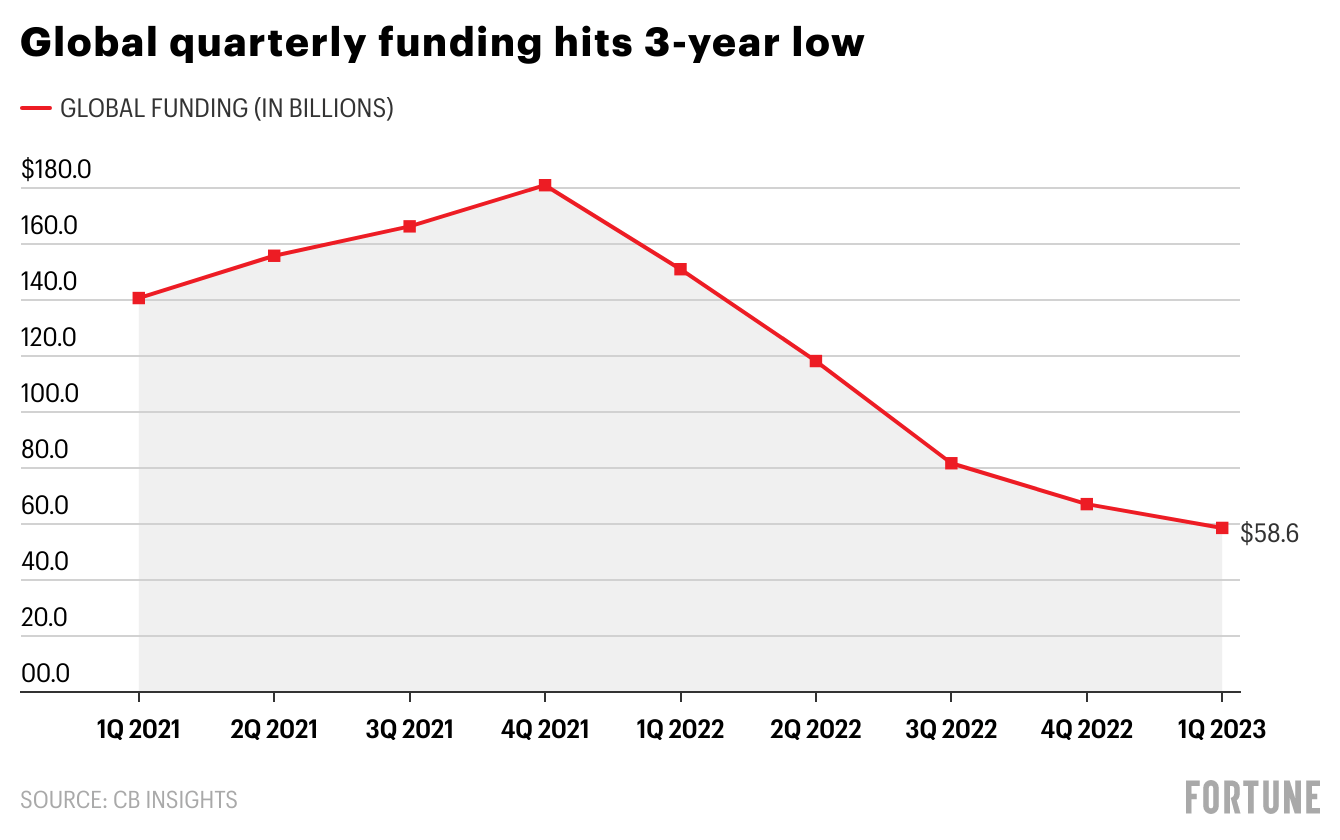

And just like that—venture capital funding has hit a new three-year low.

