Sometimes a deal can originate glamorously—at a glittering hotel, or high-powered conference. And sometimes, it all starts with something far more relatable—a DM.

Cameron Adams, Canva cofounder and chief product officer, didn’t know anyone at creative design software provider Affinity. But he thought the company could be a great fit for Canva, so he went for it, directly messaging the company on LinkedIn.

“They don’t have a big online, social presence,” Adams told Term Sheet. “I had to track them down! I eventually got in touch with [Ash Hewson], the MD and CEO. We started talking and things evolved very rapidly. A week later, we were in Nottingham to meet Ash and a bunch of the team.”

Fast-forward seven weeks from that original DM, and it’s official: Canva is acquiring Affinity (and its parent company, Serif). Though Canva isn’t disclosing financial terms, Adams told Term Sheet that it’s the company’s fastest-ever deal. To what does he attribute the speed of the deal? In this case, Adams says that there was no tussling over small details.

“If you start doing that, you can lose sight of the bigger picture, which is the two of us coming together, where one plus one equals ten…We actually very quickly reached an initial agreement before we got into the full contracts. We pretty much sealed the deal, after two days in Nottingham.”

Canva, originally focused on yearbooks, is one of Australia’s first unicorns. To date, the company has raised more than $570 million, and its investors include Bessemer Venture Partners, Felicis, and Dragoneer, among many others, according to Crunchbase. The Affinity acquisition is also a step towards Canva’s next chapter, Adams said.

“The first decade of Canva was very much about empowering individuals, small businesses, and growing teams,” said Adams. “And the next decade is very much about empowering large organizations and teams.”

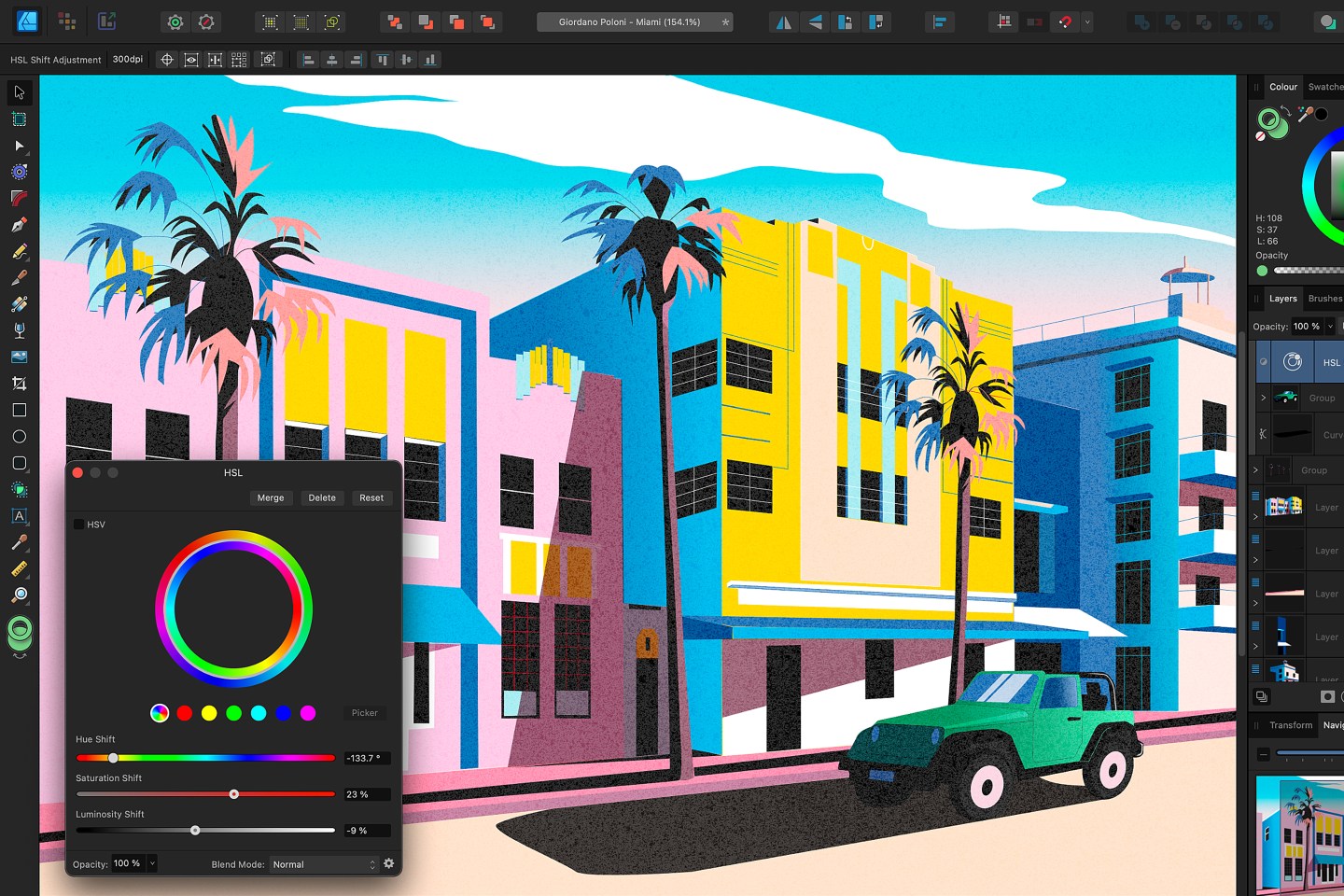

Affinity’s software is a longstanding favorite among design professionals, and Canva’s acquisition of the Nottingham, U.K.-based company marks Canva’s increasing focus on business users.

