As a sports fan myself (I’m a die-hard Manchester United fan, for those who watch Premier League football—or “soccer,” to us Americans), I’ve always kept an eye on who owns which team, or what firm or executive is acquiring what stake. Money, after all, can have the power to influence teams’ performance. In recent years, alternative asset managers—that group of investors which includes private equity, venture capital, and hedge funds—have been actively investing in the sports arena. But who is buying chunks of teams?

My colleague Luisa Beltran rolled up her sleeves and went digging—and she found 120 ‘alt’ executives who have invested in sports teams, as she reported in her latest feature. As Luisa writes:

According to an analysis by Fortune, which included scanning the websites and media guides of the roughly 153 teams, as well as speaking to investors and league officials, about 120 alt execs own stakes in sports franchises. Some are well-known, including Steve Cohen, chairman and CEO of hedge fund Point72, who acquired the New York Mets baseball team in 2020 for $2.4 billion; Josh Harris, cofounder of Apollo Global Management, who led an investor group to buy the Washington Commanders, formerly known as the Washington Redskins, for a record $6.05 billion, in May; and Marc Lasry, CEO of Avenue Capital Group, who sold his 25% stake in the Milwaukee Bucks in April.

Others more under the radar include Justin Ishbia, founder of private equity firm Shore Capital, who is an owner of the Nashville SC.

There are a couple big drivers for the interest in sports teams. As Luisa aptly points out:

The rise in alt exec ownership is, of course, in part due to the stunning returns alt firms have made in their bread-and-butter businesses over the past 25 years. For example, private equity funds generated an annualized return of 14.8% for the 25 years ended December 2020, more than double the 5.76% produced by the S&P 500 for the same time period, according to a 2022 World Economic Forum study.

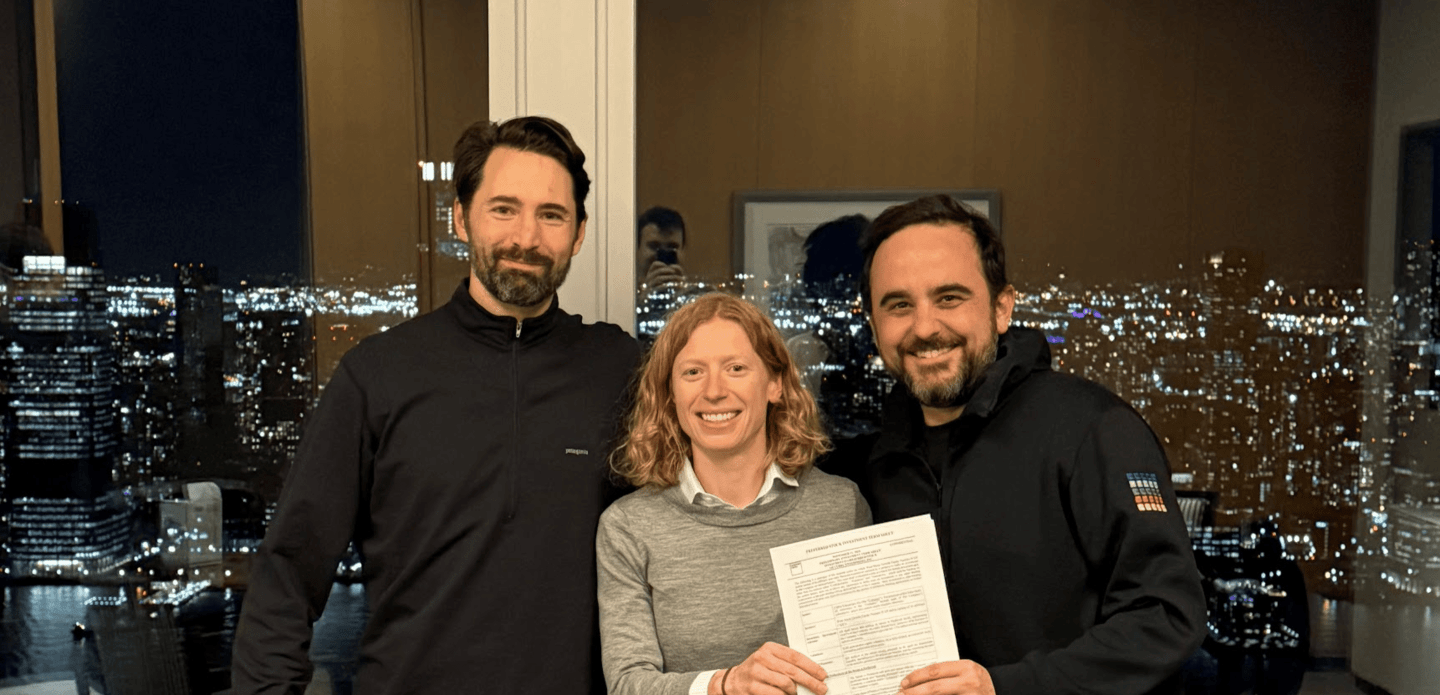

The most recent big sports deal came in June, Luisa writes, when Michael Jordan agreed to sell his majority stake in the Charlotte Hornets basketball team. The group of investor buyers included Gabe Plotkin (of Melvin Capital and meme stock fame), as well as Rick Schnall, a partner at PE firm Clayton, Dubilier & Rice; Chris Shumway, former senior managing director of Tiger Management and current managing partner of Shumway Capital; and Dan Sundheim, founder and CIO of D1 Capital Partners. Formerly of Bain Capital, Ian Loring (now at Haveli Investments, per his LinkedIn) is also part of the group.

