Good morning. We’re at the beginning of what a top tech analyst considers “The Year of AI,” which will have a considerate impact on big companies. In a Monday note to investors, Wedbush Securities’ Dan Ives wrote that Wall Street’s new tech bull market has now begun, and that artificial intelligence is one of the drivers.

“The key to tech stocks and overall demand remain the use cases for AI that are exploding globally based on our recent enterprise survey work in the field,” wrote Ives. To find out more, I had a chat with him about the research, which Wedbush conducted along with GBK Collective through a survey of 672 companies.

“Many are planning to implement generative AI in 2024. And along with cybersecurity, it is the highest priority within IT budgets,” Ives told me, adding that he expects generative AI will be eight to 10% of IT budgets this year, compared to less than 1% in 2023.

“The thing that stood out is that monetization appears a lot sooner than I think the Street’s anticipating,” he said.

The use cases will “lead to the pot of gold at the end of the rainbow,” according to Ives. For example, more than 50% of the companies surveyed see 20-plus use cases for generative AI, and over 80% see 10-plus use cases to improve business operations, such as data analysis, marketing content creation, and document editing/summarization. Creating a more cost-effective capital structure with the benefits of using generative AI is becoming increasingly clear, Ives said.

I’ve also heard about AI from CFOs, who recently shared their thoughts with me on how it will shape finance in 2024. Their predictions include that it will make processes more efficient and that it will creating new opportunities for strategic thinking. And along with becoming more strategic, the workforce of the future may be more creative, according to Matt Candy, global managing partner in generative AI at IBM.

Candy told Fortune in an interview that the jobs of the future will be filled by those who can work with AI using language and creative thinking. “Rather than us having to learn to talk the language of technology and programming computers, effectively they’re learning to talk our language,” he said.

From Wedbush’s discussions with companies about generative AI, Microsoft is perceived as currently “taking the clear lead in the AI arms race” among the Big Tech companies, Ives said. But Google isn’t far behind as it’s being viewed by some CIOs as a major generative AI player down the road, he said. “We expect other technology companies such as Amazon, Meta, Nvidia, Apple, and other tech stalwarts along with smaller players in the industry to collectively spend billions in this AI arms race over the coming years,” according to Ives.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Kate Clune was named CFO at Piper Sandler Companies (NYSE: PIPR), an investment bank, effective Jan. 1, 2024. Clune succeeds Tim Carter, who will remain with the firm through April to assist with the transition. Clune joins the firm from Evercore Inc., where she most recently served as treasurer and head of planning and strategy. She previously spent 16 years at Morgan Stanley, serving in roles including corporate treasury and CFO of their U.S. banks, as well as global head of financial planning and analysis.

Jun Zou was named CFO at H World Group Limited (Nasdaq: HTHT) a hotel management company, effective Jan. 2. Zou succeeds Jihong He, who will step down as CFO and serve as the chief strategy officer of the company. Zou previously served as the executive vice president of the company. Zou has over 30 years of experience. Before joining H World, Zou worked as the CFO of Shenzhen Qiqitong Technology Co., Ltd. He previously served as the CFO of various companies, including Huawei Technologies Co, Ltd.’s global technology services business unit and Xunlei Limited.

