Good morning. The financial services industry is on the verge of entering the crypto economy, according to Bank of America’s CEO Brian Moynihan. “It’s pretty clear there’s going to be a stablecoin,” Moynihan said in an interview with David Rubenstein on Tuesday. He added that stablecoins are digital assets like Bitcoin, but backed by the U.S. dollar—making them akin to a money market fund with check access or a bank account.

“If they make that legal, we will go into that business,” Moynihan said. Under President Trump’s crypto-friendly administration, lawmakers are seeking to pass legislation on stablecoins.

In practice, Moynihan explained, this means we could soon see the bank offer BofA coins linked to a U.S. dollar deposit account. “The question of what it’s useful for is going to be interesting,” he said.

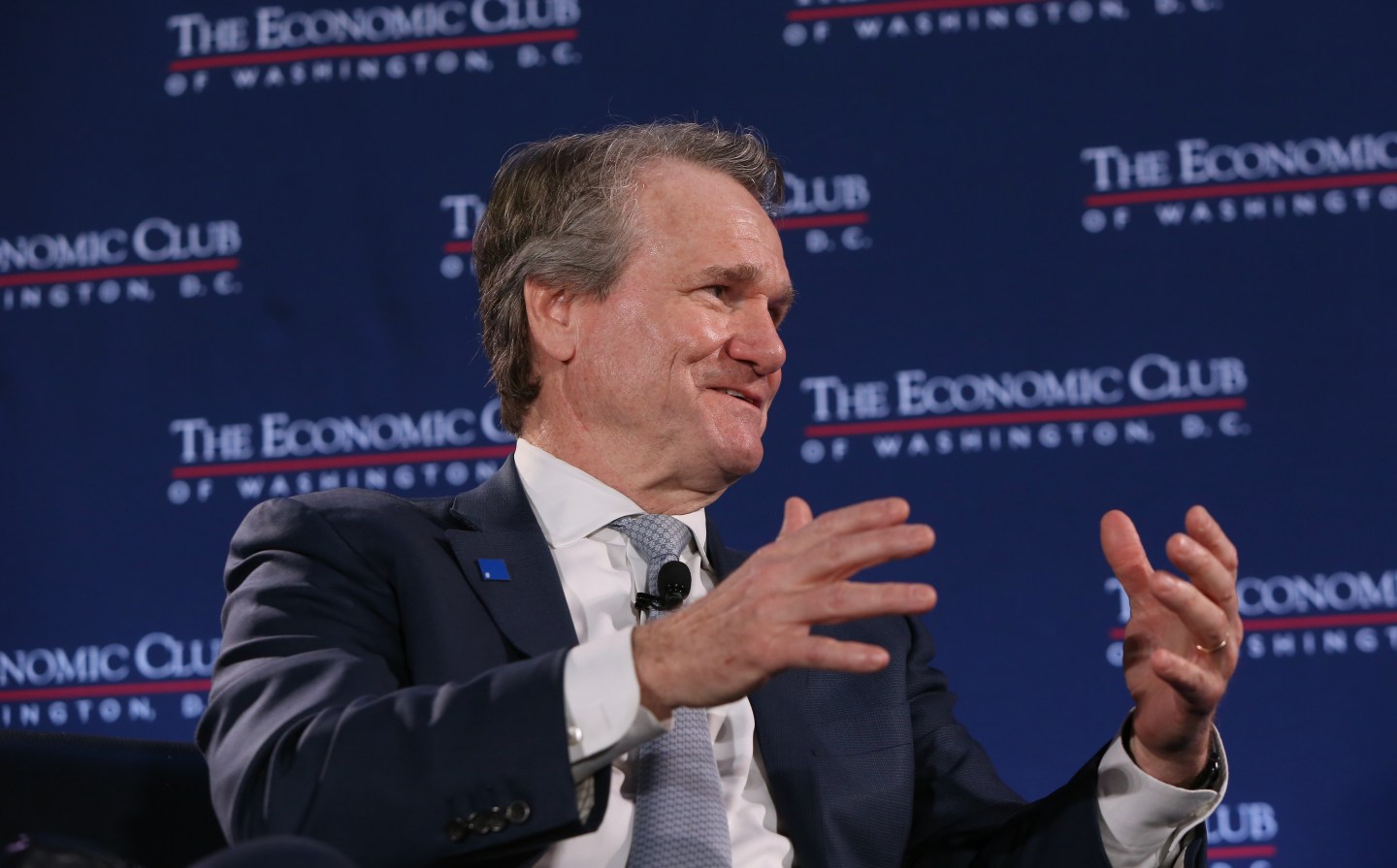

Moynihan made the remarks at the Economic Club of Washington, D.C., on Tuesday. Digital currency was among the topics that Rubenstein, chair of the club and cofounder of private equity firm the Carlyle Group, discussed with Moynihan. He also asked the chief executive how technology has already changed the way banks operate.

