Americans have a lot of anxiety around retirement. Many people are dipping into their nest eggs to make ends meet amid soaring inflation, some boomers aren’t prepared to leave the workforce as they enter their golden years, and people are increasingly working past the typical retirement age.

The most popular method for workers to save for retirement is the 401(k), which allows employees without employer-backed pensions to independently contribute to their own retirement savings, often with employer matching. But it’s not right for everyone, and the man who invented it says it has taken on a life of its own.

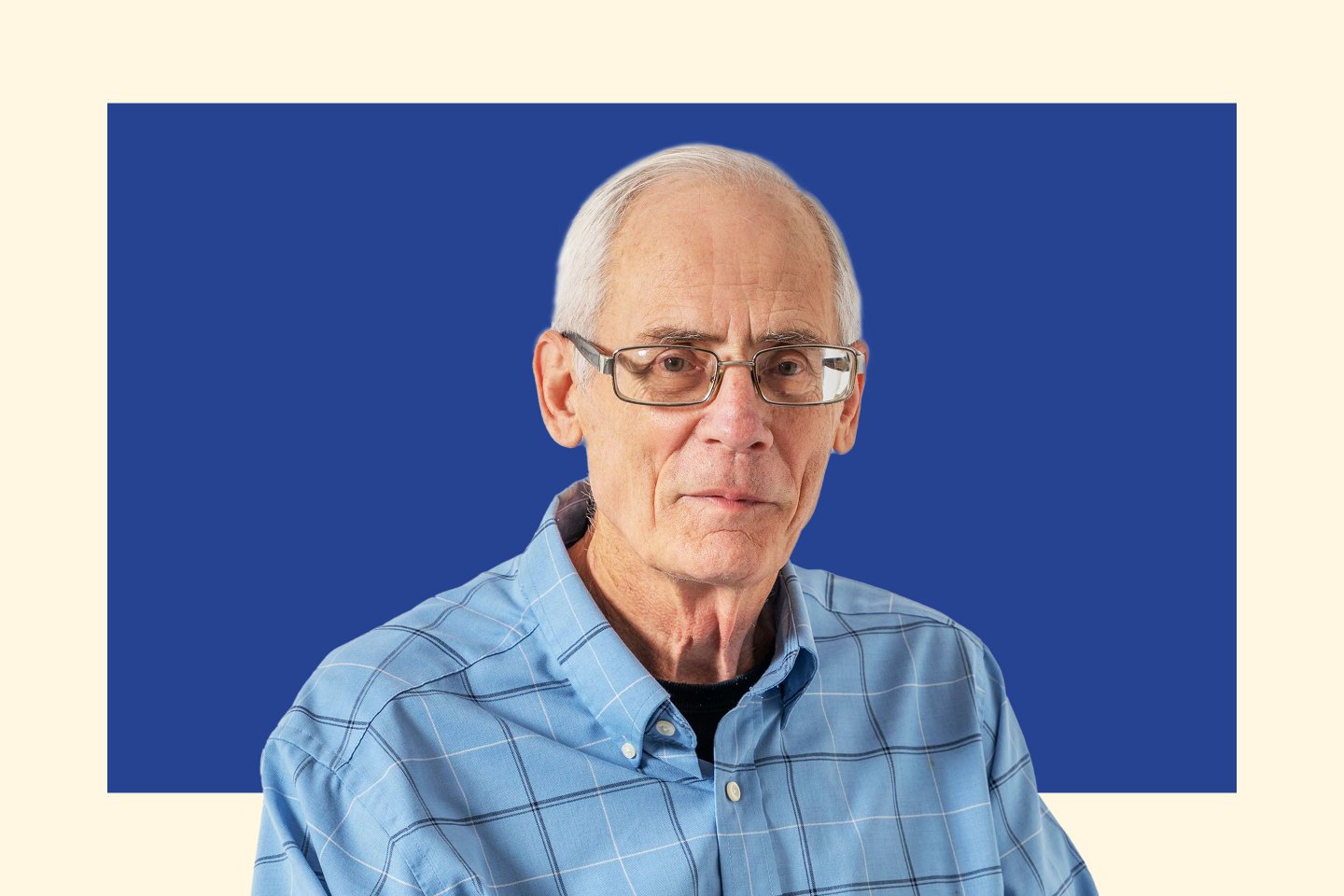

Ted Benna has been called the “father of the 401(k)” after he proposed a reinterpretation of a 1978 tax law and implemented it within his own company. The IRS picked up on his trailblazing plan, and the rest is history. But Benna tells Fortune that what started as an alternate retirement avenue to turn spenders into savers has been restructured in a way that doesn’t always benefit the contributor the way it was intended. Employers were originally expected to cover the fees of these plans, but he says they started to push those costs onto their own workers.

