Good morning.

Trimming costs has been a priority for many CFOs this year. But companies may be sacrificing some of their most important investments in the process, according to experts.

“Cost Cutting That Makes You Stronger,” a new report in Harvard Business Review, argues that trimming costs to drive short-term savings is a mistake. It states that when companies take a “one-off approach” to cost cutting, it’s ineffective.

Vinay Couto, a vice chair, and Paul Leinwand, a global managing director at Strategy&, PwC’s strategy consulting business, are the authors of the report. Couto and Leinwand explain that executives face a choice—cut costs the traditional way and risk making their organizations weaker, or do the hard work of rethinking the very basics of their business.

To learn more about companies that have successfully managed costs while still achieving growth, they conducted a study of the 1,500 largest global public companies, based on 2021 revenue.

The companies that fared the best in the long term took five critical steps: connected costs to outcomes; simplified radically; reimagined value chains digitally, in rapid sprints; and rethought what work the ecosystem should take on.

Based on the research, I asked Couto to point to specific areas they’ve found are best for cost cutting, and areas that should be avoided.

The right areas for cutbacks:

—Exiting unprofitable businesses and markets/countries

—Reducing redundant and non-value-added financial and business reporting

—Consolidating procurement spend with preferred vendors

—Cutting technology costs by eliminating redundant systems, consolidating software licenses, or switching to cloud-based solutions

—Reducing excess real estate capacity

—Cutting energy costs by investing in energy-efficient equipment

—Reducing excess seniority and hierarchy in the top three levels of the company

—Consolidating manufacturing plants

—Adopting new technologies to automate manual business processes, customer interaction processes, and business planning, reporting and analytical work

—Reducing unprofitable SKUs (analyzing the cost of carrying each inventory item) and customers

The wrong areas to cut, according to Couto.

Training and development: “Cutting budgets in this area prevents employees from acquiring new skills and adapting to changing business environments.”

Employee benefits: “This can harm employee morale, decrease productivity, and lead to increased turnover. It can also make it more difficult to attract top talent in the future.”

Research and development (R&D): “It might seem like an easy area to cut given that much of this expenditure is on long-term bets. Reducing investment in R&D can severely impact a company’s long-term growth potential.”

Customer service: “Cutting costs here can damage relationships with customers, impact customer retention rates, and erode customer loyalty.”

Marketing: “It is vital for attracting new customers, retaining existing ones, and maintaining brand awareness. Reducing marketing efforts can negatively impact sales and business growth.”

Maintenance and upgrades: “Deferring these costs can face increased costs in the long term. This could be due to equipment breakdowns, software vulnerabilities, or other operational inefficiencies that result from outdated technology or facilities.”

What about human capital? Is cutting headcount to drive short-term savings a potential pitfall?

“From a pure business perspective, if a company’s survival is at stake, layoffs might be justified to ensure the company remains viable,” Leinwand explains. “If the alternative is bankruptcy, then layoffs could save the company and, by extension, the remaining jobs. And in some cases, especially in rapidly changing industries, companies might need to shed certain roles and hire for others to adapt to new market conditions.”

“However, the decision to use layoffs to improve short-term profitability, especially when a company is not in financial distress, can be detrimental to long-term success,” Leinwand says.

What’s at stake is a loss of talent and institutional knowledge, along with lower morale and productivity, he says. “Future hiring costs could also be an issue,” Leinwand says.

You can read more here about Couto and Leinwand’s research and strategic planning.