Bank of America (No. 18 in the Fortune 500) invests about $4 billion in new technology every year, Moynihan said. And running the system requires another $8 or $9 billion annually, he said. “So the impact is unbelievable,” he said.

BofA offered a mobile banking app for iPhone before other banks, Moynihan said. “Back then it was an unusual thing to have an app,” he said. “Everybody went to the websites. So that took off. We now have 40 million consumers who bank digitally with us all the time.” About 90% of the bank’s interactions with customers last year were digital, he said. The firm launched its AI-powered assistant Erica in 2018.

Moynihan also observed that, no matter how fast the technology may progress, the bank must also remember the human element. Currently, Bank of America still has about 3,700 branches across the U.S. and people want all ways of communication, he added.

There’s a “critical importance” of a person going into one of its branches and saying, “‘I’ve gotta figure out how to save more money, can you help me create a financial plan?’” he explained. “Or, ‘my mother’s sick, I’ve got a power of attorney and I need you to figure out how I can manage her affairs,’” he said.

When it comes to using technology and offering a human experience: “You’ve got to do both,” Moynihan said.

And you can read about the parenting advice Moynihan discussed here.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Fortune 500 Power Moves

Jamie Miller, EVP and CFO of PayPal (No. 145) was named to the expanded role of chief financial and operating officer, according to a Feb. 25 regulatory filing. Miller joined PayPal in 2023. She was previously global CFO of EY and before that, CFO of Cargill. Miller also spent 12 years at General Electric.

Jere Thompson was promoted to EVP and CFO of Diamondback Energy, Inc. (No. 449), effective Feb. 20. Thompson was most recently EVP of strategy and corporate development. He joined the company in 2021. Travis D. Stice will step down as CEO, effective as of the company’s 2025 annual meeting of stockholders. Kaes Van’t Hof, the current president, will assume the CEO role.

Every Friday morning, the weekly Fortune 500 Power Moves column tracks Fortune 500 company C-suite shifts—see the most recent edition.

Big Deal

The 2025 CFO Outlook for Health care report released by Strata Decision Technology gauges whether health care leaders anticipate their organizations will see financial gains throughout the year. The research found that 44% expect their organizations’ operating margins to remain approximately the same in 2025 compared to last year. And, just over a third (36%) anticipate operating margins to increase and 14% expect them to decrease.

Almost all (96%) of the respondents said they are confident in their team’s ability to remain agile and adjust strategies amid market uncertainty. Meanwhile, margin management was cited as the top concern by 55% of respondents, followed by labor expense (52%), payer rates and negotiations (42%), and labor recruitment and retention (30%), according to the report.

The findings are based on a survey of more than 100 U.S. health care finance professionals.

Going deeper

“The $19.6 billion pivot: How OpenAI’s 2-year struggle to launch GPT-5 revealed that its core AI strategy has stopped working,” is a new report by Fortune’s Jeremy Kahn.

“OpenAI ignited the generative AI craze with its large language models, and anticipation for its next big launch can rival the buzz around a new sneaker drop or a pop star’s latest single,” Kahn writes. “But the GPT-5 rollout has not gone according to script. Two years after the launch of GPT-4, the world is still waiting for its successor—and wondering what’s been holding it up.”

Overheard

“The ongoing policy debate about cuts to federal research spending has largely ignored how such cuts threaten to devastate America’s innovation and dominance in artificial intelligence.”

—Rebecca Willett, director of AI in the Data Science Institute at the University of Chicago and Henry Hoffmann, chair of the university’s department of computer science, write in a new Fortune opinion piece, titled “Federal budget cuts threaten to decimate America’s AI superiority—and other countries are watching.”