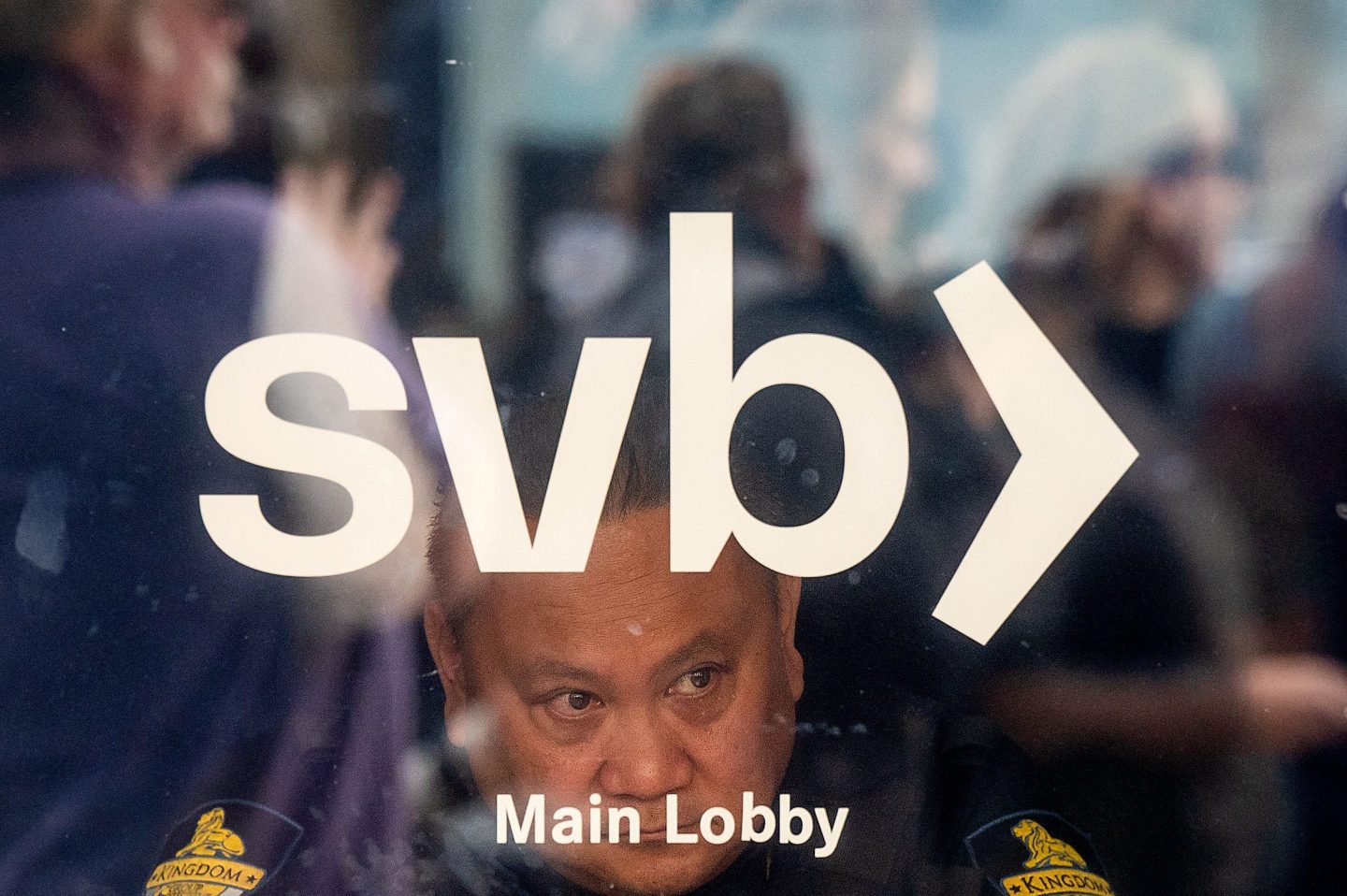

Following Silicon Valley Bank’s downfall, the pitchforks are out for diversity goals.