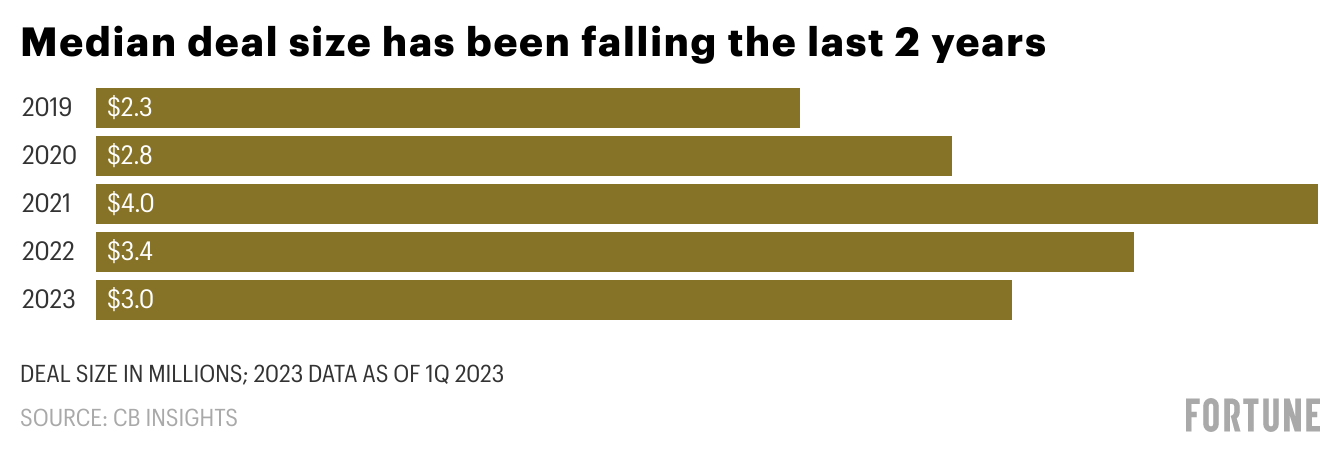

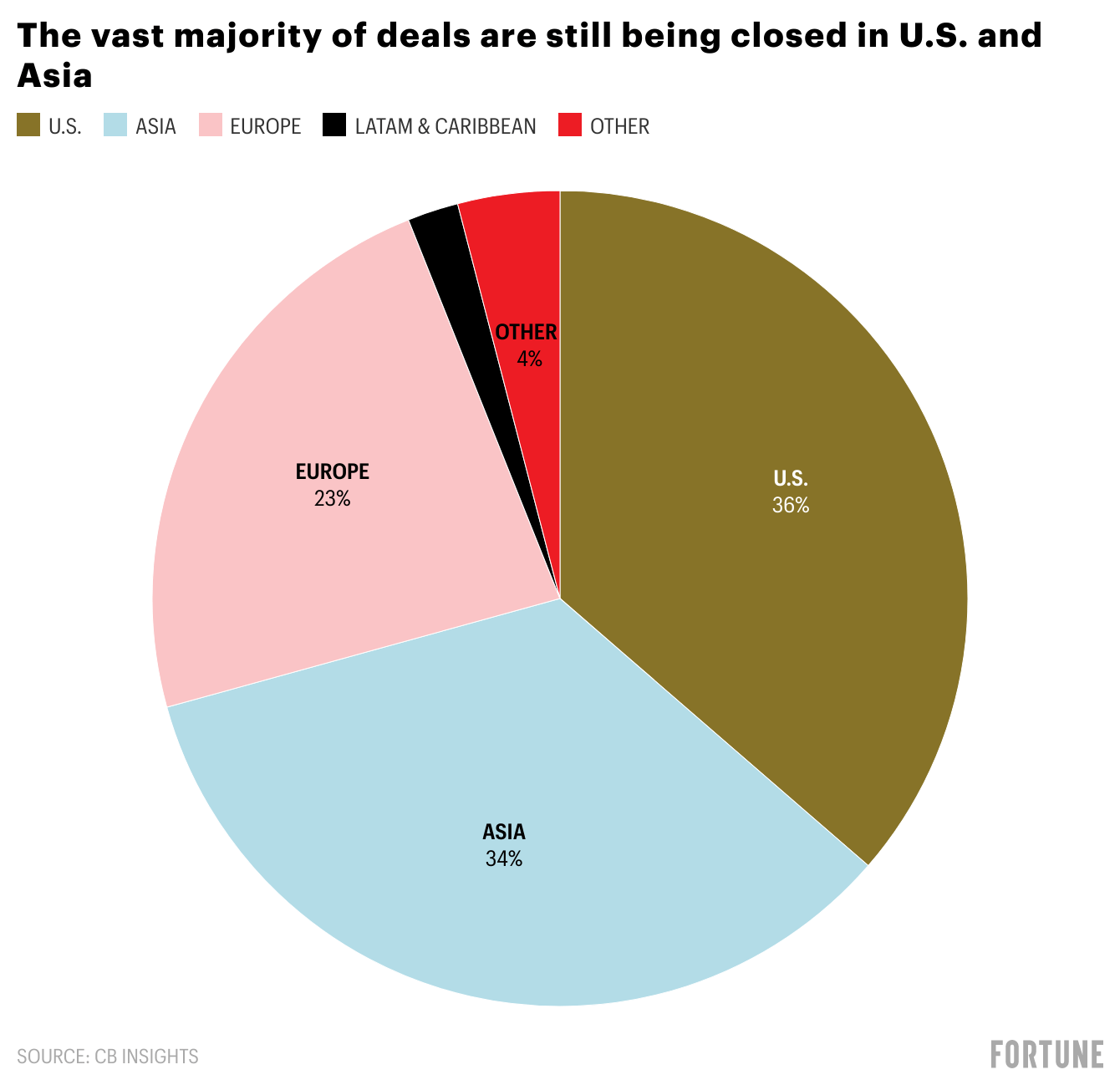

Startups around the globe raised a collective $58.6 billion in venture funding in the first quarter—dropping 13% from the last quarter and at their lowest levels since pre-pandemic, according to new data from CB Insights. In the U.S., numbers were a bit steadier, but only because of Stripe’s whopping $6.5 billion funding announcement in mid-March. International startups, in particular, are struggling to fundraise at the same levels they had been, with funding in Latin America, Asia, and Europe declining by 54%, 27%, and 12% respectively.

There were more than a dozen unicorns minted—13 to be exact—with four of them being A.I. developers. That’s fewer new unicorns than we’ve seen since the first quarter of 2017.

