Good morning. CFOs of private equity-backed companies are usually under pressure, but now it’s the PE firms themselves, specifically those that invested in tech, feeling the heat.

The performances of firms that made big outlays in 2021—a year that saw a record number of deals, many at sky-high valuations—are coming back into focus, according to my colleague Luisa Beltran. In her new report, “From KKR to Thoma Bravo: How 10 top private equity firms are performing as sky-high tech prices from 2021 fall back to earth,” Beltran has compiled a list that shows that year’s early winners—and early losers.

“The Golden Age of private equity is over,” Jeff Chang, a senior managing director and head of private equity at Guardian Life, told Beltran. “The strong returns generated from 2010 to 2020 driven by zero interest rates, a strong economy, and technology adoption is over for now.” He added that only the best private equity firms, those with differentiated skill sets, will be able to produce the returns that have “spoiled the industry for the past 10 years.”

Beltran provides some background: “In late 2021, the tech-heavy Nasdaq composite hit its all-time high of 16,057.44, on Nov. 19 of that year,” Beltran writes. “The M&A market was also setting records during this time: Roughly 50,000 global announced mergers were valued at $6 trillion in 2021, according to Dealogic. The number of U.S. deals soared by 41% year-over-year to 14,776, totaling $2.7 trillion, up 75% from 2020.” So this was a busy time for PE firms, which took part in over $400 billion worth of announced tech deals in the U.S. in 2021, according to the law firm Watchtell, Lipton, Rosen & Katz.

As mergers and IPOs have plunged since 2021, “private equity hasn’t been able to exit many of their investments, so they’re not returning capital to their investors, or limited partners, Beltran writes. “The LPs aren’t getting their money back, so they don’t have the capital to allocate to new funds, making fundraising much more difficult.”

For this report, Beltran set out to determine how well the class of 2021 PE funds are faring, focusing on those that invested in tech. Firms are ranked by how much they invested that year, with Thoma Bravo the top PE acquirer of tech companies in 2021, with 25 announced deals valued at $58.2 billion, according to Dealogic. TPG came in second, with 22 deals totaling $28.3 billion, while Hellman & Friedman placed third.

You can read the complete report here.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Thomas Okray was appointed CFO at Nikola (Nasdaq: NKLA), an electric vehicles company. Previously, Okray served as EVP and CFO at Eaton Corporation, SVP and CFO at Grainger, and EVP and CFO at Advance Auto Parts. He also held various executive and CFO roles at General Motors.

Daniel Tempesta was appointed CFO at Cerence Inc. (Nasdaq: CRNC), an automobile software company, effective March 18. Tempesta joins Cerence after more than 15 years at Nuance Communications Inc., where he most recently served as EVP and CFO. Tempesta replaces Tom Beaudoin, who has served on Cerence’s board of directors since October 2019 and as Cerence’s CFO since May 2022.

