The world’s hottest company is back to wrap up tech earnings season. Money managers are waiting nervously as Nvidia gets set to reveal its latest quarterly results on Wednesday afternoon. While Wall Street is expecting another strong showing for Q3—Visible Alpha predicts revenue will increase 84% year over year to $33.2 billion—all eyes are on the chip giant’s forecast for the final quarter of the year.

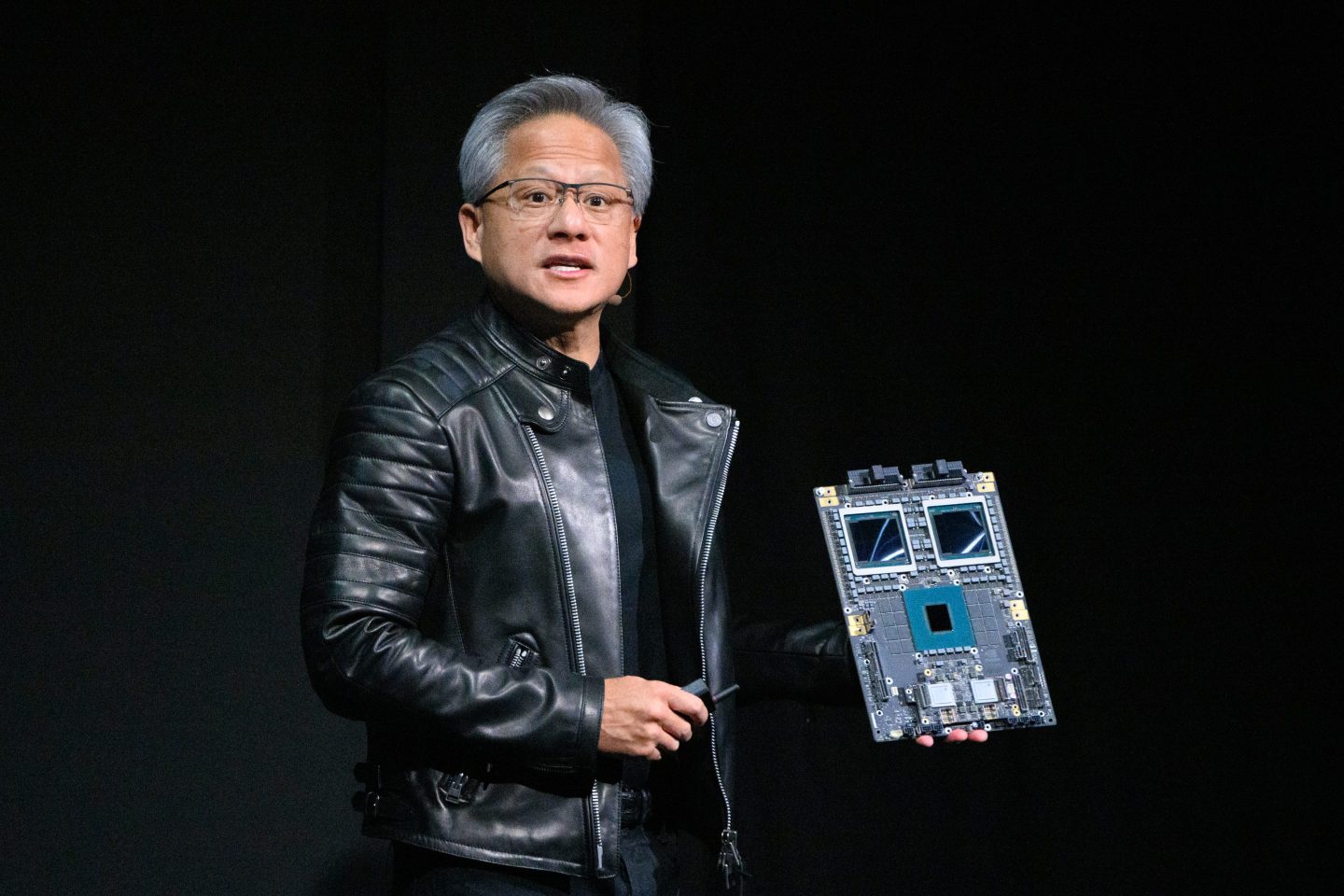

That’s because the company’s next-generation GPU offering, or Blackwell, is scheduled to start hitting the bottom line. CEO Jensen Huang has touted “insane” demand for the new platform, which represents a dramatic step up in performance from the so-called Hopper chips that have fueled the AI boom. It’s a dramatic show of innovation and strength from a company that has seen its shares skyrocket more than 800% over the last two years, with the company adding more than $3 trillion in market cap to trade places with Apple as the world’s largest company.

Wedbush Securities’ Dan Ives, one of Wall Street’s most prominent tech bulls, is anticipating another blowout release, saying that a $2 billion revenue beat and similar raise to Q4 guidance will signal that the AI party is just getting started.

“We expect another jaw-dropper tomorrow from the Godfather of AI Jensen that will put jet fuel in this bull market engine,” Ives and other Wedbush analysts wrote in a note.

Others who follow the stock, however, are sounding a more cautious note. Multiple analysts told Fortune Wednesday’s call could prove to be a “sell the news” event. That’s what happened last quarter, even though the company comfortably beat earnings and revenue expectations as sales grew over 122% year over year.

The stock dropped 18% in the week following the call, trading just north of the $100 mark, as investors pocketed their gains. The stock has gained roughly 40% since, however. Shares rose about 4% Tuesday, moving above the $145 threshold, in anticipation of another blowout release.

Nonetheless, the stage may be set for another round of immense profit-taking, according to Ted Mortonson, a managing director and technology desk sector strategist at Baird. Retail investors, he said, often trade on “FOMO,” or the fear of missing out. By contrast, he added, institutions will likely be driven by what he dubbed “FOGK.”

“That’s fear of getting killed,” he said.

With the stock nearly tripling year to date, he explained, his clients have won. They aren’t looking to give up those gains heading into the end of the year.

Blackwell delays could prompt muted guidance

How the stock moves after Wednesday’s call will likely have a lot to do with what the company says about Blackwell. Jensen previously said the groundbreaking platform should account for “several billions” of additional revenue starting in Q4, but Angelo Zino, a vice president and senior analyst at CFRA Research, said he believes Wednesday’s forecast will be relatively conservative.

Both he and Mortonson are unsurprised Blackwell’s rollout has run into production delays. A recent report from The Information, a tech-focused publication, said overheating issues had compelled Nvidia to ask suppliers to adjust the design of the platform’s server racks.

Instead of simply selling stand-alone chips, Zino explained, Nvidia is marketing Blackwell as a platform offering with configurations that can be customized to fit different customers’ needs.

“You’re talking about compute power and speeds on memory and networking that we’ve never seen before,” Mortonson said.

That also means there are many more moving parts on Nvidia’s end, however. Zino said it’s likely the delivery of some systems will be pushed to 2025, prompting the company to be less aggressive in issuing guidance.

“Given that there’s more that can go wrong, you want to provide a little bit of a buffer going into this January quarter,” Zino said, “just in case.”

That could set up Nvidia for some more massive earnings beats early next year. By Nvidia’s lofty standards, however, Wednesday’s results and forecast could be a bit pedestrian. If that happens, Mortonson said, big investors could be quick on the trigger to sell.

Retail traders, he added, are taking a knife to a gunfight. “It’s a casino stock,” he said, “so good luck to them.”