It was 2016 when Japanese tech investor and SoftBank founder Masayoshi Son flew into Turkey by private jet to make one of the biggest bets of his career: a $32 billion take-private deal for the British chip manufacturer Arm.

That trip would turn into one of SoftBank’s largest checks ever, and the deal would interlock Arm’s future with the success of the Japanese investment firm’s overall portfolio. It would also be the beginning of a saga of regulatory and corporate governance headaches as SoftBank tries to exit. Should the IPO go successfully, SoftBank could potentially double its investment. This IPO may not return what an Nvidia acquisition would have a few years back, but it’s exactly the kind of liquidity event that SoftBank needs at the moment as it recovers from several consecutive quarters of losses.

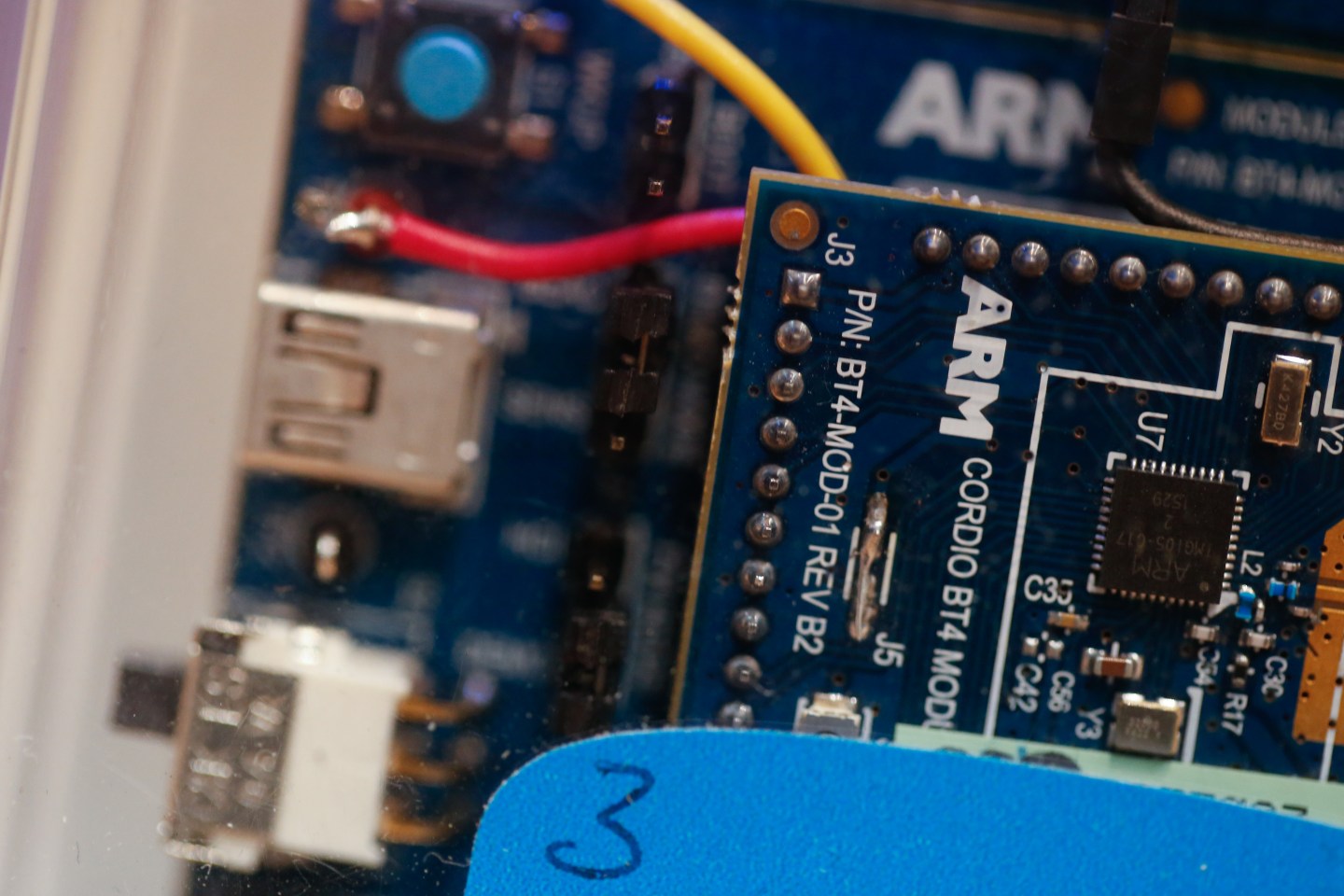

Arm, the chip designer behind the “central processing units”—or CPUs—used in approximately 99% of the world’s smartphones, won’t report a formal planned share price until it meets with investors on its roadshow. But the company is reportedly expecting to seek a valuation of $60-70 billion at that point, according to Bloomberg, which would make it the largest IPO we’ve seen since 2021 and could definitely help reopen the broader market.

It’s taken a long time for SoftBank to get to this point. Back in late 2020, Nvidia announced plans to acquire the chipmaker. But that deal would collapse in 2022 after regulatory agencies in the U.S., U.K., and E.U. raised anti-competitive concerns. After that, SoftBank started making plans for an Arm IPO, but a spat over the corporate governance of Arm China—which operates independently and is primarily owned by SoftBank, Chinese investor HOPU Investment Management Company, and other Chinese parties—delayed those plans further, and SoftBank said last year it had complicated Arm’s ability to audit the China operation. (In SEC filings, Arm said that litigation against Arm China has been “resolved favorably to Arm China,” but is subject to appeal.)

As Arm finally moves forward with its plans to go public, we are getting a better sense of the business. Revenue has fallen slightly over the last fiscal year, with Arm reporting $2.68 billion for the year ending in March 2023, compared to $2.7 billion the year prior. Net income was $524 million in the year ending in March 2023, compared to $549 million the year prior (net income was $388 million in 2021).

