Today is Data Sheet’s tenth birthday, and on occasions like these it’s always fun to look back and see how much has changed over the years—and how much hasn’t.

It’s remarkable that the very first story mentioned in Data Sheet’s inaugural edition was about HP accusing Autonomy founder Mike Lynch of fraud. That epic battle, which revolves around the $11 billion valuation at which HP bought Autonomy back in 2011, is still playing out a decade later.

HP won its U.K. civil fraud case in 2022 and hopes to see the repayment of over $4 billion—but, while former Autonomy chief financial officer Sushovan Hussein received a five-year sentence in a U.S. criminal trial in 2019, Lynch himself was acquitted there in June of this year. (Lynch said last week that even though he was “ultra innocent,” he would have been found guilty had he not been rich, due to the high costs of the U.S. justice system.)

Some themes in that first edition have contemporary echoes. Ten years ago, enterprises were trying to figure out their return on investment for cloud computing and big data, much as they are now for AI, which is generally still a matter of cloud and big data. Some remain even more comparable today—an item in that first edition noted that notebook shipments were enjoying a revival, much as they are again this year after a post-pandemic lull in the segment.

One thing’s for sure: Intel was doing a lot better during that laptop renaissance than it is now. On this day in 2014, having recently seen its stock recover after an iPad-induced notebook slump, the chip giant’s share price ended the day on $32.82. But after a 26% plunge on Friday followed by a broad stock market free fall this morning, Intel’s share price is down nearly 40% from its level a decade ago.

Intel’s latest slip followed its announcement last week of a massive cost-cutting push, involving 15,000 job losses and the suspension of its dividend, associated with a weakening bottom line—adjusted gross margins for the second quarter were down 38.7% year-on-year. And a big reason for that is Intel’s desperation to keep up in the new trend of AI PCs, in which Qualcomm is suddenly a serious competitor.

As the Motley Fool’s Timothy Green notes, Intel has only been able to ship over 15 million of its AI-processor-featuring Meteor Lake chipsets by having them made in Ireland, where production costs are higher than in Oregon. This year’s generation, Lunar Lake, will mostly be made in TSMC’s plants rather than Intel’s own. Again, outsourcing is more expensive than in-house production.

It will only be on the subsequent generation—Panther Lake, due to launch next year—that Intel will be able to bring that manufacturing back in-house, making 2026 the year when the company expects to see fat margins again.

