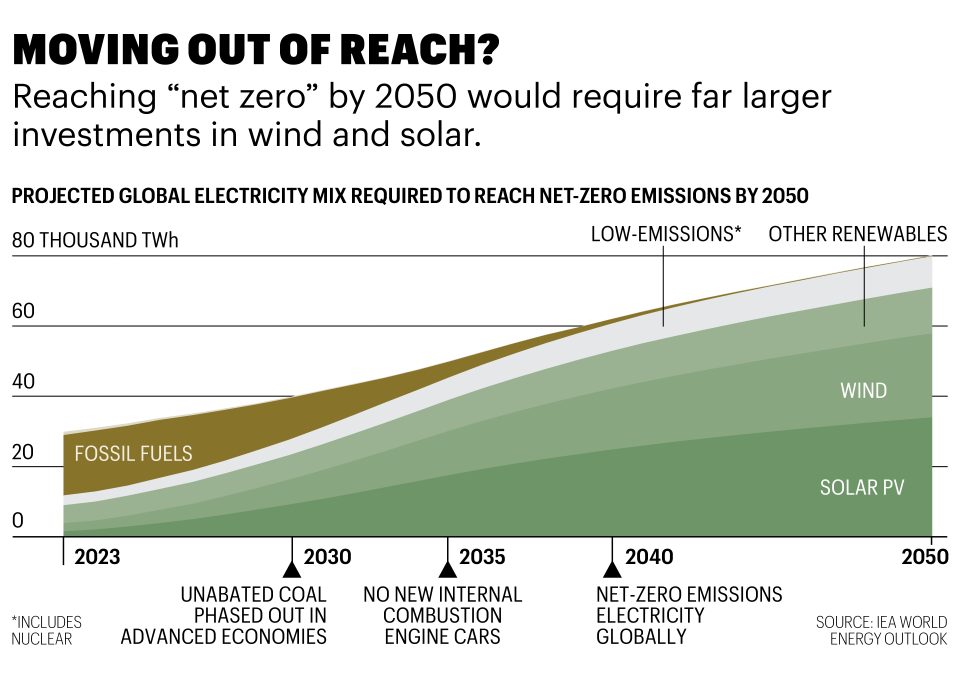

To power all that demand, generation capacity needs to grow dramatically—and wind and solar projects are among the quickest ways to accomplish that. But without tax breaks, the economics turn sour. To be sure, Big Tech has the cash to pay for wind and solar farms. But the rollout will likely be slower, and electricity costs may rise sharply for the rest of us in the interim as users compete for limited juice. Meanwhile, in China—the U.S.’s rival in the race for AI dominance—it’s build, baby, build where green power is concerned.

