Good morning.

While 2024 may be all about AI advancement, two reports released this week show there’s still work to do in building trust and mitigating risk.

An AI trust gap is forming in the workplace, according to a report released Wednesday by Workday, Inc., (a CFO Daily sponsor). The research finds that both leaders and employees lack confidence and understanding of their company’s plans around AI deployment, according to Jim Stratton, chief technology officer at Workday.

Among C-suite leaders and their direct reports surveyed, just 62% welcome AI, and the same percentage have confidence their company will make sure AI is implemented in a responsible and trustworthy way. The sentiment is even lower among other employees—at 52% and 55%, respectively.

To be clear, both leaders and employees still believe AI can be transformative for business, the research finds, but concerns linger over implementing it ethically. And for many, that means having a human being in the driver’s seat.

Seventy percent of leaders and 69% of employees believe AI applications with significant risks should remain under human control and be developed in ways that allow human intervention. But almost half (42%) of employees believe their company does not have a clear understanding of which systems should be fully automated.

This means companies, Stratton said in a statement, should look to create a detailed approach to AI responsibility and governance “with a lens on policy advocacy to help strike the right balance between innovation and trust.”

Workday’s survey, which gauged the sentiment of 1,375 business leaders and 4,000 employees across the globe, also found that both leaders and employees cited regulation and workable frameworks as key for building trust in AI.

Speaking of regulating AI, the World Economic Forum’s Global Risks Report 2024 finds that misinformation and disinformation powered by AI is the no. 1 emerging risk over the next two years. The report, released on Wednesday ahead of the organization’s annual meeting in Davos, Switzerland, beginning Jan. 15, warns the rise of AI may make it easier to carry out cyberattacks. Meanwhile, there’s growing concern generative AI chatbots could become vehicles for promoting misinformation that creates additional danger around economic or geopolitical conflicts.

Carolina Klint, chief commercial officer of Europe at Marsh McLennan, which coauthored the report with Zurich Insurance Group, affirms that AI breakthroughs will disrupt the risk outlook for organizations. “It will take a relentless focus to build resilience at organizational, country, and international levels—and greater cooperation between the public and private sectors—to navigate this rapidly evolving risk landscape,” Klint said in a statement.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Janet Chou was named EVP, CFO, and treasurer at Navitas Semiconductor (Nasdaq: NVTS), effective upon the filing of Navitas’ 2023 annual report on Form 10‑K expected at the end of February. Chou will replace Ron Shelton, SVP, CFO, and treasurer, who announced his intention to pursue other opportunities, effective March 15. Chou was previously VP and CFO of global operations for Western Digital Corporation. Before that Chou progressed through a series of senior financial management roles at NXP Semiconductors N.V.

Michael Testa was promoted to CFO at Trinity Capital Inc. (Nasdaq: TRIN), a provider of diversified financial solutions, effective immediately. Testa succeeds David Lund, who will remain on the team as a consultant. He joined Trinity Capital in 2020 as chief accounting officer. Before joining Trinity, he served as VP and controller at Oxford Funds.

