Good morning. Qualcomm has long been a giant in building chips for mobile phones, known as Snapdragon processors. The Fortune 500 company is taking that chip technology and applying it to other industries that are going through an inflection point, according to Qualcomm’s CFO and COO Akash Palkhiwala.

Qualcomm anticipates a total addressable market of approximately $900 billion by 2030, according to Palkhiwala, who said the company is pursuing a diversification strategy that goes beyond mobile into automotive, personal computing (including PCs), industrial devices, and extended reality (XR) industries. “We’re building new muscles,” Palkhiwala told me.

An example? Palkhiwala pointed to the evolution of PCs. Following the onset of the pandemic, he said, PCs have become communication devices, rather than just used for productivity. Qualcomm has core strengths in power-efficient computing and connectivity, he explained. Another area the company prioritizes is on-device AI processing, which addresses demands for data security, Palkhiwala said.

Qualcomm has become a credible rival to traditional PC processor companies like Intel and AMD—especially amid the AI boom. Using the ARM architecture that is ubiquitous in the mobile world, Qualcomm’s new Snapdragon X chipsets can be found in many of the “AI PCs” that manufacturers started selling in recent months.

I asked Palkhiwala about Qualcomm’s perspective on M&A amid reports that the company is considering a takeover of Intel. He pointed to Qualcomm’s diversification plan. “Anything that helps me accelerate that plan is of interest to me,” he said.

Palkhiwala also noted that Qualcomm’s consistent M&A strategy has been prioritizing smaller technology acquisitions over the last year and a half to bring in talent and AI technologies which get integrated into the company’s portfolio, he said. “We have not done large acquisitions,” he said. “Of course, from time to time we look at it, but we’ve chosen not to pursue it, so far.”

Palkhiwala first joined Qualcomm in 2001. Over the years, he’s held several finance leadership roles including treasurer, financial planning and analysis, and corporate development. He became CFO in 2019 and took on the additional role of COO in January.

In his COO capacity, he’s responsible for the sales, business development, and government relations teams globally. In most organizations, there has been a traditional conflict between finance and sales. So Palkhiwala sometimes must decide when it’s best to wear his COO or CFO hat, he said. But this question he asks himself puts everything into perspective: What is the right decision for Qualcomm?

“If I make every decision, or every judgment based on that framework, then I think it’s fine,” he said.

I also asked Palkhiwala what he does for fun when he’s not in the C-suite wearing two hats. “I’m a big Bollywood fan,” he told me. And tennis is at the top of his list, too.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Hao Qian, CFO of MoneyHero Limited (Nasdaq: MNY), a personal finance aggregation and comparison platform, has resigned, effective Dec. 15. Danny Leung, the company’s group finance director, was appointed interim CFO. A senior finance and accounting executive with more than two decades of experience across growth-stage businesses, Leung joined MoneyHero in 2024.

Big Deal

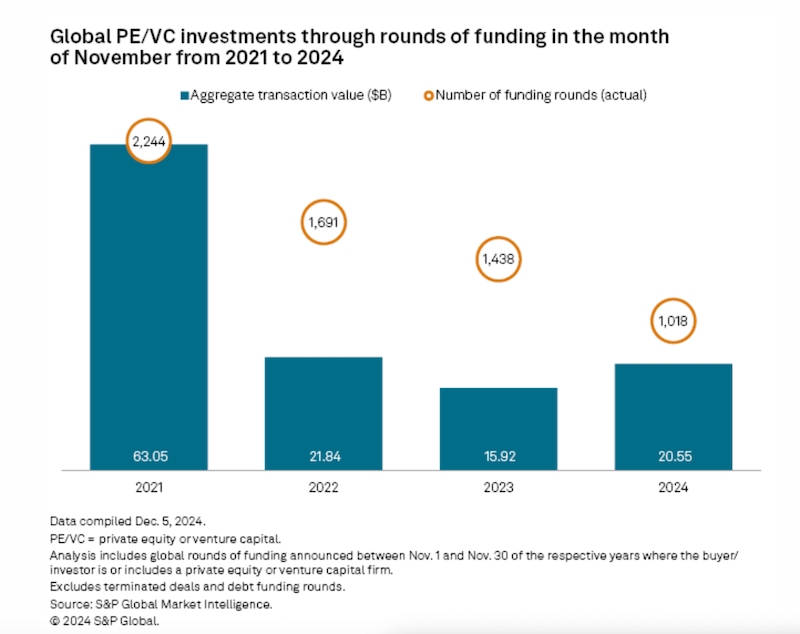

An S&P Global Market Intelligence report finds that global deals with private equity or venture capital firm involvement declined 29.2% year over year to 1,018 in November. However, deal value totaled $20.55 billion, up 29.1% from $15.92 billion a year ago.

The technology, media, and telecommunications (TMT) industry received the bulk of global venture capital investments in November (62.2%). The health care sector followed with 12.7% of the total.

The largest private equity-backed round in the month was for X.AI Corp., which raised $5 billion in a funding round valuing Elon Musk's AI startup at $50 billion, according to S&P Global.

Going deeper

A new Pew Research Center survey finds that only half of U.S. workers say they are extremely or very satisfied with their jobs overall. And 30% of workers are highly satisfied with their pay, down from 34% last year. The findings are based on a survey of 5,273 employed U.S. adults.

The report also explores how workers see various aspects of their jobs, including how they assess the importance of certain skills and their own opportunities for further training. For example, among workers who need training but didn’t get any in the last year, many point to time and resource constraints as major reasons, according to Pew.

Overheard

“It’s important for people to understand the role of the Federal Open Market Committee or monetary policy at the Federal Reserve because of the importance of price stability and maximum employment for people’s everyday lives.”

—Boston Fed President and Federal Open Market Committee member Susan Collins told Fortune in an exclusive interview. Collins wants to demystify the intricate workings of the committee and help people understand the economic landscape they live in.