Good morning.

Clear Street, a New York-based independent prime broker valued at $2 billion, wants to replace decades-old infrastructure across capital markets. The company has appointed a new CFO to help lead the charge.

I sat down with Steve Bisgay, CFO at Clear Street, on Monday for an exclusive interview. Bisgay joins the startup from Cantor Fitzgerald where he was executive managing director and CFO. He previously held senior finance leadership roles at BGC Partners, KCG Holdings, Knight Capital Group, and PwC. Bisgay succeeds Jacob Asbury as CFO. Asbury will remain with Clear Street in a consulting capacity, according to the company.

In April, Clear Street announced a $270 million investment from Prysm Capital, a growth equity firm. The investment was the second tranche of a $435 million series B capital raise, and that valued the company at $2 billion, Bisgay says.

The existing infrastructure across capital markets was essentially developed in the 1970s, he says. “It was built on 50-year-old COBOL mainframes [computer programming language designed for business use],” Bisgay explains. “Those mainframes are still in use today.” This creates a number of complex inefficiencies, especially as many firms build new technology on top of the antiquated technology, he says.

The legacy systems do not produce real-time views on risk and margin, instead delivering PDF reports at the end of the trading day, according to the company. In 2018, Clear Street built a cloud-native prime brokerage and clearing system from scratch, Bisgay says. The platform allows for on-demand service—immediate access to real-time data to make quicker decisions instead of waiting for a manually produced report, he says.

“We’ve been heavily focused on creating API-first platforms such as clearing, settlement, and custody, and that allows us to scale to other parts of the market,” Bisgay says. Instead of a legacy system that has siloed data, Clear Street’s platform consists of a library of APIs (application programming interfaces). This creates a common language for the system to communicate on the front and back end, creating one source of data.

Customer-facing APIs allow users to engage with Clear Street while incorporating immediate feedback and information into their existing workflows and systems. This adds efficiency while minimizing risk and cost for clients, Bisgay says.

Clear Street earns fees from its customers for transactions and financing of public market securities. Clients are hedge funds, family offices, and asset managers typically in the $50-$500 million range. But the company says it also works with clients with larger AUM.

Over the past year, the number of institutional clients on the platform increased by 500%, daily transactional volume increased by more than 300%, and financing balances increased by nearly 150%, according to the company. I asked if an IPO is in the near future. Bisgay says it’s too early in his tenure to discuss that at this time.

Taking a deep dive

He reports to Chris Pento, Clear Street’s cofounder and CEO. Bisgay’s “insights, strategic thinking, and strong financial acumen will undoubtedly contribute to our firm’s continued growth,” Pento said in a statement.

Bisgay says he joined Clear Street because of its unique business model and entrepreneurial ethos. “This is a firm that has really done something quite novel and has really pioneered the space here,” Bisgay says. He plans to build on the company’s $700 million capital base.

Bisgay’s plan for the first 100 days is a deep dive into Clear Street, and that means talking with everyone. “That includes all of the respective department heads—the individuals heading up human resources, operations, technology, compliance, legal, and marketing, as an example,” he says.

Bisgay says the word partnership defines his personal ethos on working with people. And when he’s not wearing his CFO hat, he enjoys reading and spending time with his family and his goldendoodle, Major.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Matt Plavan was named CFO at Origin Materials, Inc. (Nasdaq: ORGN, ORGNW), a carbon-negative materials company, effective Oct. 30. Plavan succeeds Pam Haley, who has served as interim CFO since Sept. 1. Haley will continue in her role as SVP of accounting and finance. Before joining Origin, Plavan served as CEO at IngredientWerks. Previously, he held executive roles, including CFO for Arcadia Biosciences, and he spent a decade in the executive suite at Cesca Therapeutics, Inc.

Audra Foglietta was named CFO at Pie Insurance, which specializes in commercial insurance for small businesses. Foglietta spent more than twenty years at Chubb, the property and casualty insurance company. Most recently, she served as Chubb’s executive vice president and CFO of global operations and technology. Foglietta also previously served as CFO of Westchester Specialty.