Have a good weekend.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

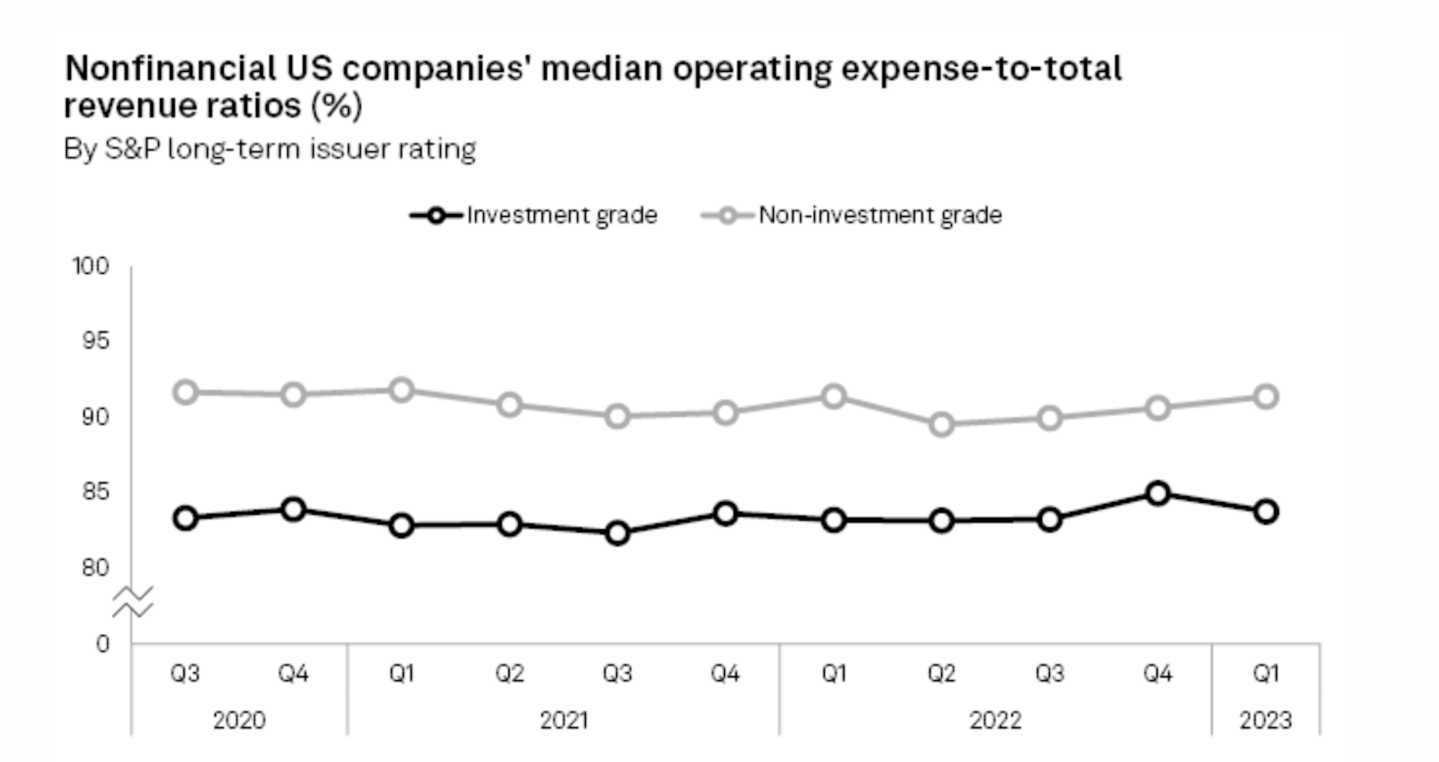

A new report by S&P Global Market Intelligence takes a look at how U.S. corporations cut costs in the first quarter of 2023. The total operating expenses of companies rated investment grade by S&P Global Ratings fell 5.3% to $2.858 trillion. This indicates companies reduced day-to-day running costs such as business travel and wages, according to the report. And the total operating expenses of non-investment-grade companies fell 3.8% from the fourth quarter of 2022 to $628.71 billion.

The research also found that the decline in expenses lowered the median ratio of operating expenses to total revenue for investment-grade-rated companies to 83.8% from 85.0% at the end of 2022.