Big deal

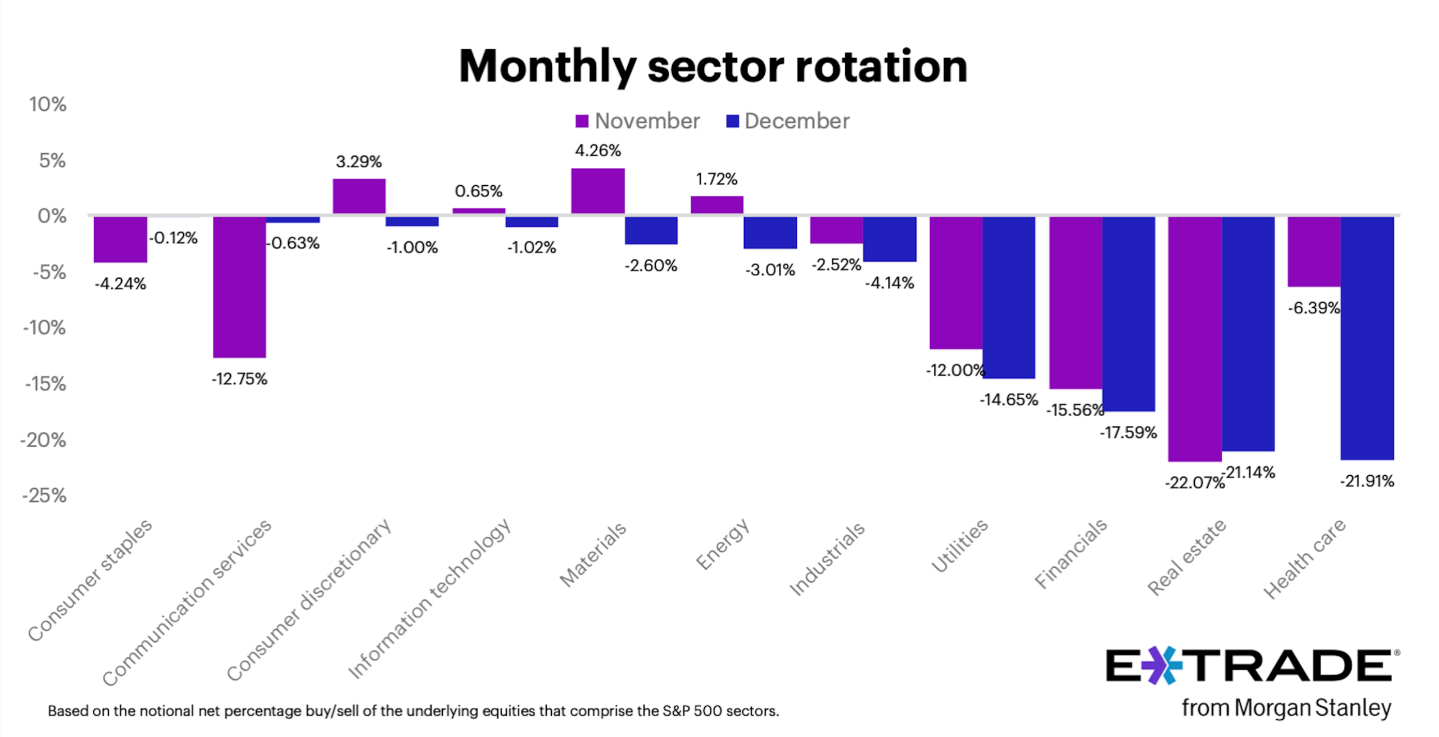

Morgan Stanley’s E-Trade released data from its monthly sector rotation study. The results are based on the trading platform’s customer notional net percentage buy/sell behavior for stocks that comprise the S&P 500 sectors.

In December, health care remained at the top of the sell list as E-Trade clients continued to “shy away from traditionally defensive sectors,” Chris Larkin, managing director of trading and investing at E-Trade from Morgan Stanley, said in a statement. “Clients saw less opportunity in interest rate dependent sectors like real estate and financials with the rate environment potentially shifting,” according to Larkin. Meanwhile, there was subdued selling in consumer discretionary, communication services, and information technology, which are consistent areas of interest for bullish clients, he said.

Going deeper

"Planning out the year’s PTO in January could help ‘manage the impacts of burnout,’ says one expert," a Fortune Well article, explores three types of breaks you should take.

Overheard

“If you look at the teams that spend the most money right now, it’s not because of their media deals. It’s because of their real estate empires that they’ve built…And I have no knowledge in that at all. It’s been hard enough learning the pharmacy and basketball business, let alone trying to learn real estate as well.”

—Mark Cuban, the billionaire cofounder of Cost Plus Drugs and Shark Tank star, said during a media briefing about selling his majority stake in the NBA's Dallas Mavericks to families linked to Sheldon Adelson, the late Las Vegas casino magnate, Fortune reported. The NBA announced its approval of the $3.5 billion deal, which will see Cuban keep a minority stake. He believes real estate will become crucial for NBA teams to succeed on and off the court.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.