Good morning. Eli Lilly and Company’s finance chief Anat Ashkenazi was tapped as the next CFO and SVP of Google and Alphabet, and Dan Ives, Wedbush Securities managing partner, believes the tech giant has made a solid hire.

“This was a strong candidate that fills a void for Alphabet at a key time in its growth transformation and ‘AI Revolution,’” Ives told me. “She has a strong reputation and great CFO experience.”

Alphabet Inc., no. 8 on the 2024 Fortune 500 list, and the parent company of Google, announced on Wednesday that Ashkenazi will succeed Ruth Porat, effective July 31. A 23-year veteran of the Indianapolis-based pharmaceutical company Lilly, Ashkenazi began her CFO role in 2021. During her tenure, other roles included CFO of Lilly Research Laboratories, CFO for several of the company’s global business areas, and leader of corporate strategy.

Porat, CFO since 2015, and Alphabet’s longest-serving finance chief, was promoted to a new role as president and chief investment officer of Alphabet and Google, previously announced in July 2023. Porat continued to occupy the CFO role as the company and board searched for her successor.

An 11-month search is on the “longer side of the spectrum,” Scott W. Simmons, co-managing partner of executive search firm Crist Kolder Associates, told me. However, the new CFO has “big shoes to fill, which immediately narrows the pool of viable candidates,” he added.

Ashkenazi is leaving Lilly on a high note. The company ranks no. 127 on the Fortune 500, jumping up 15 spots from last year’s ranking. Lilly earned $34 billion in revenue in 2023. She has been at the helm of finance as sales and demand for weight-loss drugs has skyrocketed. In Q1, worldwide revenue for Lilly rose 26% to $8.77 billion year over year, driven by the sales of Mounjaro and Zepbound.

‘The CFO should anchor the organization’

In my conversation with Ashkenazi last winter about the competitive pricing of Zepbound, we also talked about her career journey at the company.

“When I joined Lilly, I started on the business development side in venture investing, which is very kind of financially driven,” Ashkenazi explained. “But then I moved into strategy, and it opened my eyes to other areas, and I absolutely loved it. I love the breadth of looking at the entire business, the entire value chain from start to finish. I enjoyed being at the forefront of making really important decisions looking at very challenging and complex problems. And that’s where my career shifted a little bit and got on the CFO track.”

She added that during times of success and growth, or in challenging times, “the CFO should anchor the organization back to its core mission and values and chart the course forward.”

In Ashkenazi, Alphabet has found “a strong CFO, with a track record of strategic focus on long-term investment to fuel innovation and growth,” Google and Alphabet CEO Sundar Pichai said in a statement on Wednesday. Pichai also mentioned that he looks forward to working with Ashkenazi to invest responsibly in the company’s next wave of growth in the AI era.

“Google’s growth and evolution over the last 25 years has been an incredible story, helping billions of people and millions of businesses around the world,” Ashkenazi said in a statement. The opportunity to have an impact is “greater than ever,” she said.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Jane Bailey was appointed CFO for J.P. Morgan Wealth Management, according to the company. Bailey reports to Bori Cox, CFO for Consumer & Community Banking, with joint responsibility to Kristin Lemkau, CEO of J.P. Morgan Wealth Management. Bailey was previously CFO for UBS Americas & Wealth Management Americas, where she spent nearly 20 years. She held numerous leadership positions across several business divisions. Bailey began her career as an analyst at Standard Chartered Bank and later Standard & Poor’s.

Shane Hostetter was appointed CFO of The Chemours Company (NYSE: CC), a global chemistry company, effective July 1. With Hostetter's appointment, Matt Abbott, interim CFO since February, will resume his prior role of SVP, chief enterprise transformation officer. Former Chemours CFO Jonathan Lock resigned on April 23 following an internal investigation. Hostetter joins Chemours after 13 years of service at the Quaker Chemical Corporation, where he served as CFO since April 2021. Before Quaker Houghton, he held several financial leadership roles at Pulse Electronics Corporation, a publicly traded global manufacturer of electronic components, and started his career as an auditor with PricewaterhouseCoopers.

Big Deal

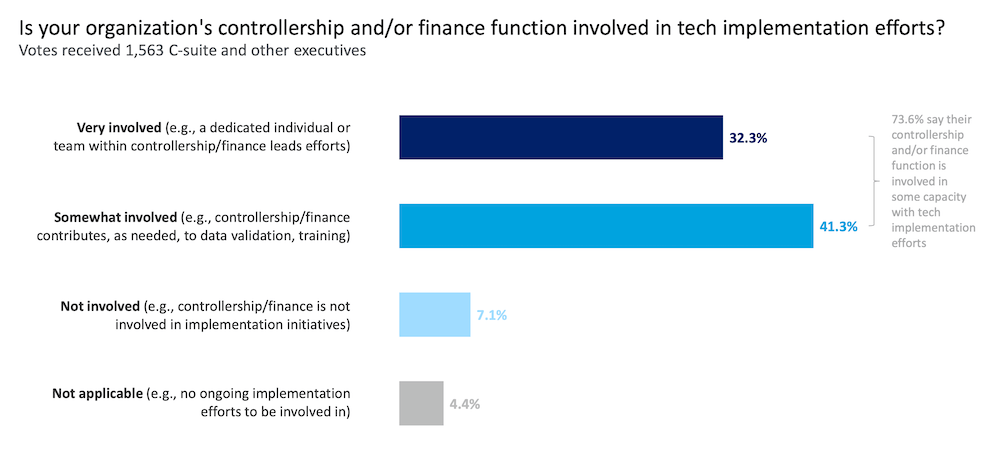

A new poll released by Deloitte gauged finance’s role in tech implementation. Approximately 73.6% of C-suite members and other execs surveyed say their controllership or finance function is involved in some capacity with tech, according to the report. Of those leaders, 41.7% say that automation for tasks like bookkeeping, payroll, and reporting is likely to be the most prioritized tech in controllership and finance, compared to 19% who say AI is prioritized.

Going deeper

"Fortune 500 CEOs are upbeat on the economy—and they wish they owned Microsoft and Nvidia stock," a new Fortune report, is based on an annual CEO survey. Some of the findings: 28% think the U.S. economy will stumble into recession in the next 12 months. Meanwhile, almost 70% believe the Federal Reserve will lower interest rates before the end of 2024, suggesting that they think policymakers are closer to beating back inflation. The survey also delves into viewpoints on AI and indicates the most admired CEOs.

Overheard

“Amazon let us drop our prices four times. I hardly ever hear the ‘whole paycheck’ narrative any longer—that’s due to Amazon.”

—John Mackey, the founder of Whole Foods, told Fortune in an interview that after Amazon acquired the company in 2017 it shed its “whole paycheck,” reputation for sticker shock. He credits Amazon’s former CEO and current executive chairman Jeff Bezos with having the foresight to take the chance on lowering prices benefitting long-term results.