Good morning. Corporate America’s relationship with cryptocurrency is far from straightforward, but many finance chiefs are planning to eventually adopt stablecoins and Bitcoin in their finance operations.

Deloitte released new data this morning from its Q2 2025 CFO Signals Spotlight, which gauges how finance chiefs envision incorporating digital currencies into their operations (CFO Daily received an early look). Only 1% of CFOs surveyed said they do not expect to use crypto for business functions in the long term. Twenty-three percent expect their treasury departments to use crypto for investments or payments within the next two years—a figure that rises to nearly 40% among finance chiefs at companies with revenues of $10 billion or more.

Price volatility is the top concern for 43% of CFOs regarding crypto investment, followed by accounting and control complexities (42%), and a lack of industry regulation (40%).

“Crypto is a unique asset, and the accounting treatment for digital assets seems to be a work in progress,” Steve Gallucci, the global and U.S. leader of Deloitte’s CFO Program, told me. For example, in January, the SEC rescinded earlier guidance on accounting for crypto and then created a task force to develop a new framework, he explained. “Where that task force eventually lands is, at this point, uncertain,” he said.

The survey, conducted June 4–18, polled 200 North American finance chiefs at companies with at least $1 billion in revenue.

The business case for crypto

Stablecoins are typically backed by reserve assets and pegged to traditional currencies, unlike Bitcoin. The survey highlights the appeal of conducting transactions with stablecoins: 45% of finance chiefs cited enhanced customer privacy as the top benefit, followed by improved cross-border transactions. In addition, 15% of respondents said that within two years, their companies will likely accept stablecoin as payment—a percentage that rises to 24% for companies with at least $10 billion in revenues.

“It seems very likely that CFOs will need to have a solid grounding in digital assets, along with treasury and accounting capabilities, and an appropriate understanding of cryptocurrencies,” Gallucci said.

President Trump signed an executive order in March establishing a strategic Bitcoin reserve and a national digital asset stockpile. Subsequently, in June, the U.S. Senate passed legislation regulating stablecoins.

Bitcoin, Ether, and other non-stable forms of crypto can offer certain advantages for treasurers, such as diversifying a company’s investment portfolio. A recent Fortune report examines the rise of crypto in corporate treasuries: 160 firms globally now hold Bitcoin on their balance sheets, including 90 in the U.S., according to a site called Bitcoin Treasuries. Notable names include GameStop, Block, Tesla, and the Trump Media & Technology Group, which is controlled by the president’s family. However, some experts remain skeptical of the trend of firms putting spare cash into crypto.