Here’s how venture capital is shaping up, in four charts:

See you tomorrow,

Jessica Mathews

Twitter: @jessicakmathews

Email: jessica.mathews@fortune.com

Submit a deal for the Term Sheet newsletter here.

Jackson Fordyce curated the deals section of today’s newsletter.

VENTURE DEALS

- Altruist, a Culver City, Calif.-based custodian for registered investment advisers, raised $112 million in Series D funding. Insight Partners led the round and was joined by Adams Street Partners and others.

- Cybersyn, a New York-based data-as-a-service company, raised $62.9 million in Series A funding. Snowflake led the round and was joined by Coatue and Sequoia Capital.

- Recuro Health, a Dallas-based digital health solutions company, raised $47 million in Series B funding. ARCH Venture Partners, the Flippen Group, GPG Ventures, 4D Capital, and others invested in the round.

- 1upHealth, a Boston-based health care data platform, raised $40 million in Series C funding. Sixth Street Growth led the round and was joined by F-Prime Capital, Jackson Square Ventures, and Eniac Ventures.

- Tradier, a Charlotte-based retail brokerage firm, raised $24.6 million in Series B funding. PEAK6 Strategic Capital led the round and was joined by F-Prime Capital and KF Business Ventures.

- Hometree Group, a London-based home energy services company, raised $46 million in Series B funding co-led by Legal & General Capital, 2150, and Energy Impact Partners.

- Companion, a San Francisco-based interactive device for dogs, raised $6 million in additional funding from Lerer Hippeau and Digitalis Ventures.

- Ampersand, a San Francisco-based developer platform focused on SaaS interoperability, raised $4.7 million in seed funding. Matrix Partners led the round and was joined by Base Case Capital, Flex Capital, and 2.12 Angels.

- Kuberno, a London-based legal entity SaaS provider for corporate employees, raised £3.5 million ($4.37 million) in Series A funding from Nasdaq Ventures.

- NATIX, a Hamburg, Germany-based developer for crowd-sourced camera networks and event detection software, raised $3.5 million in seed funding. Blockchange Ventures led the round and was joined by XYO, Mysterium Network, CVVC, Mulana Capital, Blockarm Capital, Techstars, Plug and Play Ventures, and CoinIX Capital.

- Hakbah, a Riyadh, Saudi Arabia-based fintech savings platform, raised $2 million in pre-Series A funding from Global Ventures and Aditum Investment Management.

PRIVATE EQUITY

- Brookfield Infrastructure Partners agreed to acquire Triton International, a Hamilton, Bermuda-based intermodal shipping containers company, for $4.7 billion.

- Lee Equity Partners and Twin Point Capital agreed to acquire Tessco Technologies, a Hunt Valley, Md.-based wireless communication products distributor, for about $161.4 million.

- Blue Point Capital Partners acquired eyebobs, a Minneapolis-based glasses company. Financial terms were not disclosed.

- H.I.G. Capital acquired a majority stake in Office People, a Münster, Germany-based personnel management and temporary staffing company. Financial terms were not disclosed.

- Hunter Point Capital acquired a minority stake in Coller Capital, a London-based private capital secondaries market investment firm. Financial terms were not disclosed.

- Quinbrook acquired PurposeEnergy, a Windham, N.H.-based biogas company. Financial terms were not disclosed.

- Sound Partners acquired Marathon, a Los Angeles-based residential HVAC company. Financial terms were not disclosed.

- Technical Safety Services, a portfolio company of Levine Leichtman Capital Partners, acquired Precision Air Technology, a Morrisville, N.C.-based environment testing and certification services provider. Financial terms were not disclosed.

EXITS

- Mitratech acquired Trakstar, a Seattle-based employee lifecycle platform, from Turn/River Capital. Financial terms were not disclosed.

- Numerix, backed by Genstar Capital, acquired FINCAD, a Vancouver-based derivatives risk management software and pricing analytics company, from Zaffin. Financial terms were not disclosed.

OTHER

- Emerson Electric agreed to acquire National Instruments, an Austin-based measurement systems maker. The deal is valued at $8.2 billion.

- InteleTravel acquired Hickory Global Partners, a Delray Beach, Fla.-based corporate travel company. Financial terms were not disclosed.

FUNDS + FUNDS OF FUNDS

- MetaVC Partners, a San Francisco-based venture capital firm, raised $62 million for a fund focused on early-stage, hard-tech metamaterials startup companies.

PEOPLE

- ICG, a London-based alternative asset manager, hired Ryan Croteau as managing director. Formerly, he was with Sun Life Capital Management.

- Macquarie Capital, the Sydney, Australia-based corporate advisory, capital markets, and investing arm of Macquarie Group, hired Morgan LeConey as managing director, head of U.S. consumer and retail. Formerly, he was with Nomura.

- One Rock Capital Partners, a New York-based private equity firm, hired Monica Yavin as chief people officer. Formerly, she was with First Eagle Investment.

Correction, Apr. 13, 2023: A previous edition of this newsletter misstated Morgan LeConey’s gender. He is male.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.