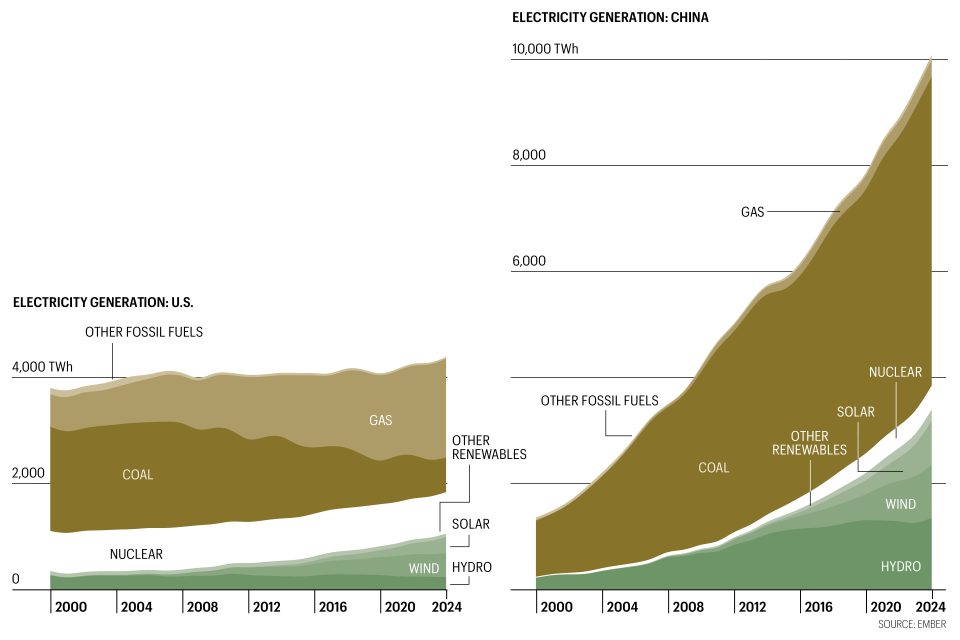

China and the U.S. both need much more energy…

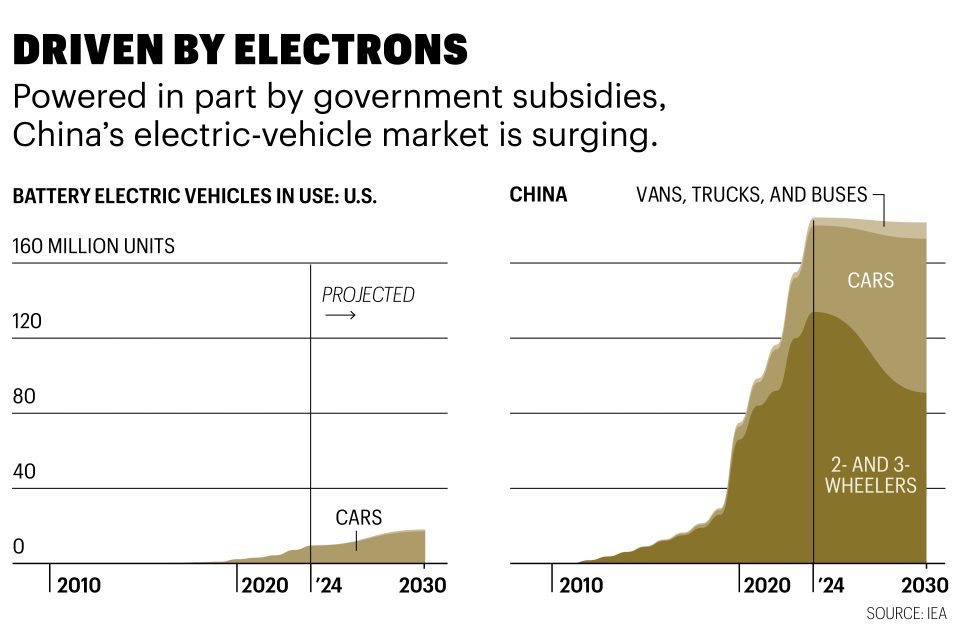

The U.S. and China share common drivers of energy consumption—including far-flung, car-loving populations and a soaring demand for power to run AI models and platforms. They also have much to lose from fossil-fuel-driven climate change.