“We’ve always firmly believed that professional designers have their place, and that the two sides of the coin need to work together,” said Adams.

Over the last few years, Canva’s been building up its resume as an acquirer. Dating back to 2019, Canva’s acquisitions have included Flourish, Kaleido, Smartmockups, Pexels, and Pixabay. Adams says he doesn’t consider Canva to be a particularly acquisition-hungry company though.

“I’m not sure what the run rate of other companies is, but I don’t feel like we’re hugely acquisitive. We’ve done about seven now,” said Adams. “And most of those have actually been in Europe. We found a really great bench of product-builders. They’re particularly folks who build a viable business that quickly reaches profitability, and that enables them to fuel themselves.”

One thing that’s clear is Canva’s direct, no-beating-around-the-bush approach to M&A, something that cofounder and COO Cliff Obrecht addressed in a 2023 interview with 20VC’s Harry Stebbings. “I’m just going to be super transparent with you from Day 1,” Obrecht said of Canva’s acquisition strategy.

Adams laughs, when I mention the reference: “I’ve picked up a few tips off Cliff over the years.” And it’s easy to see how it played out with Canva’s latest deal. “Our first meeting, I just laid out for them–that we were really interested in fully acquiring Affinity and making it a true part of Canva. I think they were a bit taken aback by that forthrightness, but it really helped us get on the same page.”

Not bad for a deal that began as a DM.

See you tomorrow,

Allie Garfinkle

Twitter: @agarfinks

Email: alexandra.garfinkle@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today’s newsletter.

VENTURE DEALS

- FundGuard, a New York City, Boston, Mass., and Tel Aviv, Israel-based AI-powered platform designed to help asset managers and their service providers manage mutual funds, ETFs, and more, raised $100 million in Series C funding. Key1 Capital led the round and was joined by Euclidean Capital, Hamilton Lane, Blumberg Capital, and Team8.

- Tennr, a New York City-based platform designed to automate referral processing, payment posting, claims auditing, medical record management, and more for the health care industry, raised $18 million in Series A funding. a16z led the round and was joined by Foundation Capital and The New Normal Fund.

- Circular.co, a San Francisco-based platform for buying and selling post-consumer recycled materials, raised $10.5 million in funding from Maniv, Oxygea, and Eclipse.

- Abstract Security, a San Francisco-based security analytics platform, emerged from stealth with an $8.5 million seed funding round led by Crosslink Capital, Rally Ventures, and Liquid 2 Ventures.

- Iron Sheepdog, a Williamsburg, Va.-based dump truck hauling management platform, raised $10 million in Series B funding. SJF Ventures led the round and was joined by Grand Ventures, Supply Chain Ventures, and others.

- Foundational, a San Francisco-based AI-powered data management platform, raised $8 million in seed funding. Viola Ventures and Gradient led the round and were joined by Asymmetric Venture Partners and angel investors.

- OpenPipe, a Seattle, Wash.-based tool that lets developers create their own application-specific large language models, raised $6.7 million in seed funding. Costanoa Ventures led the round and was joined by Y Combinator and angel investors.

- Belong, a London, U.K.-based personal finance platform that offers users an optional loan to use for long-term investments in equities, raised £3 million ($3.8 million) in pre-seed funding. Octopus Ventures led the round and was joined by angel investors.

PRIVATE EQUITY

- KKR, Ares Management, and Blackrock Capital Investment Advisors recapitalized KBS, an Oceanside, California-based provider of facility services to businesses in the industrial, commercial, logistics, retail, and grocery sectors. Financial terms were not disclosed.

- Perforce Software, backed by Francisco Partners and Clearlake Capital Group, acquired Delphix, a Redwood City, Calif.-based provider of data management software designed to automate data security. Financial terms were not disclosed.

EXITS

- An investment group led by Arsenal Capital Partners, in partnership with BayPine, acquired POLYWOOD, a Syracuse, Indiana-based manufacturer of outdoor living products made out of recycled polyethylene material, from Mayfair Capital Partners. Financial terms were not disclosed.

OTHER

- American Express Global Business Travel agreed to acquire CWT, a Minneapolis, Minn.-based provider of business travel and meetings solutions, for approximately $570 million.

FUNDS + FUNDS OF FUNDS

- SYN Ventures, a West Palm Beach, Fla.-based venture capital firm, raised $100 million for its cybersecurity seed fund focused on cybersecurity companies providing solutions to reduce technology risk, address the talent gap in the industry, and help automate and enhance security programs.

PEOPLE

- Founders Fund, a San Francisco-based venture capital firm, hired Ellie Pearson as head of recruiting. Formerly, she was with SwingSearch.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers in venture capital and private equity. Sign up for free.