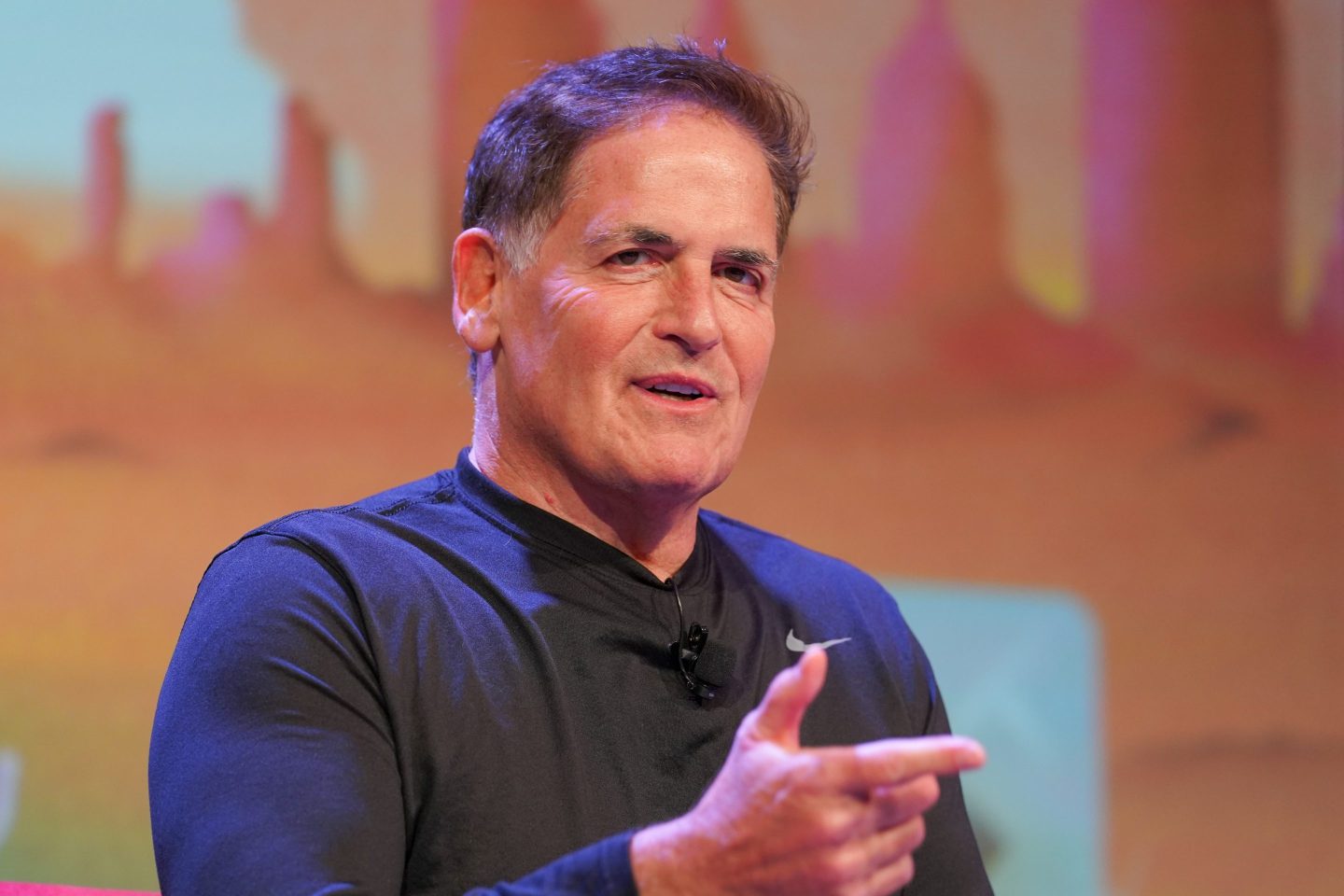

- As many economists warn of the inflationary consequences of tariffs, billionaire Mark Cuban believes uncertainty surrounding the tariffs may actually bring down prices in some instances. Companies may try to rid themselves of inventory they stockpiled as a result of tariff threats, slashing costs to “get back to cash,” Cuban said in a recent social media post.

Billionaire investor Mark Cuban said there’s a reason why tariffs are not yet causing the sticker shock many consumers are expecting.

The Shark Tank star said on social media on Sunday that inflation has not risen as economists predicted because companies who stocked up on imported products before tariffs went into place are now focused on getting rid of that inventory, even slashing prices to clear out goods in exchange for some quick cash flow. Cuban said he sees this phenomenon in all of his product-based companies.

“The variance in tariffs has made it impossible to know how to manage costs,” Cuban said in a social media post. “So you do all you can to clear out inventory and get back to cash. And take your chances on tariffs not being as big as you feared.”

Indeed, the Commerce Department’s PCE report from last week indicated inflation slowed to a 2.1% annual rate in April from 2.3% in March. That’s despite concerns of investors and economists that businesses will pass down the cost of tariffs to consumers, jacking up the prices of goods, which would lead to greater inflation.

Companies managing supply chains impacted by tariffs pulled forward shipments of goods to get ahead of the taxes, Cuban said. Tracking data found increases in shipments prior to the implementation of the tariffs. These increases coincided with companies stockpiling goods before they would be tariffed. Since then, traffic at U.S. ports has been down.

But there’s a potential downside to businesses sitting on so many goods, Cuban argued.

“They see the on-and-off-again tariffs in action, so they don’t know how long their inventory will have the value they expected,” he said.

In order to pull forward shipments—sometimes by three to six months, according to Cuban—companies may have taken out loans. But with so much uncertainty around tariffs, businesses may not want to be saddled with debt.

“So they don’t raise prices,” Cuban said. “In fact they may even discount some as a way to clear out inventory and replenish cash or pay down expensive loans.”

Cuban did not respond to Fortune’s request for comment.

Why lower prices aren’t good news

Just because inflation and prices are lower than expected doesn’t mean it’s good news for the companies weathering tariffs or the economy more broadly.

“None of the above is a positive,” Cuban said.

In order to stock up on inventory, some companies may borrow cash on unfavorable loan terms or use existing cash on hand. While fortunate businesses may be able to make deals with manufacturers, who know the risks of tariffs and are able to offer better prices, other companies may not be so lucky.

By taking out hefty loans to pull forward shipments, companies may have lost the ability to earn interest or invest in other parts of their business, Cuban said. On top of that, they may have to pay interest, sometimes between 10% and 20%, on the loans they took out.

“This isn’t just small companies,” Cuban said. “This is all companies facing this.” He added that this is the reason Walmart may increase prices in the future.

Cuban has previously warned of the long-term consequences of President Donald Trump’s tariffs in social media posts, even suggesting they could contribute to an economic crisis.

“If the new tariffs stay in place for multiple years and are enforced and inflationary, and [the Department of Government Efficiency] continues to cut and fire, we will be in a far worse situation than 2008,” Cuban said in April.