…but the U.S. has narrowed its options

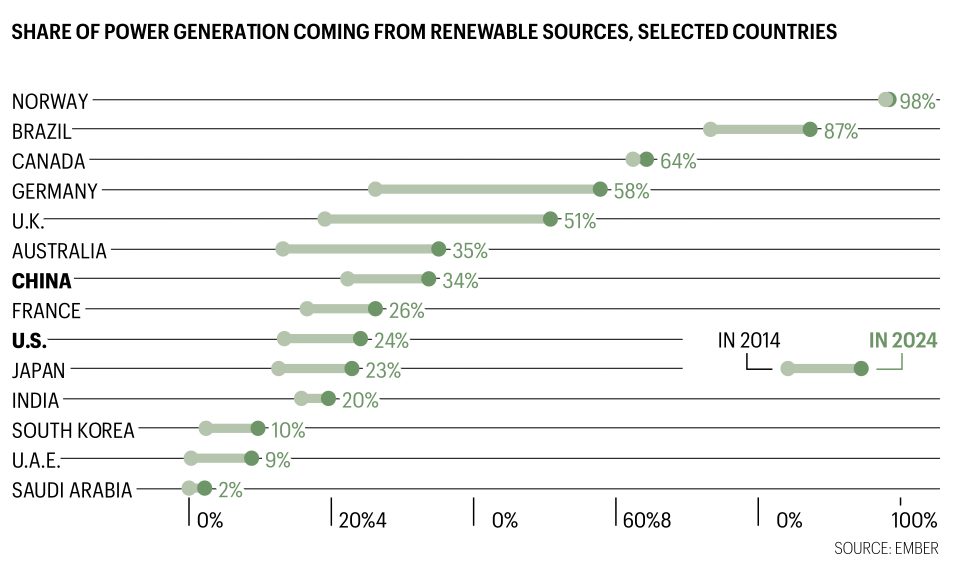

Given the twin imperatives of meeting increased demand and restraining carbon emissions, the U.S. Congress’s decision to slash subsidies for wind and solar power—both of which can be deployed relatively quickly and generate virtually no emissions—seems to have taken away a promising tool. China, for its part, is dealing with a different set of incentives: The country’s huge, coal-dependent manufacturing sector caused enormous pollution problems in the late 20th century, forcing government and business leaders to go green or almost literally choke. China also dominates global production of solar-power hardware—adding another complicating factor to the geopolitical calculus of the energy race.

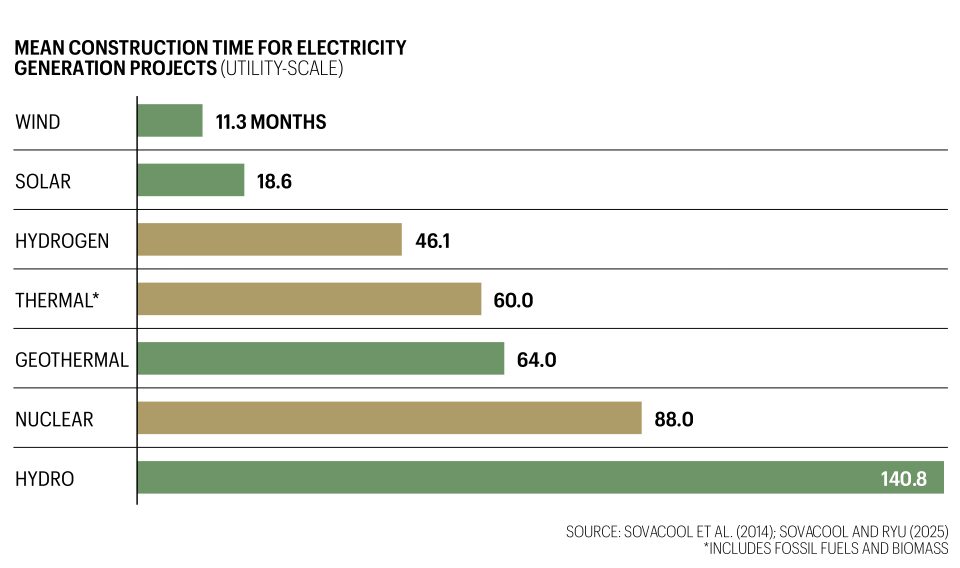

Faster fixes

Among clean energy options, wind and solar generation have the advantage of being relatively simple, and thus speedy to build; nuclear power lies at the opposite end of both spectrums.

Far behind the leaders

The U.S. consumes far more electricity per capita than any other country—97% more than China, and more than twice as much as the European Union. In a sense, that makes its recent progress in renewables that much more impactful, though its carbon footprint is still huge. China’s reliance on coal, meanwhile, means that it remains the world’s largest emitter of CO2, despite having gone further than the U.S. in its green transition.

This article appears in the August/September 2025 issue of Fortune.