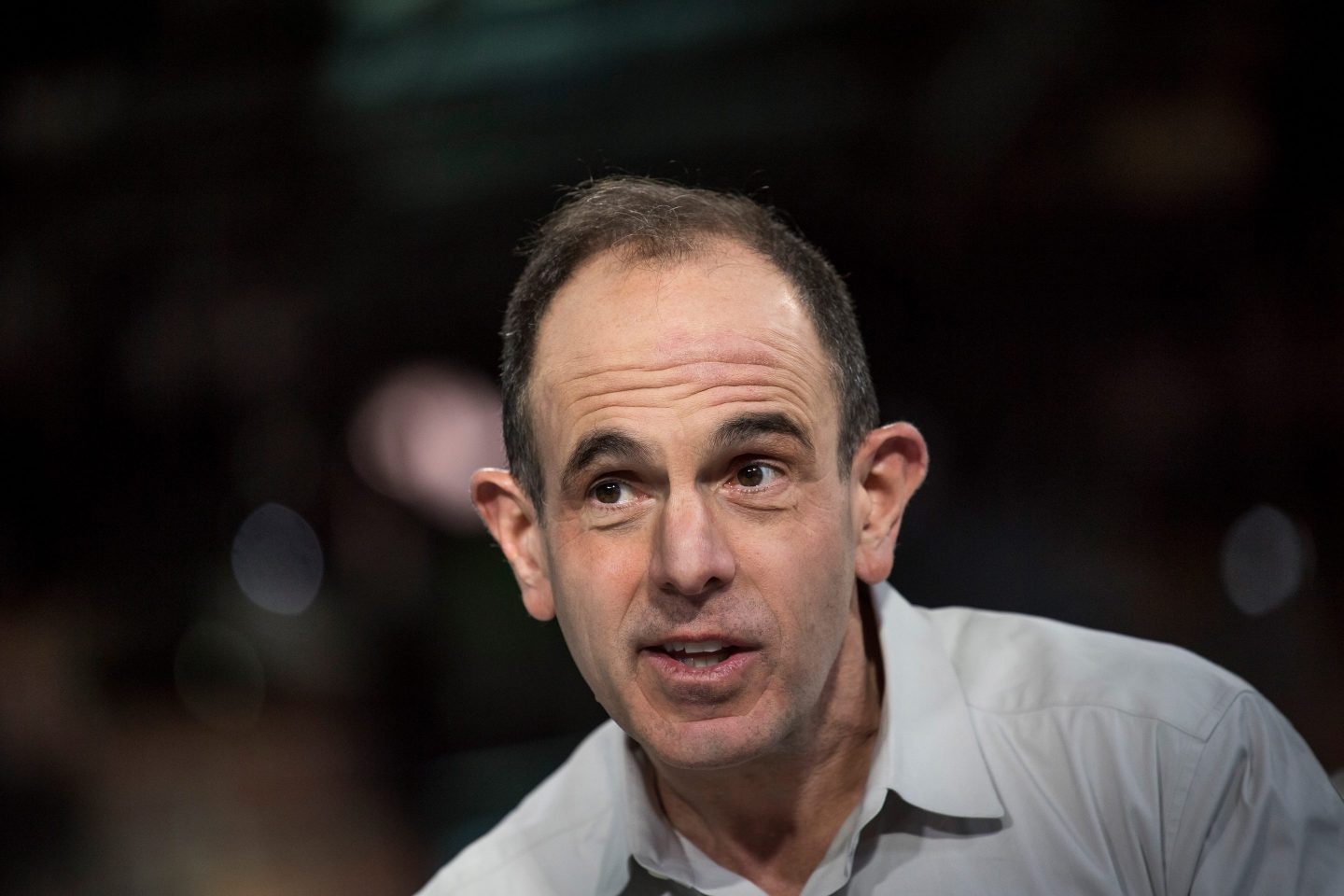

A VC’s job is to look at a company and simultaneously see what it is today and what it could be over time. We take for granted that VCs invest in startups and founders, but by the choices they make, VCs simultaneously invest in places—and no one seems to be more directly engaged with this than Keith Rabois, who’s thinking about his investment in Miami much like any other.

“When I first moved here, I thought it would take about ten years, which to an entrepreneur seems like an eternity, but from a venture perspective, ten years is the normal default,” Rabois told me over a Zoom call Friday. “In ten years, we want to have [in Miami] three or four really impressive, iconic companies.”