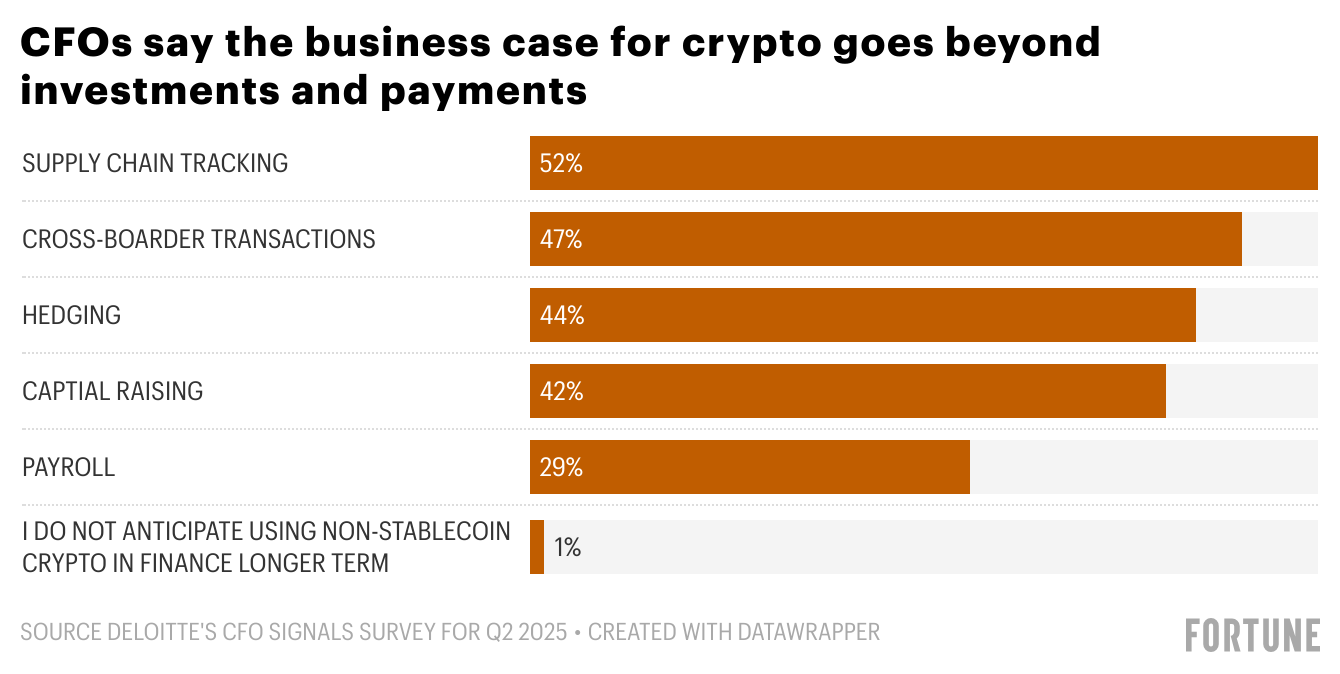

Taking a longer-term perspective, the CFOs surveyed by Deloitte see possibilities for business uses of both non-stable and stable crypto beyond investments and payments. More than half (52%) of finance chiefs anticipate using non-stable crypto for supply chain tracking, and a slightly smaller percentage (48%) said the same for stablecoin.

With more than a third of CFOs already discussing the use of crypto with their boards, it will be interesting to see which direction organizations take.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Eyal Bar was appointed CFO of security startup Chainguard. Bar brings to Chainguard more than 16 years of financial and operational leadership experience from high-growth technology companies. He previously served in senior finance roles at global companies, including Monday.com, steering the company through its Nasdaq IPO, as well as Motorola Solutions, Ernst & Young, and Wix.com.

Jeff Glajch, CFO of Orion S.A. (NYSE: OEC), a global specialty chemicals company, intends to step down early in the fourth quarter of 2025. The company plans to conduct a comprehensive search to identify a successor. Glajch will continue to support Orion through the end of 2025.

Big Deal

On Wednesday, the Federal Reserve said it would hold interest rates at its current range of 4.25% to 4.5%. That's down from their peak over the past two years but still higher than pre-COVID levels of 1.5% to 1.75%, Fortune's Marco Quiroz-Gutierrez reports. The last time the Fed cut interest rates was in December 2024, trimming rates by 0.25 percentage points. In its decision, the Fed cited low unemployment and a solid labor market as reasons for holding rates steady.

However, the decision included two dissenting votes from Fed governors Michelle Bowman and Christopher Waller—a rare level of dissent.

Going deeper

"What Shapes Analysts’ Long-term Forecasts?" is a new report in Wharton's business journal. Wharton's Marius Guenzel discusses his research uncovering the different factors that shape the long-term forecasts that drive valuations.

Overheard

“We found this format to be overly transactional and lacking the warmth and human connection that defines our brand.”

—Starbucks CEO Brian Niccol said during the company's earnings call on Tuesday regarding closing a convenience that was explicitly targeted toward Gen Z’s taste for “frictionless” experiences: their mobile-only “pickup” stores, Fortune reported. The move signals a deliberate shift away from the high-speed, tech-driven model that defined much of the chain’s recent expansion.