On brand with SoftBank’s newfound A.I. absolutism, Arm has positioned itself as a winner within the ongoing generative A.I. boom, as its CPUs run A.I. and machine learning workloads in devices like smartphones, cameras, or cars. Arm said in its IPO filings that it’s working with companies like Alphabet, GM’s Cruise, Meta, and Nvidia for running A.I. workloads.

But, per disclosures, A.I. and machine learning could also be a potential business risk, as Arm disclosed Monday evening. If new technologies start using algorithms that aren’t suitable for Arm’s general purpose CPUs, Arm processors would become less important in a chip.

This morning…The Securities and Exchange Commission is voting on whether to adopt the new fee disclosure rules for private funds that it proposed last year. This is the first major regulatory change for private funds since the financial crisis, and could necessitate sweeping new disclosure requirements from hedge funds, private equity shops, and VC firms (for more information on what the rules entail, you can read this previous edition of Term Sheet). The meeting begins at 10a.m. ET, and you can tune in here.

Cruising off the streets…Not long after California approved 24/7 robotaxi services in San Francisco, a Cruise vehicle collided with a firetruck. Cruise has agreed with state traffic safety officials to slash the size of its San Francisco fleet by half as a precautionary measure while the investigation is ongoing. You can read the story here.

See you tomorrow,

Jessica Mathews

Twitter: @jessicakmathews

Email: jessica.mathews@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today’s newsletter.

VENTURE DEALS

- Ramp, a New York City-based finance automation platform, raised $300 million in Series D funding. Thrive Capital and Sands Capital co-led the round and were joined by General Catalyst, Founders Fund, and existing investors.

- SpyCloud, an Austin, Tex.-based digital identity protection company, raised $110 million in funding. Riverwood Capital led the round.

- Thyme Care, a Nashville, Tenn.-based value-based cancer care partner, raised $60 million in Series B funding. Town Hall Ventures and Foresite Capital led the round and were joined by Andreessen Horowitz Bio + Health, AlleyCorp, Casdin Capital, and Frist Cressey Ventures.