“It was never designed to be what it is today,” he says. “I became very disturbed by what happened with investment expenses.”

Fortune sat down with Benna to discuss how the 401(k) has evolved since it became mainstream in the 1980s, the death of pensions, who the plan works best for, and the future of retirement in the U.S..

This interview has been edited and condensed for clarity.

Is the 401(k) today what you envisioned back when you created it?

The 401(k), politically, was a fluke. The original legislation was only a page and a half long. It was enacted in 1978, and became effective January of 1980. That year, people weren’t running around selling 401(k) plans. It was never designed to be what it is today.

I became very disturbed by what happened with investment expenses. With the original 401(k) plan, employers were supposed to pay the administrative fees, record keeping audits, etc., rather than the participants. The next thing that happened, that I unfortunately had a hand in and regret, was helping to clear the way for investment advice to be given to participants.

In the original version there would have been a $10 to $20 a year fee paid by the employer to get investment advice. But when I was helping Fidelity and Vanguard meet with major mutual fund providers, I said: “This is something you should make available to your participants.” But one of the major players in the room said, “Well, I don’t want to do that because I don’t want our financial results impacted by an independent financial adviser.” Then they learned, “Hey, this is a way we can make more money rather than less money.” So what they did was add another layer of fees.

Did you anticipate that the 401k would essentially replace most pension plans?

I didn’t necessarily know that it would replace them. I knew that pension plans, with or without the 401(k), were dying. When ERISA was passed, which was badly needed, unfortunately the way the PBGC structure was enacted, it began to kill off pension plans. The other thing that had a major impact killing them off was a change in accounting rules, which made the financial impact on quarterly and annual profits very unpredictable. So that became a big reason to kill them off, as well.

What kinds of businesses is a 401(k) right for?

Unfortunately, 401(k)s are often sold when they shouldn’t be, because financial advisors are trained to sell a 401(k). And generally, for most business owners making less than $150,000, they’re probably going to be better off with other options.

Various alternatives are available for those employers. Many times IRA-based plans are a better alternative. The SEP is one, but the simple IRA is a great program for business owners earning $100,000 or so, they’re very easy to set up. You don’t need an advisor, you don’t need to pay a bunch of fees.

IRA-based plans just aren’t well known or promoted. Financial advisors don’t make money from them, and even big financial firms are a bit limited in terms of promoting them as well, because they don’t generate the kind of funds a 401(k) does.

Could you tell me more about the new retirement savings plan you created in March of this year?

It’s an employer-sponsored retirement plan, which I called Wheat Grain Incentive plan. I grew up on a farm, and I have a small horse farm. And planted grains of wheat grow into multiple wheat, which is kind of where the idea came from.

The way it works is the employer would set up a retirement plan, but it would be very different from 401(k), because the plan would cover mid- to low-income employees. It would not cover high paid employees, and as a result of that, it’s not subject to all the technical non discrimination. Employers can actually design the plan however they want to: decide which employees they want to include, and how to reward them. They could be rewarded for continuing employment, performance, profit, or maybe safety. And on a monthly basis, participants would accumulate wheat grains, and the employer would contribute into a retirement plan account. They would be able to withdraw, use it for reasons other than just hardship withdrawals, and more readily have access to it.

What do you think about the “retirement apocalypse,” and the idea that our society is totally unprepared to retire?

We definitely need a healthy economy and robust stock market forever. The question is, will we have them forever? Back in 1980 I forecasted, in that decade, that one of the major social economic tensions is going to be between retirees and workers. The cost that workers were having to bear for retirees. We’re in that decade now, and it’s clearly an issue. It’s a concern.

If you could go back and do it all over again, would you have done anything differently?

I definitely wouldn’t do it differently. I had to work with what the legal parameters were, so I didn’t have a lot of opportunity. But the biggest benefit from the 401(k) has been the fact that it has converted spenders into savers. Many employees have said “I would have never been able to retire without it.”