Rafee Tarafdar, the chief technology officer at Infosys, wasn’t caught off guard by last month’s news of a low-cost artificial intelligence model by DeepSeek. The India-based IT services company has been keeping an eye on the Chinese AI company for more than a year.

“We’ve been fairly closely watching all of the developments,” says Tarafdar. “The reasoning model that they have launched is something we found to be very good.”

Infosys is a little over two years into its generative AI journey and has built the company’s architecture to support the use of various AI models from the likes of OpenAI and Google, matching those large language models to best fit use cases that range from coding assistance to content developed for employee upskilling. DeepSeek could potentially join that group of AI vendors though Infosys isn’t yet ready to work with it, citing concerns that surfaced after conducting tests evaluating privacy violations and how the system responds to fraud.

“These are some areas that we have identified as risk areas that need to be mitigated,” says Tarafdar.

CTOs and chief information officers have only had a couple weeks to evaluate DeepSeek’s latest AI model, which upended prior assumptions about the training and inference costs to develop AI and presents a new case in support of open-source AI. And with rising geopolitical tensions between the U.S. and Chinese governments, heightened by the latest salvo of tariffs, corporate tech leaders must balance a wide spectrum of factors as they assess the industry’s hot new AI model.

“This comes from a country with sanctions,” says Carl Froggett, CIO at cybersecurity provider Deep Instinct. “That’d be a pretty risky move, in my opinion, to really start embedding it and using it.”

For CIOs at companies thinking about trying DeepSeek, the most important first step involves addressing concerns that they and their legal department may have around data privacy. Many tech leaders Fortune spoke to stress the distinction between DeepSeek’s AI app, which collects and stores personal information from users on servers in China, compared to running the DeepSeek-R1 model via model catalogs offered by Microsoft Azure and other cloud providers, which is a more secure environment. “For companies that do choose to use DeepSeek, it’s important that they understand the privacy policy and terms of service,” says Graeme Thompson, CIO of enterprise cloud data management company Informatica.

For organizations that deem DeepSeek safe, they will then need to evaluate if its AI models are a good fit for their companies’ generative AI use cases and the outcomes they hope to achieve. The fact that DeepSeek is open source is a big plus for organizations looking for greater control or lower costs as they incorporate AI into their operations. Informatica’s Thompson cites the ability to fine-tune the R1 model on proprietary datasets as an important benefit, for example.

For Patrick Richards, CIO of fleet management software provider Motive, greater clarity on pricing is a potential draw. “We evaluate all the most interesting and potentially valuable technologies in the marketplace to see if they have applicability, if they could be run safely at lower cost,” he says. “With that mindset, DeepSeek is no different.”

As Motive has ongoing conversations with vendors like cloud-based software giant Salesforce and AI-powered search startup Glean, Richards is still sorting through how best to evaluate AI’s pricing structure. Some AI vendors are experimenting with consumption-based pricing, which is similar to how cloud computing is billed, but comes with uncertainty as businesses like Motive don’t know how much AI they’ll end up consuming in the long run.

“We’re very concerned and very closely tracking the cost of compute,” says Richards. “Things like DeepSeek are exciting because they represent dramatic decreases in that cost.” Open source AI isn’t exactly “free,” as there are plenty of costs associated with data preparation, ongoing maintenance to keep the AI systems up to date, development costs as engineers design and implement the AI model to match each use case, and computing power.

OutSystems CIO Tiago Azevedo says he will evaluate DeepSeek with the playbook he developed to evaluate OpenAI and to later assess major AI hyperscalers like Google and Amazon. “The type of risks that we always assess is how much of the information that we incorporate is used to train the model,” says Azevedo.

DeepSeek, he adds, will ultimately put more pressure on U.S.- and European-based AI companies to lower the AI’s costs. “The competition that [DeepSeek] is generating is healthy,” says Azevedo.

How that competition plays out amid the fraught political backdrop remains unclear however. In recent months, there have been job cuts in China by major American employers like IBM; sanctions imposed against 16 Chinese chip manufacturers; Beijing’s antitrust probes that have targeted Nvidia, Google, and other U.S. tech giants; and state and federal bills that are already seeking to ban DeepSeek from government devices.

“If I’m using DeepSeek’s open source and I’m hosting it, the issue you then have is, you don’t know how it was trained and its biases,” says Froggett. “Do you trust Facebook and Llama, or Mistral or whatever open-source you want, or do you trust China and DeepSeek?”

John Kell

Send thoughts or suggestions to CIO Intelligence here.