- Fulcrum, a Minneapolis-based cloud software company, raised $18 million in Series A2 funding. Bessemer Venture Partners led the round and was joined by Battery Ventures, Motivate Venture Capital, Schematic Ventures, and others.

- Cerby, an Alameda, Calif.-based access management platform for nonstandard applications, raised $17 million in Series A funding. Two Sigma Ventures led the round and was joined by Outpost Ventures, Ridge Ventures, Founders Fund, Bowery Capital, and others.

- Pico MES, a San Francisco-based factory and machinery control software company, raised $12.4 million in Series A funding. Bosch Ventures led the round and was joined by Counterpart Ventures, Momenta, Lemnos, and others.

- Electric Era, a Seattle-based electric vehicle battery charging station company, raised $11.5 million in Series A funding. HSBC Asset Management led the round and was joined by SQM Lithium Ventures, Blackhorn Ventures, and Proeza Ventures.

- ACCURE, an Aachen, Germany-based battery safety and performance software provider, raised $7.8 million in funding. Blue Bear Capital and HSBC Asset Management led the round and were joined by Capnamic Ventures and Riverstone Holdings.

- Sizzle AI, a New York City-based company creating direct-to-learner products powered by A.I., raised $7.5 million in seed funding. Owl Ventures led the round and was joined by 8VC.

- Abbey, a San Francisco, Calif.-based secure infrastructure platform for engineers, raised $5.3 million in seed funding. Point72 Ventures led the round and was joined by Haystack, Essence Ventures, and others.

- Maple, a Miami-based institutional on-chain capital marketplace, raised $5 million in funding. Blocktower Capital and Tioga Capital led the round and were joined by Cherry Ventures, Spartan Capital, and others.

- Pest Share, a Boise, Idaho-based SaaS pest control services platform, raised $4.5 million in seed funding. MetaProp and Capital Eleven led the round and were joined by Vesta Ventures and Far Out Venture Capital.

- Mosh, a Los Angeles-based brain health brand, raised $3 million in Series A funding. MSA Advisors led the round and was joined by Joyance Ventures, The Lab Capital Advisors, Verso Capital, and Entrepreneur Ventures.

- ScribeUp, a Los Angeles-based subscription management company, raised $3 million in seed funding. Mucker Capital led the round.

PRIVATE EQUITY

- Apollo Funds acquired a majority stake in Composite Advanced Technologies, a Houston-based hydrogen and compressed natural gas storage solution manufacturer. Financial terms were not disclosed.

- Beyond ONE, a subsidiary of Priora Management Holding Dubai, acquired Virgin Mobile Latin America, a Bogotá, Colombia-based alternative mobile services provider. Financial terms were not disclosed.

- CH&CO, a portfolio company of Equistone Partners Europe, acquired Blue Apple, a Berkshire, England-based workplace catering company and Pabulum, a Hampshire, England-based caterer for schools. Financial terms were not disclosed.

- The Firefly Group acquired a minority stake in Titus Talent Strategies, a Milwaukee-based talent strategy firm. Financial terms were not disclosed.

- Trive Capital acquired Hypergiant Industries, an Austin, Tex.-based A.I. defense platform and solutions company. Financial terms were not disclosed.

EXITS

- Trading Technologies acquired Abel Noser Solutions, a New York-based transaction cost analysis provider, from Abel Noser Holdings, an Estancia Capital Partners portfolio company. Financial terms were not disclosed.

OTHER

- 1WorldSync acquired PowerReviews, a Chicago-based SaaS provider of user-generated ratings, reviews, and other content. Financial terms were not disclosed.

PEOPLE

- Left Lane Capital, a New York-based venture capital and growth equity firm, hired Chris Taylor as chief growth officer. Formerly, he was with SmartAsset.

Correction, Aug. 23, 2023: This newsletter has been corrected to reflect that The Firefly Group acquired a minority stake in Titus Talent Strategies, not a majority stake. It has also been updated to clarify that Electric Era is an electric vehicle battery charging station company.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.