Good morning, Peter Vanham here in Geneva.

As a CEO considering taking a stance on social issues, should you follow your heart or your head? According to Richard Edelman, the CEO of the eponymous communication firm, public relations disasters such as the backlash against Bud Light’s campaign with transgender influencer Dylan Mulvaney show it must be the latter.

“Companies will have to do more of a cold risk-reward calculation going forward,” Edelman told me over coffee in Geneva’s old town, ahead of a World Economic Forum meeting this week. “Because the world has become so politicized, that’s why,” he added.

One way to make that calculus, Edelman said, is for companies to “fix their own houses” before taking a very public stance through marketing campaigns or public statements by their CEOs. As Edelman found, the stakeholders who have the highest expectations are employees. And they expect “actions, not words,” of their employer.

Companies must listen to—and understand—their customers. Just because the Gen Z incarnation of the “yuppie” (young, urban professionals) demands a progressive stance doesn’t mean the average Joe in America’s heartland will agree. The right strategy may be different depending on whether it’s for Levi’s or Wrangler, Nike or Under Armour.

The last thing to bear in mind is that marketing teams and CEOs should be careful not to want to be everything, everywhere, all at once. CEOs shouldn’t always want to be the spokesperson for the company. (In fact, employees look to their direct managers for guidance, Edelman’s latest Trust Barometer, out next week, shows.) Marketing teams shouldn’t try to appeal to every consumer.

If it hadn’t already, AB InBev, the maker of Bud Light, will have learned a lot about the cold risk-reward calculus that Edelman preconizes this week. As my colleague Christiaan Hetzner noted yesterday, as the Mulvaney campaign backfired and Bud Light lost its title as America’s top-selling beer to Mexican rival Modelo, AB InBev “comforted investors by saying it was still the bestselling beer for all of 2023.” But as the latest retail sales figures came out this week, “now even that consolation prize is gone.”

More news below.