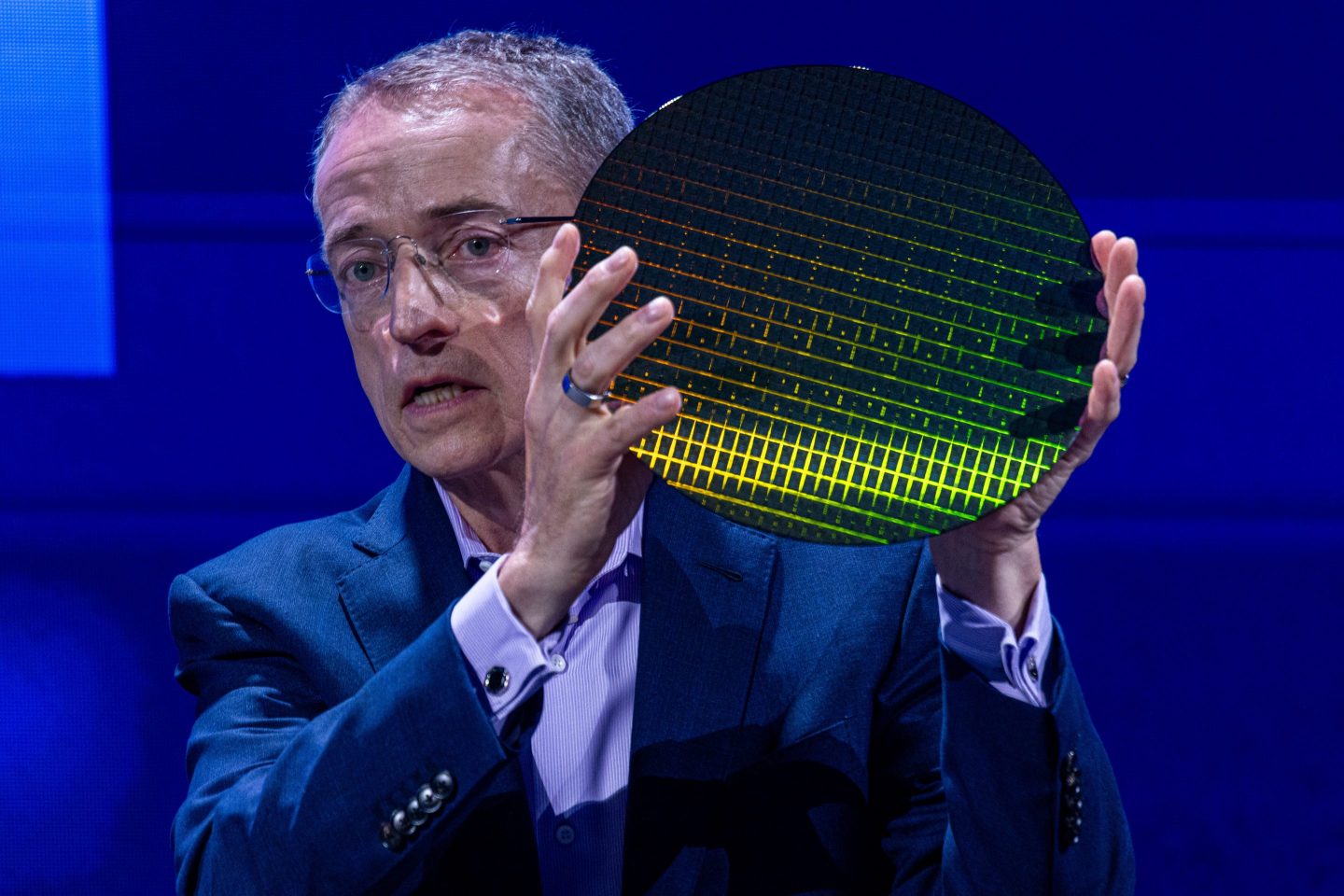

Let’s see if CEO Pat Gelsinger, whose turnaround plans remain far from fruition, will still be around by then. Intel has dropped from #53 to #79 in the Fortune 500 over the last decade. In the Fortune Global 500 for 2014, Intel enjoyed the 195th spot, but in this year’s list—which is out this morning—it languishes at #261.

A lot can change in 10 years, especially in tech. Here’s to the next decade! More news below.

David Meyer

Want to send thoughts or suggestions to Data Sheet? Drop a line here.

Update: This article was updated on Aug. 6th to add context to Lynch’s quote.

NEWSWORTHY

Stocks fall. The markets are generally ugly today due to fears of a U.S. recession, but tech stocks are looking uglier than most. The Nasdaq Composite, which already entered correction territory on Friday, started the week with a fall of around 5% that has since been slightly pared. Intel was down by over 9% at one point (see above), Nvidia was down by over 8%, and Apple slid by over 5% (see below).

Infineon job cuts. The German chipmaker Infineon, which is big in the auto sector and is therefore hurting from the electric-vehicle slump, is cutting 1,400 jobs and relocating a further 1,400 to cut labor costs. As Reuters reports, the company has lowered its annual revenue guidance for the third time, after missing analyst expectations for quarterly revenues.

TikTok ends rewards in Europe. TikTok has agreed to permanently withdraw a controversial new rewards program from Europe, to close a probe recently launched under the EU’s new Digital Services Act (DSA). Officials had said the feature of the TikTok Lite app, which gave people points for watching videos and liking content, could have had “very addictive” consequences. “The available brain time of young Europeans is not a currency for social media, and it never will be,” declared EU digital chief Thierry Breton, according to Bloomberg. “The DSA effect kicks in.”

SIGNIFICANT FIGURES

$84.2 billion

—Berkshire Hathaway’s remaining Apple stake as of the end of Q2, after Warren Buffett’s conglomerate dumped almost half its holdings in the tech giant. Apple is still Berkshire’s biggest stock stake, CNBC reports, but either way, the sale played a big role in the company’s sliding share price today (see above).

IN CASE YOU MISSED IT

Bitcoin price plunges and ether has worst drop since 2021, by Bloomberg

TikTok parent sued for ‘massive-scale invasions of children’s privacy’, by Amanda Gerut

Google’s hiring of Character.AI’s founders is the latest sign that part of the AI startup world is starting to implode, by Sharon Goldman

Nvidia’s upcoming AI chips reportedly face delay of 3 months or more due to design flaw, by Bloomberg

Despite the stock crash, the AI-fueled bubble will soon regain momentum, economist says, by Jason Ma

Uber’s legal chief takes leave to support sister-in-law Kamala Harris’ presidential campaign, by Bloomberg

The government is reportedly investigating Nvidia for anticompetitive practices, by the Associated Press

BEFORE YOU GO

OpenAI’s cheating tool. Good news for teachers freaking out about students cheating using ChatGPT: OpenAI has developed a tool that reportedly has a 99.9% success rate in spotting whether a document was written using its hit chatbot. Now the bad news: According to the Wall Street Journal, it’s already been good to go for a year and OpenAI still has no plans to release it anytime soon, despite the enthusiasm of the staffers who developed it. The Journal reports that OpenAI polled loyal ChatGPT users and found “nearly a third would be turned off by the anticheating technology.”