Good morning.

Making a way for innovation is part of having a growth mindset, even during times of crises.

The 2023 Future 50, created by Fortune and Boston Consulting Group (BCG), was released on Monday. The ranking, first launched in 2017, assesses the long-term revenue growth prospects of more than 1,700 of public companies with at least $20 billion in market value or $10 billion in revenue in the 12 months through the end of 2022.

A “vitality” index is based on a top-down, market-based assessment of a company’s growth potential, and a bottom-up analysis of its capacity to deliver, based on financial and nonfinancial metrics—such as long-term strategic orientation, technology and investments, people, and structure, according to BCG. (More here on the methodology).

Although the macroenvironment, rising interest rates, and geopolitical conflicts have roiled the markets all year, the companies on the index are built to deliver growth—along with outsize returns for shareholders in the long term. IT and communication services sectors continue to dominate this index, accounting for 28 of this year’s Future 50. Snowflake, a cloud-computing company based in Bozeman, Mont., takes the top spot, powered by the AI boom.

Both in 2022 and 2023, the tech sector faced significant headwinds due to rising capital costs and increased investor scrutiny of profitability. This sent stocks plummeting and companies also enacted a wave of layoffs. But the analysis “suggests that these are short-term corrections, and that the long-term growth potential of the sector is alive and well,” according to BCG.

‘Tidal wave’ of AI spending

Wedbush Securities analyst Dan Ives has a similar viewpoint on the future of the tech sector heading into next year. “We believe the new tech bull market has now begun and tech stocks are set up for a strong 2024,” Ives wrote in a Sunday note to investors. “We expect tech stocks to be up 20%-plus over the next year led by Big Tech as the AI spending tidal wave hits the shores of the broader tech sector.”

Ives views AI as the “most transformative technology trend since the start of the internet in 1995,” he wrote. “Many on the Street are still underestimating the $1 trillion of AI spend set to happen over the next decade in a bonanza for the chip and software sectors,” according to Ives.

There are several factors why tech dominated the Future 50, according to BCG. For example, tech companies’ market valuations often reflect investors’ high expectations of future growth—and the methodology gives substantial weight to the share of valuation attributable to those expectations, BCG explains.

Ravi Inukonda is the CFO of the delivery startup DoorDash, which ranks no. 9 on the Future 50. He began in the role in March, promoted from VP of finance and strategy. Inukonda told me recently that he is “personally super excited” about generative AI, and he’s continually reviewing use cases for the finance function. “Finance needs to be an enabler, not a cop,” he said. “Finance cannot just be a reporting function. We’re constantly focused on the business and thinking about how we can further DoorDash’s mission of empowering local economies.” The company has been using machine learning for the last four or five years, and prediction capabilities have gotten “significantly better over time,” Inukonda said.

You can read the complete Future 50 analysis here. And view the 50 companies here.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Nicole Anasenes, CFO and SVP of finance at Ansys (Nasdaq: ANSS), an engineering simulation software provider, will depart the company in the second quarter of 2024. Ansys has launched a search for a new chief financial officer, whom Anasenes will help to transition into the role. She joined the company as CFO in 2020. Before that, Anasenes served as CFO and COO of Squarespace, Inc. She was also previously CFO at Infor.

Jeremy Johnson was named EVP and CFO at Ceridian HCM Holding Inc. (NYSE: CDAY), a human capital management company, effective Jan. 1. Johnson is a former Ceridian executive, returning to a new role. Most recently, he served as CFO at SmartRecruiters, Inc., where he also served as interim CEO. Previously, Johnson spent nearly a decade within Ceridian’s finance team.

