Not so long ago economists were largely convinced employees were the most powerful players in the labor market.

A stuttering economy, rampant inflation and a handful of mass layoffs later, it seems the tables may be turning.

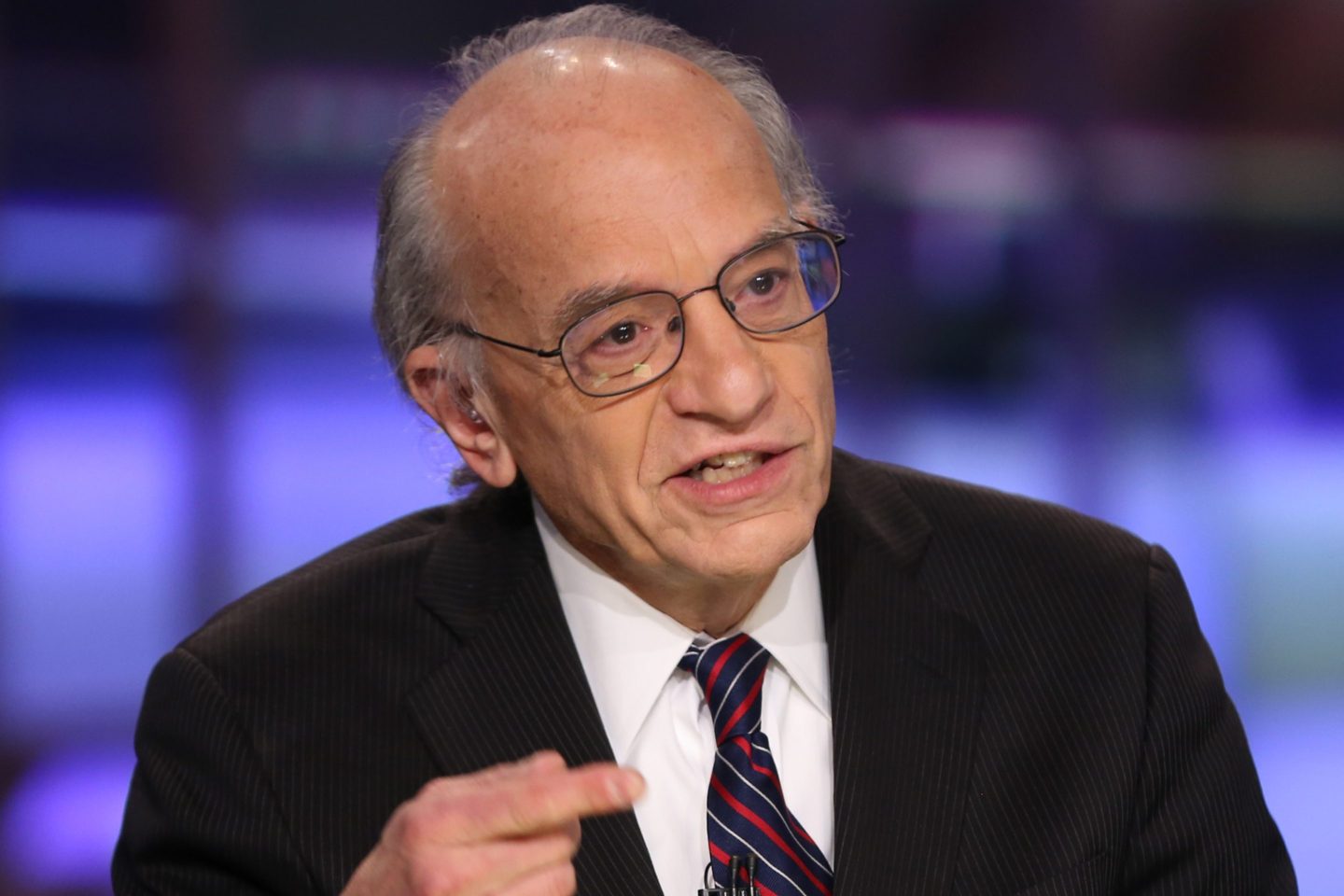

According to Professor Jeremy Siegel, emeritus professor of finance at the Wharton School of the University of Pennsylvania, staff looking over their shoulders at laid off peers may have actually proved useful to the economy.

Professor Siegel pointed out that productivity is surging, with the Bureau of Labor Statistics reporting last week it had risen at a 4.7% annualized rate for the third quarter of the year.

Some of the motivation behind this productivity surge could be fear, Professor Siegel wrote in his weekly commentary on Wisdom Tree: “Workers might be working harder so they cannot be laid off; the era of ‘do nothing, the boss can’t fire me’ is over.”

Professor Siegel said he expects this upwards productivity trajectory to continue, buoyed partially by advances in artificial intelligence.

“Productivity growth is alive and well,” he said. “Outside of the pandemic, this latest quarter’s productivity rate was among highest in the last two decades. This is partly a rebound after a very disappointing productivity fall in 2022 and I think more of this rebound can still occur.”

However, Siegel said he was “disappointed” the Fed wasn’t paying much heed to productivity in the wider macroeconomic environment. In Siegel’s view, this increased productivity by workers was behind the “surprising” GDP growth in the third quarter.

Fed chair Jerome Powell did not link the two figures together, and previously warned the Fed may delay scaling back rates because of the tight labor market.

However, Professor Siegel says the tone of the labor market is changing with latest results coming in “very soft.”

He was referring to the Labor Department’s much-anticipated Employment Situation Summary released Nov. 2, which confirmed the unemployment rate was 3.8%, compared to the forecast for 3.7%.

While some factors came in ahead of expectations—the Dow Jones consensus estimate, for example, had nonfarm payrolls increasing by 170,000 when in reality they grew by 336,000—Professor Siegel maintains “the jobs data… came in quite weak.”

‘A 1-2 punch for lower rates’

Siegel believes the case for increasing—or maintaining—rates has suffered a “powerful 1-2 punch,” in part thanks to the labor statistics.

Fed chair Powell has remained tight-lipped on his thoughts about if, or when, rates may come down.

But Siegel is taking note of Powell’s nuance and seeming flexibility, writing: “I was encouraged about the discussion around two-sided risks for inflation and economic growth.

“[Powell] did infer upside risks to inflation with another hike a little more likely, but the balanced tone of the discussion was very encouraging.”

As a result, Siegel said this “solidifies another pause from the Fed at the December meeting unless something extraordinary happens in the coming weeks.”

Indeed, next month the discussions should begin about when rates should be lowered, Professor Siegel wrote: “My opinion is the Fed needs to think about lowering rates and the narrative will start to pivot. 2024 is an election year, and the pressures are growing with the unemployment rate rising.”

He added: “This is not to say that the Fed will do anything right away. But the flexibility in Powell’s remarks seems to admit (at least my interpretation) that the Fed will not stand firm if the data continues to weaken.”

Although such a move would be welcomed by many on Wall Street, JPMorgan Chase CEO Jamie Dimon has warned against betting on such an outcome.

Speaking at a conference in Texas last week, Dimon said: “I think [the Fed] are right to pause here and see what happens. I suspect that they may not be done.”

“We stress for a whole bunch of different things basically to make sure we can handle low rates, high rates, high rates with inflation, high rates with recession, high rates with real estate losses,” Dimon continued. “We’re in pretty good shape…which means we can serve our clients regardless of that.”