Sixteen years after Lehman Brothers’ collapse, Jefferies CEO Richard Handler shared the email he sent to the bank’s former CEO, Richard “Dick” Fuld, on the day the firm filed for the largest bankruptcy in U.S. history.

In a series of Instagram posts, Handler revealed the exchange with Fuld, which occurred just before Lehman’s fall sent the global economy into a tailspin.

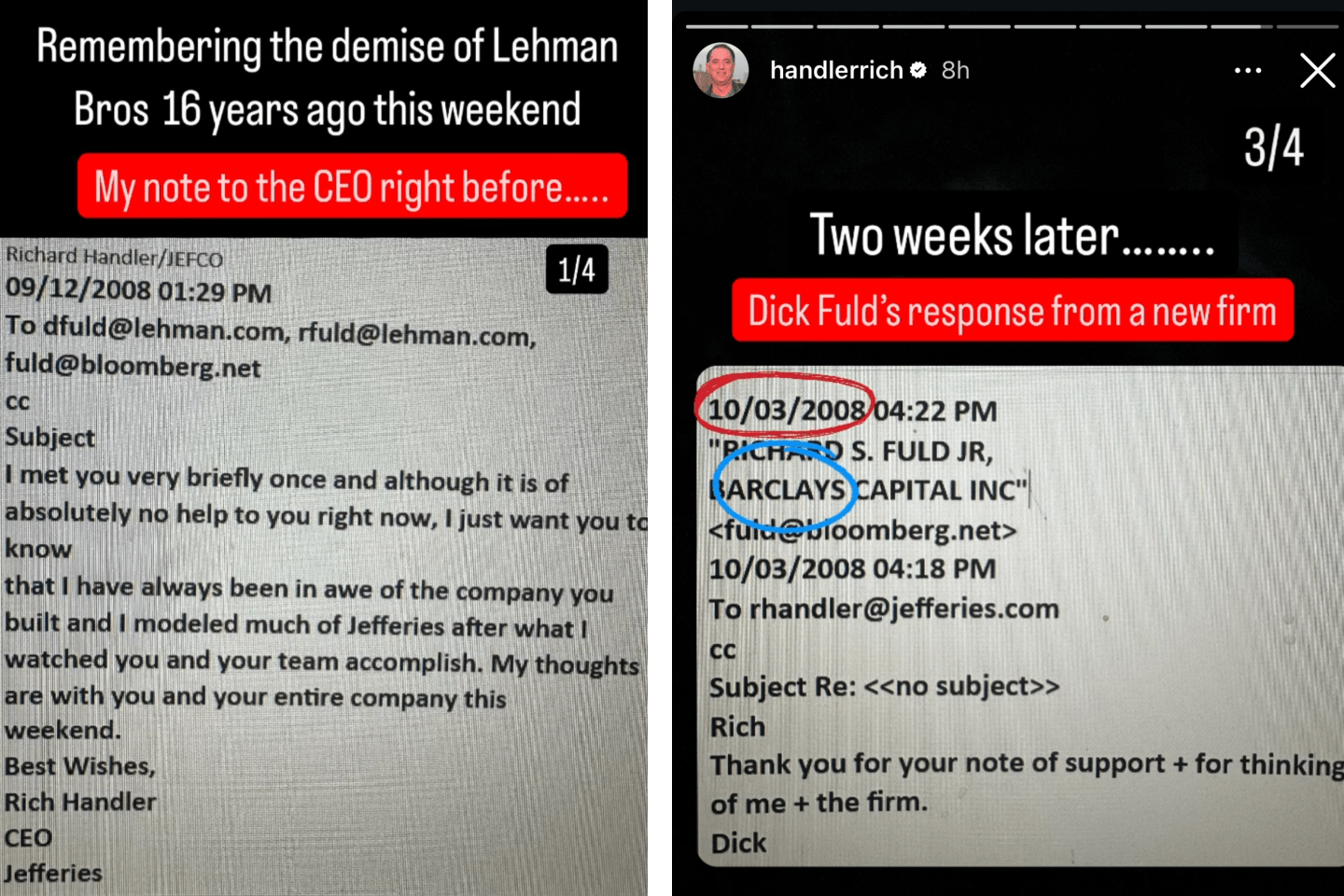

“I met you very briefly once, and although it is of absolutely no help to you right now, I want you to know that I have always been in awe of the company you built,” Handler wrote to Fuld three days before the collapse. He added that he had “modeled much of Jefferies” on the financial giant.

On September 15, 2008, when Lehman Brothers filed for bankruptcy with more than $600 billion in debt, Handler sent a final email to Fuld: “I am so very sorry for you and the special company that you built.”

Fuld responded two weeks later, thanking Handler for his “note of support” and “for thinking of me (and) the firm.”

What did Wall Street learn from Lehman Brothers?

Lehman Brothers, the 158-year-old bank that had survived the 1929 Wall Street crash, was deemed “too big to fail.” At the time, Jefferies Group was a rising investment bank, with Handler having recently taken the helm.

Reflecting on the collapse, Handler said the crisis offered “life-saving lessons,” including that “arrogance always kills” and “life will go on.”

By 2009, Jefferies had transformed from a small equity trading shop to a primary dealer for the New York Fed, allowing it to participate in the open-market buying and selling of securities—critical to the Federal Reserve’s operations.

Handler’s 10 lessons:

1. There is no such thing as a “slight liquidity crisis”

2. Everything in life is fragile

3. Sometimes bad things happen to good people

4. Never take anything or anyone for granted

5. Leverage can’t distinguish between good or bad, but it will happily (magnify) both

6. You never have as much time as you may think

7. Character is determined during tough times

8. Arrogance always kills

9. If your debt holders are at risk, your shareholders will probably be wiped out

10. If you stay positive through the storm, the sun always eventually rises, and life will go on.

See the email exchange

Where is Dick Fuld now?

Fuld ran Lehman for 14 years before the bank collapsed.

In the years that followed, Fuld repeatedly blamed the government (and their very aggressive push to increase homeownership) for Lehman’s death, before owning up to some “bad judgments” years later.

Read more from Fortune

Despite being the self-confessed “most hated man in America,” Fuld has still managed to maintain a career in the financial industry.

Today, the 78-year-old is running Matrix Private Capital Group which offers investment advice to “high-net-worth” clients.

In his first (and last) speech since the financial crash, in 2015, Fuld said: “Whatever it is, enjoy the ride. No regrets.”

A version of this story originally published on Fortune.com on Sept. 16, 2024.

More on banks:

- Remote work impedes women’s careers, CEO of top U.K. bank claims

- Saving vs. investing: What to know and how to choose the right strategy for you

- Bank CEO running 4-day workweek: cutting working hours isn’t ‘progressive’, and AI will make it ‘bloody logical’