NEWS PACKETS

IT unemployment rises as greater use of AI impacts the tech labor market. In the wake of recent job cuts at Salesforce, Workday, Meta and other major technology companies in recent weeks, the Wall Street Journal reports that the unemployment rate in the IT sector grew from 3.9% in December to 5.7% in January, also above last month’s overall jobless rate of 4%. Tech giants are spending more on AI infrastructure, but not necessarily creating new jobs and in some cases, eliminating roles that are deemed mundane. “As they start looking at AI, they’re also looking at reducing the number of programmers, systems designers, hoping that AI is going to be able to provide them some value and have a good rate of return,” Victor Janulaitis, CEO of consulting firm Janco Associates, told WSJ.

Tech giants ramp up spending in 2025 to record highs as AI race heats up. Alphabet, Amazon, Microsoft, and Meta are among the tech giants that have told Wall Street they will increase spending by tens of billions of dollars in 2025 from last year’s levels, reflecting big investments in data centers, hardware, and other gear necessary to support the generative AI boom. “We think virtually every application that we know of today is going to be reinvented with AI inside of it,” Amazon CEO Andy Jassy told analysts last week during an earnings call.

OpenAI nears a deal that values the startup at $300 billion. OpenAI has had a busy week in the news, including reports that the maker of ChatGPT is close to completing a $40 billion investment from Japanese investment company SoftBank. That news came before a group of investors led by Elon Musk offered $97.4 billion to buy the nonprofit that controls OpenAI. Separately, OpenAI told Bloomberg it has spoken to U.S. government officials about an ongoing probe into whether DeepSeek used data obtained in an unauthorized manner from OpenAI. Reuters, meanwhile, reports that OpenAI is pushing forward with the development of its first generation of in-house AI silicon, which could reduce the company’s reliance on Nvidia for its chip supply.

Workday debuts AI agents. Much has been made about development of AI agents to complete workplace tasks autonomously, with big tech companies including Salesforce, ServiceNow, and Oracle along those developing automated assistants. The latest debut is from HR software maker Workday, which says AI agents will be “digital employees” that coexist with humans, though the company also recently laid off 8.5% of its workforce, which raises questions about the impact of AI on labor. Workday CEO Carl Eschenbach tells Fortune the AI agent announcement is unrelated to the job cuts. “It’s about restructuring to get more dollars to spend on innovation and meet the customer demand,” he said.