Going deeper

Here are a few Fortune weekend reads:

"A $12 billion manufacturing powerhouse has avoided layoffs for 70 years while dominating its industry—but good luck replicating its formula" by Geoff Colvin

"5 reasons why Tesla stock is worth just $26 per share, according to New Constructs’ David Trainer" by Will Daniel

"Loan officer: I’m seeing middle class homebuyers take on $7,000 mortgages thinking they can ‘always refinance when rates come down in the future’" by Lance Lambert

"Americans check their phones 144 times a day. Here’s how to cut back" by L'Oreal Thompson Payton

Leaderboard

Some notable moves this week:

Mario Marte, CFO at Chewy, Inc. (NYSE: CHWY), an online retailer of pet food and other pet-related products, has decided to retire from the company, effective July 28. Marte has been CFO since 2018. Stacy Bowman, chief accounting officer, has been appointed interim CFO while the company continues its search for a permanent CFO. Before Chewy, Bowman served in several senior accounting roles at Brightstar, Ernst & Young and PricewaterhouseCoopers.

John W. Dietrich was named EVP and CFO at FedEx Corp. (NYSE: FDX), effective Aug. 1. Current EVP and CFO Michael C. Lenz will transition out of his role on July 31, and will remain with the company as a senior advisor until Dec. 31. Dietrich held numerous leadership roles at Atlas Air Worldwide since 1999, including serving as president and CEO, and member of the board of directors since 2020. Before Atlas Air Worldwide, Dietrich worked for United Airlines for 13 years.

Alexis DeSieno was named CFO at Cardlytics, Inc. (Nasdaq: CDLX), an advertising platform. DeSieno brings nearly 20 years of experience in a wide range of finance and data functions, most recently as SVP of finance at Clear Secure, Inc. Before that, she held various finance roles at SoulCycle Inc. and the Estée Lauder Companies, Inc. DeSieno also has over a decade of experience on Wall Street, most recently in global investment banking at Bank of America.

Tricia L. Fulton, EVP and CFO at Helios Technologies, Inc. (NYSE: HLIO), a provider of motion and electronic controls technology, has decided to retire from Helios after serving over 26 years with the company and the last 17 years as CFO. Following Helios’ earnings call on Aug. 8, Sean P. Bagan, VP of Finance—Business Unit CFO for International and Shared Services at Polaris (NYSE: PII), will succeed Fulton as CFO. Bagan joins Helios after spending 23 years at Polaris Inc.

Kristy Chipman was named CFO and treasurer at Five Below, Inc.(Nasdaq: FIVE), a value brand, effective July 17. Chipman succeeds Ken Bull, who has assumed the new role of chief operating officer of Five Below. Chipman most recently served as EVP, CFO, and COO at Ruth's Chris Hospitality Group. Before Ruth's Chris, she served in a variety of financial leadership roles with Orangetheory Fitness, Domino's Pizza and McDonald's Corporation.

David M. Kratochvil was named CFO at Northann Corp., a producer of natural and sustainable material-based products for interior finishes, effective July 14. Kratochvil brings more than 25 years of experience to the Northann Corp. team. He was previously managing partner at Vista Capital Advisors and Group CFO at VolitionRx, an NYSE-listed company.

Arvind Bobra was named CFO at Lessen, a tech-enabled, end-to-end solution for outsourced real estate property services. Bobra most recently served as SVP of finance at Axon Enterprise (Nasdaq: AXON). In his eight-year tenure at Axon, Bobra served in a variety of finance roles, including investor relations. Before Axon, Bobra spent five years as director of finance and business development at Ferroglobe PLC (formerly Globe Specialty Metals).

Overheard

"Bankers working from home, while brewing their morning coffees in pajamas, have been setting a higher ethical standard than their well-heeled office counterparts."

—Gleb Tsipursky, Ph.D., author and CEO of the boutique future-of-work consultancy Disaster Avoidance Experts, discusses in a Fortune opinion piece a recent peer-reviewed study published in the European Financial Management. The findings suggest that bankers are five times less likely to engage in financial misconduct when working from home. The researchers assert that "removing a trader from an office environment riddled with unprofessional conduct significantly reduces their likelihood of engaging in similar indiscretions," Tsipursky writes.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get CFO Daily delivered free to your inbox.