Big deal

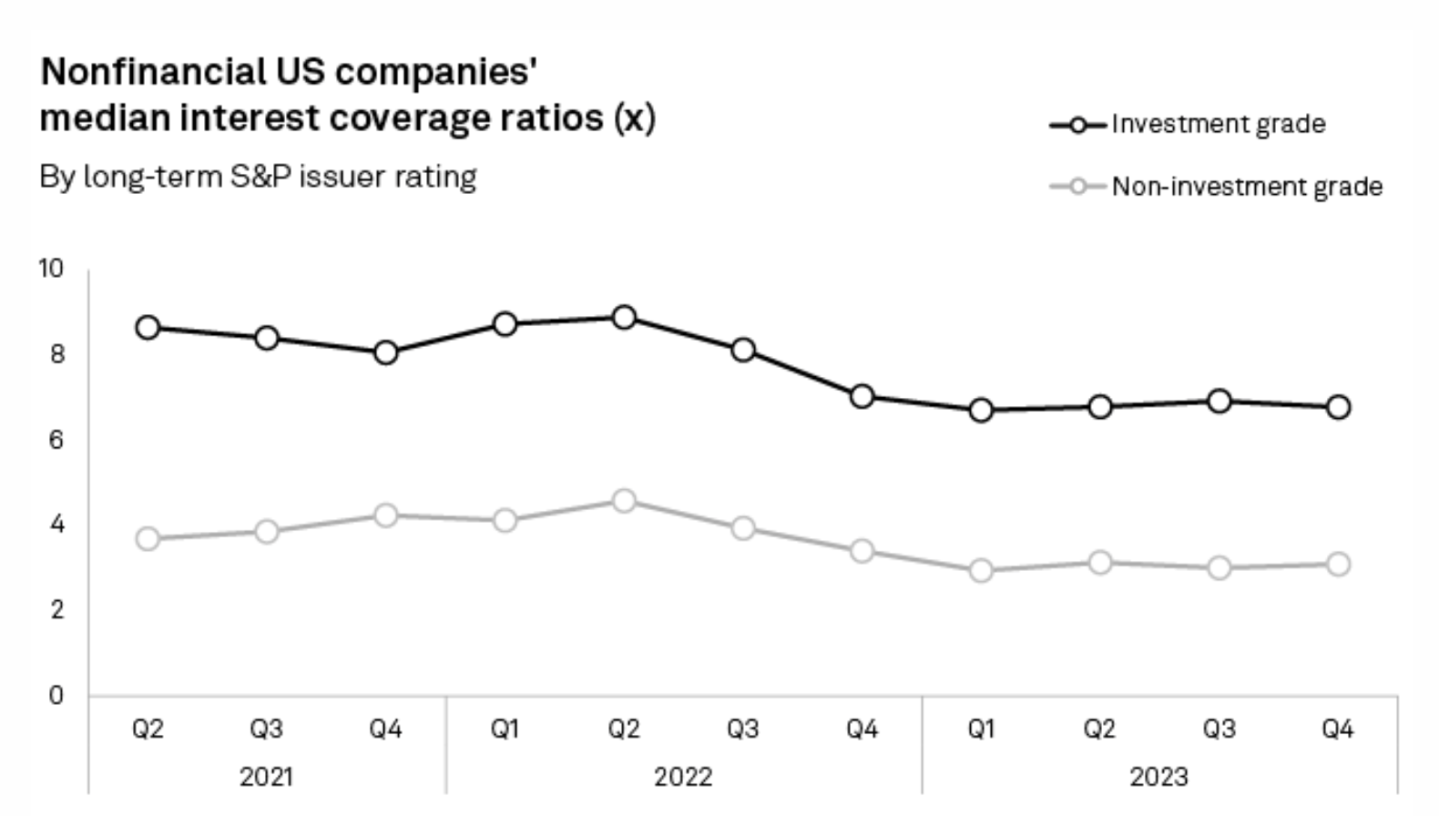

The latest S&P Global Market Intelligence data indicates that interest payments are "eating further" into U.S. companies' profits. Median interest coverage ratios for investment-grade and noninvestment-grade companies have been on a gradual decline since peaking in Q2 of 2022. This generally coincides with the U.S. Federal Reserve's initial push to raise its benchmark rate from "the pandemic-era near-zero floor," according to the report.

In Q4 of 2023, earnings before interest and tax were able to cover debt-interest payments approximately 6.78 times for the median investment-grade rated company. This interest coverage ratio declined from a revised 6.92 a quarter earlier.

Higher interest rates have made new borrowing and refinancing existing debt more costly for U.S. firms. "While the Fed is likely to cut rates in 2024, the timing and degree of those reductions remain in question," according to S&P Global Market Intelligence.

Going deeper

Want to Achieve Your Dreams? Try Subdividing Your Goals, a new report in Wharton's business review, explains Wharton research that finds breaking down big work goals into smaller components can enhance long-term success significantly.

Overheard

“If you look at kids they gotta be educated to get jobs. Too much focus in education has been on graduating college…It should be on jobs. I think the schools should be measured on, did the kids get out and get a good job?”

—JPMorgan Chase CEO Jamie Dimon said in a recent interview with Indianapolis-based WISH-TV. Dimon argued that there should be more focus on skills and pointed out that a 17-year-old could be a bank teller and earn $40,000 a year. He has long been an advocate of shaking up the education system to introduce a greater focus on skills, Fortune reported.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.