ADOPTION CURVE

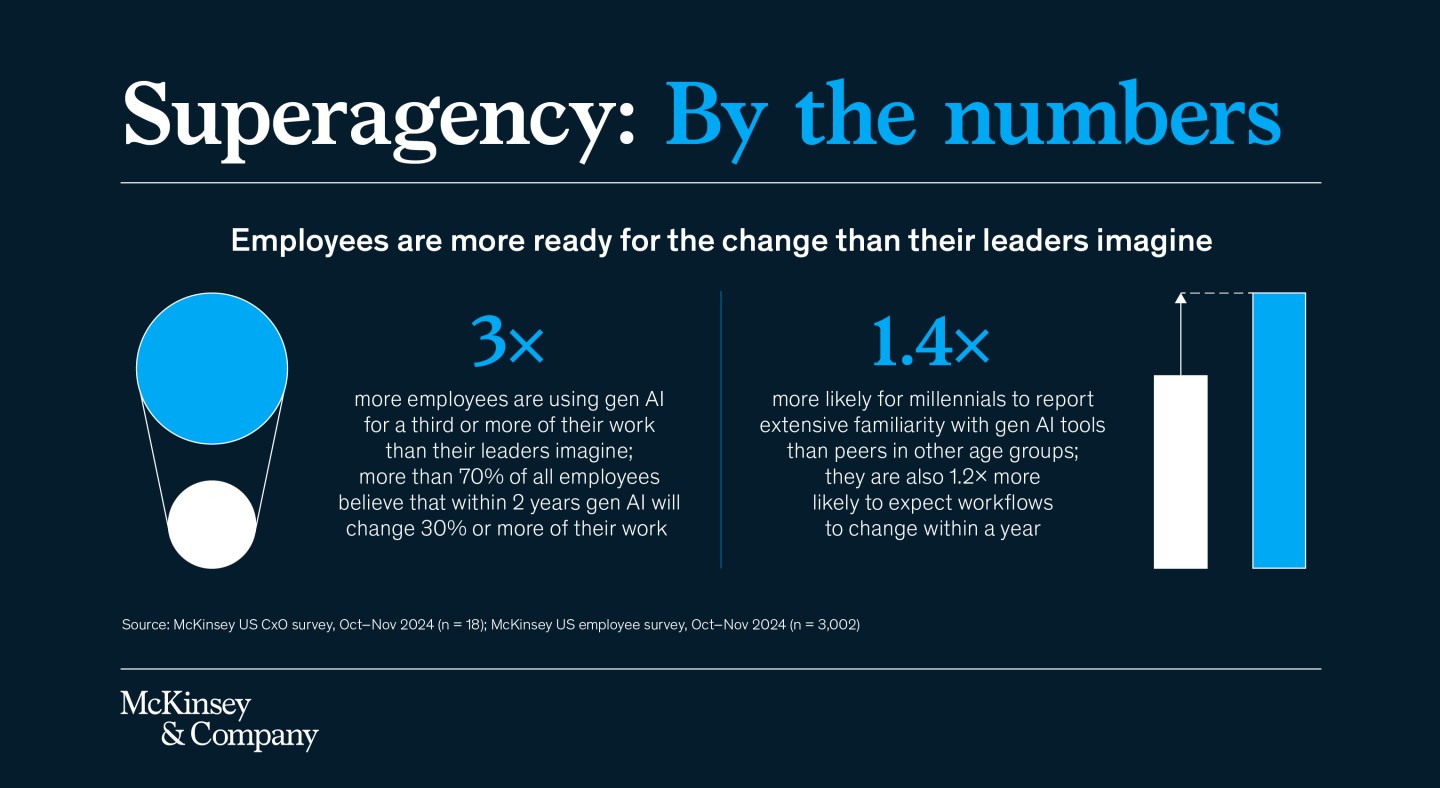

Millennials may be the secret to unlocking AI’s potential. Recent findings from consulting firm McKinsey makes the case that millennials—especially those between the ages of 35 to 44—have more experience and enthusiasm about AI and can become generational champions as the technology becomes more pervasive. A survey of around 3,000 U.S. employees found that 62% of workers in that age demo report high levels of expertise with AI, compared to 50% of 18- to 24-year old Gen Zers and just 22% of baby boomers over 65.

McKinsey asserts that because many millennials are managers, they can help push their companies toward AI maturity. One area of focus should be on training. McKinsey’s survey shows that half of employees say they want more formal trailing, yet more than a fifth report that they received minimal to no support.

Lareina Yee, senior partner at McKinsey, tells Fortune that 70% of all employees expect that 30% or more of their tasks will be augmented or replaced by AI over the next few years. Millennials, she says, are the most proactive in educating themselves. “Irrespective of whether they are skeptical or more optimistic about AI, they are pragmatically walking the talk that you need to become a power user,” says Yee.

JOBS RADAR

Hiring:

- Mama’s Creations is seeking a VP of technology strategy, based in the New York City metropolitan area. Posted salary range: $175K-$215K/year.

- Salesforce is seeking a VP, CIO go-to-market industry lead, based in Chicago. Posted salary range: $273K-$401.7K/year.

- The city of Baltimore is seeking a CIO, based in Baltimore. Posted salary range: $159.4K-$263K/year.

- Amy’s Kitchen is seeking a VP, technology officer, based in Petaluma, California. Posted salary range: $260K-$390K/year.

Hired:

- Priceline appointed Sejal Amin to the role of CTO, overseeing product engineering, infrastructure, data, and technology operations for the online travel agency that’s part of Booking Holdings. Amin joins Priceline from Shutterstock, where she served as CTO, and she also previously served as CTO of tax and accounting at Thomson Reuters.

- Panera Bread named Santhosh Kumar to the role of CIO, effective February 12, reporting to interim CEO Paul Carbone. Kumar will steer the restaurant chain’s tech organization and deploy technology across more than 2,200 cafe locations. Kumar joins Panera Bread from United Natural Food, where he served as CTO for three years, and also had several leadership roles, including SVP of IT, at Dunkin’ Brands.

- Fiverr appointed Yossi Levin to the role of CTO, joining the Israeli-based marketplace for freelance services after previously serving as head of engineering at software company NICE Actimize. Levin also spent nearly seven years at software developer LivePerson, where he served as VP of engineering.

- Open Health announced the appointment of David Sakadelis as CTO, joining the biopharmaceutical consulting company after most recently serving as SVP of technology at health marketer Klick Health. Sakadelis also spent 10 years in leadership roles at healthcare marketing agency Heartbeat.

- The Strawhecker Group appointed Shelley Joyce to the role of CTO, joining the payments consulting firm after previously serving as a CTO at Global Payments. Other leadership roles held by Joyce include serving as CEO at Monetary and as VP of product at Total Merchant Services.

- Flash named Jim Zeitunian as CTO, joining the parking technology provider after most recently serving as CTO at Powerfleet. Earlier in his career, Zeitunian developed enterprise software-as-a-service platforms at Coupa Software and at Thomson Reuters.

- Momentec Brands appointed Christine Rose to the role of CTO, joining the apparel manufacturer to oversee all technology initiatives, including enterprise infrastructure, supply chain systems, and information security. Rose previously served as CIO at Rite Aid and held leadership roles at Sephora, Align Technology, and Kendra Scott.

- ECI Software Solutions has promoted Brian Hildebrand to serve as CIO, overseeing the cloud-based business software provider's entire technology infrastructure. Hildebrand initially joined ECI Software in 2008 and has served in various leadership roles, including most recently as VP of IT and cloud delivery.