Good morning.

Most CFOs are confident that the U.S. will avoid a full-blown economic downturn. Just 8% of finance chiefs strongly agree there will be a recession in the next six months.

“CFOs have spent, I would say, the better part of the COVID crisis and beyond really anchoring scenario planning, shoring up their balance sheet writing, and their cost structure,” Wes Bricker, U.S. vice chair and trust solutions co-leader at PwC, said during a media call on Monday. “I think that gives them optimism across multiple scenarios that they’ll help guide the company to financial success.”

This morning, PwC released a new report based on a survey of more than 600 U.S. C-suite leaders (including CFOs, CHROs, COOs, CTOs, CIOs, CROs, and CMOs). Overall, just 17% of executives strongly agreed that there will be a recession in the next six months, down 35% from October 2022. However, 27% of chief operating officers (COOs) think there will be one in the next six months.

COOs are focused on the complexity of transformation—from customer experience to the workforce to risk functions, Bricker said. “I think what we see in the data is that COOs are looking at multiple scenarios around the transformation work with a bit more caution than the chief financial officers who feel ready to allocate capital to invest in the future,” he said.

Although most of the execs think the odds of a recession may be lower, 27% view an uncertain macroeconomic environment as a serious risk to their company, according to the findings. Meanwhile, cyberattacks were the top-cited risk, with 36% of respondents saying it’s a serious risk to their company, and 38% saying it’s a moderate risk.

Growing with tech

Other themes that came across in the survey are prioritizing investments in technology, and investing in the workforce, Neil Dhar, U.S. vice chair and consulting co-leader at PwC, said on the call. The C-suite leaders are focused on three things, Dhar said: “How do they grow their companies? How do they operate with more efficient operating models? And how do they balance risk and compliance? And that’s all underpinned by technology.” The leaders said integrating advanced technologies in their businesses in the next 3–5 years is a high priority.

I recently had a conversation with Walmart EVP and CFO John David Rainey who said he envisions that five years from now Walmart will have the ability to forecast customer demand. “Technology is one of the biggest investments that we have been making,” Rainey said.

Fifty-nine percent of the PwC survey respondents said they will invest in new technologies in the next 12–18 months. And 46% specifically pointed to generative A.I. In terms of use cases for generative A.I., “industries such as financial services, pharma, life sciences, and consumer markets seem to be leading the charge within specific functions, such as customer operations, sales and marketing, software writing, and research and development,” Dhar said. But challenges to companies’ ability to transform include achieving measurable value from new tech (88%), the cost of adoption (85%) and training talent (84%).

And 89% of CFOs said striking the right balance between cost cutting and investing for growth is a top challenge to transformation. However, finance chiefs are still focused on prioritizing investments in new capabilities, like generative A.I., to move the company forward.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