Big deal

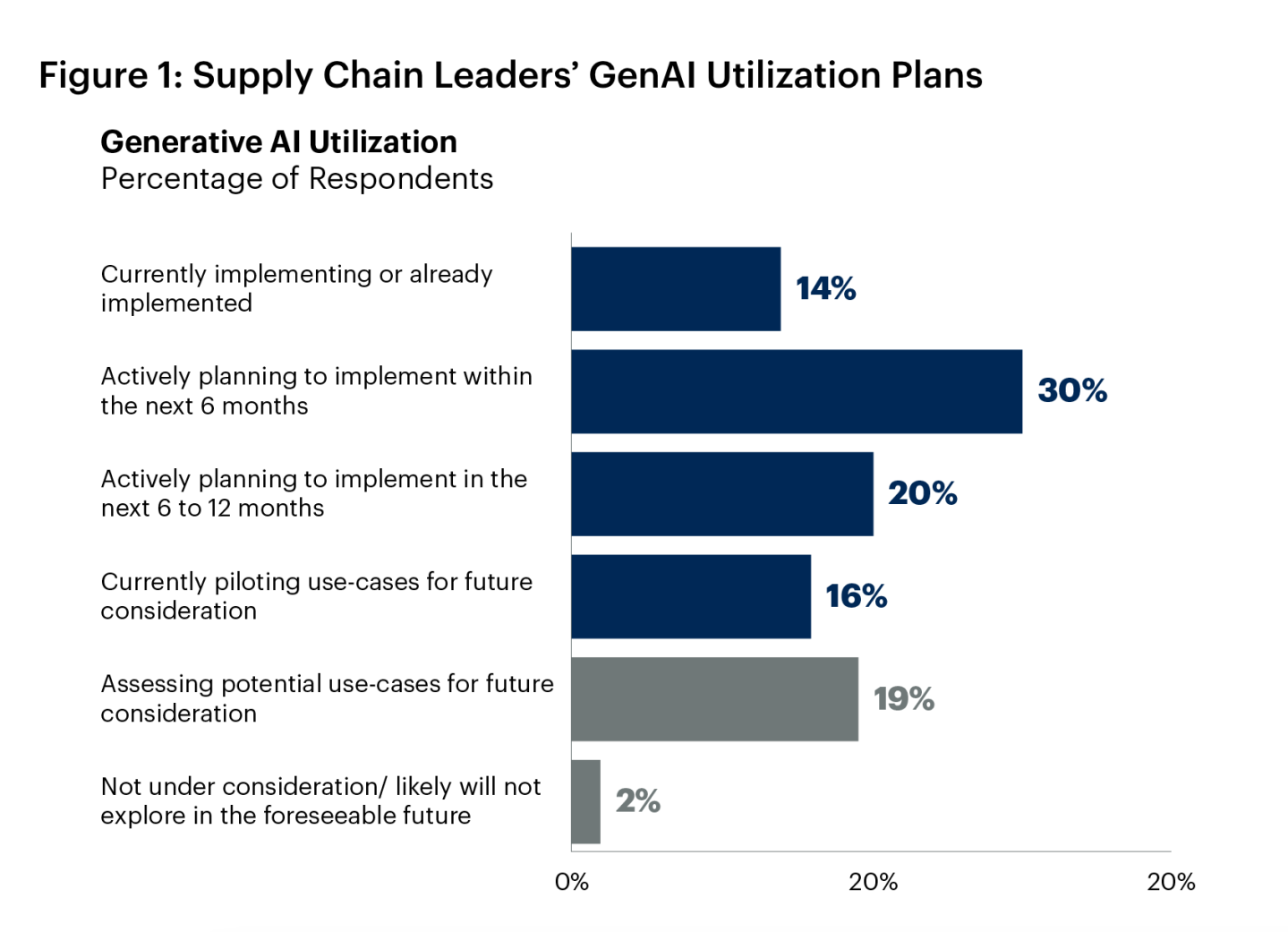

A survey by Gartner, Inc. finds that in the next 12 months, half of supply chain leaders plan to implement generative AI, with an additional 14% already in the implementation stage. The 127 supply chain leaders surveyed also said they are dedicating 5.8% of their function’s budget, on average, to generative AI.

Going deeper

"A framework for assessing AI risk," a new article released by MIT Sloan School of Management, discusses a framework based on a “red light, yellow light, green light” approach that can help companies streamline AI governance and decision-making.

Overheard

"It’s a moment of traditional finance finally having broad-based, convenient access vehicles."

—Robert Mitchnick, head of digital assets for BlackRock, told Fortune in an interview following the Securities and Exchange Commission on Wednesday approving spot Bitcoin ETFs. The agency announced in a filing that applications for 11 issuers, including BlackRock and Grayscale, had been approved—a process that began in 2013, Fortune reported.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.