Good morning.

For BlackRock, shareholder democracy is the surprising new way to commit to stakeholder capitalism.

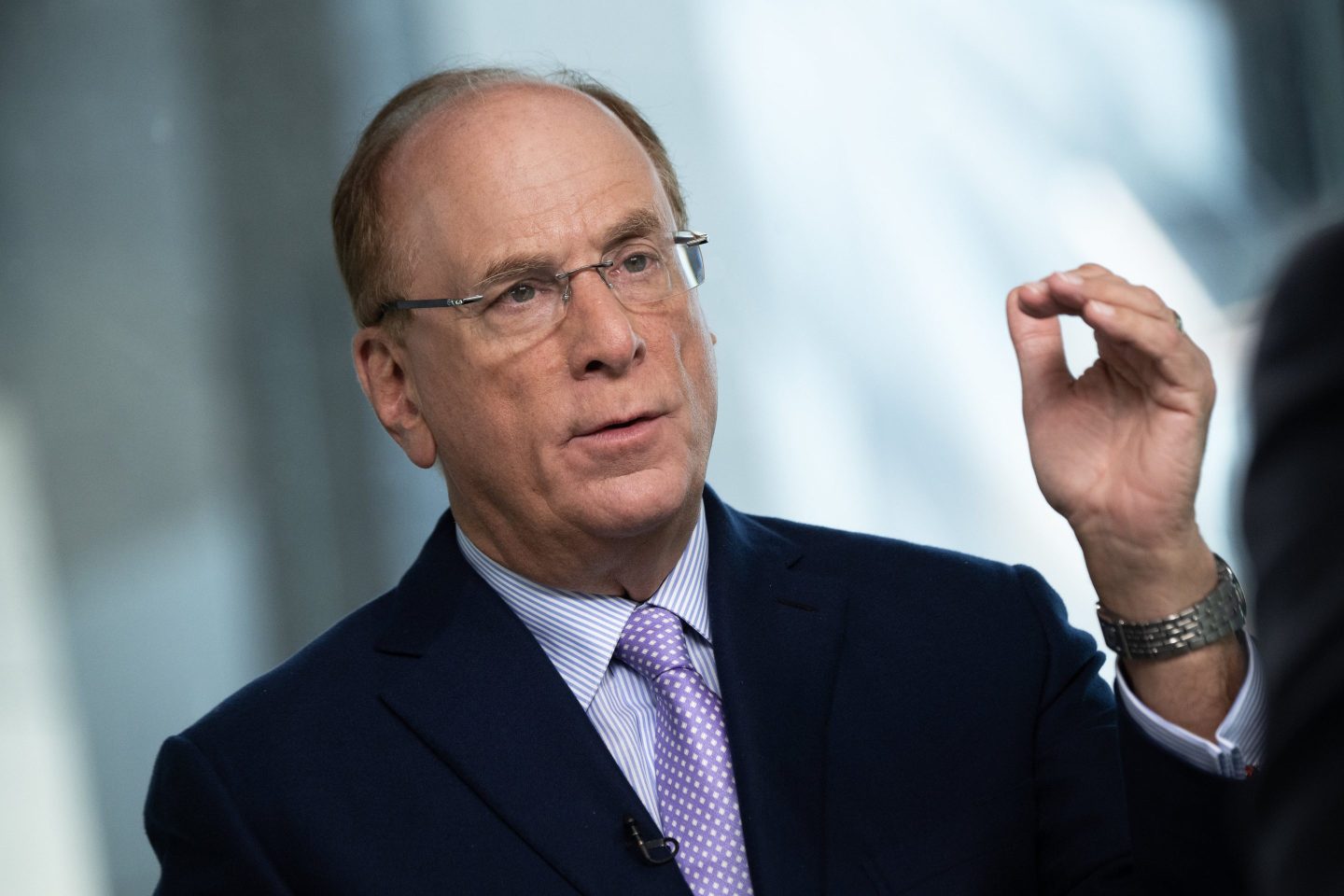

The world’s largest asset manager, led by CEO Larry Fink, is a proponent of stakeholder capitalism if there ever was one. In his annual letter to CEOs, Fink wrote in 2022 that “stakeholder capitalism is not about politics. It is not a social or ideological agenda. It is not ‘woke.’ It is capitalism, driven by mutually beneficial relationships between you and the employees, customers, suppliers, and communities your company relies on to prosper.”