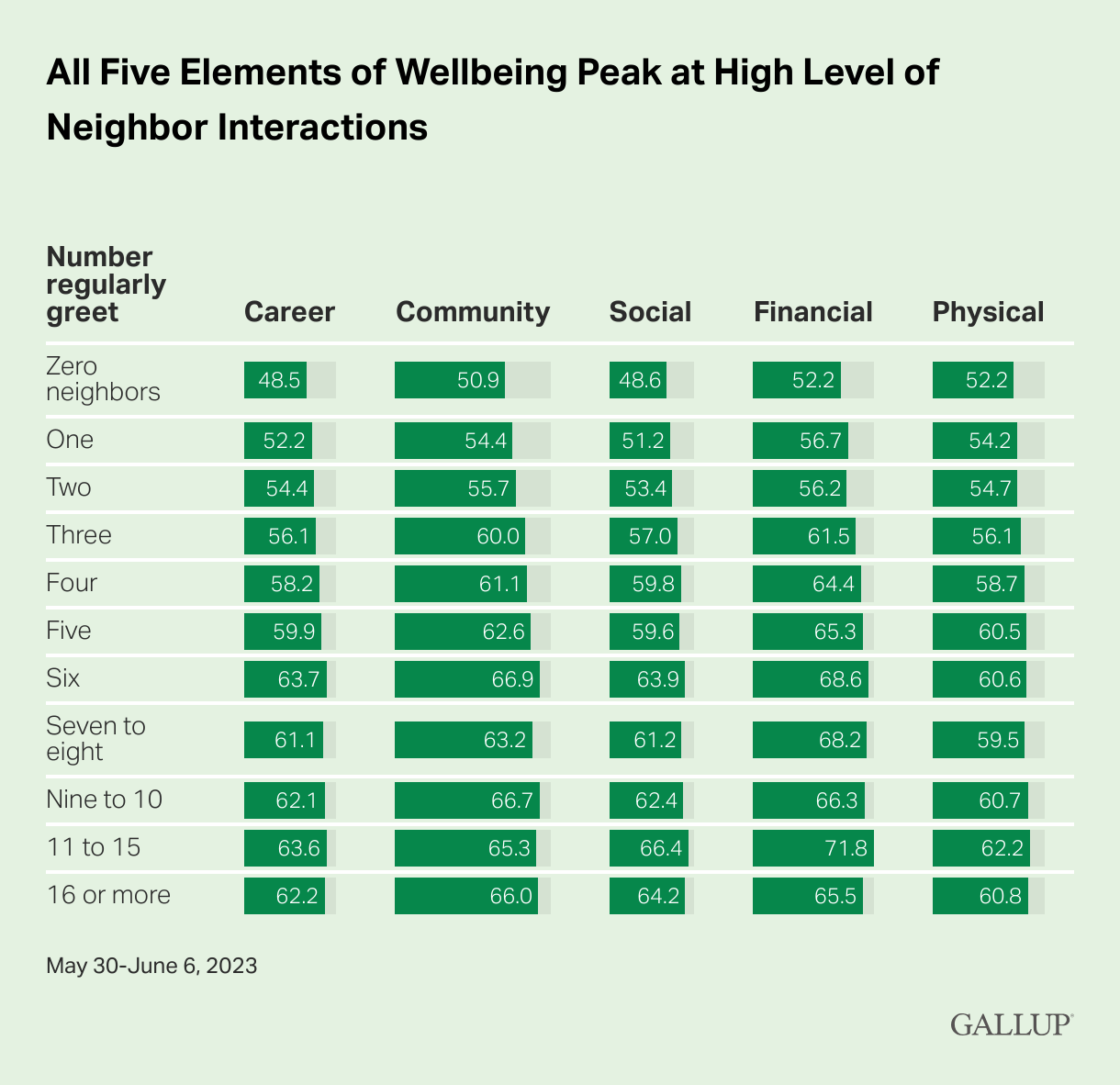

Are you saying hi to your neighbors? According to a new report by Gallup, regularly saying hello to multiple people in your neighborhood may result in higher well-being than those who greet fewer or no neighbors, and there are even implications for one's career well-being. The Gallup National Health and Well-Being Index is calculated on a scale of zero to 100, where zero represents the lowest possible well-being and 100 represents the highest possible well-being.

Career well-being (you like what you do every day) is one of the five metrics that affect overall well-being. Social, community, career, and physical well-being peak at greeting six neighbors, while financial well-being hits its numeric high point at 11 to 15 such interactions, according to Gallup.

The findings are based on a poll of 4,556 U.S. adults.

Going deeper

In a new blog post, Jim Stratton, chief technology officer at Workday (sponsor of CFO Daily) details the company’s generative A.I. strategy. "We’re currently building capabilities that leverage generative A.I. for various language and image-related tasks, including natural language generation, document understanding, and content search, summarization, and augmentation," Stratton writes. "These new capabilities will enable our customers to unlock increased productivity through streamlined tasks and processes, increased efficiency, and better decision-making. These are not far off in the future—in fact, our customers can expect access to these cutting-edge features within the next 6–12 months."

Read more about Workday's strategy here.

Leaderboard

Dror Heldenberg, CFO at Valens Semiconductor (NYSE: VLN), a provider of connectivity solutions, will be stepping down to pursue other opportunities, effective Sept. 1, after more than eight years in the role. Heldenberg will continue to advise Valens Semiconductor for a transition period. Yael Rozenberg Haine, VP of finance, will be appointed interim CFO. Rozenberg Haine is a 10-year veteran of Valens Semiconductor. Before joining the company in 2013, she served in various finance positions at Broadcom and at Provigent, which was acquired by Broadcom.

Ana Sirbu was named CFO at LeanTaaS, Inc., a provider of software solutions for hospital and infusion center operations. Lloyd Martin, who served as CFO since 2017, will take on the newly created role of chief administrative and risk officer. Sirbu has more than 15 years of experience in finance, strategy, and technology investing leadership roles. Before joining LeanTaaS, Sirbu was the CFO of Nitro Software and BlueVine. Her previous roles include three years at Google Capital and working as a technology investor at Silver Lake, with a focus on making investments in leading Enterprise SaaS and Fintech businesses. Sirbu began her career in investment banking on Wall Street.

Overheard

"Picture this: If full-time in-office work was a giant, hulking dinosaur, then the pandemic was the meteor that caused its extinction. The survivors? Hybrid and fully remote work models, the adaptable organisms of the new world of work. Now it’s about choosing one of the two."

—Gleb Tsipursky, Ph.D., the CEO of the boutique future-of-work consultancy Disaster Avoidance Experts, writes in a Fortune opinion piece on what the new normal of work looks like.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get CFO Daily delivered free to your inbox.