With tax season coming to an end, most Americans know how rigorous they have to be when tracking their finances. Every dollar must be accounted for, or the IRS could come calling.

But when it comes to spending taxpayers’ money, the federal government isn’t so precise. Over the past 20 years, federal agencies and programs have made “payment errors” that add up to $2.4 trillion, according to a recent report from the U.S. Government Accountability Office (GAO). That’s more than the annual GDP of Brazil, a country with over 215 million people.

GAO officials said that these payment errors, including overpayments and payments that should not have been made at all—like those to deceased individuals or people who are no longer eligible for government programs—are a “continuing concern” that was made worse by pandemic-era spending programs.

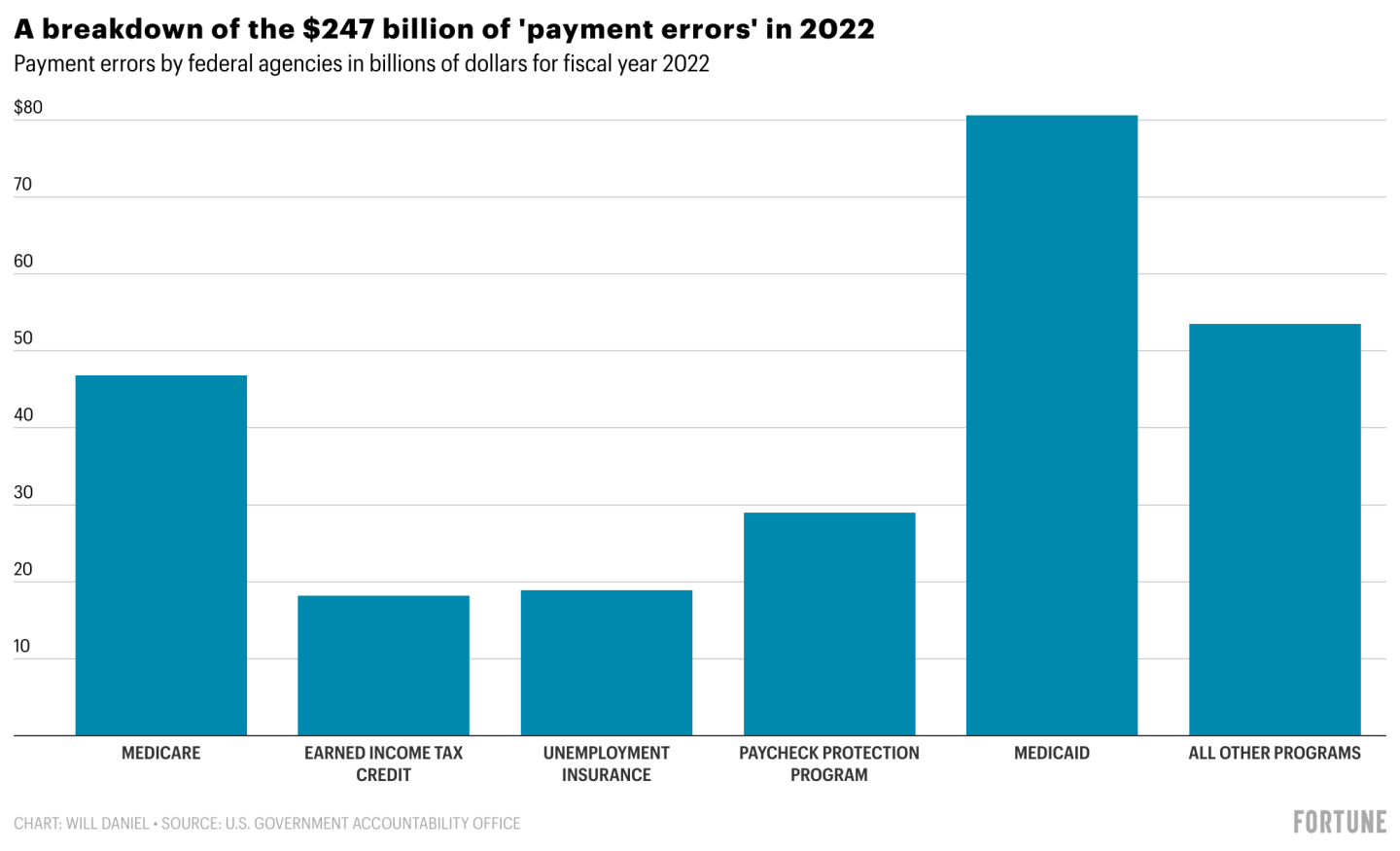

Most improper payments “are not fraudulent and not all represent a monetary loss to taxpayers,” according to the Office of Management and Budget. But in 2022, there were $247 billion in payment errors reported by 18 agencies, across 82 programs in the federal government, including $200 billion in “overpayments” alone.

That’s down from the $281 billion peak in 2021, but well above the pre-pandemic level of $175 billion. The improper payment rate, or the percentage of payments deemed to be in error, also fell from its high of 7.2% in 2021 to 5.1% this year.

It’s progress, but the GAO still sees payment errors as a big problem. And some 78% of these errors were contained within five programs last year—Medicaid, Medicare, the Paycheck Protection Program, unemployment insurance, and the earned income tax credit.

Pandemic-era spending programs helped buoy the economy through lockdowns, and are credited with keeping millions of Americans out of poverty and saving 2.3 million jobs. But there was also a downside—increased fraud.

GAO officials specifically highlighted the the Paycheck Protection Program (PPP) as a system that was “vulnerable to payment errors” in their latest report.

“During the beginning of the pandemic, many agencies—including the Small Business Administration, which administered PPP—were able to distribute funds quickly to help businesses, communities and individuals. But the tradeoff was that agencies like SBA did not have systems in place to prevent and identify payment errors and fraud,” they explained.

To their point, a group of finance professors from the University of Texas at Austin found that $64 billion of the nearly $800 billion in loans issued under the PPP showed signs of fraud. And they cautioned that “suspicious loans are being overwhelmingly forgiven at similar rates to other loans.”

The GAO officials also noted that the fraud within the unemployment uninsurance program “increased substantially” during the pandemic and recommended the Department of Labor “examine the suitability of existing fraud controls.”

The accountability office isn’t happy about the payment errors made across federal agencies or the lack of response from Congress, saying that they have “made numerous recommendations” about methods that could reduce improper payments which were largely ignored.

“Our recommendations for federal agencies include those that would call for better monitoring of federal programs and planning that would help identify risks for payment errors,” they wrote. “For Congress, we think agencies could use help identifying susceptible programs, developing reliable methods for estimating improper payments, and implementing effective corrective action.”

As of February of this year, there were still 37 recommendations that the GAO made to federal agencies regarding payment errors that hadn’t been addressed. “While some steps have been taken, more action is needed,” the GAO officials wrote.