It seems like a goal that’s imposing—but just maybe doable. Rabois recently left Founders Fund to return to Khosla Ventures, a move he declines to discuss at length, saying it’s already “old news.” That may be true, but Khosla’s setting up a new Miami office in the trendy Wynwood neighborhood, a recognition of Rabois’ commitment to the city. Rabois moved to Miami in 2020, where he’s since cofounded e-commerce aggregator OpenStore and invested in Miami-based startups like Traba, which has raised $43.6 million to date. He will now be Khosla’s first partner based in The 305.

Rabois going all-in on Miami has been well-covered, albeit with an air of quirky skepticism. And I get it—after all, Miami is known for its nightclubs, South Beach, and proximity to the Caribbean.

But I come to Rabois’ argument for Miami with a different skepticism: I grew up in Miami. When I left for college, I figured I would never come back (and haven’t) for lack of professional opportunities. I tell Rabois this, and dare him to persuade me otherwise.

He outlines a case for Miami that’s both data-oriented and historic. Rabois cites third-party studies (like this one conducted by Mindbody) that call Miami America’s happiest city. “Entrepreneurs are humans too, and entrepreneurs want to be happy and healthy,” he says.

“The only ingredient missing is capital—angel capital, not just venture capital and institutional capital, and it turns out that’s basically the history of Silicon Valley,” Rabois added. “ [Sand Hill Road is] the most mundane, boring, drab place on the planet, but it became a thing because there was a colocation of investors back then, mostly angels or pseudo-angels with an unusual risk appetite…[entrepreneurs] came to meet the capital.”

I push back: What about Stanford? Didn’t it play a key role in Silicon Valley’s development? Rabois may have gotten his BA at Stanford, but his response is stark and quintessentially contrarian.

“I don’t think Stanford’s relevant in the history of Silicon Valley at all,” he told me. “The companies that are important to the history of Silicon Valley weren’t founded by Stanford undergrads.”

He and I run down the list of Silicon Valley’s most important companies, past and present—no to Apple, Facebook, Netscape, and Salesforce. Google also doesn’t count, since it was “Stanford grad students, not undergrads,” Rabois distinguishes. (It didn’t occur to me until later to ask him about Palantir, a company cofounded by Joe Lonsdale and Rabois’ longtime associate Peter Thiel, both of whom were Stanford undergrads.) It’s an animated argument that he says he picked up from Sebastian Mallaby’s 2022 book, The Power Law: Venture Capital and the Making of the New Future. It’s also an argument that affects who he writes checks to—Rabois said doesn’t even particularly like funding entrepreneurs from Stanford.

“Stanford grads are like the Navy and you need pirates,” he told me.

Talking to Rabois, he’s persuasive and systematic in how he articulates himself. In a lawyerly way, he’s able to build a case using facts the way bricks build a wall. (I remember later that he is, in fact, a lawyer.)

Rabois is methodical, and it’s a trait that seems to apply across the board. We get to talking about his well-documented love for Barry’s Bootcamp, and though he enjoys telling me the story of how he got into the high-intensity interval training workout (it’s a tale that involves Instagram cofounder Kevin Systrom and Spanish wine), he’s having the most fun delineating exactly why Barry’s is such a good product.

Rabois loves Barry’s for the workout’s efficiency, efficacy, and musicality. He knows exactly how many classes he’s taken and how many he’s taught. (He’s careful to tell me he’s only taught 16 classes.) We talk about types of Barry’s instructors—some are drill sergeants, others are encouragers.

I ask Rabois which type of instructor he gravitates toward. We both realize I already know the answer.

“I like to crack the whip, probably not surprising.”

See you tomorrow,

Allie Garfinkle

Twitter: @agarfinks

Email: alexandra.garfinkle@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today’s newsletter.

VENTURE DEALS

- Welligence Energy Analytics, a Houston, Texas-based data and analytics platform for the global oil and gas markets, greenhouse gas emissions, and carbon capture projects, raised $41 million in Series B funding. Elephant led the round and was joined by Veriten, EDG Group, and others.

- Bluewhite, a Tel Aviv, Israel-based developer of remote and autonomous farming technology for tractors, raised $39 million in Series C funding. Insight Partners led the round and was joined by Alumni Ventures, LIP Ventures, and others.