Big deal

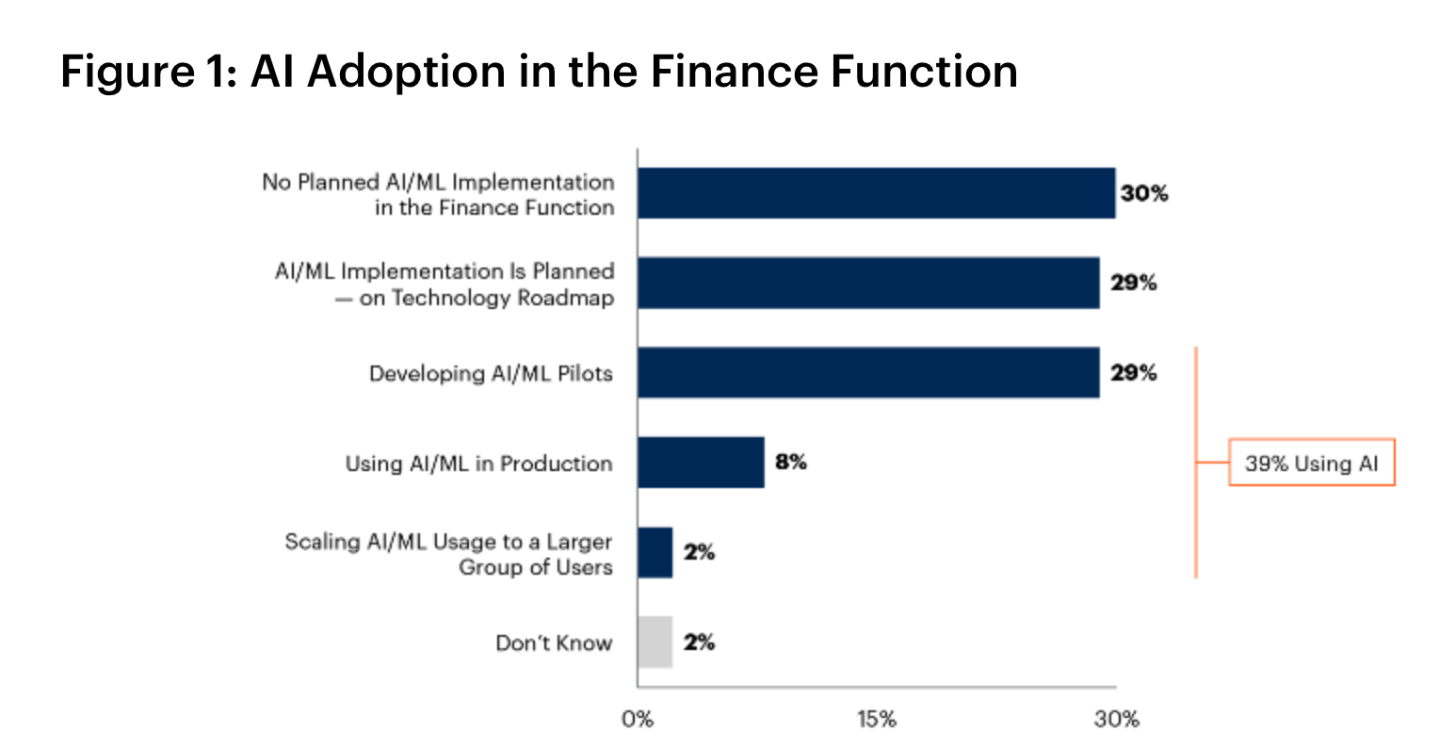

A newly-released survey by Gartner, Inc. finds that 68% of finance organizations are using AI or plan to use the technology. The survey of 133 finance leaders indicates that 39% of respondents are using AI/machine learning (ML), and an additional 29% of respondents said they're planning to use the technology, according to Gartner.

“The most successful AI-forward finance organizations embrace and evangelize AI at the C-suite level and embed data science teams directly within finance departments," Mark D. McDonald, senior director analyst in the Gartner Finance Practice, said in a statement.

Gartner also identifies three characteristics of what the firm views as "the most successful finance organizations using AI today."

Courtesy of Gartner

Going deeper

"To Craft a Purpose That Motivates Your Team, Balance Pragmatism and Idealism," an article in Harvard Business Review, acknowledges that employees often feel disconnected to their company’s core purpose, and provides some solutions. The article discusses how to develop and implement a clear purpose for your business that stretches between current strategy and long-term plans, according to the authors.

Overheard

“To some degree, but unfortunately, to a large degree, the last year of conversation and dialogue around AI has been focused on a very small number of institutions. The reality is that this field is much, much larger than that.”

—Darío Gil, a senior vice president at IBM and head of the corporation’s research lab, said in an interview with Fortune. IBM and Meta co-launched the “AI Alliance” on Tuesday. Intel, Sony Group, and Dell are among the other major companies in the group. There are also various top universities, as well as a collection of tech startups and foundations participating.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.