Some investment funds are also chasing sports deals.

Some of the biggest funds investing in sports belong to Dyal HomeCourt Partners, which is part of Blue Owl Capital, and Arctos Sports Partners. This year, Arctos has been in the market with its second pool, which has raised more than $2.2 billion on a $2.5 billion target, a person familiar with the fundraising said. Artcos takes passive, minority stakes in professional sports teams; it owns holdings in the Tampa Bay Lightning, and through Smith Entertainment Group, has stakes in the Utah Jazz basketball team and Real Salt Lake soccer.

And there are some particular, sports-related factors that make teams a good bet for investors. As Luisa reports:

One reason for all the deals is skyrocketing valuations, according to bankers and private equity executives. The $6.05 billion clinched by the Commanders beat the $4.65 billion attained by the Denver Broncos when it was sold last year to Walmart heir Rob Walton…“What’s the last sports team that sold at a loss? I don’t know either,” said Jeff Klein, an attorney with the law firm Clarick Gueron Reisbaum who advises clients in the sports and entertainment industries. “Even teams that aren’t operationally successful, or aren’t successful on a cash-flow basis, are selling at sizable gains.”

…Deals involving sports teams are resistant to market fluctuations, said Sal Galatioto, president and founder of Galatioto Sports Partners (GSP), a sports firm that advises on buy-side and sell-side transactions involving teams. The number of U.S. mergers and IPOs has slowed significantly this year due to the stock market downturn, but that’s not happening with sports transactions. “I’ve never seen the level of demand that we’re seeing right now, and I think that will continue,” said Galatioto, who also teaches sports finance at Columbia University Graduate School of Business.

Check out the full list of 120 alt owners in the exhaustively reported story here.

Fresh funding for Hugging Face? Buzzy A.I. model platform Hugging Face is reportedly in the process of raising a Series D round, which could be at least $200 million, according to a Forbes report late last week. The startup most recently raised $100 million last spring, and is backed by the likes of Lux Capital and Sequoia Capital. Hugging Face provides a hub for developers to explore open source A.I. models. According to Forbes, Ashton Kutcher’s VC firm, Sound Ventures, is currently leading the latest round. Hugging Face didn’t respond to Fortune’s request for comment by press time.

See you tomorrow,

Anne Sraders

Twitter: @AnneSraders

Email: anne.sraders@fortune.com

Submit a deal for the Term Sheet newsletter here.

Jackson Fordyce curated the deals section of today’s newsletter.

VENTURE DEALS

- CurvaFix, a Bellevue, Wash.-based medical devices developer to repair fractures in curved bones, raised $39 million in funding. MVM Partners led the round and was joined by Sectoral Asset Management and others.

- CarePredict, a Plantation, Fla.-based health care provider for senior citizens, raised $29 million in Series A-3 funding co-led by SV Health Investors’ Medtech Convergence Fund and Aspire Healthtech Partners.

- Embrace, a Los Angeles-based mobile experience engineering provider, raised an additional $20 million in funding. NEA led the round and was joined by Greycroft, AV8, and Eniac.

- Xterio, a Zug, Switzerland-based Web3 game platform and publisher, raised $15 million in funding from Binance Labs.

- Efficient Capital Labs, a New York-based nondilutive capital provider to B2B SaaS companies, raised $7 million in pre-Series A funding. QED Investors led the round and was joined by 645 Ventures, The Fund, Lorimer Ventures, Riverside Ventures, and Generalist.

PRIVATE EQUITY

- Arrow Global acquired Blue Current Capital, a London-based ESG-focused real estate investor. Financial terms were not disclosed.

- The Vertex Companies, a Wind Point Partners portfolio company, acquired Breakwater Forensics, a Chicago-based witness and business consulting firm. Financial terms were not disclosed.

OTHER

- Greenfly acquired Miro AI, a Grand Haven, Mich.-based content-as-a-service platform for the sports industry. Financial terms were not disclosed.

FUNDS + FUNDS OF FUNDS

- The Riverside Company, a Cleveland-based private investment firm, raised $350 million for a fund focused on control investments in businesses that generate revenue between $60 million and $300 million.

PEOPLE

- Crossbeam Venture Partners, a New York-based venture capital firm, promoted Ryan Morgan to partner.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.