- Turquoise Health, a San Diego, Calif.-based healthcare pricing platform, raised $30 million in Series B funding. Adams Street Partners led the round and was joined by Yosemite and existing investors Andreessen Horowitz and BoxGroup.

- ModernFi, a New York City-based deposit network, raised $18.7 million in Series A funding. Canapi Ventures led the round and was joined by Andreessen Horowitz, Remarkable Ventures, and others.

- Better Stack, a Prague, Czech Republic-based provider of software observability tools, raised $10 million in funding from existing investor KAYA and angel investors.

- bluesheets, a Singapore-based tool designed to automate finances and bookkeeping across a user’s different online platforms, raised $6.5 million in Series A funding. Illuminate Financial led the round and was joined by Antler Global, Insignia Ventures Partners, and 1982 Ventures.

- RagaAI, a San Francisco.-based platform designed to test for issues in AI programs, raised $4.7 million in seed funding. pi Ventures led the round and was joined by Anorak Ventures, TenOneTen Ventures, Arka Ventures, Mana Ventures, and Exfinity Venture Partners.

PRIVATE EQUITY

- Genesys, backed by Hellman & Friedman and Permira, acquired Radarr Technologies, a Singapore-based social media engagement platform. Financial terms were not disclosed.

- Kano Laboratories, backed by Gryphon Investors, acquired the Super Lube and Synco brands of Synco Chemical Corporation, a Bohemia, N.Y.-based manufacturer of synthetic food grade greases and lubricants. Financial terms were not disclosed.

- Martis Capital and Din Ventures acquired a majority stake in Archway Dental Partners, a Danbury, Conn.-based dental platform. Financial terms were not disclosed.

- Pelican Energy Partners acquired Stewart Tubular Products, a Houston, Texas-based manufacturer of products used in oil and gas wells. Financial terms were not disclosed,

- RoadSafe Traffic Systems, a portfolio of Trilantic North America, acquired B.C. Cannon, a Greenville, S.C.-based supplier of traffic control services and products. Financial terms were not disclosed.

OTHER

- Deloitte acquired Giant Machines, a New York City-based software engineering and digital solutions company. Financial terms were not disclosed.

- Lawson Products, the operating company of Distribution Solutions Group (NASDAQ:DSGR), acquired Safety Supply Illinois LLC, DBA Emergent Safety Supply, a Batavia, Ill.-based distributor of safety products including hearing protection, eyewear, and first aid. Financial terms were not disclosed.

IPOS

- Amer Sports, a Helsinki, Finland-based manufacturer of sports and outdoor equipment, plans to raise up to $1.8 billion in an offering of 100 million shares priced between $16 and $18. The company posted $4.3 billion in sales for the year ending September 30, 2023. ANTA Sports Products, FountainVest Partners, Anamered Investments, and Tencent Holdings back the company.

- ArriVent BioPharma, a Newtown Square, Pa.-based biotech company developing cancer medicines, plans to raise up to $157.7 million on the NYSE in an offering of 8.3 million shares priced between $17 and $19. Lilly Asia Ventures, Octagon Capital Advisors, OrbiMed, Shanghai Allist Pharmaceuticals, Sofinnova Venture Partners, Hillhouse Investment Management, and Sirona Capital Partners back the company.

- VNG, a Ho Chi Minh City, Vietnam-based gaming, communications, and media startup, withdrew its IPO launch in the U.S.. The company had planned to raise $100 million.

FUNDS + FUNDS OF FUNDS

- Plural, a London, U.K.-based venture capital firm, raised €400 million ($435.3 million) for its second fund focused on AI, tech, and healthtech companies.

PEOPLE

- Carmel Partners, a San Francisco-based real estate investment firm, hired Bryan Crane as chief investment officer and managing director. Formerly, he was with Veritas.

- Levine Leichtman Capital Partners, a Los Angeles, Calif.-based private equity firm, promoted Josh Kaufman to partner, Debbie Habib, Michael Knapp, and Adam McKean to managing director, Jay Berajwala to director, and Oliver Demaine, Zak Ibnatik, and Cole Sterrett to senior associate.

- Pantheon, a London, U.K.-based fund of funds firm, promoted David Elliott to partner on the real estate team, Justin Mallis to partner global investor relations team, and Cecil Ross to managing director on the U.S. private equity investment team.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers in venture capital and private equity. Sign up for free.