Big deal

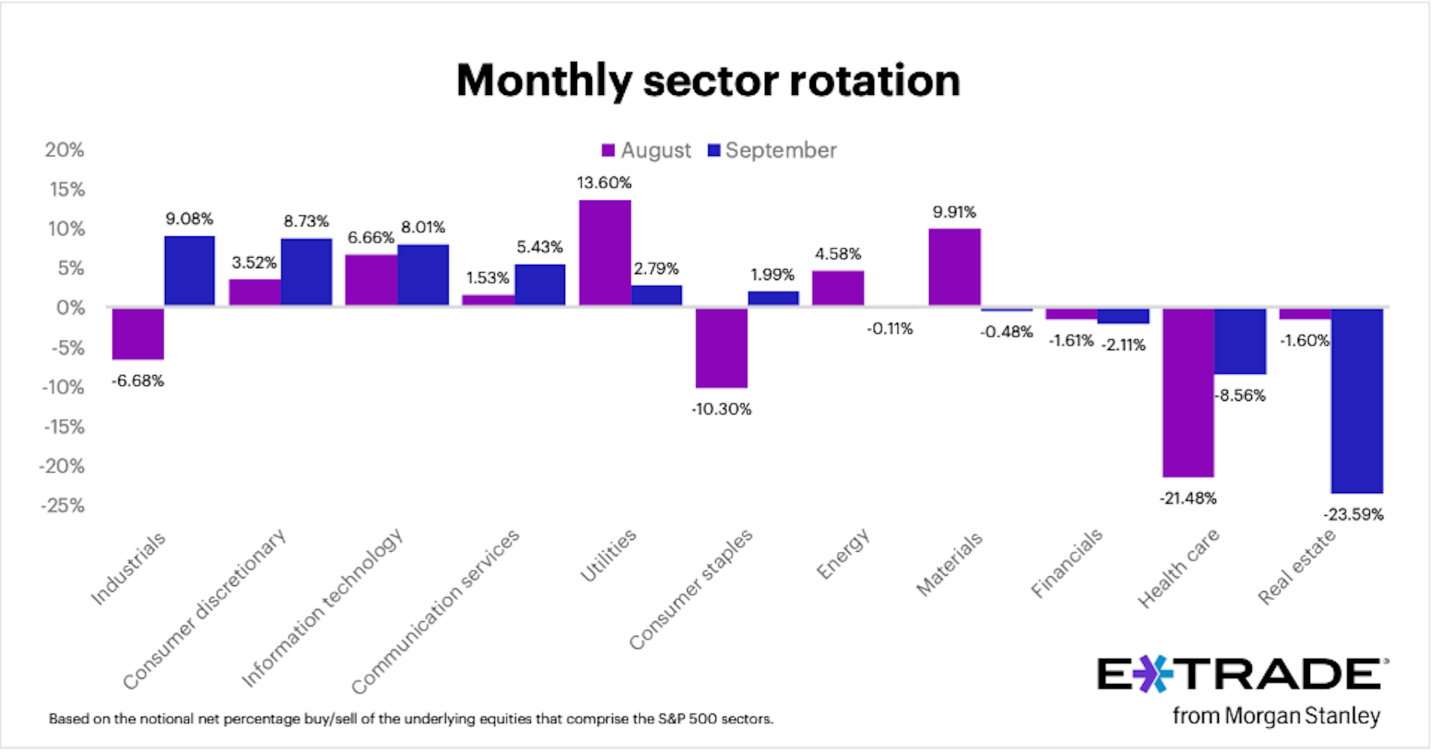

Morgan Stanley’s E-Trade released data from its monthly sector rotation study. The results are based on the trading platform’s customer notional net percentage buy/sell behavior for stocks that comprise the S&P 500 sectors.

In September: "Most notable were the rotations into industrials and consumer staples—both areas of the market that traders typically seek out for some safety amid volatility," Chris Larkin, managing director of trading and investing at E-Trade from Morgan Stanley, said a statement. "Bearishness continued in financials as the interest rate situation evolved and traders started to recognize cuts are further in the distance than expected. On the bullish side, traders continue to favor IT and Consumer Discretionary stocks—with concentrated buying in big names like AMZN and NVDA."

He continued, "The question is now whether October will follow through on its tendency for bullishness—it’s been a positive month 25 of the past 38 years. But even if it is, traders shouldn’t expect a smooth ride, since it’s also been one of the most volatile months of the year."

Going deeper

How Americans see the state of gender and leadership in business, a report by Pew Research Center, finds a majority of Americans (55%) say there are too few women in top executive business positions. It also delves into what Americans think are the major reasons why there aren’t more women in top executive business positions.

Overheard

"It’s very much developing in real time. AI capabilities six months ago are not going to be the same as they are in a year or two years from now."

—Spotify’s CEO Daniel Ek told the Financial Times in an interview that due to the speed of change in the capabilities of AI, it's difficult to build laws that would stand the test of time.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get CFO Daily delivered free to your inbox.