The drumbeat of voices claiming that “wokeness” played a role in bringing down Silicon Valley Bank began on Sunday, three days after a bank run prompted U.S. regulators to seize control of the California-based firm. In a Fox News interview, Rep. James Comer (R-Ky.), who chairs the House Oversight Committee, called SVB “one of the most woke banks.”

The next day, anti-ESG crusader Vivek Ramaswamy charged that the bank had attempted to curry favor with Democrats by committing $5 billion to a sustainability project. Many other Republicans, including Donald Trump Jr. and Florida Gov. Ron DeSantis, attributed the bank’s downfall to DEI distractions.

Most alarmingly, the argument appeared in a mainstream publication where the Wall Street Journal opinion columnist Andy Kessler wrote: “In its proxy statement, SVB notes that besides 91% of their board being independent and 45% women, they also have ‘1 Black,’ ‘1 LGBTQ+’ and ‘2 Veterans.’ I’m not saying 12 white men would have avoided this mess, but the company may have been distracted by diversity demands.”

The idea is intentionally provocative and shouldn’t warrant attention, except it also raises the question: What if it doesn’t stop?

The danger of DEI-hushing

Unpacking the SVB crisis has already sparked several smart and legitimate takes on the bank’s managerial skills; the board’s risk oversight, composition, and expertise; and banking regulations. Even Kessler nodded at the myriad economic and managerial decisions that may have brought SVB to the brink in his Wall Street Journal column.

However, the suggestion that SVB’s interest in DEI distracted the board from its basic fiduciary duties is not only meritless and misaligned with scholarly research about the benefits of gender and cultural diversity in the boardroom, it’s also offensive, says Douglas Chia, president of Soundboard Governance and former executive director of the Conference Board’s ESG Center. “[Kessler] was pointing to one small chart on one page of the proxy statement,” he says. “To just pull that out and say that this was a cause, it makes you question, ‘What is this person trying to implant in people’s heads?’”

It’s the equivalent of asking, “When did you stop beating your wife?” Chia adds. “You could say, ‘I’m just asking the question; it has nothing to do with anything.’ But clearly, you are insinuating something.”

This is the second time this month that Republicans have tried to link a company’s diversity ambitions with a business disaster. The attacks on SVB’s DEI efforts come just a week after Republican Congressman Mike Collins of Georgia blamed DEI for the Norfolk Southern train derailment in Ohio. In that case, the congressman asked whether the transport company’s DEI policies were “directing resources away from the important things like greasing wheel bearings?”

It appears we’ve reached a moment when corporate snafus will inevitably be attributed to a push for diversity and equity. If the trend continues, DEI naysayers will be busy. The vast majority of public companies are at least ostensibly working to diversify their executive teams and boards, believing that more diverse voices allow a company to better manage risks. Now that it’s become standard practice for companies to include board diversity disclosures in proxy statements (Nasdaq-listed companies must), ESG critics will have fodder for virtually any business misstep.

Governance experts who spoke to Fortune say that companies are unlikely to back down from DEI goals no matter how much noise agitators on the right make. However, it’s equally important that leaders continue to defend diversity practices and not downplay them in the same way that many are now said to be “green-hushing” to avoid a backlash against their climate strategies. DEI-hushing would arguably be worse and a huge step backward.

Just ask Cynthia Soledad, who coleads the diversity and inclusion practice at Egon Zehnder. When the Trump administration banned DEI training at government agencies, she says chief diversity officers began to second-guess themselves and how much their leaders valued their work.

“When people leading these efforts are put in a position where they have to question the validity of their work—do they have the permission to do their best work—that is the opposite of psychological safety,” says Soledad. Like any team, board members need to feel safe and empowered to function effectively.

“I see all of this rhetoric as problematic,” says Soledad, “and I think creating the distraction feels purposeful, it feels hurtful, and it feels very unfortunate.”