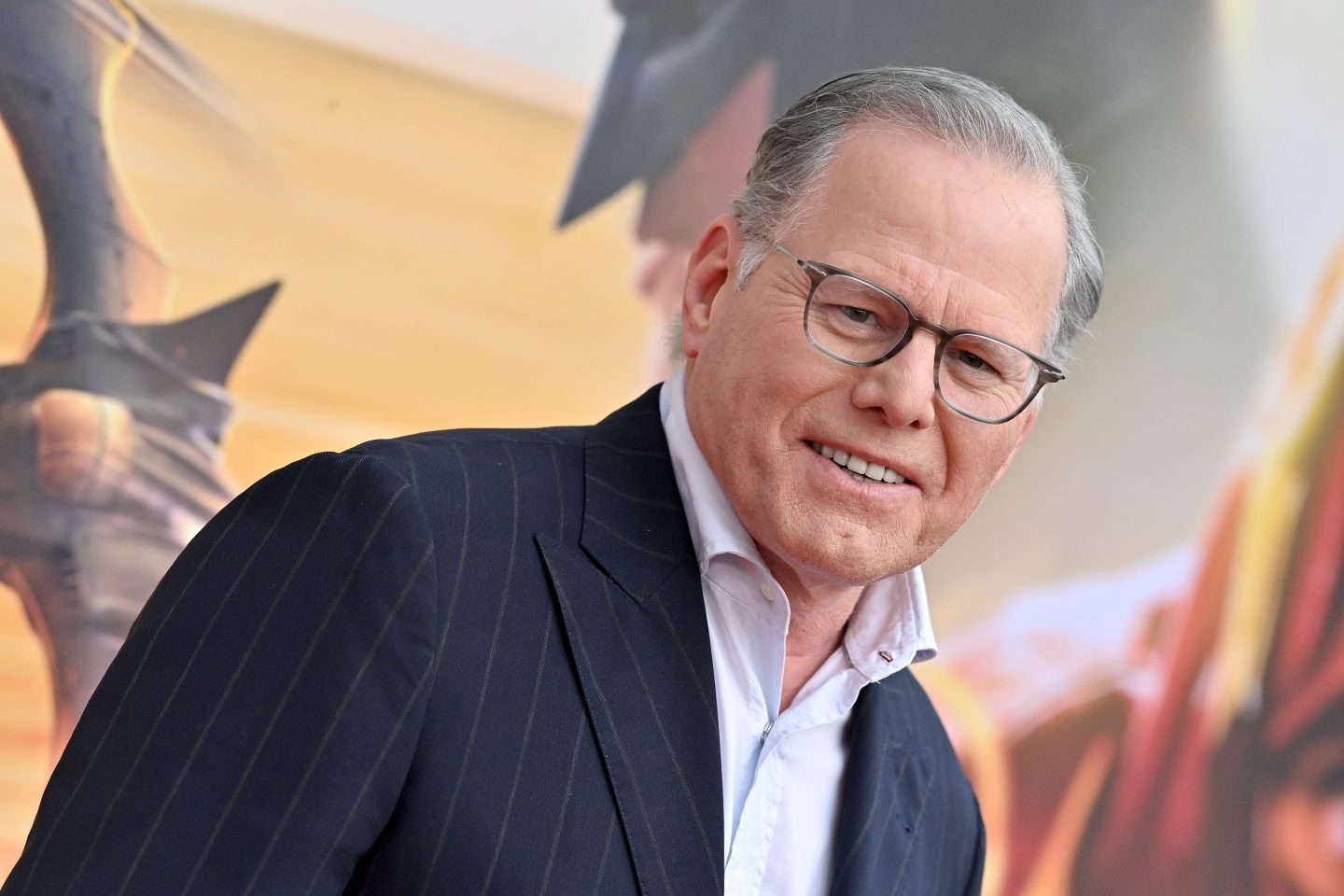

When Hollywood boss David Zaslav pulled off one of the biggest bond sales in corporate history to pave the way for his creation of Warner Bros. Discovery, the Federal Reserve still had its benchmark interest rates at its lowest in living memory.

The $30 billion he raised in March 2022 to finance the takeover of AT&T’s media assets made perfect sense in a world where money had no cost and growth was the only currency that mattered to investors.

In the short span of time since, however, the Fed hiked rates more than five percentage points from virtually zero, meaning the debt incurred in the deal has become a millstone around Zaslav’s neck.

The $574 million paid in interest expenses far eclipsed his $97 million in operating profit, leaving shareholders with a hefty loss for the third quarter.

Making matters worse, maneuvering room is scarce now that the floor under the once dominant TV ad market has fallen out.

Commercials that might have run on cable or free-to-air channels are being pulled in favor of reinvesting the dollars into spots destined for digital platforms where they can best capture the attention of younger demographic groups.

“This is a generational disruption we’re going through,” Zaslav said on Wednesday.

This raises the pressure on the CEO to swiftly reach scale on his flagship MAX streaming service before his highly profitable networks run out of steam.

But WBD is not the only one suffering from this trend.

“Television advertising is in free fall,” wrote Martin Peers from The Information in a daily newsletter on Thursday.

He estimates Warner Bros. Discovery, Disney, Comcast’s NBCUniversal, and Paramount’s CBS collectively lost around $670 million in ad revenue during the quarter even as Google’s YouTube raked in $881 million, a gain of nearly 13% over a year ago.

“While the TV companies are trying to sell ads on their streaming services to capture some dollars moving to digital, the amount they’re generating doesn’t come close to offsetting what they’re losing.”

Worst single-day sell-off in two years

Out of the $30 billion in debt Warner Bros. Discovery raised for the deal specifically, nearly $12 billion has since been paid back, leaving it with just over $45 billion still on its balance sheet.

The end result is that Zaslav’s management team had to admit its top priority—bolstering its sagging balance sheet—is now at acute risk barring a meaningful recovery of the TV ad market. Plans to lower debt to no more than three times its underlying cash earnings by the end of next year will likely not be reached.

“Based on the early indications from that we’re seeing how the market is developing right now, I’m just not confident to stand here today and say ‘Don’t worry about it, we’re definitely going to hit that [2.5x–3x EBITDA] range,’” finance chief Gunnar Wiedenfels said on Wednesday.

Investors recoiled at the news, sending the stock plummeting 19% and handing Zaslav his worst trading day in two years.

There is some good news, however.

Virtually all of the floating-rate debt, which has become prohibitively expensive, has now been paid off.

The rest of its liabilities clock in at an average maturity of 15 years with a weighted average coupon of roughly 4.6%, giving it time to restructure its balance sheet.

Stuck with measly below-market-rate returns on the company’s bonds, WBD’s remaining lenders might even be willing to accept a haircut if it means they don’t have to wait well over a decade before getting their cash back.

Finance chief Wiedenfels believes they would be quite keen to reinvest in the current higher rate environment.

“We will have increasing opportunities to retire debt at a significant discount,” Wiedenfels said cheerfully.