But yesterday, BlackRock announced its largest ever expansion of its “Voting Choice” program. It allows BlackRock’s retail shareholder accounts, representing $2.6 trillion in assets under management, to vote at the annual meetings of the companies they hold shares in. In other words: small BlackRock investors can have their voices heard directly instead of having BlackRock speak on their behalf—or, rather, having Fink tell company CEOs what his clients value.

On its face, BlackRock’s Voting Choice is incongruous with the firm’s commitment to stakeholder capitalism. Stakeholder capitalism is about company management being empowered to consider all the company’s stakeholders in their decision making—and having the discretionary power to do so. Shareholder voting, by contrast, is the purest form of shareholder primacy; it is about shareholders having the ultimate say over all other stakeholders.

The upside of BlackRock promoting shareholder democracy, however, is that it could shield the company from further criticism that it’s trying to unfairly influence the corporate and political agendas. This past year, BlackRock was one of the main victims of attacks on business leaders pursuing an environmental, social, and corporate governance (ESG) agenda. That criticism hurt, and not just financially. Fink even stopped using the acronym ESG, despite being its greatest promoter at one time.

By putting power in the hands of its investors, Larry Fink can now reasonably claim it’s ultimately up to shareholders to validate or not BlackRock’s views on ESG and sustainability. If his commitment to stakeholder capitalism is—theoretically, at least—collateral damage, so be it.

More news below.

Peter Vanham

peter.vanham@fortune.com

@petervanham

TOP NEWS

AI conflicts of interest

OpenAI board chair (and former Salesforce co-CEO) Bret Taylor launched his AI startup Sierra on Tuesday. The company, which has already raised $110 million in funding, hopes to help businesses create AI agents to interact with customers. Taylor is the latest tech executive to launch a startup while sitting on a potential competitor’s board: He promises to recuse himself from OpenAI decisions “whenever there is a potential for overlap.” Fortune

Lyft’s typo

Lyft shares see-sawed in after-hours trading after CFO Erin Brewer revealed an error in the ride-hailing company’s earnings statement. Shares surged by as much as 60% after Lyft projected a 500 basis point expansion of its margins for 2024; Brewer later corrected the record to say the company expects a 50 basis point increase. In spite of the error, Lyft shares are still up 15% from market close. CNBC

Toyota shakes up Daihatsu

Toyota Motor is taking more direct control of its scandal-plagued subsidiary, Daihatsu Motors. Daihatsu suspended production late last year after revealing more than 170 safety irregularities dating back to 1989. Both Toyota and Daihatsu blamed tight development schedules for the scandal. Nikkei Asia

AROUND THE WATERCOOLER

5 steady-rising stocks for 2024 by Larry Light

Amazon and Walmart want to use gen AI to transform online shopping. This startup wants to do the same for everyone else by Jason Del Rey

CEO of a $19 billion U.K. bank with business in Hong Kong since the Victorian age sees a ‘lack of confidence’ unraveling China’s economy by Paolo Confino

Klarna’s CEO embraced AI by telling OpenAI’s Sam Altman, “I want Klarna to be your favorite guinea pig” by Allie Garfinkel

JetBlue, reeling from kiboshed Spirit merger, has a new suitor in corporate raider Carl Icahn who’s looking to get his mojo back by Amanda Gerut

Jeff Bezos’s move from Seattle to Miami could save him over $600m in capital gains taxes on a planned share sale by Eleanor Pringle

This edition of CEO Daily was curated by Nicholas Gordon.

This is the web version of CEO Daily, a newsletter of must-read insights from Fortune CEO Alan Murray. Sign up to get it delivered free to your inbox.