Peter Vanham

peter.vanham@fortune.com

@petervanham

TOP NEWS

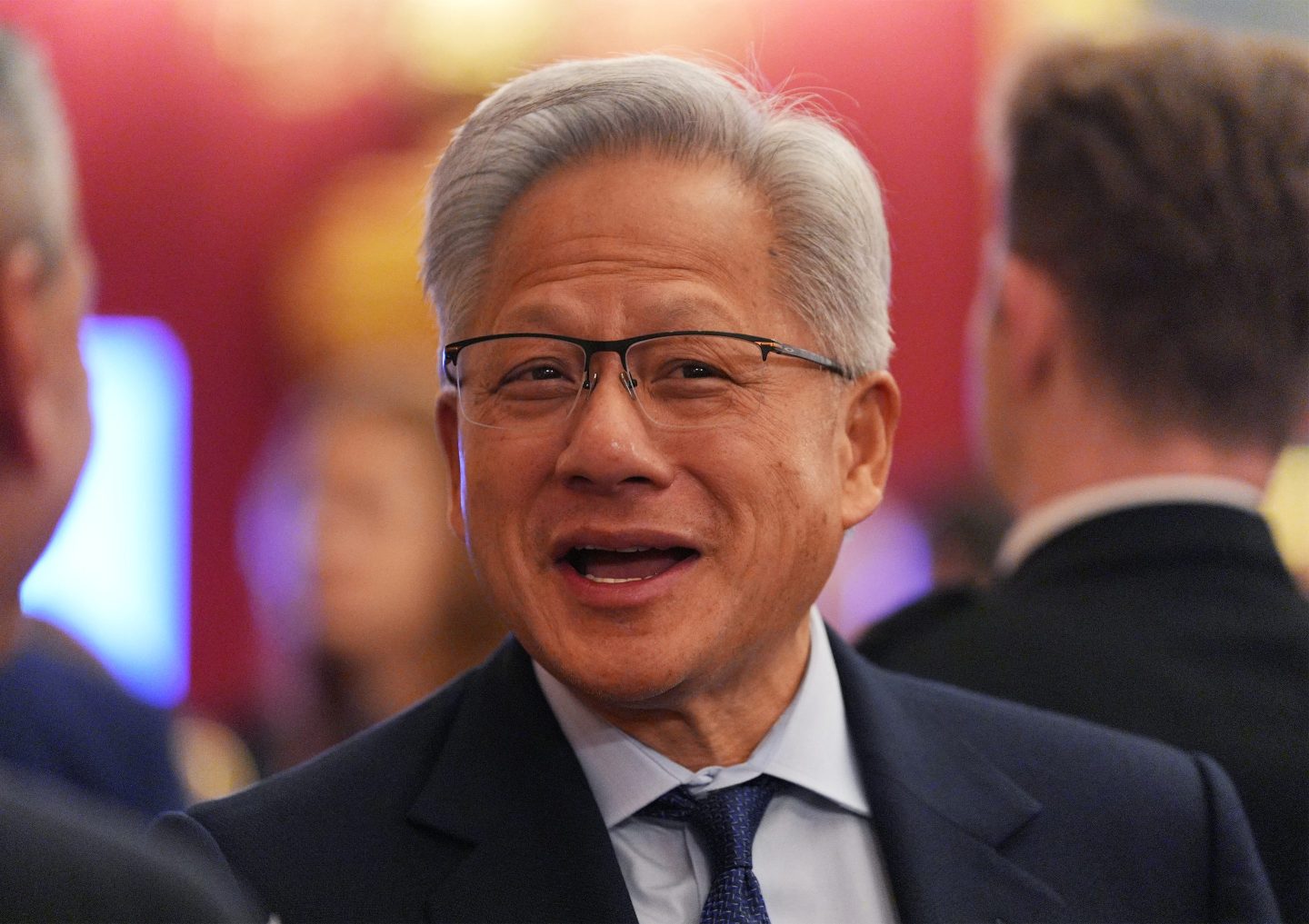

Nvidia surges

Shares in chipmaker Nvidia rose by over 6% in after-hours trading after the company forecasted $16 billion in revenue for the coming quarter, equal to its sales for the entire year of 2021. Shares in the chipmaker are now up by over 200% so far this year, pushing its market capitalization past $1 trillion. The company’s processors are key to the A.I. boom, and there are concerns short supply could create a bottleneck. Bloomberg

TikTok shop

TikTok’s e-commerce service in the U.S. could lose as much as $500 million as developer ByteDance makes an expensive play for the sector despite ongoing threats of a government ban. The app may soon ban links to external sites like Amazon, following its playbook in China with its domestic version, Douyin. TikTok’s U.S. users are spending just $3 million to $4 million a day shopping on the app, compared to the over $200 billion Chinese consumers spent through Douyin last year. The Information

Japan wastewater

Japan released treated wastewater from the Fukushima nuclear power plant today in a move criticized by environmental groups, local communities, and foreign governments. China imposed a blanket ban on all seafood imports for Japan Thursday, having previously accused Tokyo of treating the ocean like a “private sewer.” China and the semiautonomous city of Hong Kong together received 42% of Japan’s maritime exports last year. Japan says the released wastewater meets international standards. Reuters

AROUND THE WATERCOOLER

Snap seeks salvation by tapping into Google’s talent pipeline by Rachyl Jones

Arm’s IPO poised to be the deal that SoftBank—and the IPO market—desperately need by Jessica Mathews

Companies are beefing up so-called ‘nonqualified’ retirement plans to attract and retain C-suite talent by Sheryl Estrada

Vladimir Putin claims his war on the dollar is ‘gaining momentum’ in 17-minute video tirade by Eleanor Pringle

Lufthansa’s CEO tried being a flight attendant—but there was one challenge he wasn’t ready for by Prarthana Prakash

Boomers have a new retirement strategy: Buy the dip by Alicia Adamczyk

A.I. could boost earnings nearly 20% by replacing human jobs, Goldman says. These are the short- and long-term winners of the boom by Will Daniel

This edition of CEO Daily was curated by Nicholas Gordon.

This is the web version of CEO Daily, a newsletter of must-read insights from Fortune CEO Alan Murray. Sign up to get it delivered free to your inbox.