Good morning. CFOs are becoming more bullish on the economy. But they still have concerns about ongoing challenges like geopolitics and market volatility.

Deloitte has released its fourth quarter 2024 North American CFO Signals survey which finds 72% of CFOs believe the North American economy will improve over the next year, and half of them rate the the current economy as good. A metric used by Deloitte, the CFO Confidence Score, came in at 5.8 for Q4, up from 5.0 in Q3—the highest reading in 10 quarters. And 67% of CFOs said it’s a good time to take risks, up from a 10-year average of 50%.

I had a conversation with Steve Gallucci, global and U.S. leader of Deloitte’s CFO program about the survey results. He pointed to two variables that gave a boost to CFO optimism. The data for the survey was collected in Q4 following the U.S. presidential election, Gallucci said. It was also after the Federal Reserve meeting in November, where the agency lowered interest rates, following a rate cut in September.

“I think you could draw a pretty straight line back to the fact the election was determined,” Gallucci said of the uptick in optimism. There was much speculation that it would take time to determine the winner, which would have created more uncertainty, he said.

One of the key findings of the report is finance chiefs are preparing for a bump in salaries for employees. On average, the CFOs expect to see a 7.3% increase in domestic wages and salaries over the next 12 months at their companies, up from a predicted increase of 3.65% in Q3, and well above market projections, according to Deloitte. They also expect a 5.8% hike in domestic hiring. About half of CFOs seek to hire or promote from within.

CFOs also foresee a 7.6% increase in earnings. Capital investments are expected to increase by 8.7%, with dividend growth of 6.4%. The data is based on a survey of 200 CFOs in organizations with a minimum of $1 billion in revenues.

But despite the increase in optimism, when asked to identify their top priority for 2025, enterprise risk management was the most cited answer. They also plan to double down on technology-driven insights to drive agility.

“There still are a lot of risks that CFOs are managing,” Gallucci said. Many questions still linger around how policies, whether it be trade or tax, impact the broader economy, he said. And, how the Fed will continue to address inflation, he added. Other key points from Deloitte’s CFO report:

—The most worrisome eternal risks for CFOs: the economy (56%), geopolitics (46%), and interest rates (44%). Forty-seven percent said that over the next year, their companies will explore options for relocating parts of their global value chain.

—CFOs’ top internal risks: technology deployment, including generative AI, lack of agility and resilience, and efficiency and productivity.

—Doubts about U.S. equity market valuations persist, with 58% of CFOs viewing current valuations as overvalued.

The upshot is that increased optimism among finance chiefs could support a strategic balance between seizing opportunities and creating robust frameworks to address financial and operational challenges.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Ed Weber has been promoted to CFO of Major League Baseball (MLB). Weber previously served as EVP and deputy CFO. He succeeds Bob Starkey, who will remain with MLB as a senior advisor to Commissioner of Baseball Robert D. Manfred, Jr. Weber began his baseball career in 2006 when he became SVP and CFO of MLB Advanced Media.

Andy Wamser was appointed CFO of NCR Atleos Corporation (NYSE: NATL), a financial services company, effective Jan. 27. Wamser joins the company from BlueLinx where he held the position of SVP and CFO. He succeeds Paul Campbell who stepped down from his role as EVP and CFO. Campbell will remain with the company through April 1.

Big Deal

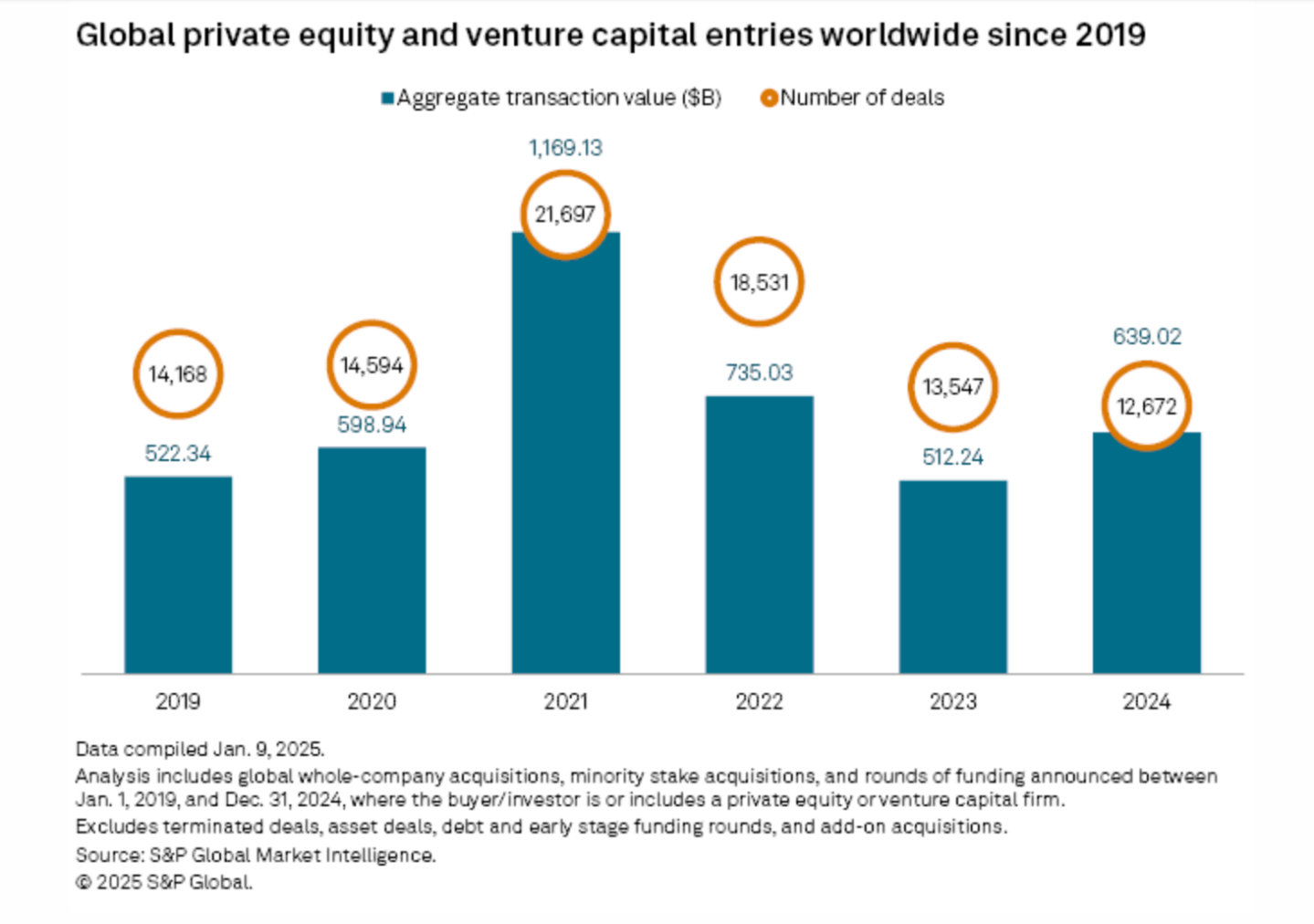

A new S&P Global Market Intelligence data report finds that global private equity and venture capital deals showed some resilience last year as aggregate deal value increased for the first time since 2021. Total deal value rose 24.7% year over year to $639.02 billion, with private equity of at least $5 billion significantly contributing to the growth, according to the report.

However, transaction volume declined on an annual basis falling to 12,672 deals in 2024 compared to 13,547 in 2023. Among the mega-deals driving private equity M&A was Novo Holdings A/S acquiring U.S. pharmaceutical products developer Catalent Inc. for $16.5 billion, the research found.

Going deeper

Are you a coffee drinker? “The best time of day to drink coffee for maximum benefits isn’t first thing when you wake up,” a new Fortune Well article by Alexa Mikhail, provides some insight on how to get the most out of your coffee intake.

Overheard

“My career has been shaped by the serendipitous interactions and vibrant cultures that physical offices foster, but stepping into a leadership role in a fully remote environment revealed undeniable benefits I hadn’t previously experienced.”

—Chris O’Neill, the CEO of GrowthLoop, writes in a new Fortune opinion piece. His career spans 25-plus years featuring roles as managing director of Google Canada and CEO of Evernote.